Ga Disclosure Statement For Loan

Description

How to fill out Georgia Residential Real Estate Sales Disclosure Statement?

Regardless of whether it's for commercial reasons or personal matters, everyone must confront legal circumstances at some point in their lives. Completing legal documents requires meticulous care, starting with choosing the appropriate form template. For instance, if you select an incorrect version of a Ga Disclosure Statement For Loan, it will be rejected upon submission. Thus, it is crucial to obtain a reliable source of legal forms like US Legal Forms.

If you need to acquire a Ga Disclosure Statement For Loan template, follow these simple steps: Obtain the template you require by utilizing the search bar or catalog navigation. Review the form’s details to confirm it aligns with your situation, state, and county. Click on the form’s preview to examine it. If it is the incorrect form, return to the search function to locate the Ga Disclosure Statement For Loan sample you need. Retrieve the file when it meets your requirements.

- If you have a US Legal Forms account, simply click Log in to access previously saved files in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the file format you desire and download the Ga Disclosure Statement For Loan.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it manually.

- With an extensive US Legal Forms catalog available, you never need to waste time searching for the correct template across the web.

- Utilize the library’s straightforward navigation to find the suitable template for any occasion.

Form popularity

FAQ

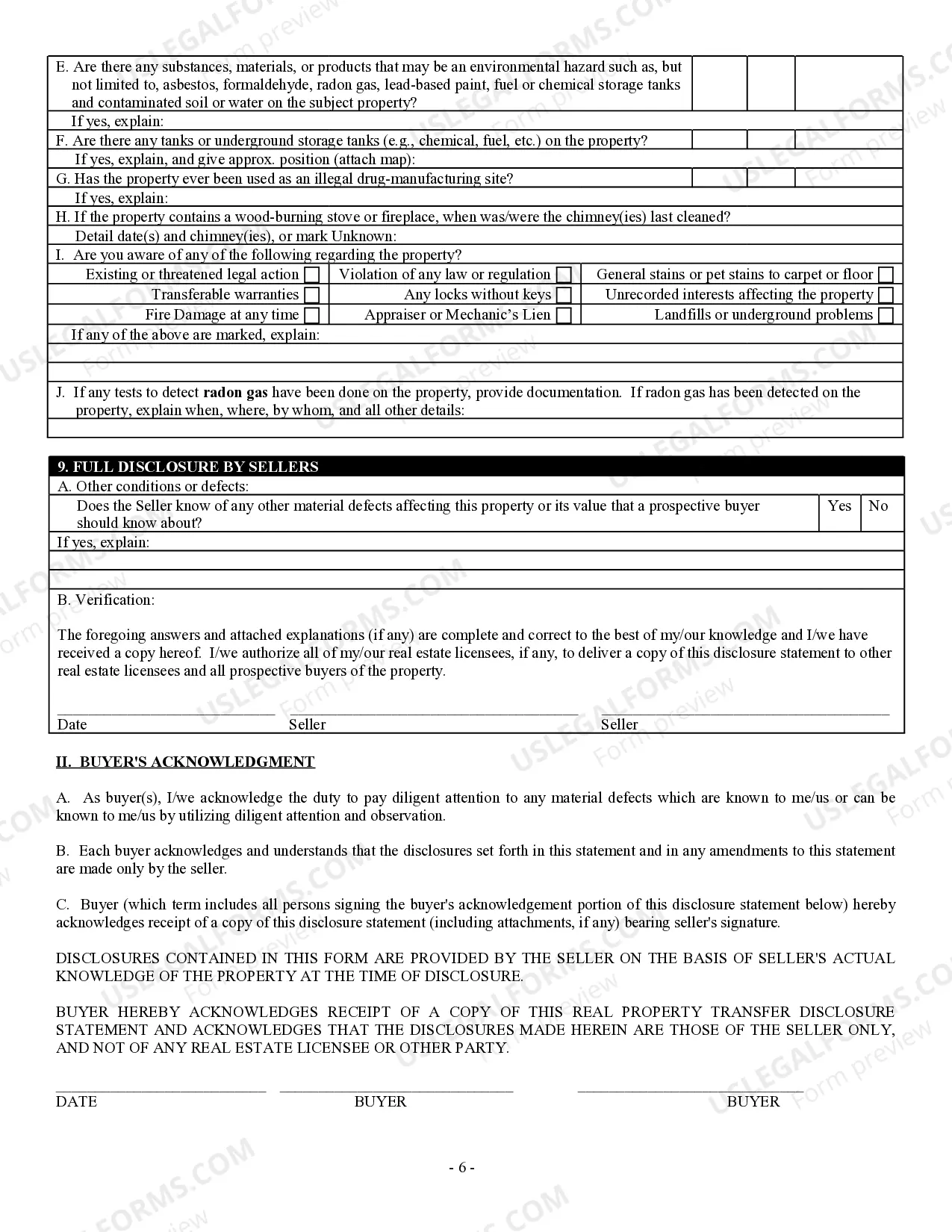

A disclosure statement example in the context of a GA disclosure statement for loan provides essential information about the terms and conditions of the loan. It typically outlines the loan amount, interest rate, payment schedule, and any fees involved. Understanding this document is crucial for borrowers as it helps them make informed financial decisions. For more comprehensive examples and templates, you can visit the US Legal Forms platform, which offers reliable resources tailored to your needs.

The closing disclosure is typically prepared by the lender or a qualified loan officer. This document details the final terms of the loan, including the Ga disclosure statement for loan, which outlines all costs associated with the transaction. It is essential for buyers to review this document carefully before closing. Platforms like US Legal Forms can assist in ensuring all necessary disclosures are accurately prepared.

Yes, Georgia operates under a full disclosure policy regarding real estate transactions. This means that sellers are required to disclose known issues with the property, as outlined in the Ga disclosure statement for loan. This practice helps protect buyers from unexpected surprises after the sale. Understanding this requirement can enhance your confidence when purchasing property in Georgia.

A disclosure statement for a loan is a document that outlines key information regarding the loan terms and conditions. This statement includes details such as interest rates, payment schedules, and any associated fees. In Georgia, the Ga disclosure statement for loan is critical for buyers to understand their financial obligations. It ensures that borrowers are fully informed before signing any agreements.

Yes, property disclosures are indeed required in Georgia. Sellers must provide a Ga disclosure statement for loan that informs potential buyers about the property's condition and any defects. This requirement aims to promote transparency and protect both parties involved in the transaction. Using platforms like US Legal Forms can help you generate the necessary disclosures efficiently.

Yes, disclosures are required in Georgia. The state mandates that certain disclosures must be provided to buyers during the home buying process. This includes the Ga disclosure statement for loan, which outlines important information about the property's condition and any known issues. Ensuring that you have these disclosures can help facilitate a smoother transaction.

Page 3: Calculating Cash to Close: On page 1 of the closing disclosure under cost at closing, there was an amount that you need to bring to closing for your cash to close. This section gives you a full breakdown of the money needed to close.

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

The purpose of a disclosure statement is to provide explanatory information regarding the significant features of the insurance policy to enable the insured to make an informed decision regarding purchasing the insurance policy.

Last Updated June 8, 2023. Taking out a loan can be a big decision, and the Truth in Lending disclosure is a standard form designed to help you understand your loan's specific terms, like how much you've borrowed, how many payments you'll make, and what your annual percentage rate (APR) is.