Georgia Deeds And Record Form 3231

Description

How to fill out Georgia Administrator's Deed?

Utilizing legal templates that adhere to federal and state statutes is vital, and the web provides numerous alternatives to choose from.

But what’s the purpose of squandering time to find the appropriate Georgia Deeds And Record Form 3231 sample online if the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the most extensive online legal repository with over 85,000 fillable templates prepared by attorneys for any professional and personal circumstance.

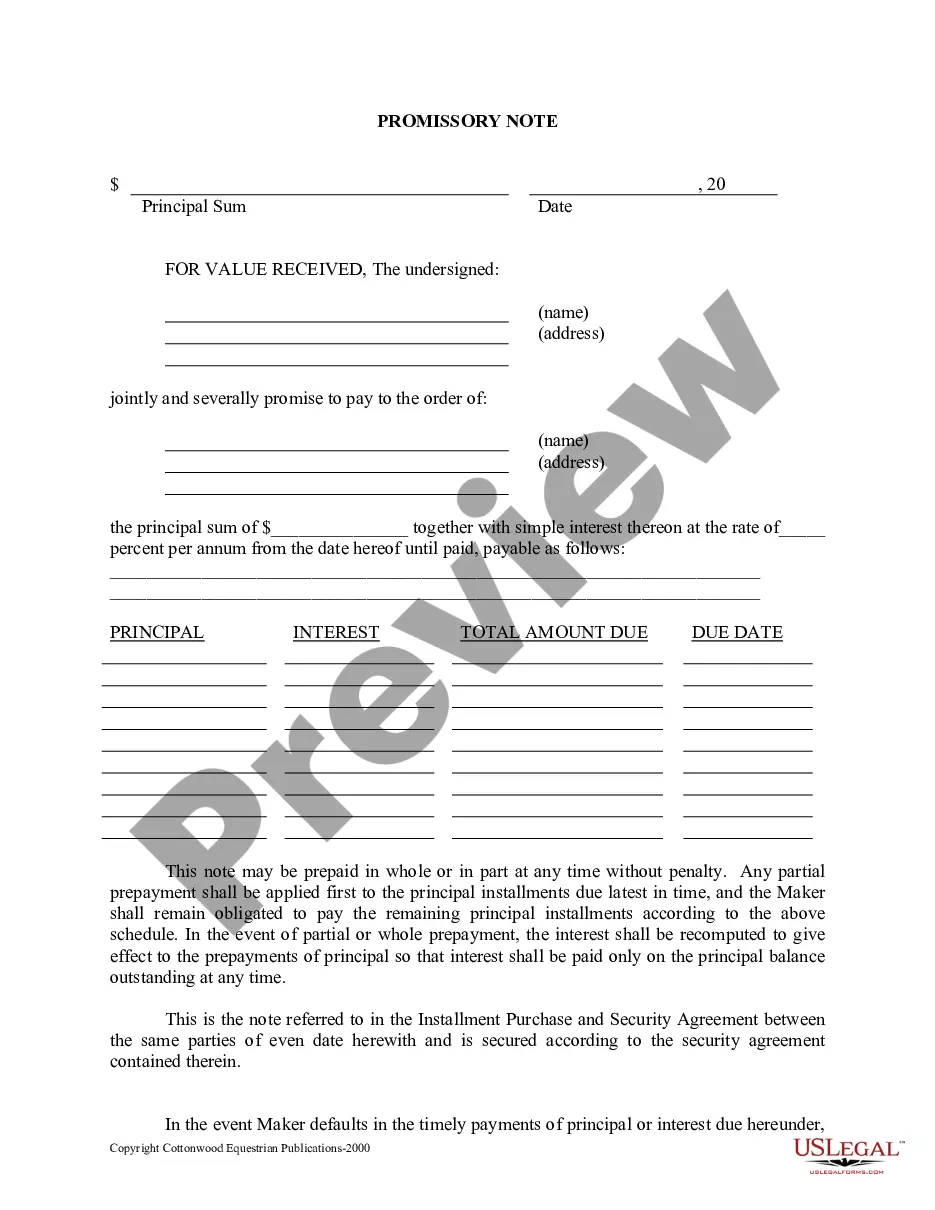

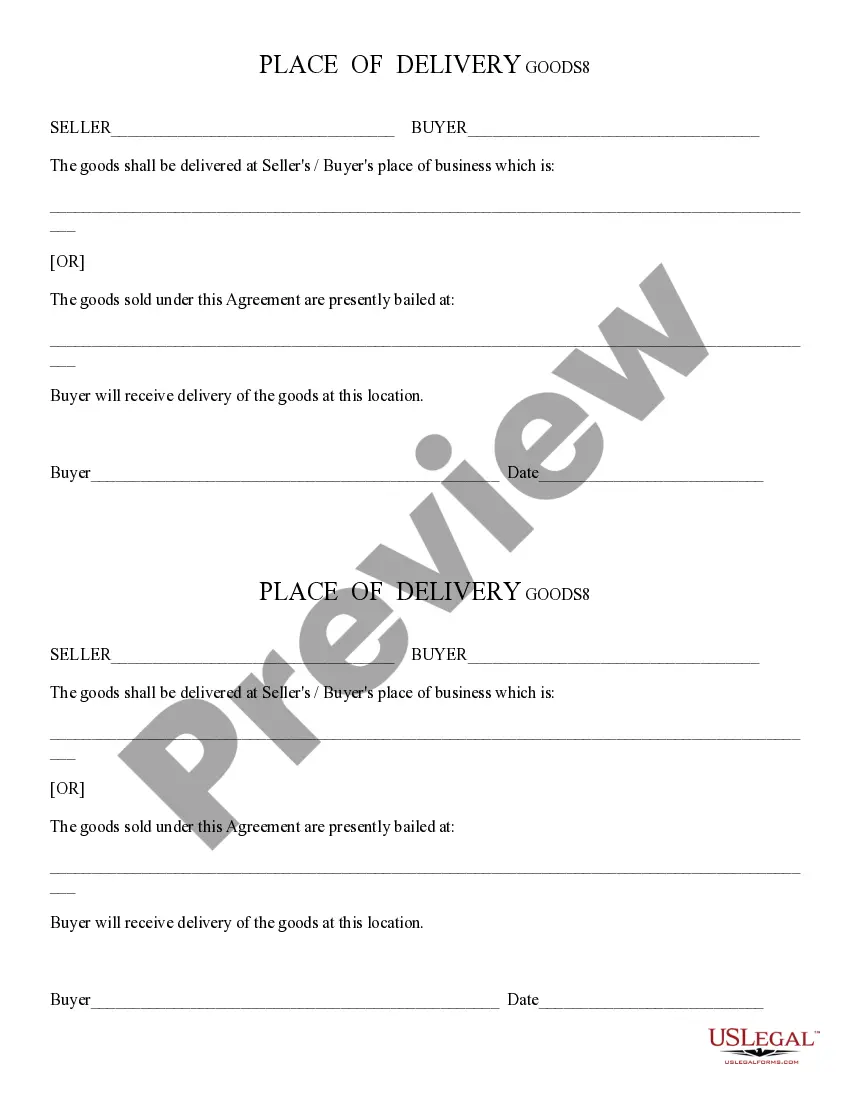

Review the template using the Preview feature or through the text description to ensure it fulfills your needs.

- They are straightforward to navigate with all documents organized by state and intended use.

- Our experts stay updated with legal developments, ensuring your form is current and compliant when obtaining a Georgia Deeds And Record Form 3231 from our site.

- Acquiring a Georgia Deeds And Record Form 3231 is effortless and rapid for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the form sample you require in the correct format.

- If you are new to our website, follow the steps outlined below.

Form popularity

FAQ

If you are a new business, register online with the Nebraska Department of Labor to retrieve your number and tax rate. If you already have a Nebraska Employer Account Number and Tax Rate, you can look this up online or find it on the Combined Tax Rate Notice mailed by the Nebraska Department of Labor each year.

Mail this return and payment to: Nebraska Department of Revenue, PO Box 98911, Lincoln, NE 68509-8911.

A Form 22 should be filed by any taxpayer who: ? Has a name or address change; ? Needs to correct, cancel, reinstate, or change a Nebraska tax certificate, license, or permit; ? Needs to change the filing frequency for sales and use tax, tire fee, lodging tax, or income tax withholding returns; or ? Needs to report a ...

Form 6XN may be filed at any time after you have filed your original Form 6. This amended form, properly signed and accompanied by remittance, is to be filed with the county treasurer in the county where the original form was filed or with the Nebraska Department of Revenue.

You can complete the current or previous tax year Nebraska State Income Tax Amendment with Form 1040XN and mail it in to file it. . You can not submit it electronically. For a federal amendment the IRS requires a different Form - Form 1040X -to amend an IRS return (do not use Form 1040 for an IRS Amendment).

How much does it cost to get an EIN? Applying for an EIN for your Nebraska LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

A Form 22 should be filed by any taxpayer who: ? Has a name or address change; ? Needs to correct, cancel, reinstate, or change a Nebraska tax certificate, license, or permit; ? Needs to change the filing frequency for sales and use tax, tire fee, lodging tax, or income tax withholding returns; or ? Needs to report a ...

If you need additional information, please contact Taxpayer Assistance at 800?742?7474 (toll free in Nebraska or Iowa), or 402?471?5729.