Estate Administration Forms Ontario

Description

How to fill out Georgia Administrator's Deed?

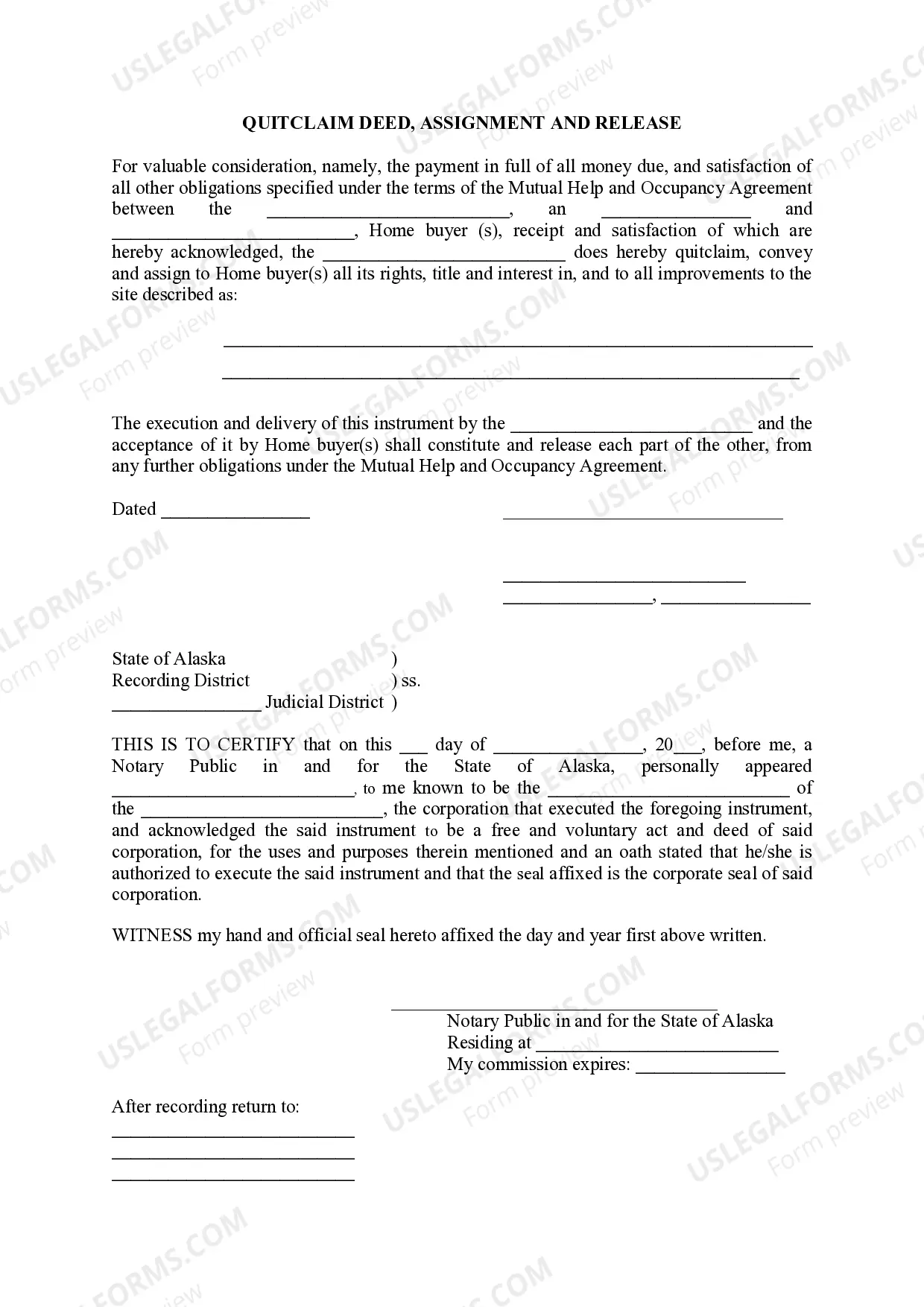

The Estate Administration Documentation Ontario displayed on this page is a versatile legal template crafted by expert attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has delivered individuals, businesses, and legal experts with more than 85,000 authenticated, state-specific documents for any entrepreneurial and personal events.

Select your preferred format for the Estate Administration Documentation Ontario (PDF, DOCX, RTF) and save the sample to your device.

- Search for the document you require and verify it.

- Review the sample you found and examine it or read the form description to confirm it meets your needs. If it doesn’t, use the search bar to find the correct one. Select Buy Now once you have located the template you desire.

- Register and Log In.

- Select the pricing option that fits your needs and establish an account. Utilize PayPal or a credit card for swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

An executor should be able to settle an estate in Ontario within 1 (One) year. The executor is responsible to distribute funds as soon as possible. However, the entire process takes time. Therefore, it is common for executors to distribute funds among the beneficiaries to take up to a year.

Estate Administration Tax (otherwise known as probate tax or probate fees) ? approximately 1.5% of the value of the estate (use our probate fees calculator to approximate the amount of Estate Administration Tax payable ? see below). This is the only true 'estate taxes' payable in Ontario.

In Ontario, probate is required when a deceased person's assets are held in their sole name. This includes assets such as real estate, bank accounts, investments, and personal property. If the assets are jointly held with someone else, probate may not be required.

If an estate is under $150,000 probate can be applied for through the small estate court process, otherwise, an estate must be probated through the more extensive application for estate certificate process.

Apply for probate (Certificate of Appointment of Estate Trustee/Small Estate Certificate) give a person the authority to act as the estate trustee of an estate. confirm the authority of a person named as the estate trustee in the deceased's will. formally approve that the deceased's will is their valid last will.