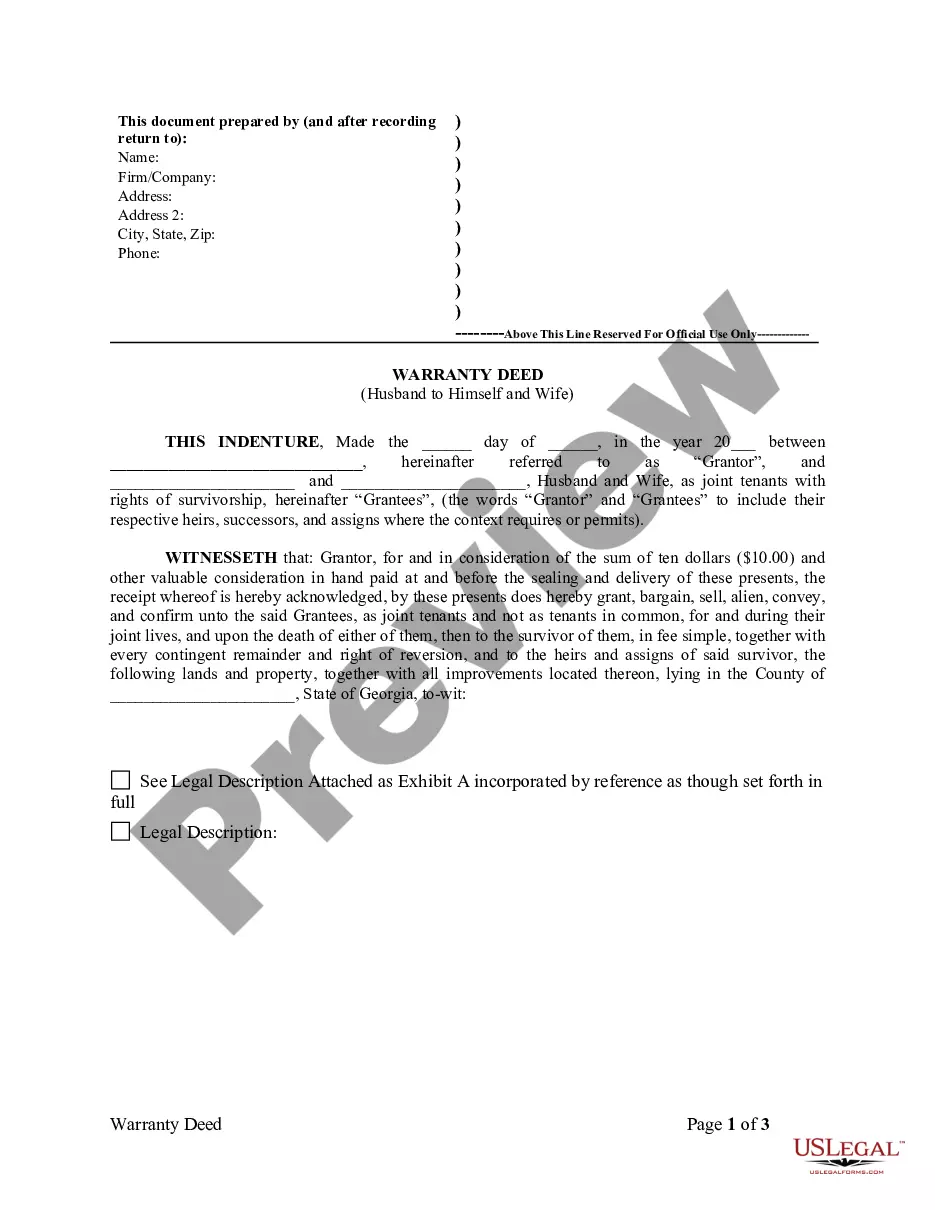

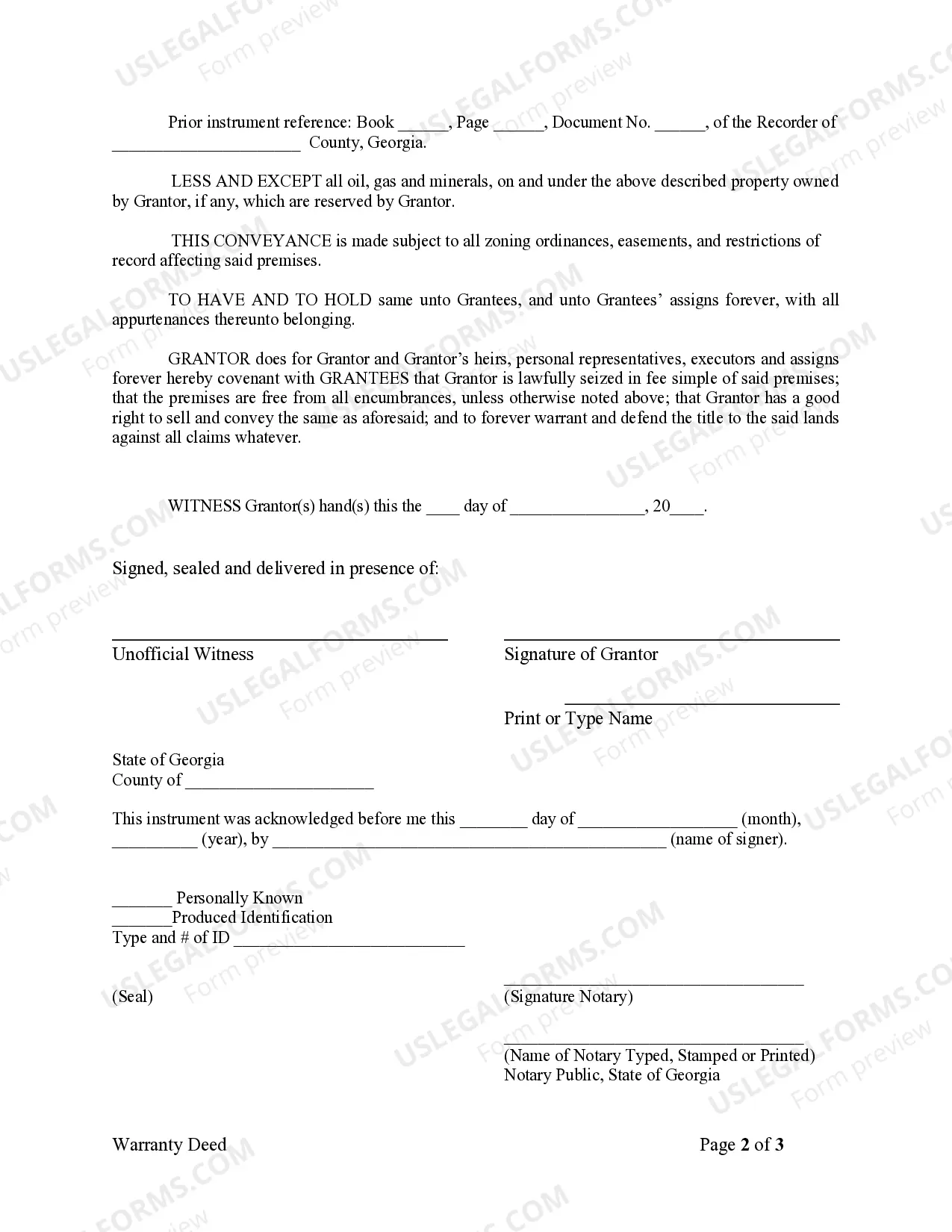

This form is a Warranty Deed where the grantor is the husband and the grantees are the husband and his wife. Grantor conveys and warrants the described property to grantees as joint tenants with rights of survivorship less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Adding a spouse to a deed in New York is a legal process that allows a married individual to include their spouse's name on the property title. This action solidifies joint ownership and recognizes the spouse's ownership rights. There are several types of adding a spouse to a deed in New York, including: 1. Adding Spouse to Deed as Joint Tenant: This method establishes joint tenancy, where both spouses have equal ownership rights and the right of survivorship. In the event of one spouse's death, the surviving spouse automatically inherits the full ownership without the need for probate. 2. Adding Spouse to Deed as Tenants in Common: This approach allows both spouses to have ownership rights, but they may have unequal shares. In this case, each spouse retains the ability to transfer or sell their share without the other's consent. 3. Adding Spouse to Deed via Quitclaim Deed: This method involves using a quitclaim deed to transfer the property ownership from one spouse to both spouses jointly. It is relatively straightforward and commonly used for adding a spouse to the deed in New York. 4. Adding Spouse to Deed via Warranty Deed: A warranty deed is another option for adding a spouse to a deed in New York, providing a guarantee that the granter holds a clear title to the property and has the right to transfer it. This method ensures a higher level of protection for the new joint owners. When adding a spouse to a deed in New York, it is crucial to follow the legal process to ensure it is done correctly. It generally involves drafting the necessary documents, such as a deed or quitclaim deed, which should be executed and notarized according to state and local requirements. Additionally, it is advisable to consult with a real estate attorney or a qualified professional to guide you through the process. By adding a spouse to the deed, couples can ensure joint ownership, protect their rights, and streamline the property transfer process in the future. It is important to note that each situation may vary, so it's essential to consult with legal experts specializing in real estate matters to determine the best course of action based on individual circumstances.