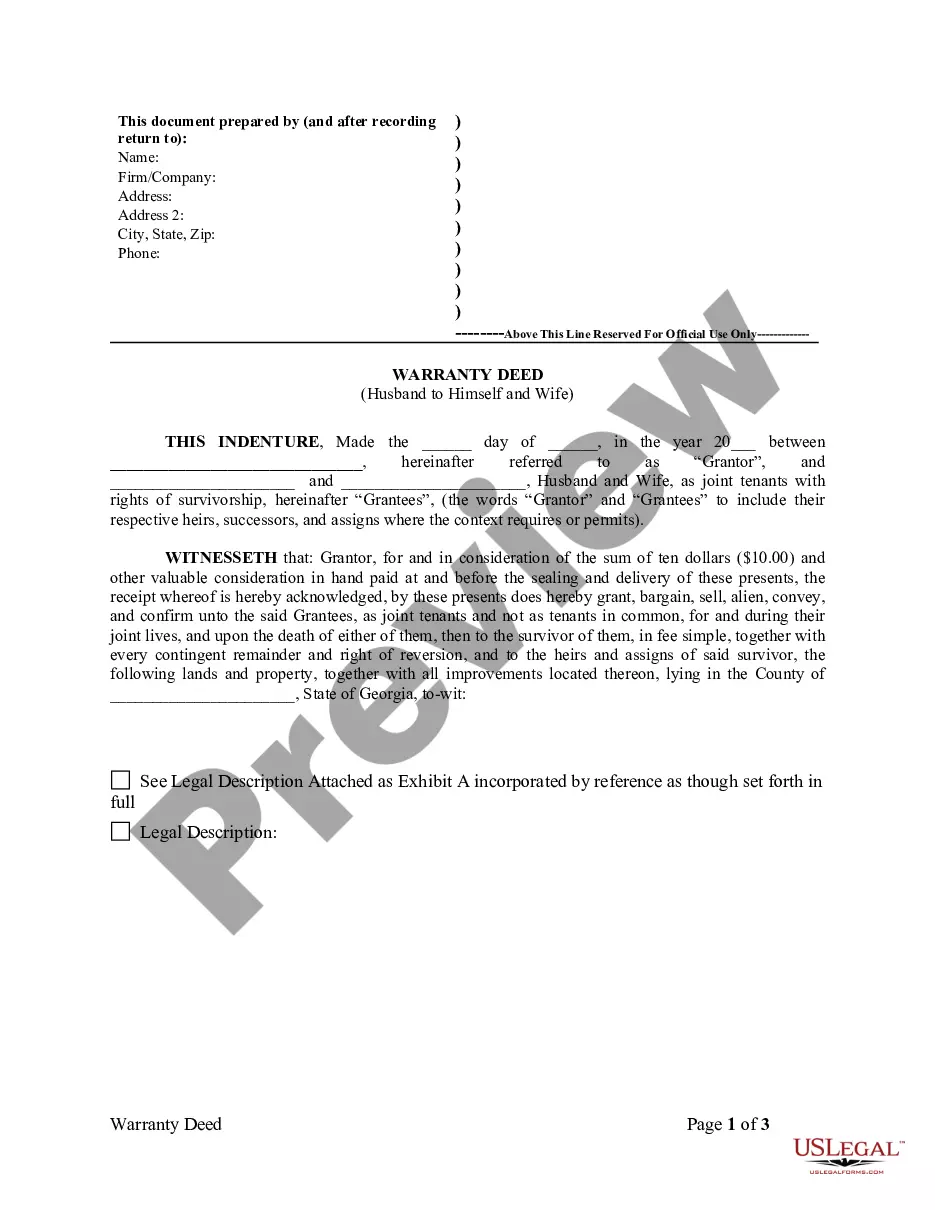

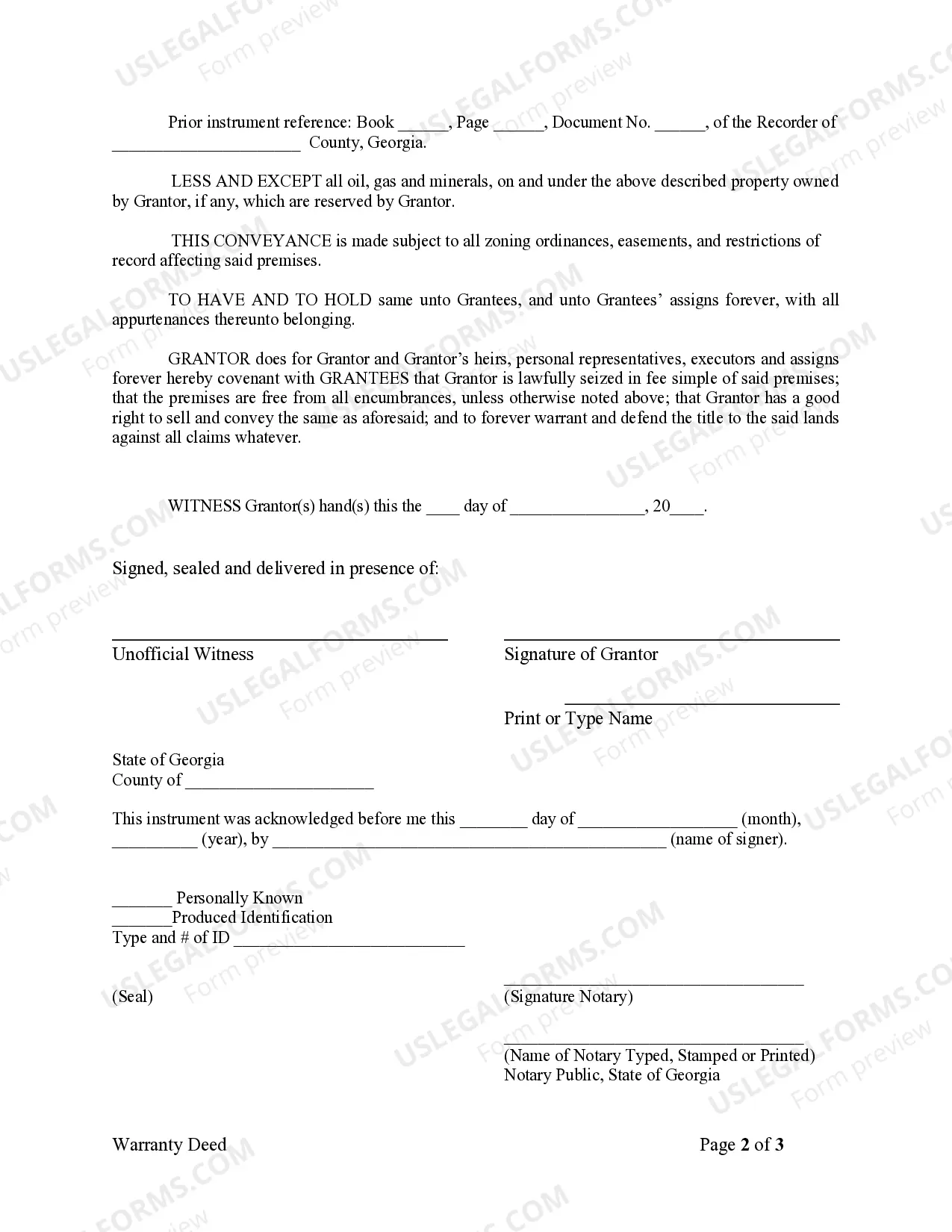

This form is a Warranty Deed where the grantor is the husband and the grantees are the husband and his wife. Grantor conveys and warrants the described property to grantees as joint tenants with rights of survivorship less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Adding A Name To A Deed In Ontario

Description

How to fill out Georgia Warranty Deed From Husband To Himself And Wife?

Legal managing might be mind-boggling, even for the most skilled specialists. When you are looking for a Adding A Name To A Deed In Ontario and do not have the a chance to devote trying to find the right and up-to-date version, the operations might be stress filled. A robust online form library could be a gamechanger for anyone who wants to take care of these situations efficiently. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available at any moment.

With US Legal Forms, you may:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any requirements you could have, from individual to business paperwork, all in one location.

- Employ advanced tools to complete and handle your Adding A Name To A Deed In Ontario

- Access a useful resource base of articles, instructions and handbooks and materials related to your situation and needs

Save effort and time trying to find the paperwork you will need, and utilize US Legal Forms’ advanced search and Preview tool to locate Adding A Name To A Deed In Ontario and get it. If you have a monthly subscription, log in for your US Legal Forms account, search for the form, and get it. Review your My Forms tab to find out the paperwork you previously saved and to handle your folders as you can see fit.

If it is the first time with US Legal Forms, register a free account and get unlimited use of all benefits of the library. Listed below are the steps for taking after downloading the form you want:

- Validate this is the proper form by previewing it and reading through its description.

- Be sure that the sample is acknowledged in your state or county.

- Choose Buy Now once you are all set.

- Select a monthly subscription plan.

- Pick the file format you want, and Download, complete, eSign, print out and send your document.

Enjoy the US Legal Forms online library, supported with 25 years of experience and stability. Transform your day-to-day document management in to a easy and easy-to-use process today.

Form popularity

FAQ

Canada considers gifted property as having been sold at its fair market value. To defer capital gains tax, the tax rules allow a tax-free rollover automatically at a cost to a spouse or common-law partner.

To take possession of a property, a Transfer of Title must happen first. This is a formal legal exchange of ownership of a home from one person to another. In Ontario, this must be completed by a lawyer to ensure you are protected from future claims on the home and that all financial and legal obligations are laid out.

Adding a family member to the deed as a joint owner for no consideration is considered a gift of 50% of the property's fair market value for tax purposes. If the value of the gift exceeds the annual exclusion limit ($16,000 for 2022) the donor will need to file a gift tax return (via Form 709) to report the transfer.

You would need to retain the services of a real estate lawyer for the transfer of a property to a family member in Ontario. Your real estate lawyer will be responsible for preparing all documentation and advising you if any land transfer tax would be applicable upon transfer to a family member.

We recommend you consult with an experienced real estate lawyer for professional advice as each circumstance is unique. (Please note, the fee for our office to add someone to your deed is $650.00, plus recording costs and documentary stamps ? recordings costs are normally less than $50.00.) Want to Know More?