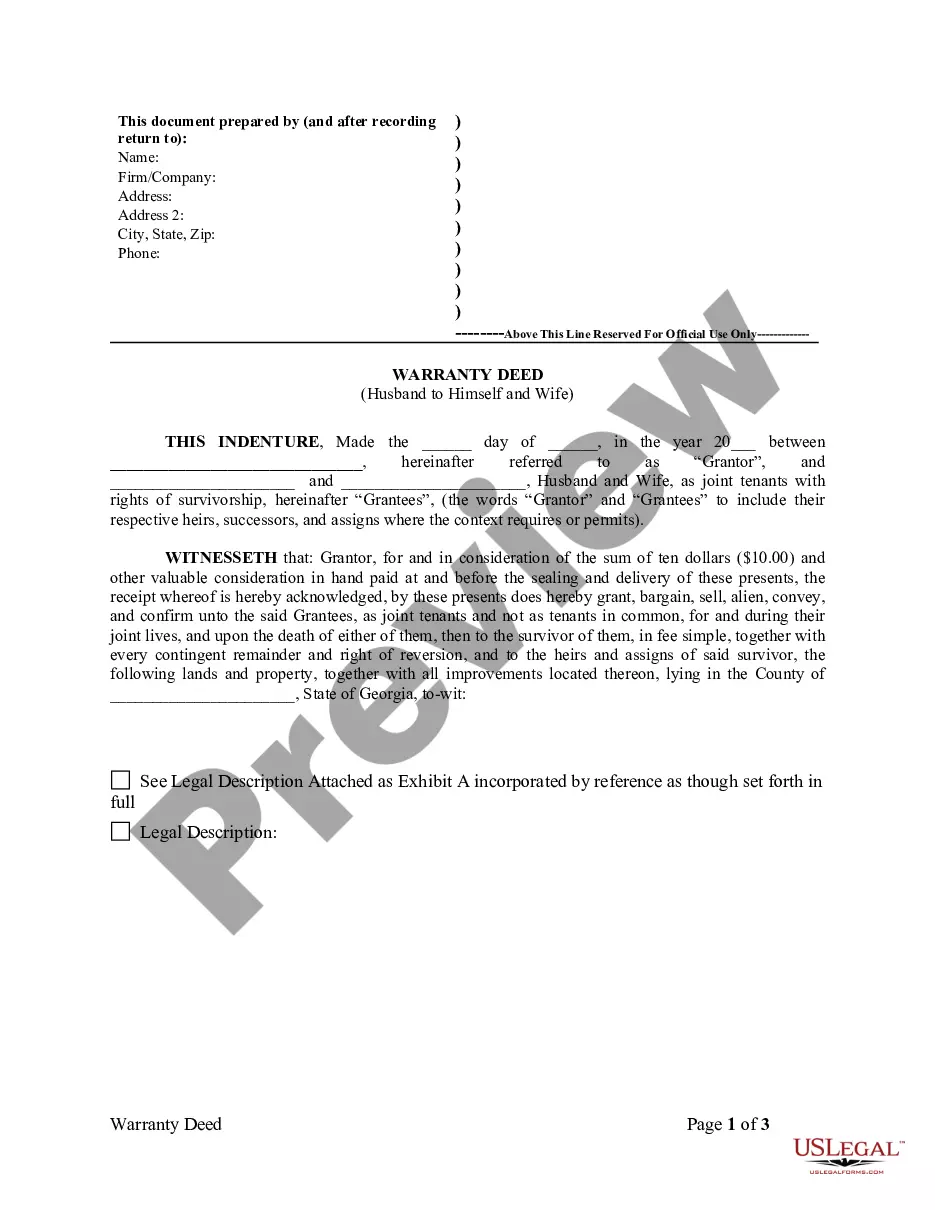

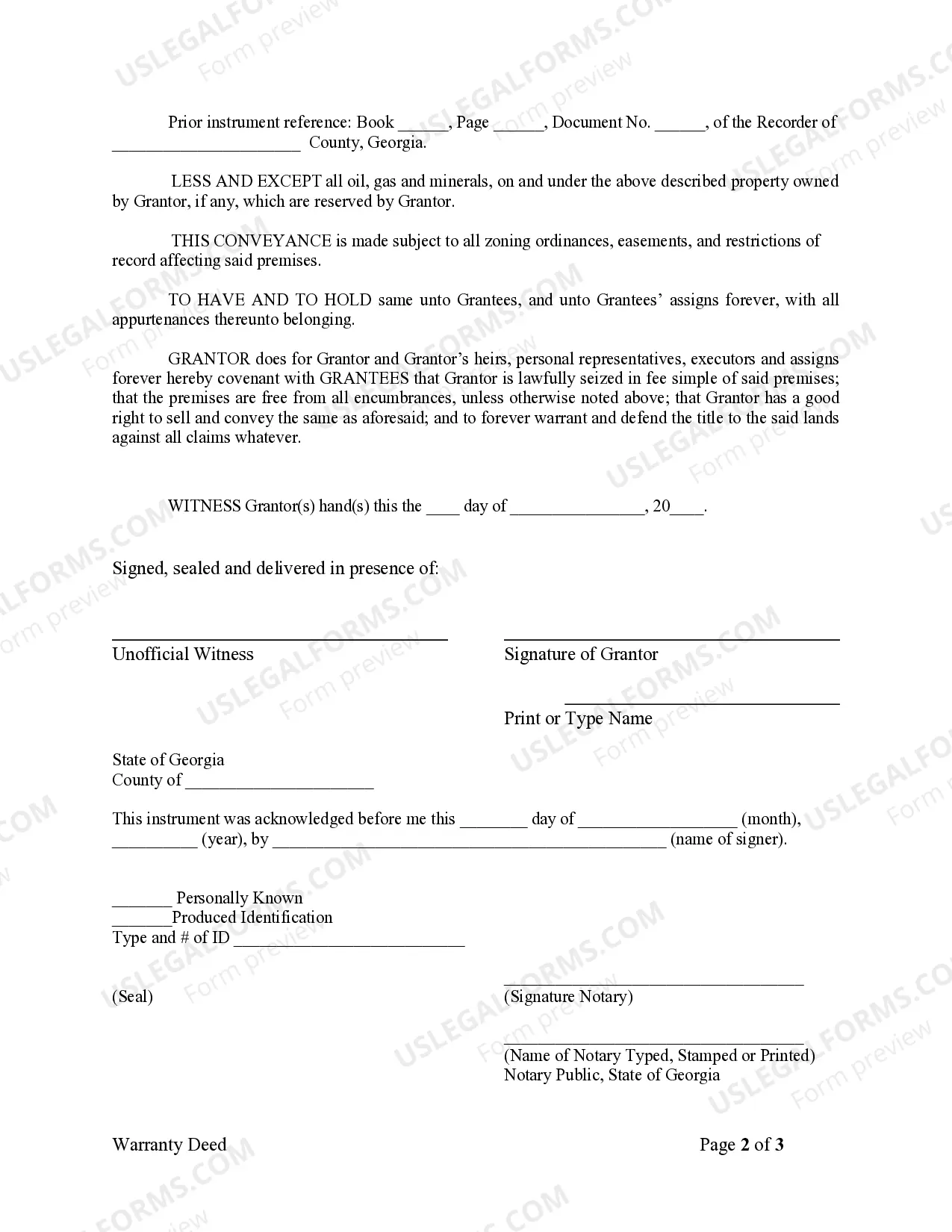

This form is a Warranty Deed where the grantor is the husband and the grantees are the husband and his wife. Grantor conveys and warrants the described property to grantees as joint tenants with rights of survivorship less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Title: Add Someone to House Deed with Mortgage: A Comprehensive Guide Introduction: Adding someone to a house deed with a mortgage involves the process of amending the legal ownership of a property while maintaining an ongoing mortgage. This can have various purposes, such as safeguarding the property, sharing ownership, or facilitating financial arrangements. In this article, we will explore the different types of adding someone to a house deed with a mortgage and provide a detailed description of the process. Types of Adding Someone to House Deed with Mortgage: 1. Joint Tenancy: This type of addition grants ownership rights to multiple individuals equally. Each owner possesses an undivided share and has the right of survivorship, meaning if one owner passes away, their share automatically transfers to the surviving owner(s). 2. Tenancy in Common: Adding someone to a house deed under tenancy in common allows for unequal ownership shares. Owners can have distinct percentage interests, and if one owner passes away, their share does not automatically transfer to the other owner(s). Instead, it is distributed according to their will or applicable laws. 3. Trust Ownership: Adding someone to a house deed with a mortgage through a trust allows the property to be held by a trustee for the benefit of the beneficiaries. This type offers various benefits, including avoiding probate, preserving privacy, and controlling the property's future distribution. Process of Adding Someone to House Deed with Mortgage: 1. Consultation: Consult with an attorney or a real estate professional to understand the legal implications, potential tax consequences, and specific requirements for adding someone to a house deed with a mortgage. 2. Review Mortgage Agreement: Examine the existing mortgage agreement to determine any restrictions or permissions related to adding someone to the deed. Contact the mortgage lender to discuss the necessary steps and potential implications on the mortgage terms. 3. Prepare the Necessary Documents: Work with a legal professional to draft the required legal documentation, such as a Quitclaim or Warranty Deed, reflecting the intended changes to the ownership. 4. Obtain Consent: Ensure all parties involved, including the existing owner(s), the mortgage lender, and the new individual to be added, provide their full consent to the addition. 5. File with County Recorder's Office: Submit the duly executed and notarized deed documents to the county recorder's office where the property is located. Pay any applicable fees for recording and transferring ownership. 6. Update Mortgage Information: Inform the mortgage lender about the change in ownership and provide any requested documentation or forms to update their records accordingly. Conclusion: Adding someone to a house deed with a mortgage involves a legal process to modify property ownership while considering the implications on the existing mortgage. Whether opting for joint tenancy, tenancy in common, or trust ownership, seeking professional advice is crucial to navigate the complexities and ensure compliance with legal requirements. By following the proper steps, individuals can effectively add someone to a house deed with a mortgage and address their specific ownership objectives.