Trust Deed For School

Description

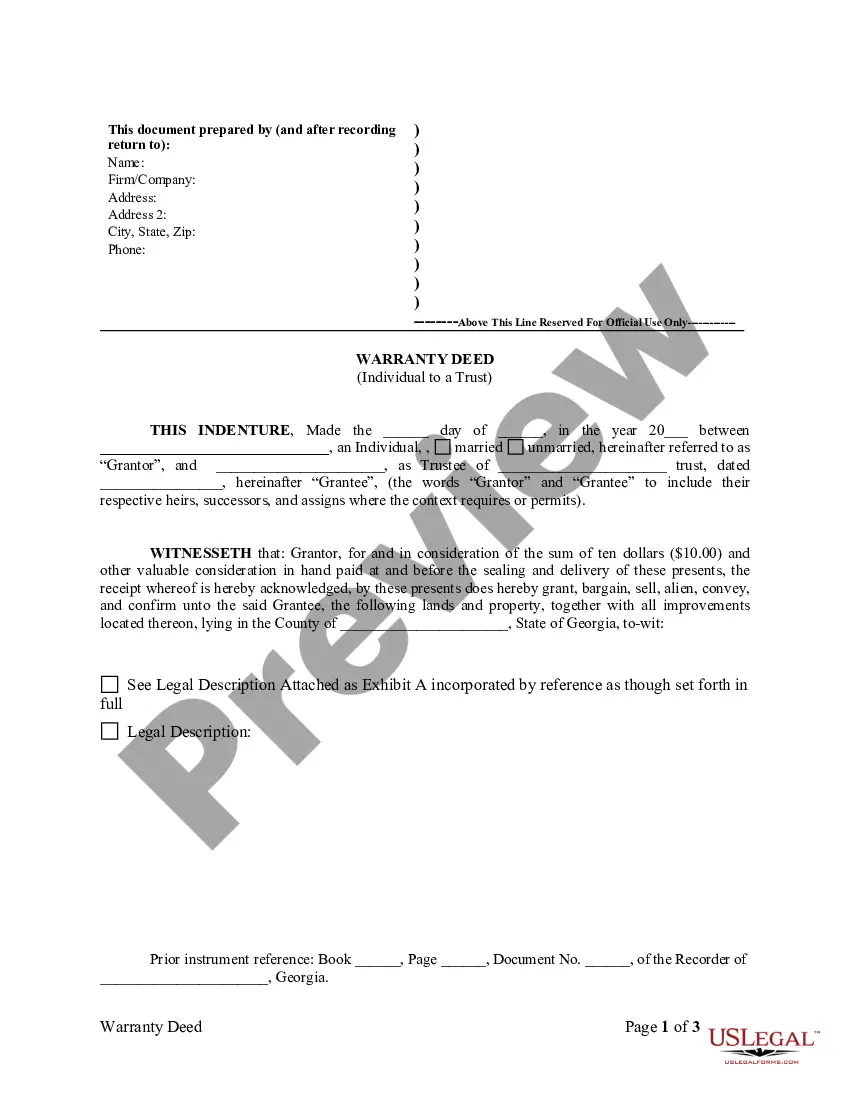

How to fill out Georgia Warranty Deed From Individual To A Trust?

- Access your US Legal Forms account or create a new one if you're a first-time user.

- Browse the available forms and check the preview mode to verify that the trust deed for school meets your specific needs.

- If you find the right template, proceed to purchase by clicking the Buy Now button, selecting your preferred subscription plan.

- Complete the payment process using your credit card or PayPal to gain full access to the library's resources.

- Download the trust deed for school and save it on your device, allowing easy access to your document in the 'My Forms' section whenever needed.

Once you've followed these steps, you will have successfully acquired your trust deed for school, benefiting from the simple process and extensive support offered by US Legal Forms.

Take control of your legal documentation today—sign up for US Legal Forms and ensure you have all the resources necessary for your educational institution!

Form popularity

FAQ

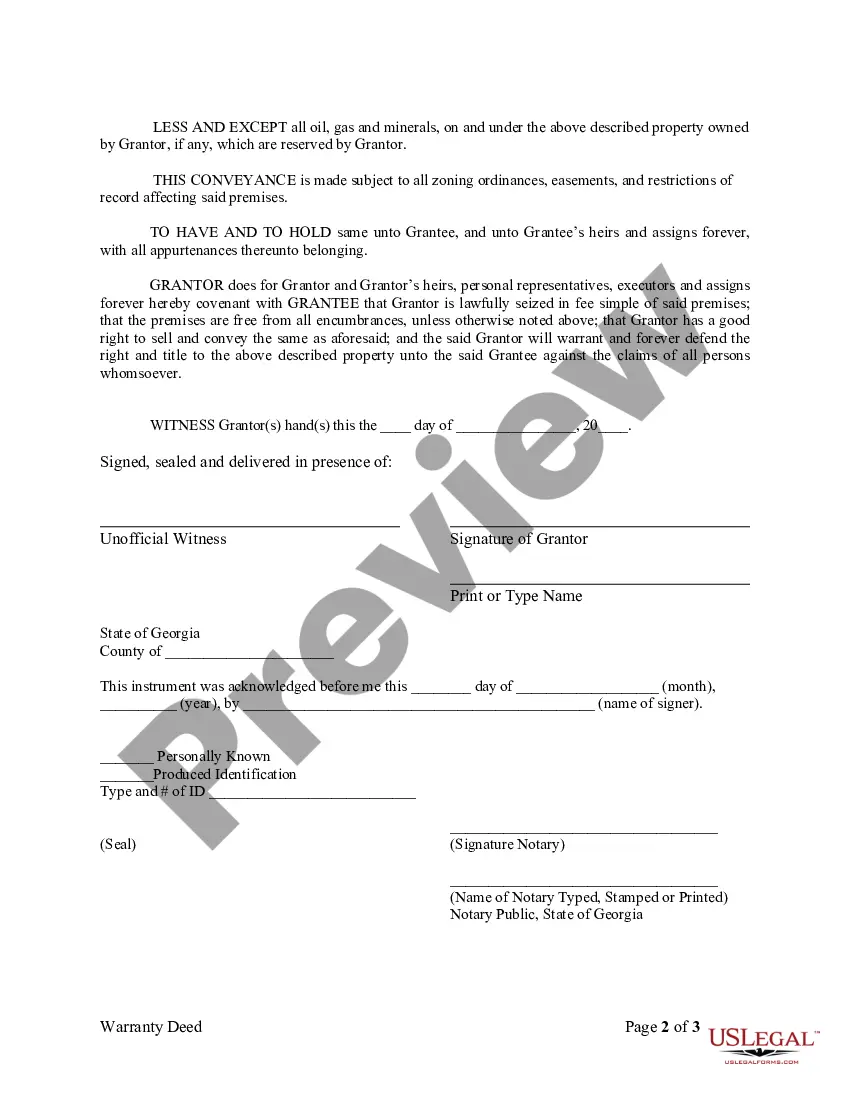

The purpose of a deed trust is to clarify the relationship between lenders and borrowers, especially in financing situations. For a trust deed for school, this ensures that the educational institution can secure necessary funding while maintaining transparency with its financial obligations. By having a clear deed trust, schools can effectively manage their assets while protecting the interests of all stakeholders involved.

Writing a trust deed for school requires careful consideration of all terms involved. First, clearly outline the roles of the parties involved, including the trustee, borrower, and lender. Next, specify the property being used as collateral, as well as all repayment obligations and procedures. To ensure accuracy and legality, you may want to utilize platforms like USLegalForms that offer guidance and templates for creating trust deeds.

The purpose of a trust deed for school is to provide a legal framework that outlines how assets are managed and distributed. It acts as a binding agreement, ensuring the interests of all parties are protected. With a clear trust deed, educational institutions can confidently manage resources, making decisions with transparency and accountability.

The disadvantage of a trust deed for school often lies in its complexity and the potential for misunderstandings. If parties involved do not fully grasp the terms, it can lead to disputes down the line. Additionally, a trust deed may involve significant legal fees and the commitment of time to ensure it is set up correctly. It's important to fully understand all aspects before proceeding.

Choosing between a trust and a 529 plan depends on individual financial goals and plans for education. While a 529 plan offers tax advantages for college savings, a trust deed for school provides flexibility in how funds can be used, including for primary and secondary education. Evaluating your specific needs and goals can help you make the best choice, and consulting with a financial advisor is often beneficial.

To draft a trust deed, start by clearly defining the trust's purpose and the beneficiaries involved. You will outline the terms, including how assets will be managed and distributed, particularly in relation to education. If you feel uncertain about legal language, using UsLegalForms can help provide a reliable framework, making the drafting process easier and more compliant.

Setting up a trust for a child involves several key steps. First, you define the purpose of the trust, which often includes allocating funds for education. Next, you draft the trust deed for school, specifying how the funds will be managed and distributed over time. Finally, consider utilizing platforms like UsLegalForms to simplify the setup process, ensuring all legal documents are properly prepared.

Typically, a trust deed for school is created by a settlor, who is often a parent or guardian. This individual outlines the specific terms and conditions of the trust, ensuring it meets their intentions for the child's educational journey. In many cases, working with an attorney or a specialized service can help streamline this process and ensure all legal requirements are met.

A trust asset can be any valuable property that you transfer into the trust. Common examples include real estate properties, vehicles, or substantial savings accounts. If you are creating a trust deed for school, consider including scholarships or educational funds as trust assets. This will enhance the trust's effectiveness in supporting the intended educational goals.

Three common types of trusts include revocable trusts, irrevocable trusts, and testamentary trusts. A revocable trust allows the trustor to modify it while alive, while an irrevocable trust cannot be changed once established. Testamentary trusts, created through a will, take effect after the trustor's death. Each type can be tailored to specific needs, such as education through a trust deed for school.