Ga With Company

Description

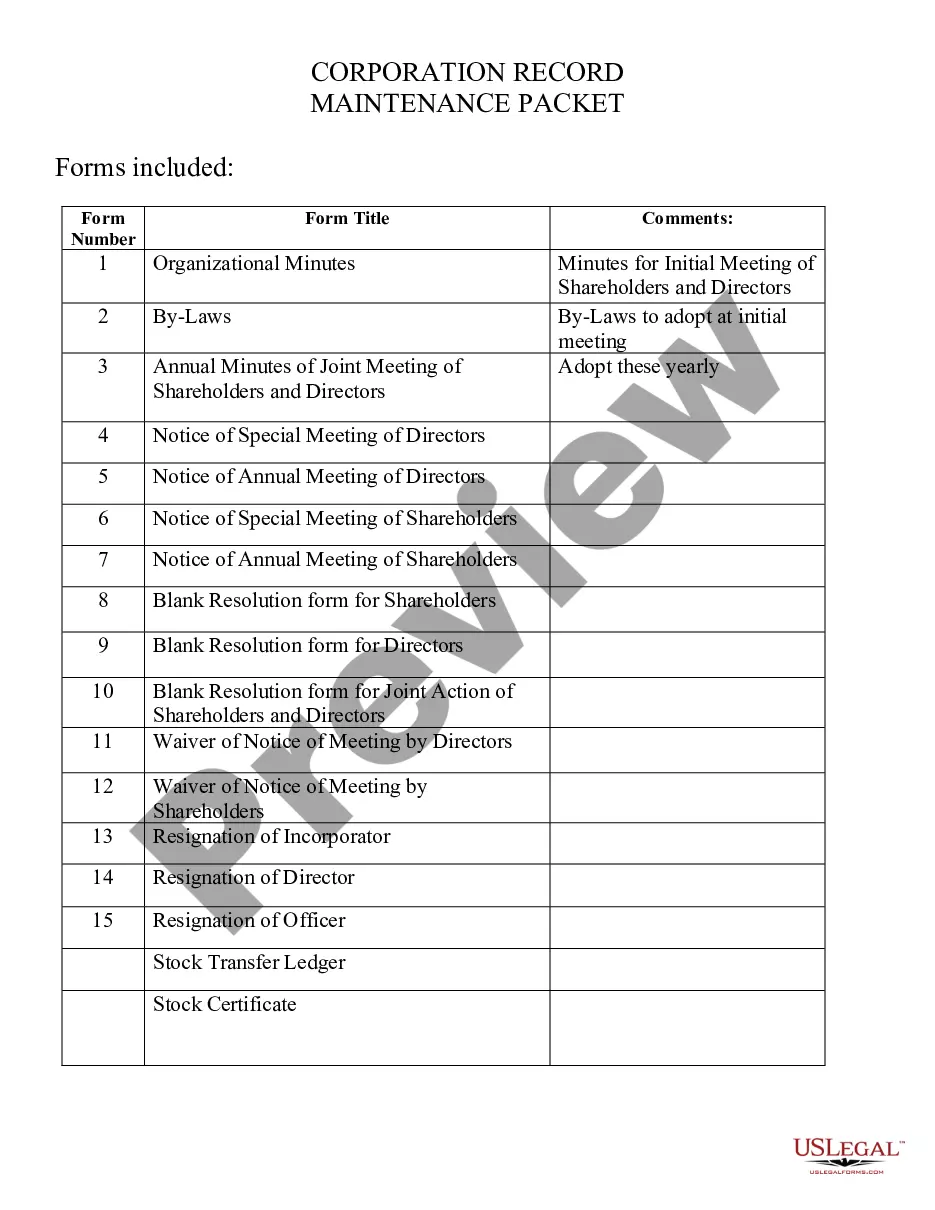

How to fill out Georgia Corporate Records Maintenance Package For Existing Corporations?

Discovering a reliable location to obtain the latest and most pertinent legal templates is a significant part of dealing with regulatory processes.

Selecting the appropriate legal documents necessitates precision and carefulness, which is why it's crucial to obtain Ga With Company samples exclusively from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and prolong the situation you are facing.

Eliminate the complications that come with your legal paperwork. Discover the extensive US Legal Forms library where you can find legal templates, evaluate their relevance to your situation, and download them instantly.

- Use the catalog navigation or search feature to find your template.

- Check the form’s details to ensure it meets the standards of your state and locality.

- Examine the form preview, if available, to confirm it is the document you seek.

- Return to the search to find the appropriate document if the Ga With Company does not fulfill your requirements.

- When you are confident about the form’s suitability, proceed to download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account, click Buy now to obtain the form.

- Choose the pricing plan that fits your needs.

- Continue with the registration to finalize your purchase.

- Conclude your purchase by selecting a transaction method (credit card or PayPal).

- Choose the document format for downloading Ga With Company.

- After you have the form on your device, you can edit it with the editor or print it and complete it manually.

Form popularity

FAQ

You will need to: Hire a registered agent in the state. Reserve a business name. File Articles of Organization. Submit a Transmittal form. Apply for the appropriate Georgia business licenses and permits.

While many Georgia businesses are required to register with the Corporations Division, businesses often need local operating licenses, federal operating licenses depending on the business, and/or state-level professional licenses. In certain cases, employees may need to be individually licensed as well.

Georgia LLC Formation Filing Fee: $100 To form an LLC in Georgia, you'll need to file Articles of Organization with the Georgia Corporations Division and pay the $100 filing fee ($110 if filing by mail or in person). Your articles are what create your Georgia LLC, you can't have one without forking over the filing fee.

You can access the Online Employer Tax Registration on the Department of Labor's website. After you fill out your business information, you will receive a determination stating if you're responsible for paying unemployment insurance taxes. If you are, you will receive instructions for setting up an account.

Forming an LLC in Georgia is relatively simple. You'll need to register your business with the Georgia secretary of state, who defines the rules and procedures for LLC formation in the state.