Georgia Contractor Form Withholding

Description

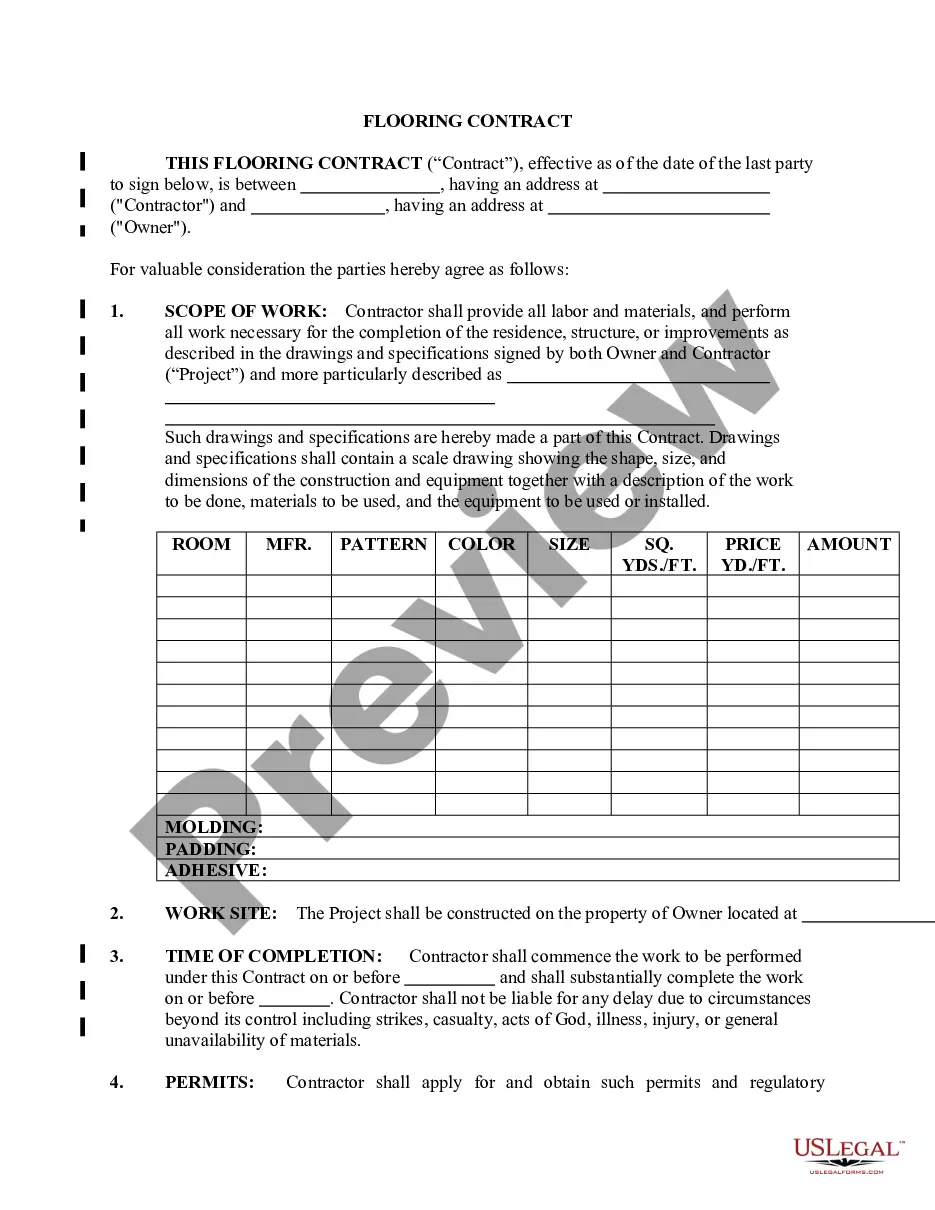

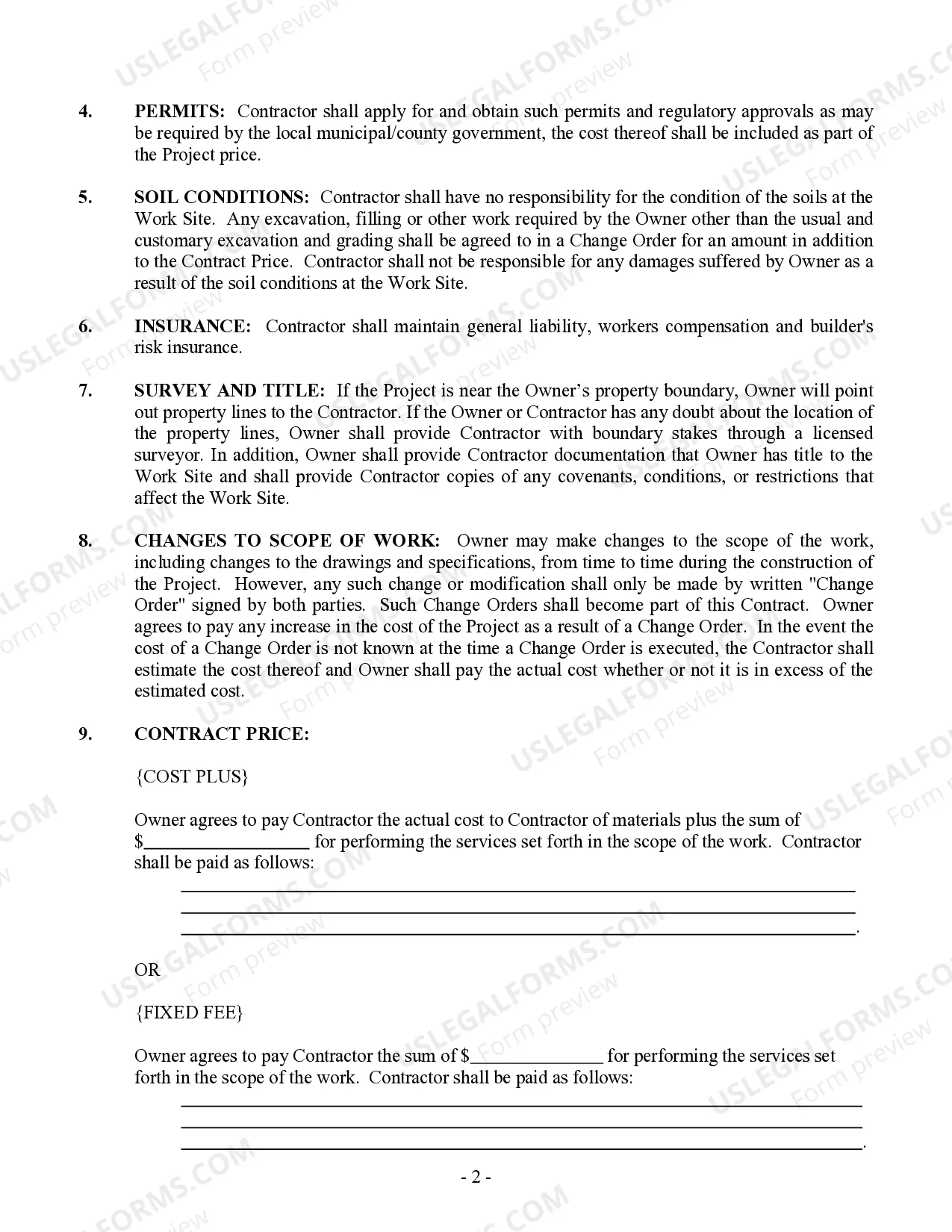

How to fill out Georgia Flooring Contract For Contractor?

When you are required to submit the Georgia Contractor Form Withholding per your local state's statutes and regulations, there may be many alternatives available.

There’s no need to verify every document to ensure it meets all the legal specifications if you are a US Legal Forms member.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any subject.

Utilizing professionally prepared official documents becomes effortless with US Legal Forms. Additionally, Premium users can benefit from the powerful integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms holds the largest online database featuring a collection of over 85k ready-to-use documents for commercial and personal legal matters.

- All templates have been confirmed to adhere to each state’s statutes.

- Thus, when you download the Georgia Contractor Form Withholding from our site, you can be assured that you possess a legitimate and current document.

- Accessing the required sample from our platform is exceedingly straightforward.

- If you already possess an account, simply Log In to the platform, ensure your subscription is active, and save the chosen file.

- In the future, you may navigate to the My documents section in your account and gain access to the Georgia Contractor Form Withholding at any time.

- If this is your first encounter with our library, kindly follow the instructions below.

- Browse the recommended page and verify it for alignment with your needs.

Form popularity

FAQ

Married, Filing Joint Return - One Spouse Working = Two (2) personal exemptions. Married, Filing Separate Returns or Joint Return - Both Spouses Working = One (1) personal exemption. Single or Head of Household = One (1) personal exemption.

How to Complete the W-4 Tax FormDetermine your allowances.Fill out your personal information.Claim an exemption if it applies.Fill out itemized deductions, if you're using them.Figure out how much additional withholding you need.

You can pay electronically through the DOR's Georgia Tax Center (GTC) website (there is a convenience fee if you pay by credit card). Payments on paper must be filed with the correct payment voucher or return. Monthly filers use Form GA-V,Withholding Payment Voucher.

You must use either one of two forms, a W-4 or a W-9, depending on whether you are hiring a new employee or an independent contractor. If you are hiring a new employee, you must have that person fill out a W-4 form. If you are hiring an independent contractor, you must have that person complete a W-9 form.

The W-4 requires basic personal information, like your name, address, and Social Security number. Previously, the number of allowances and your tax filing status determined how much income tax was withheld from your pay. Now, it's much simpler than that.