Joint Tenants With Right Of Survivorship Florida Form

Description

Form popularity

FAQ

While joint tenancy with right of survivorship offers benefits, it also has drawbacks. One major con is that one owner's creditors may claim the property if they encounter financial issues. Furthermore, both owners have equal rights to the property, which can create complications in decision-making or in case of a breakup. Understanding these challenges can help you make an informed decision about using the joint tenants with right of survivorship Florida form.

Joint tenants with right of survivorship Florida form can have significant tax implications for both owners. Upon the death of one joint tenant, the surviving tenant generally receives a step-up in basis, which can reduce capital gains taxes if the property is sold. However, there may be estate tax considerations depending on the total value of the estate. Consulting a tax professional can help clarify your specific situation.

Yes, the right of survivorship typically overrides a will. If you hold property as joint tenants with right of survivorship Florida form, the surviving owner automatically inherits the property upon the other owner's death. This automatic transfer occurs regardless of what the will states, emphasizing the importance of understanding joint tenancy. It is crucial to plan accordingly to ensure your wishes are met.

Avoiding joint ownership may protect your assets from disputes and unwanted consequences. When you opt for joint tenants with right of survivorship Florida form, you share ownership with specific rights. However, this can lead to complications, especially if disagreements arise or if one owner wishes to sell. Exploring alternatives may provide more control over your property.

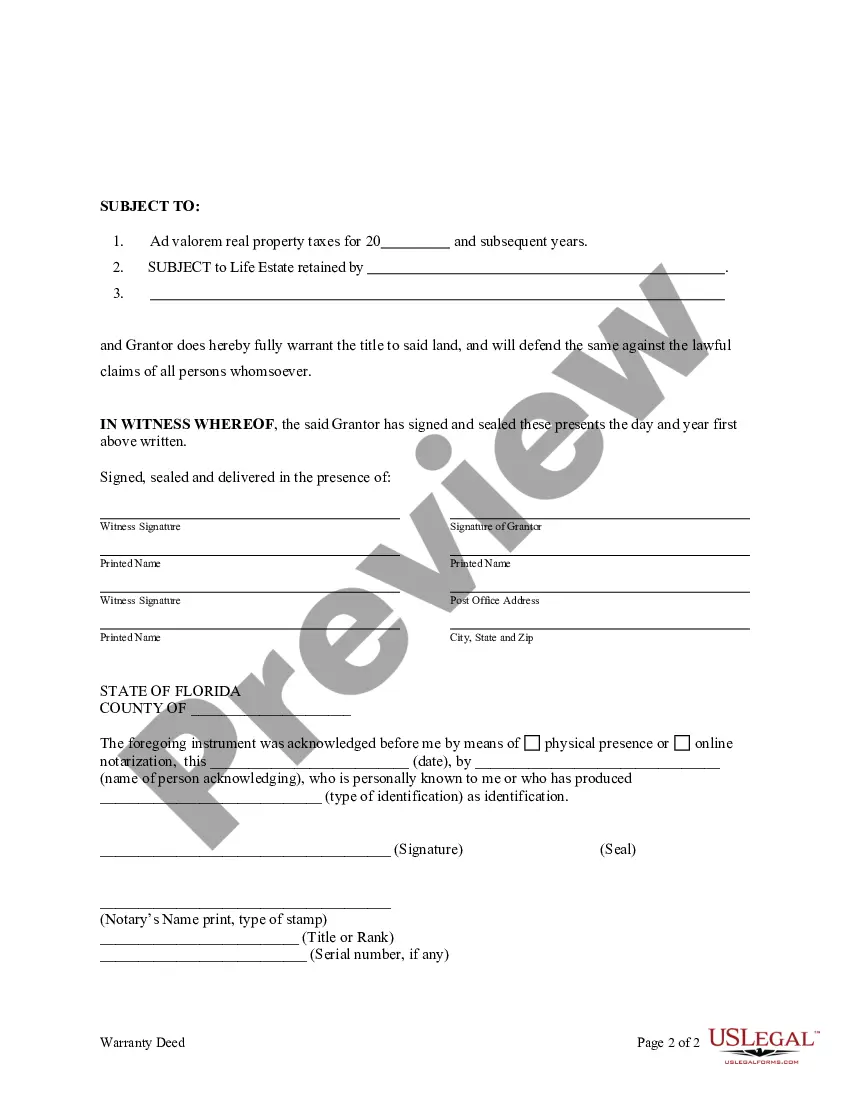

To break a joint tenancy with right of survivorship in Florida, you can execute a severance by having one party file a formal notice of severance with the county clerk. This action converts the joint tenancy into a tenancy in common, allowing individual ownership of your share. Another option is to reach an agreement with the other joint tenant and draft a new deed reflecting the changes. Using the Joint tenants with right of survivorship Florida form can simplify this process and ensure your decisions are documented properly.

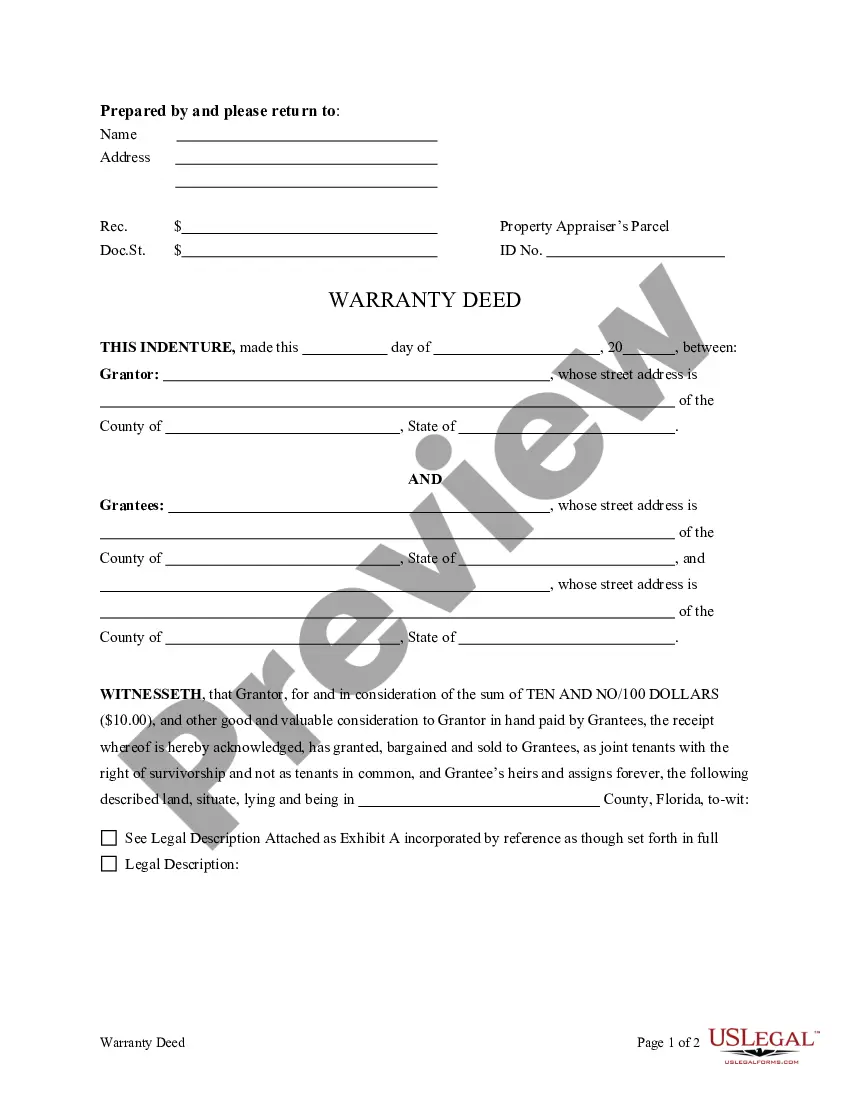

To file a joint tenancy with right of survivorship, you first need to complete the deed that reflects your ownership terms. Once prepared, both parties should sign the deed. You can then file the signed document with the county's property records office. Using resources like US Legal Forms helps streamline this filing process and ensures accuracy.

Creating joint tenancy with right of survivorship in Florida involves drafting a deed that clearly names all owners and specifies the joint nature of the ownership. It's vital to use precise language, such as 'joint tenants with right of survivorship,' to avoid misunderstandings. After signing the deed, you should file it with the county clerk for it to take effect. Consider using US Legal Forms to ensure all documentation is properly completed.

In Florida, the right of survivorship is not automatic but depends on how the deed is written. If the deed does not include the phrase 'joint tenants with right of survivorship,' the default ownership rules apply, which may not allow for the right of survivorship. This means that it’s crucial to use the proper language in your documents to ensure desired outcomes. Accessing US Legal Forms can assist in drafting an accurate deed.

To establish joint tenancy with right of survivorship, you need to prepare a deed that explicitly states your intent. Both parties must be identified and agree to hold the property jointly. Signing the deed and filing it with the relevant county authority secures the ownership interests. Utilizing a reliable resource like US Legal Forms can guide you through this process seamlessly.

One disadvantage of joint tenancy with right of survivorship is that it can limit the ability of an individual to will their share of the property to someone else. Additionally, if one joint tenant incurs debt, creditors may claim the property, affecting all owners. It’s also important to consider that decisions regarding the property must be mutually agreed upon, which can lead to conflicts. In this case, the US Legal Forms platform provides resources to help navigate these challenges.