Florida Corrective Deed With A Mortgage

Description

How to fill out Florida Deed Of Correction - Failure To Attach Legal Description?

The Florida Corrective Deed With A Mortgage presented on this page is a versatile legal template crafted by experienced attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 validated, state-specific forms for various business and personal situations. It’s the quickest, easiest, and most reliable method to acquire the documentation you require, as the service ensures bank-level data protection and anti-malware safeguards.

Select the format you prefer for your Florida Corrective Deed With A Mortgage (PDF, Word, RTF) and download the document onto your device.

- Explore the document you require and evaluate it.

- Search through the template you've located and preview it or verify the form's description to ensure it meets your needs. If it does not, utilize the search feature to find the correct document. Click Buy Now when you've identified the template you desire.

- Choose and Log Into your account.

- Pick the pricing plan that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and review your subscription to continue.

- Receive the editable template.

Form popularity

FAQ

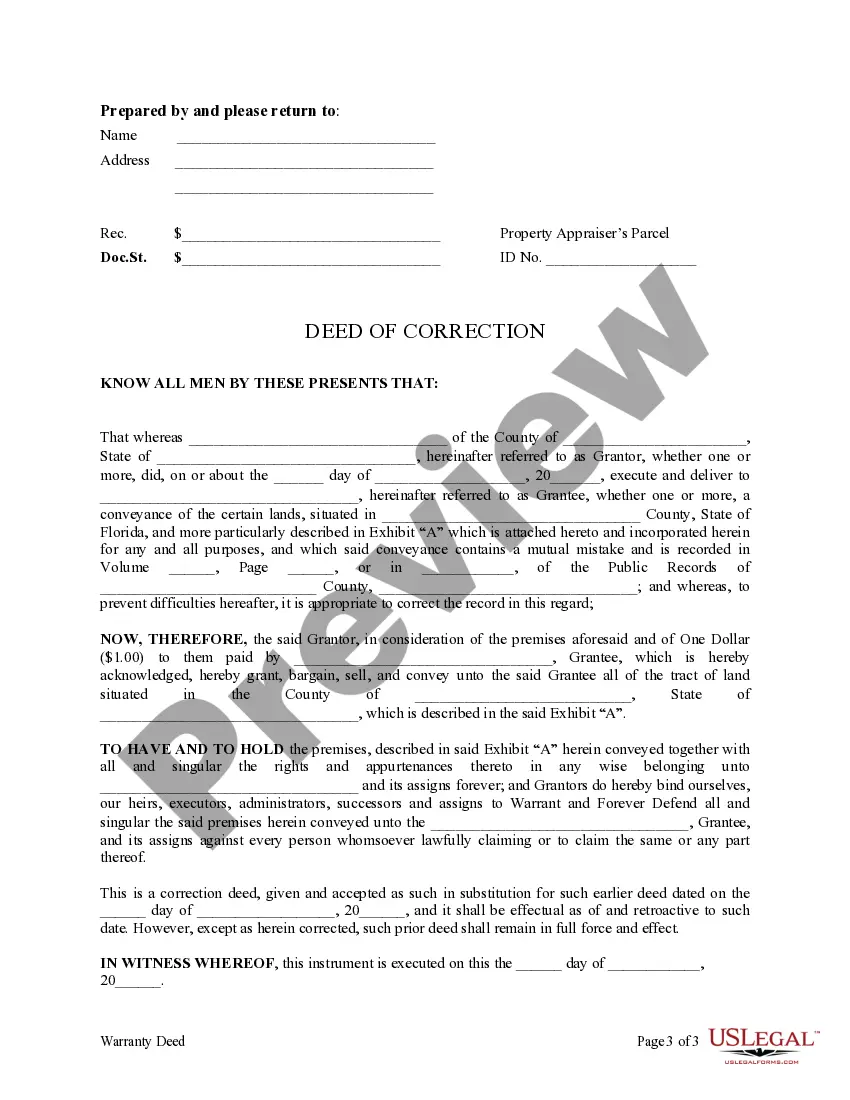

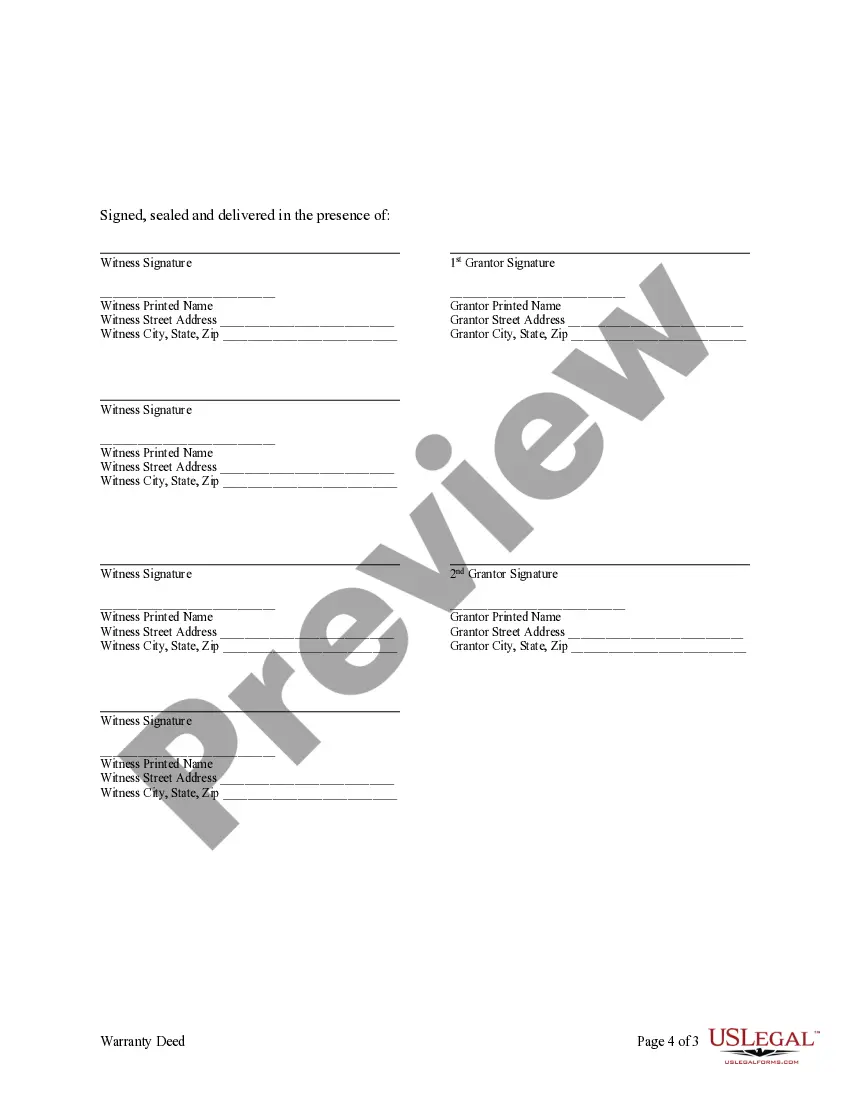

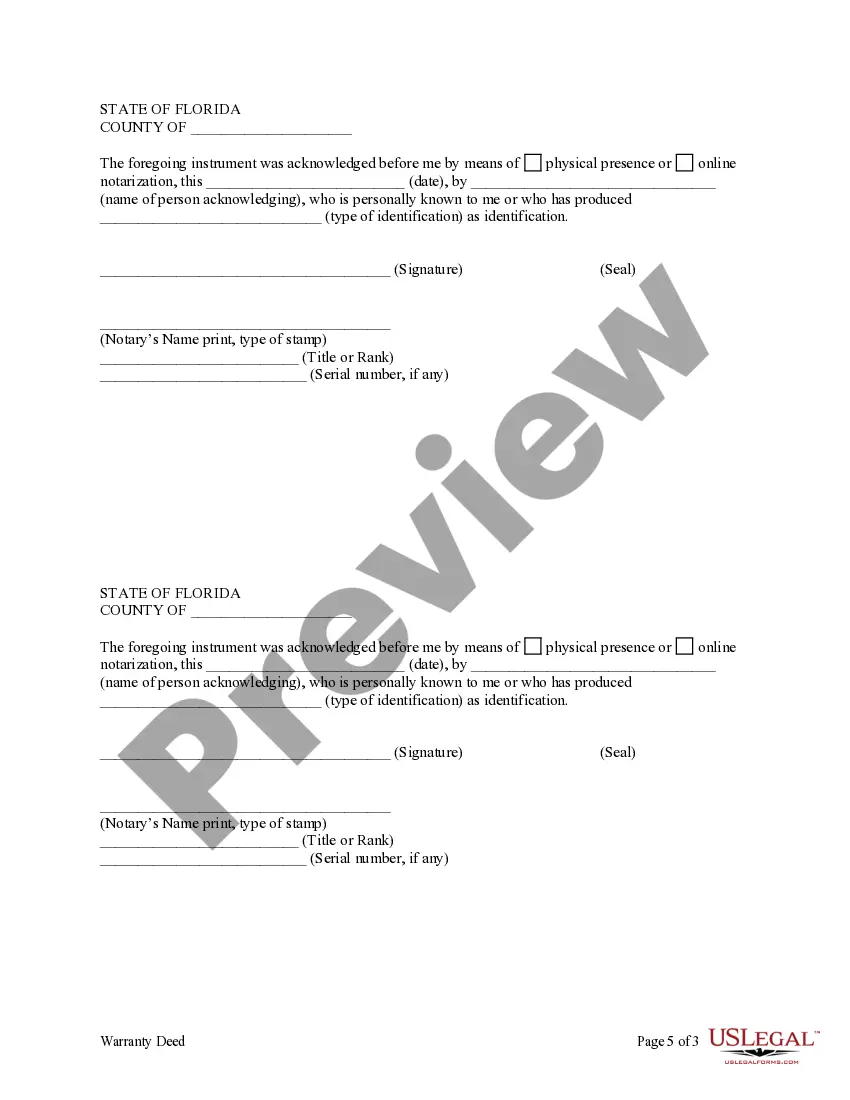

Steps to fixing an incorrect deed Determine if the error is harmless or fatal to the transfer of title. Decide what instrument is best suited to the error. Draft a corrective deed, affidavit, or new deed. Obtain the original signature(s) of the Grantor(s). Re-execute the deed with proper notarization and witnessing.

A corrective deed has execution requirements just like any deed. It must be signed by the original grantor with witnesses and re-acknowledged.

A corrective deed is valid without any additional consideration. Acceptance by the grantee of a corrective deed is admission of the error found in the original deed.

Steps to fixing an incorrect deed Determine if the error is harmless or fatal to the transfer of title. Decide what instrument is best suited to the error. Draft a corrective deed, affidavit, or new deed. Obtain the original signature(s) of the Grantor(s). Re-execute the deed with proper notarization and witnessing.

Property owners can use this special type of deed to amend common errors such as misspellings, incomplete names, and other missing information. They can also use a correction deed to fix defects in the way the deed was executed or acknowledged.