Partial Release Of Mortgage Template Format

Description

How to fill out Florida Partial Release Of Property From Mortgage For Corporation?

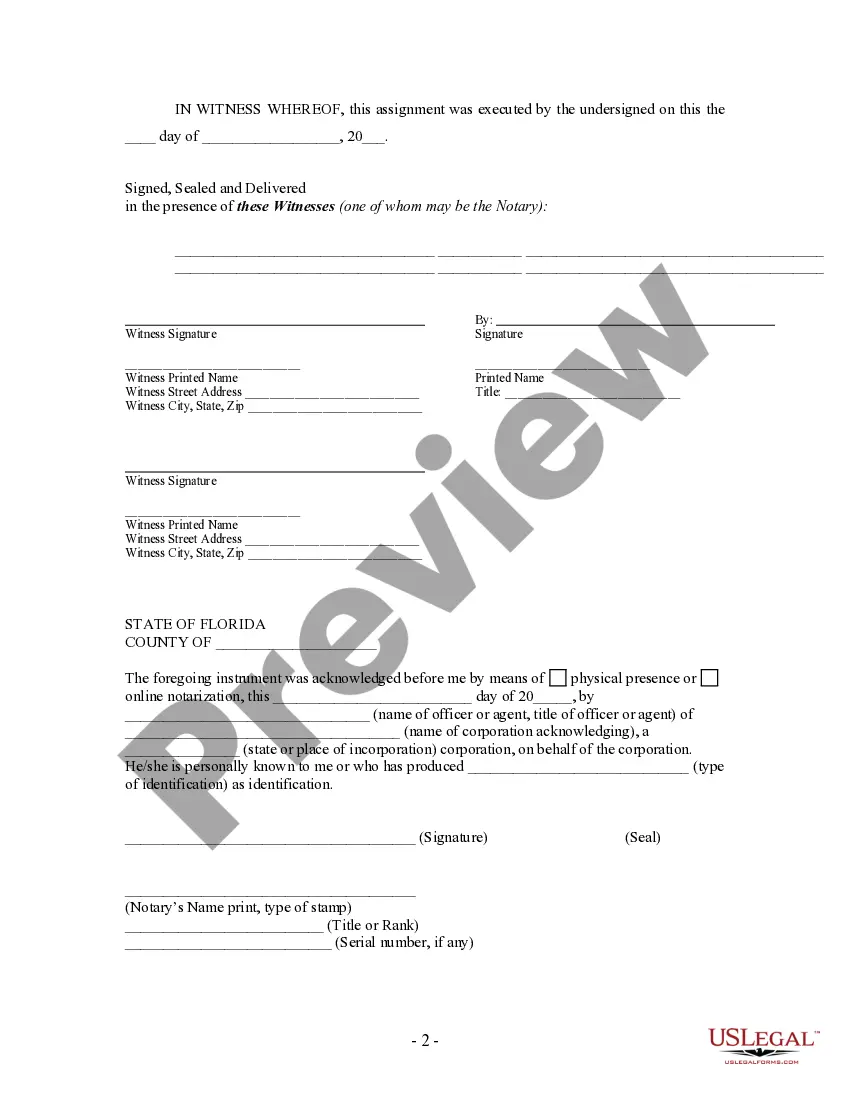

The Partial Release Of Mortgage Template Format displayed on this page is a reusable official template created by experienced attorneys adhering to federal and state laws.

For over 25 years, US Legal Forms has offered individuals, enterprises, and legal practitioners with more than 85,000 authenticated, state-specific documents for any commercial and personal scenario.

Re-download your documents as needed. Access the My documents tab in your profile to retrieve any previously saved forms.

- Look for the document you require and examine it.

- Browse through the file you searched and preview it or review the form description to ensure it meets your needs. If it doesn't, use the search function to find the suitable one. Click Buy Now once you’ve located the template you want.

- Choose and register for a pricing plan that fits your preferences and create an account. Use PayPal or a credit card for a swift payment. If you already have an account, Log In and verify your subscription to continue.

- Select the format you prefer for your Partial Release Of Mortgage Template Format (PDF, Word, RTF) and retrieve the sample on your device.

- Print the template to fill it out by hand. Alternatively, use an online multi-functional PDF editor to efficiently and accurately complete and sign your form with a legally-binding electronic signature.

Form popularity

FAQ

An example of a partial release might involve a homeowner who sells a section of their property while keeping the mortgage on the remaining land. In this case, the lender issues a partial release of mortgage, allowing the sale to proceed without affecting the entire mortgage. To facilitate this, using a partial release of mortgage template format will streamline the paperwork and clarify the agreement between the homeowner and the lender. This ensures that all parties are on the same page regarding the mortgage's terms.

A partial mortgage discharge occurs when a lender agrees to release a portion of a property from the mortgage obligation while retaining the mortgage on the remaining property. This process can be beneficial if you sell part of your property or want to refinance a portion. Utilizing a partial release of mortgage template format can simplify this process, ensuring all necessary details are included. This template helps both parties understand their responsibilities and the terms of the discharge.

Yes, you can write your own release deed, but it’s important to ensure it meets legal standards and includes all necessary information. Using templates, like a partial release of mortgage template format, can help you create a compliant and effective document. However, it might also be wise to consult with a legal professional to confirm that your deed is valid.

A partial discharge of a mortgage refers to a legal process in which a lender releases part of the lien securing a mortgage, typically for one specific property. This action allows the owner to sell or transfer ownership of that property without affecting the remaining properties under the mortgage. Using a partial release of mortgage template format can guide you in preparing the required forms for your lender.

A partial release of a mortgage allows you to remove a specific property from the lien attached to your mortgage while keeping the remaining properties secured. This process generally involves the lender agreeing to release their claim on the designated property, usually in exchange for payment. Utilizing a partial release of mortgage template format can help you articulate your request effectively.

This is when a lender releases their lien on part of your property. This is in place of a full release, which usually only happens once you've paid off your mortgage completely. A partial release enables lenders to waive their claim on a certain amount of collateral in a mortgage agreement.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

Valuation of Release Parcel ? If the Release Parcel is expected to be released as collateral from the loan, Lender may require that it either be excluded from the initial valuation (which may affect available principal), or that the Release Parcel be separately appraised either at the time of loan origination or prior ...

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

A release of a portion of commercial real property from the lien of a mortgage in New York. Lenders in New York customarily use a partial release of mortgage to discharge a mortgage lien against some, but not all, of the borrower's commercial real property.