A partial mortgage release form with Wells Fargo refers to a legal document that allows a borrower to release a portion of their property from the mortgage lien. This process usually occurs when a borrower wishes to sell a portion of their property or transfer ownership of a certain part, while keeping the remaining property as collateral. A partial mortgage release form helps in clarifying the new ownership structure and establishing clear boundaries for the released portion. Wells Fargo, one of the leading mortgage lenders, offers various types of partial mortgage release forms to cater to different scenarios: 1. Partial Release of Liens: This type of form is used when a borrower wants to release a specific parcel of land or a property (such as a section of a larger plot) from the mortgage lien. It allows the borrower to sell or transfer the released portion while ensuring the remaining property remains mortgaged. 2. Substitution and Release of Collateral: This form is used when a borrower wants to substitute the property securing a mortgage with another property. It allows the borrower to release the original property as collateral and replace it with a new property, subject to Wells Fargo's approval. 3. Partial Release for Construction Loans: Construction loans often involve releasing portions of the property as milestones are met. Borrowers may request a partial release to sell completed units or sections of a development project, helping them manage their financing needs effectively. 4. Partial Release for Land Development: For borrowers involved in land development projects, Wells Fargo provides partial mortgage release forms that enable them to release specific lots or sections of a development for sale. This option allows developers to sell individual portions while maintaining control over the remaining undeveloped land. When using a Wells Fargo partial mortgage release form, it is crucial for borrowers to carefully review and understand the terms and conditions associated with the release. This includes considering any potential fees or charges applicable to the release process. To initiate a partial mortgage release with Wells Fargo, borrowers should contact their mortgage specialist or reach out to Wells Fargo's customer service. The bank may require specific documentation, such as property surveys, legal descriptions, deeds, and other related paperwork, to facilitate the release process efficiently. Overall, Wells Fargo offers a range of partial mortgage release forms designed to accommodate various circumstances and needs of borrowers. These forms help borrowers manage their mortgage obligations and facilitate the transfer of ownership in a legally sound manner.

Partial Mortgage Release Form With Wells Fargo

Description

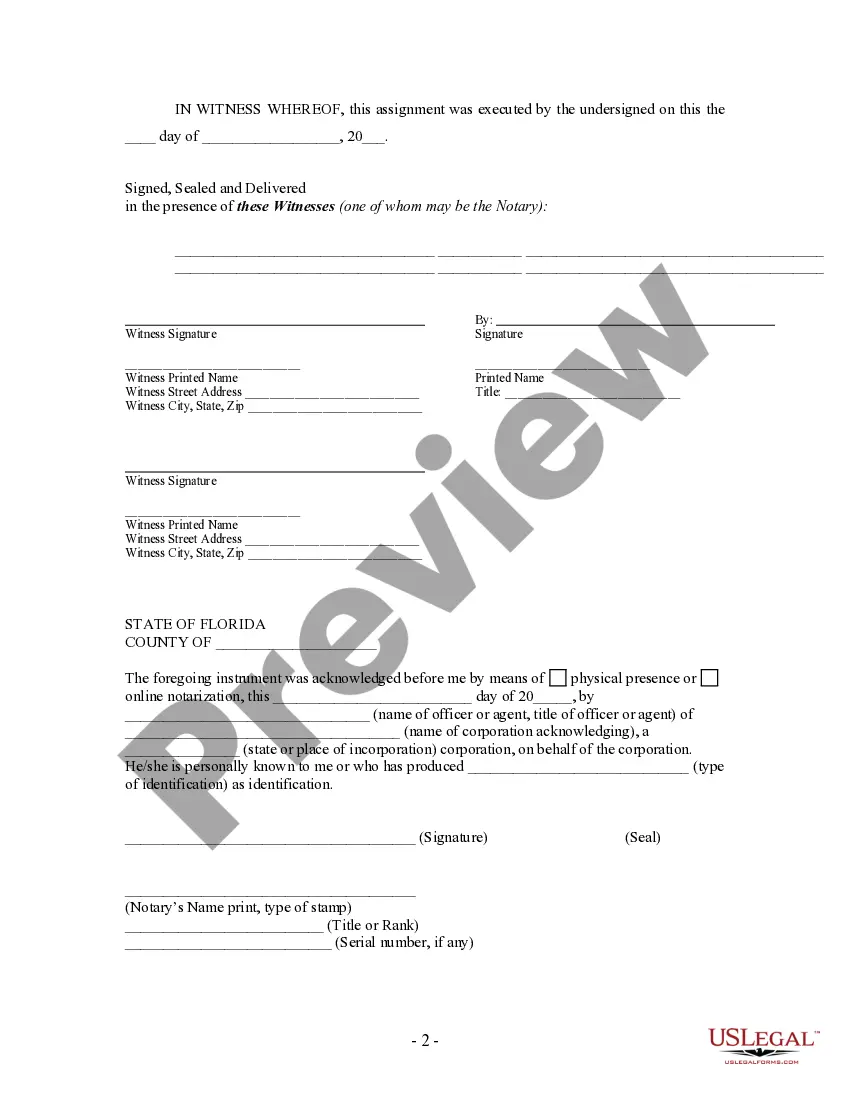

How to fill out Florida Partial Release Of Property From Mortgage For Corporation?

The Partial Mortgage Release Form With Wells Fargo you see on this page is a multi-usable formal template drafted by professional lawyers in line with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided people, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, easiest and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Partial Mortgage Release Form With Wells Fargo will take you only a few simple steps:

- Search for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it suits your needs. If it does not, utilize the search bar to get the right one. Click Buy Now once you have found the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Choose the format you want for your Partial Mortgage Release Form With Wells Fargo (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your papers one more time. Use the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Under federal law, a person is generally prohibited from acquiring or possessing firearms if, among other things, they have been convicted of certain crimes or become subject to certain court orders related to domestic violence or a serious mental condition.

During the 2022 legislative session, the General Assembly passed three significant pieces of legislation regarding firearms safety in Rhode Island: a bill banning large capacity feeding devices, a bill banning the open carry of loaded shotguns and rifles, and a bill to raise the age to purchase a firearm from 18 to 21.

A person must be 18 years old and not be prohibited by state and federal law from possessing a firearm to purchase a rifle or a shotgun. A person must complete a ?Purchase of a Shotgun or Rifle Application Form? before any sale of a rifle or shotgun, whether through a licensed dealer or through a private party.

Rhode Island law now generally prohibits people from purchasing, owning, carrying, transporting, or having in their possession any firearms if they have been convicted of (or plead no contest to) a domestic violence offense that is punishable as a felony under state law.

Open carry of handguns is only expressly permitted for those with a pistol permit issued by the attorney general. Open carry of loaded long guns along public roadways is prohibited by law. Vehicle carry? Permitted with a valid Rhode Island Pistol Permit.

Does Rhode Island issue concealed carry licenses to non-residents? Yes, if you have a valid CCW license from your home state. The Attorney General may issue licenses to non-residents without CCW permits from their home state.

Is it legal to sell guns in Rhode Island? Yes, it is legal, but there are stipulations. A private seller can conduct business only with a buyer who has a valid purchase permit. Moreover, they must observe a seven-day waiting period between completing the financial transaction and delivering the firearm to the buyer.

To buy a handgun, you must obtain a Rhode Island License to Carry Concealed Weapons (LCCW), or obtain a ?blue card?. Must be 18 years of age to possess a firearm. Unless you already have a concealed carry license, you must obtain a safety certificate. Firearms are not required to be registered.