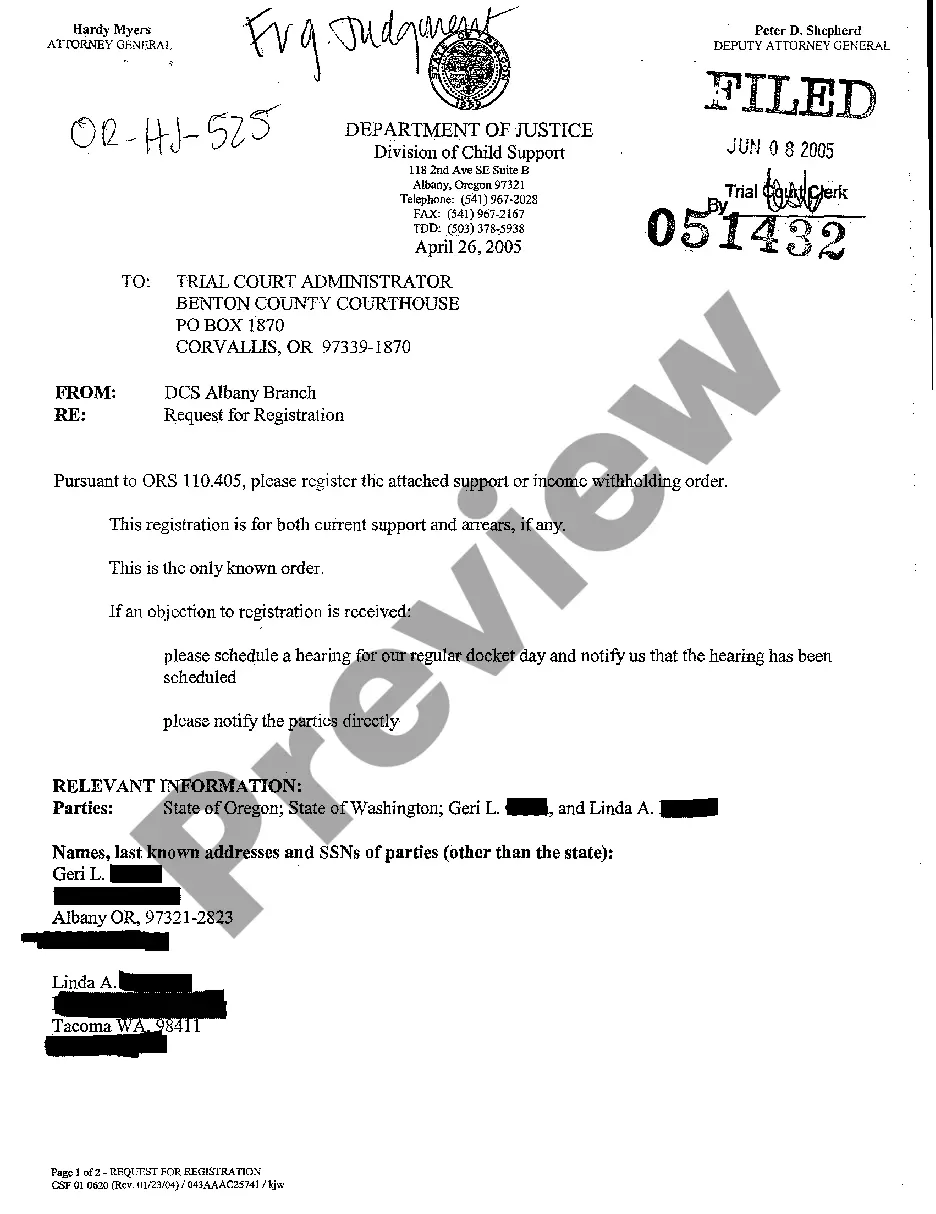

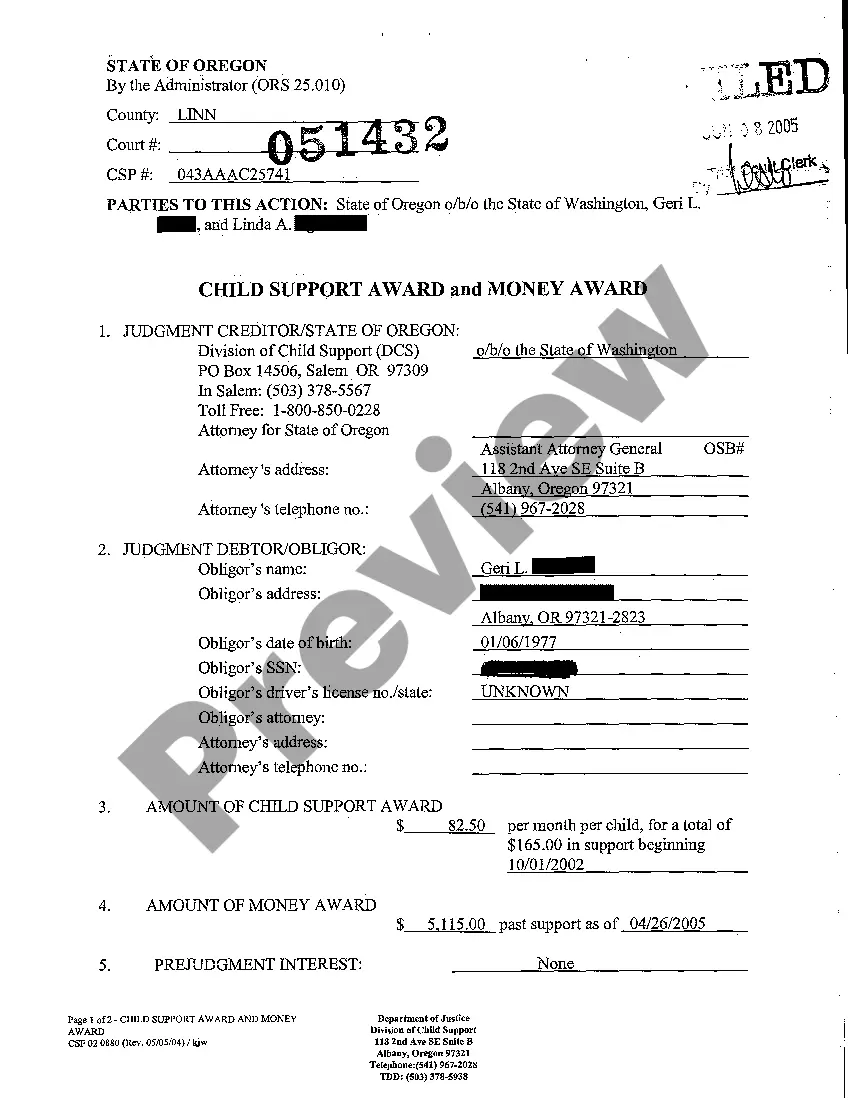

Oregon Child Support and Income Withholding Order

Description

How to fill out Oregon Child Support And Income Withholding Order?

Creating documents isn't the most simple process, especially for those who rarely work with legal papers. That's why we advise making use of correct Oregon Child Support and Income Withholding Order samples made by professional attorneys. It allows you to prevent problems when in court or dealing with official organizations. Find the files you want on our website for top-quality forms and accurate descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will automatically appear on the template web page. After accessing the sample, it’ll be saved in the My Forms menu.

Customers without an active subscription can quickly create an account. Make use of this short step-by-step guide to get your Oregon Child Support and Income Withholding Order:

- Be sure that file you found is eligible for use in the state it’s necessary in.

- Verify the document. Utilize the Preview option or read its description (if available).

- Click Buy Now if this file is the thing you need or go back to the Search field to find another one.

- Choose a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after doing these straightforward actions, you are able to fill out the form in your favorite editor. Double-check filled in details and consider requesting a lawyer to review your Oregon Child Support and Income Withholding Order for correctness. With US Legal Forms, everything becomes much simpler. Try it now!

Form popularity

FAQ

For certain outstanding debts -- including past-due child support and unpaid student loans -- the IRS can withhold some or all of your unpaid stimulus payment issued as a Recovery Rebate Credit when you file your taxes.

Cash: Pay in person or at a kiosk. Check or money order: Pay by mail, in person, or at a kiosk. Credit or debit card: Pay online, by phone, or at a kiosk. Electronic Check: Pay online or by phone through a bank withdrawal.

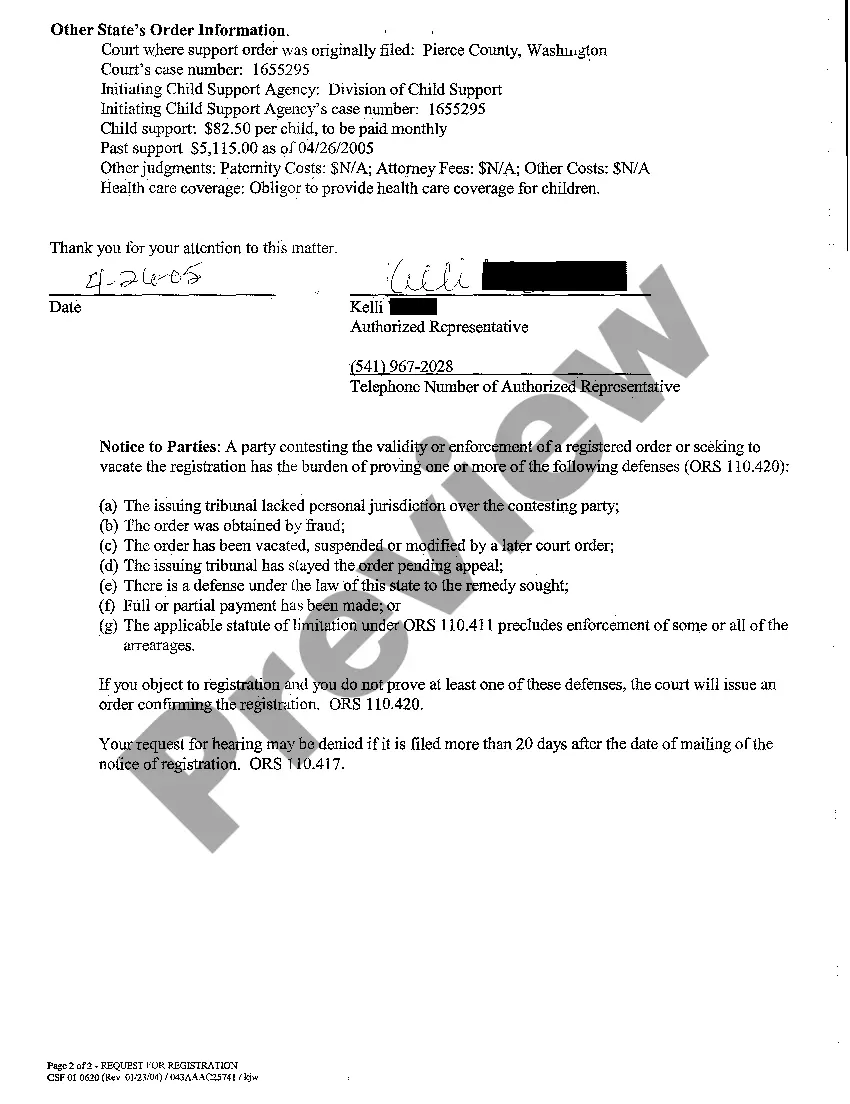

One way to collect unpaid child or spousal support is to ask that the payments be taken directly from the wages of the paying parent or spouse. This requires a wage-withholding order, which is issued either by a court or by a child support enforcement agency.

A deadbeat parent who fails to pay the full amount of child support every month may be subject to restrictions and other penalties aimed at collecting support, including "contempt," which can mean significant fines and even jail time.

A custodial parent can waive or forgive all arrears owed to him or her directly. Use the Account Summary from the SCU to determine what arrears are owed to the parent, and what arrears are owed to the state (if the custodial parent ever received Public Assistance).

Although child support payments are owed to the custodial parent, the child is the beneficiary of these payments. Child support itself cannot be waived or modified except by agreement of the parties in writing and approval by the court.

Child support back pay cannot be totally forgiven or waived, but there are a few situations that can help you handle it. Double-check the amount the court states you are in arrears.Back pay does accrue interest but, in some cases, you may not have to pay all of it. You can request a manageable payment schedule.

When you lose your job the legal obligation to pay child support does not stop it will not go away. If there are arrears of payment of child support the amount of the arrears is not waived. Becoming a bankrupt does not extinguish the arrears the debt survives the bankruptcy.

Placing a parent under contempt of court for failure to pay child support or to force them to pay in the future. The circuit court judge may also impose a jail sentence.