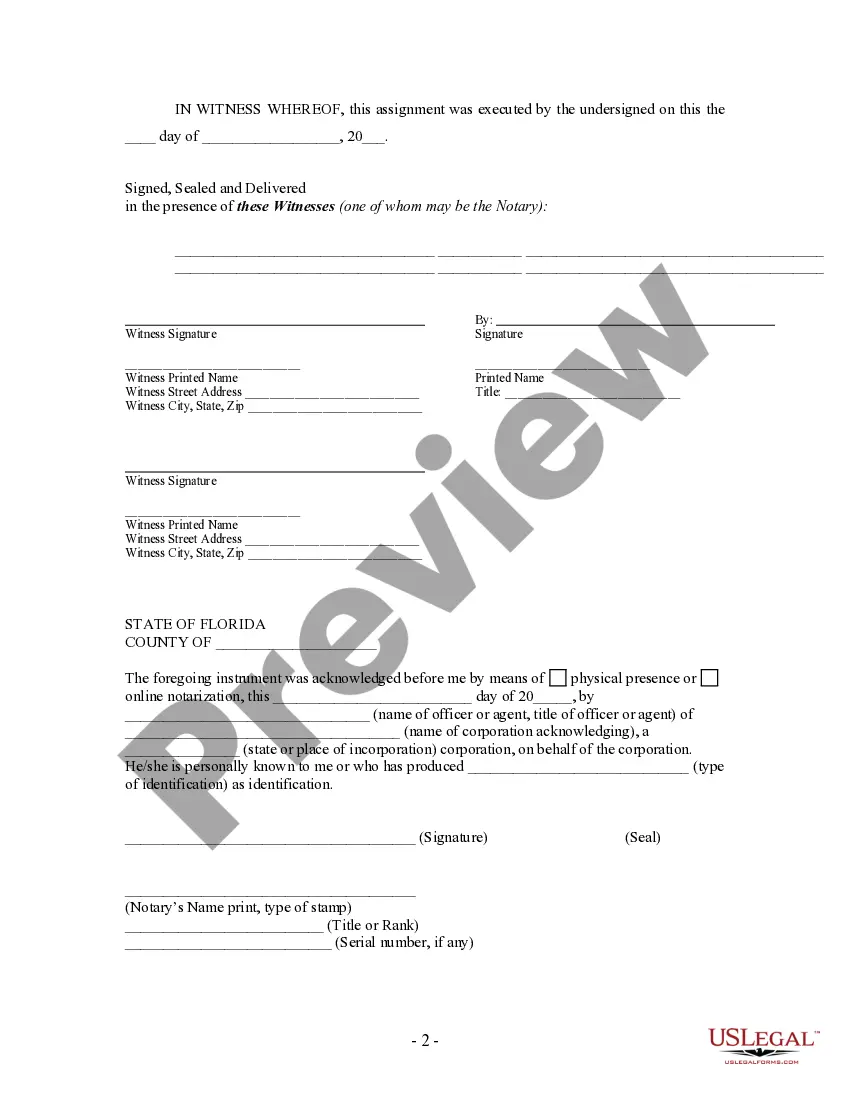

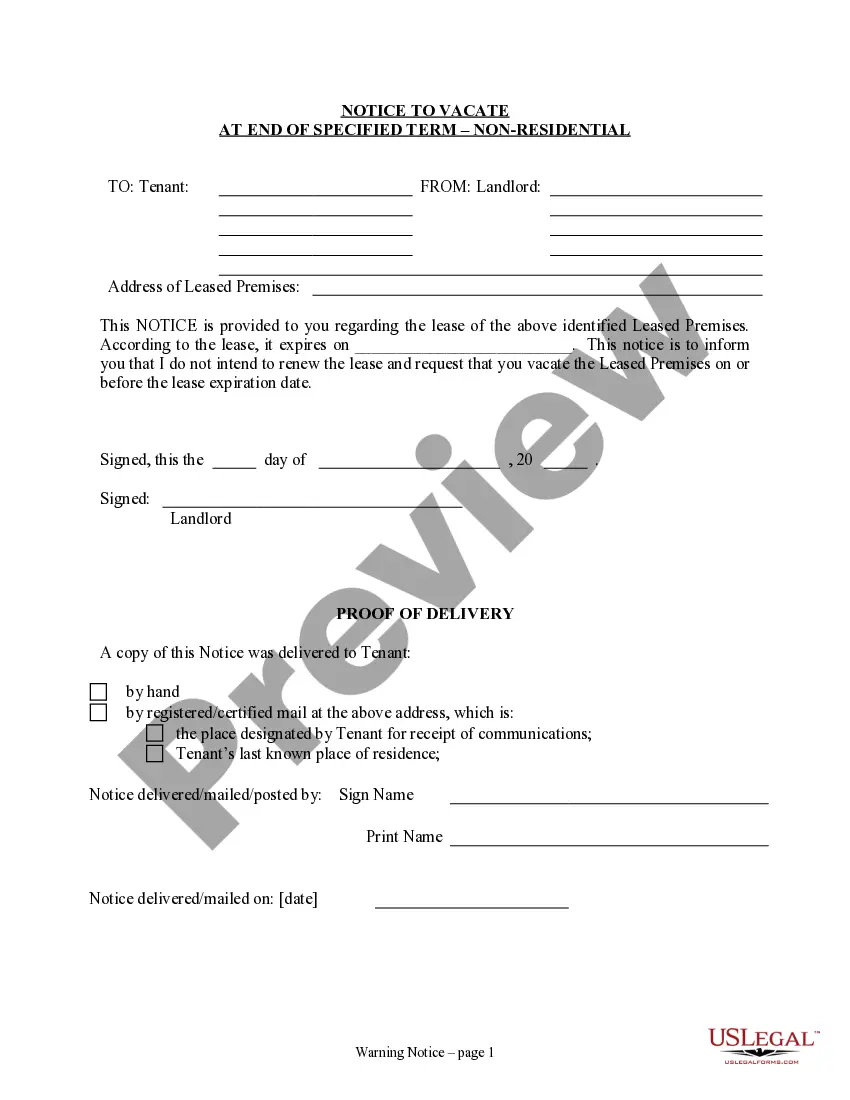

A partial mortgage release form with Chase is a legal document that allows a borrower to release a specific portion of their mortgage lien from their property. This form is generally used when the borrower wants to sell a portion of their property or refinance the remaining loan balance. The partial mortgage release form is necessary because it provides clarity and transparency in the transaction, protecting both the borrower and the lender's interests. By executing this form, the borrower ensures that they are legally releasing a part of their property from the mortgage while the lender ensures they are being repaid for the portion of the loan being released. Chase offers different types of partial mortgage release forms depending on the specific situation. These forms include: 1. Partial Mortgage Release — Sale of a Portion of Property: This form is used when the borrower wants to sell a part of their property, such as subdividing a large parcel of land or selling a portion of a commercial property. It allows the borrower to release the mortgage lien from the portion being sold while maintaining the remaining mortgage obligation on the retained portion. 2. Partial Mortgage Release — Refinancing: This form is used when the borrower wants to refinance their existing mortgage loan. It allows them to release a specific part of their property from the current mortgage lien while refinancing the remaining balance. This is commonly used when the borrower wants to take advantage of lower interest rates or change the loan terms. In both cases, the partial mortgage release form requires detailed information such as the borrower's name, property address, current loan balance, and a legal description of the portion being released. The form must also be signed and notarized by all necessary parties, including the borrower and any co-owners or co-signers. It's important to note that the partial mortgage release form with Chase may have additional requirements or procedures specific to the lender. Therefore, borrowers are advised to contact Chase directly or consult with a mortgage professional to understand the exact process and documentation needed for their specific situation. Overall, the partial mortgage release form with Chase provides borrowers with the flexibility to sell or refinance a portion of their property while maintaining the mortgage lien on the remaining portion. This document ensures a clear and legally binding transaction between the borrower and the lender, protecting both parties' interests.

Partial Mortgage Release Form With Chase

Description

How to fill out Partial Mortgage Release Form With Chase?

The Partial Mortgage Release Form With Chase you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and state regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, simplest and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Partial Mortgage Release Form With Chase will take you just a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or check the form description to verify it satisfies your requirements. If it does not, make use of the search option to get the right one. Click Buy Now when you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Partial Mortgage Release Form With Chase (PDF, DOCX, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your papers again. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

Rhode Island SELLER Title Transfer Instructions - YouTube YouTube Start of suggested clip End of suggested clip Number. You must include the names and addresses of both the seller and buyer seller must sign it.MoreNumber. You must include the names and addresses of both the seller and buyer seller must sign it. Then give the buyer the title. Bill of sale and current registration make copies for your records.

It must be notarized in some, but not all, cases. Odometer Disclosure Statement ? The state of Rhode Island does not have a designated odometer disclosure form, but does require the listing of a vehicle's recorded mileage in section E of the application for title change and registration.

In Rhode Island, anyone selling a car must fill out the back of the title with the buyer's information, then give the title to the buyer along with the bill of sale. The bill of sale must include an accurate odometer reading. If the title is lost or destroyed, the seller can request a new one from the Rhode Island DMV.

Rhode Island DMV Vehicle Title Transfer Guide? The buyer and seller of the vehicle need to sign the vehicle title. You need to complete the required forms. Take the title to your local Rhode Island Department of Motor Vehicles (DMV) Pay the RI vehicle title transfer fee of $52.50.

Non-Titled Vehicles Rhode Island does not title vehicles model year 2000 and older. If you would like to obtain documentation in lieu of a title, you must provide the following documents: Bill of Sale (if you are not the current registered owner). Identification.

Does a vehicle title have to be notarized in Rhode Island? No. The vehicle title itself does not need to be notarized although the application for title (form TR-2/TR-9) will need to be notarized.

Anyone can draft a bill of sale in Rhode Island. As long as the document has been signed by the buyer and the seller, it can be legally binding. Getting a bill of sale notarized can help it hold up in court.