Partial Mortgage Release Form For Illinois

Description

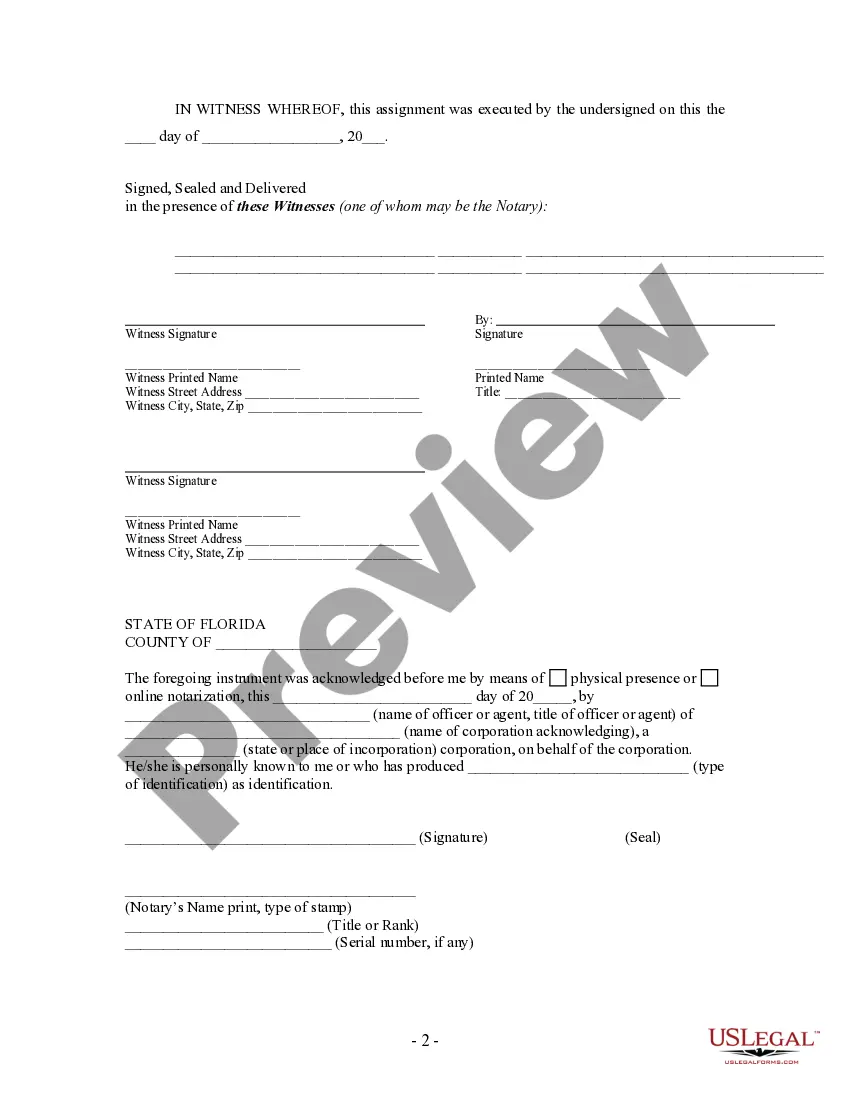

How to fill out Florida Partial Release Of Property From Mortgage For Corporation?

Creating legal documents from the ground up can occasionally be somewhat daunting.

Certain situations may entail extensive research and significant expenditures.

If you're looking for a simpler and more budget-friendly method of preparing the Partial Mortgage Release Form For Illinois or any other documents without unnecessary hurdles, US Legal Forms is readily available for you.

Our online collection of more than 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can promptly access state- and county-compliant forms meticulously crafted for you by our legal experts.

Before rushing to download the Partial Mortgage Release Form For Illinois, keep these guidelines in mind: Review the document preview and descriptions to confirm that you have located the correct form. Verify if the chosen template meets the regulations of your state and county. Select the suitable subscription option to acquire the Partial Mortgage Release Form For Illinois. Download the form, then fill it out, sign, and print it. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us now and make form completion an effortless and efficient process!

- Utilize our platform whenever you require dependable services to swiftly locate and download the Partial Mortgage Release Form For Illinois.

- If you’re a returning user and have previously set up an account with us, simply Log In to your account, select the form, and download it immediately or re-download it anytime in the My documents section.

- Not registered yet? No problem.

- Setting up your account takes minimal time, and navigating the library is straightforward.

Form popularity

FAQ

A partial release of a mortgage is when a lender agrees to release a portion of the property securing a mortgage. This might happen during refinancing, selling part of the property, or upon receiving a specified payment. To execute this transaction properly in Illinois, it's essential to complete the corresponding partial mortgage release form for Illinois, ensuring all parties have a clear understanding of the agreement.

When you place a security freeze, creditors cannot access your credit report. This will keep them from approving any new credit account in your name, whether it is fraudulent or legitimate.

It's called ?permissible purpose,? as defined by the Fair Credit Reporting Act or ?FCRA,? and it allows certain companies and employers to access your Equifax credit report in order to make informed decisions about you, such as the likelihood you'll pay your debts or be a good hire.

The Fair Credit Reporting Act (FCRA) includes a section known as permissible purpose. It establishes the need for written consent or documentation from the consumer before a financial institution can pull the individual's credit report.

A freeze can give you a false sense of security ? you may still be susceptible to credit fraud or other fraud involving your Social Security number.

One of the most effective ways to protect against identity theft is to monitor your credit reports and billing statements so you can spot and report unauthorized activity.

After you report the fraud, you can work with collection agencies and banks to get any fraudulent collection accounts, late payments and balances removed from your credit reports. You can also file a dispute with the three nationwide credit bureaus.

A credit freeze can help prevent identity thieves from opening new accounts in your name, but it does nothing to keep them from committing fraud with your existing accounts. That means fraudsters could make charges on a payment card in your wallet.

A credit freeze blocks any new credit inquiries unless they're from a current creditor or government agency. This can keep identity thieves from opening credit accounts or loans in your name.