Satisfaction Of Mortgage Form Florida With Notary

Description

How to fill out Florida Satisfaction, Release Or Cancellation Of Mortgage By Individual?

Creating legal documents from the ground up can occasionally be daunting.

Some situations may require extensive research and significant financial expenditure.

If you're seeking a simpler and more cost-effective method of preparing the Satisfaction Of Mortgage Form Florida With Notary or other papers without needing to navigate complex procedures, US Legal Forms is here for you.

Our online collection of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-compliant templates meticulously crafted by our legal professionals.

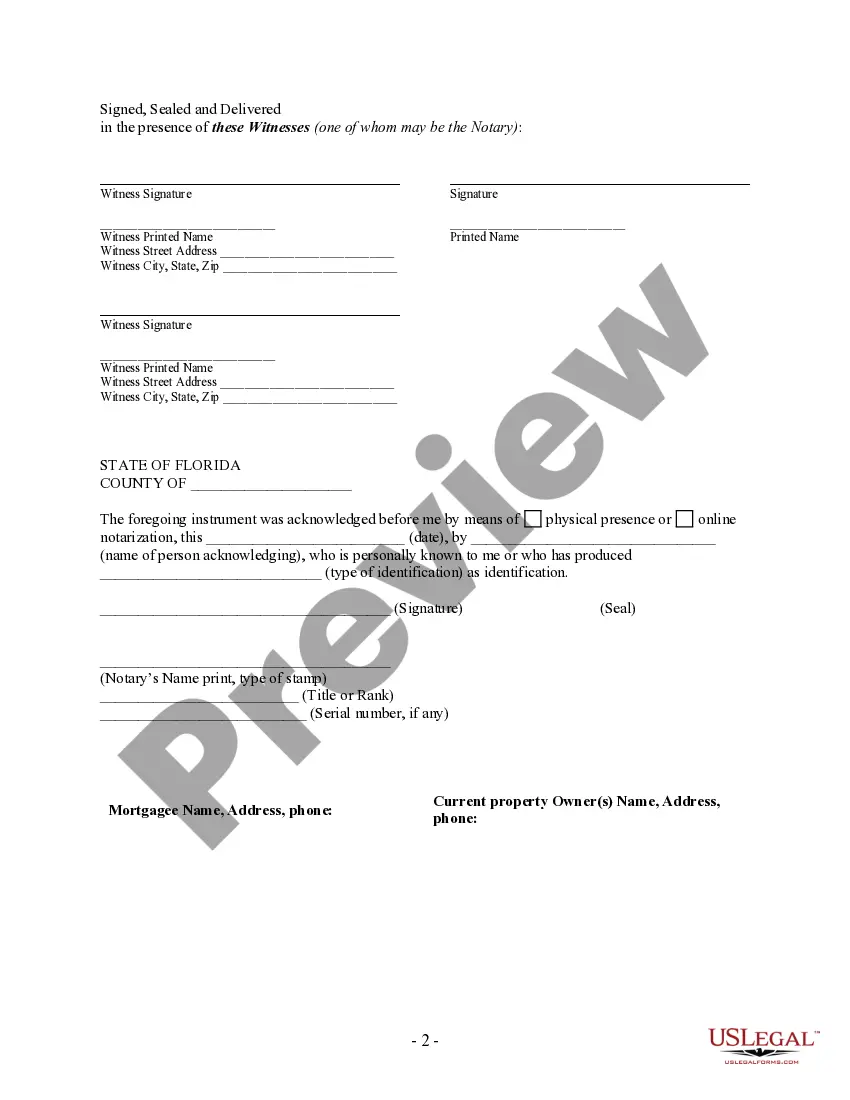

Verify that the form you choose complies with your state and county regulations. Select the most appropriate subscription plan to purchase the Satisfaction Of Mortgage Form Florida With Notary. Proceed to download the file, complete it, have it notarized, and print it out. US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and make the form completion process effortless and efficient!

- Utilize our platform when you require a dependable service to promptly find and download the Satisfaction Of Mortgage Form Florida With Notary.

- If you’re an existing user and have previously registered an account with us, simply Log In to your account, locate the form, and download it immediately or re-download it at any time later under the My documents section.

- Not yet registered? No problem. Registration is quick and easy, allowing you to explore the library.

- However, before rushing to download the Satisfaction Of Mortgage Form Florida With Notary, heed these suggestions.

- Review the form preview and descriptions to ensure it is the correct document you are looking for.

Form popularity

FAQ

For estates of $40,000 or less: $1,500. For estates between $40,000 and $70,000: $2,250. For estates between $70,000 and $100,000: $3,000. For estates between $100,000 and $900,000: 3% of the estate's value.

For formal administration, Florida law typically requires you to hire a probate attorney. However, you generally don't need to hire a probate attorney if the estate is very small or if you plan to file for an alternative version of probate, like summary administration or disposition without administration.

For estates of $40,000 or less: $1,500. For estates between $40,000 and $70,000: $2,250. For estates between $70,000 and $100,000: $3,000. For estates between $100,000 and $900,000: 3% of the estate's value.

Under Florida law, you are required to hire an attorney to assist you with the probate process in most situations. An attorney is not legally required in the following situations: Summary administration. Disposition without administration.

Filing for probate ? 10-day deadline This specifies that the individual in possession of the deceased's last will and testament must file for probate within 10 days from the date of death of the deceased in the same county where the deceased died. The size of the estate to be probated does not affect these ten days.

The most common assets that go through this process are bank accounts, real estate, vehicles, and personal property. In order to determine if a specific financial account is subject to probate, the financial institution should be contacted.

For formal administration, Florida law typically requires you to hire a probate attorney. However, you generally don't need to hire a probate attorney if the estate is very small or if you plan to file for an alternative version of probate, like summary administration or disposition without administration.

Probate proceedings are filed with the clerk of the circuit court, usually in the county in which the decedent lived at the time of his or her death. A filing fee is required and should be paid to the clerk.