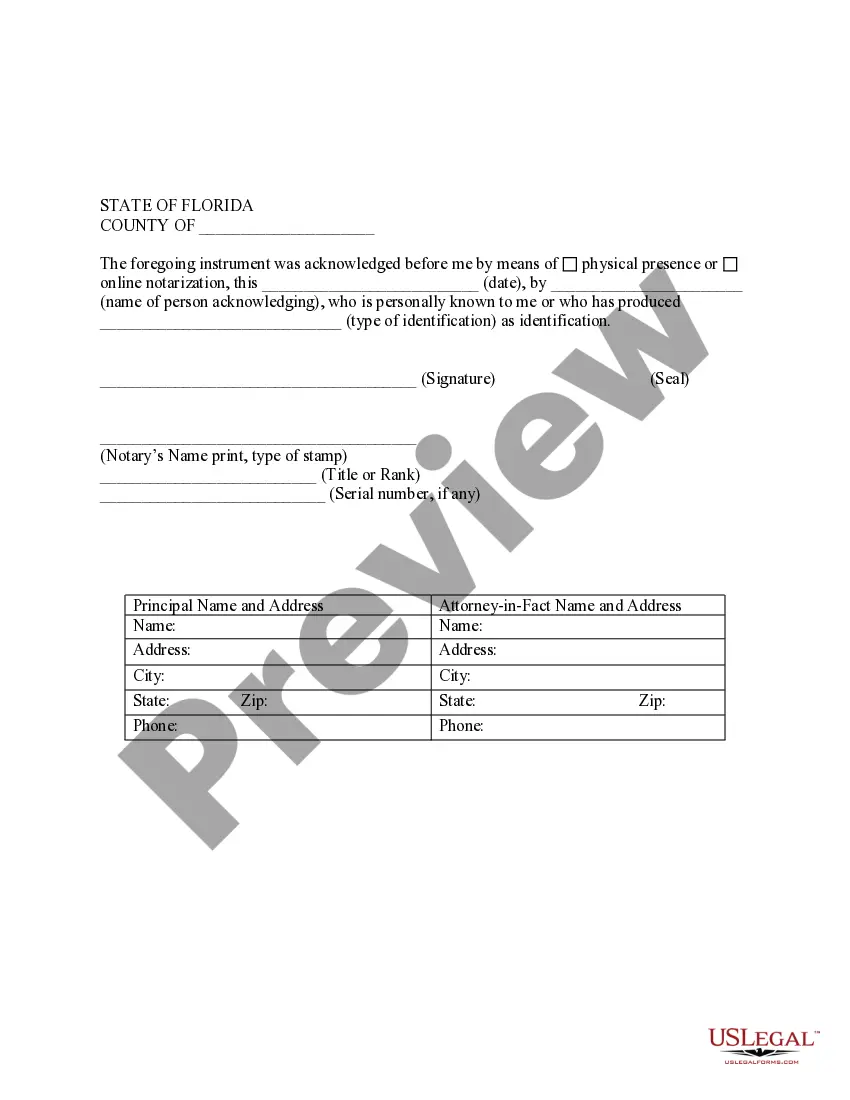

Bank Form With Account Information

Description

How to fill out Florida Special Durable Power Of Attorney For Bank Account Matters?

- Log in to your account if you already have one, or create a new account to access our library.

- Use the Preview mode to verify you’ve selected the correct bank form with account information that meets your local jurisdiction requirements.

- If any inconsistencies arise, utilize the Search tab to find another suitable form.

- Once confirmed, click on the Buy Now button and select your desired subscription plan to proceed.

- Complete your purchase by entering your payment details using a credit card or your PayPal account.

- Download the bank form and save it on your device. You can always access it later through the My Forms menu in your profile.

US Legal Forms is designed to empower users by providing a robust collection of legal forms at competitive prices. With premium support available for form completion, it ensures that every document you create is accurate and enforceable.

Streamline your legal document process today by visiting US Legal Forms for your bank form with account information!

Form popularity

FAQ

When setting up direct deposit, provide your employer with your bank account number, routing number, and specify whether it’s a checking or savings account. This information ensures that your salary goes directly into your bank account promptly. Completing a bank form with account information streamlines this process.

To fill out direct deposit information, use the appropriate bank form with account information. Enter your bank account number, routing number, and any other specified information accurately. Checking this information before submission can help prevent delays in your deposits.

A bank account details form is a document that collects essential information about your bank account. It usually includes details like your account number, routing number, and associated bank. Having the correct bank form with account information is crucial for various transactions such as direct deposits or automated payments.

For direct deposit, you typically need to provide your bank's routing number, your account number, and the type of account—checking or savings. This information allows your employer to deposit funds directly into your account. A bank form with account information simplifies this process.

To fill out your direct deposit information, complete the designated sections of the bank form with account information. Include your bank account number, routing number, and any additional required details. Ensure accuracy to facilitate timely deposits.

A common example of a direct deposit is receiving your paycheck directly into your bank account. Employers often use this method for convenience and efficiency, eliminating the need for paper checks. Using a bank form with account information makes setting up direct deposits straightforward.

To fill out a bank form with account information, start by entering your personal details, such as your name and address. Next, provide your account number and routing number accurately to avoid any processing issues. Always double-check your entries for any mistakes before submitting the form.

Open account information refers to the current details and status of your active bank accounts. This includes your account balances, transaction history, and any pertinent conditions. Understanding this information is vital for managing your finances and making informed decisions. Platforms like uslegalforms can assist you in gathering the necessary bank form with account information to keep your records updated.

A bank letter stating account information is an official document from your financial institution that confirms details about your account. This letter generally includes your account number, type of account, and current balance. You may need this document when applying for loans, verifying your financial status, or during tax preparation. Be sure to request this letter from your bank whenever you need to demonstrate your account information.

Account opening form information refers to the specific data collected when you create a new bank account. This includes your identification details, banking preferences, and initial deposit amount. Providing accurate and complete information on this bank form with account information is essential for establishing your account smoothly. Keeping records of your submission can also be beneficial in the future.