Attorney Powers Power Forward

Description

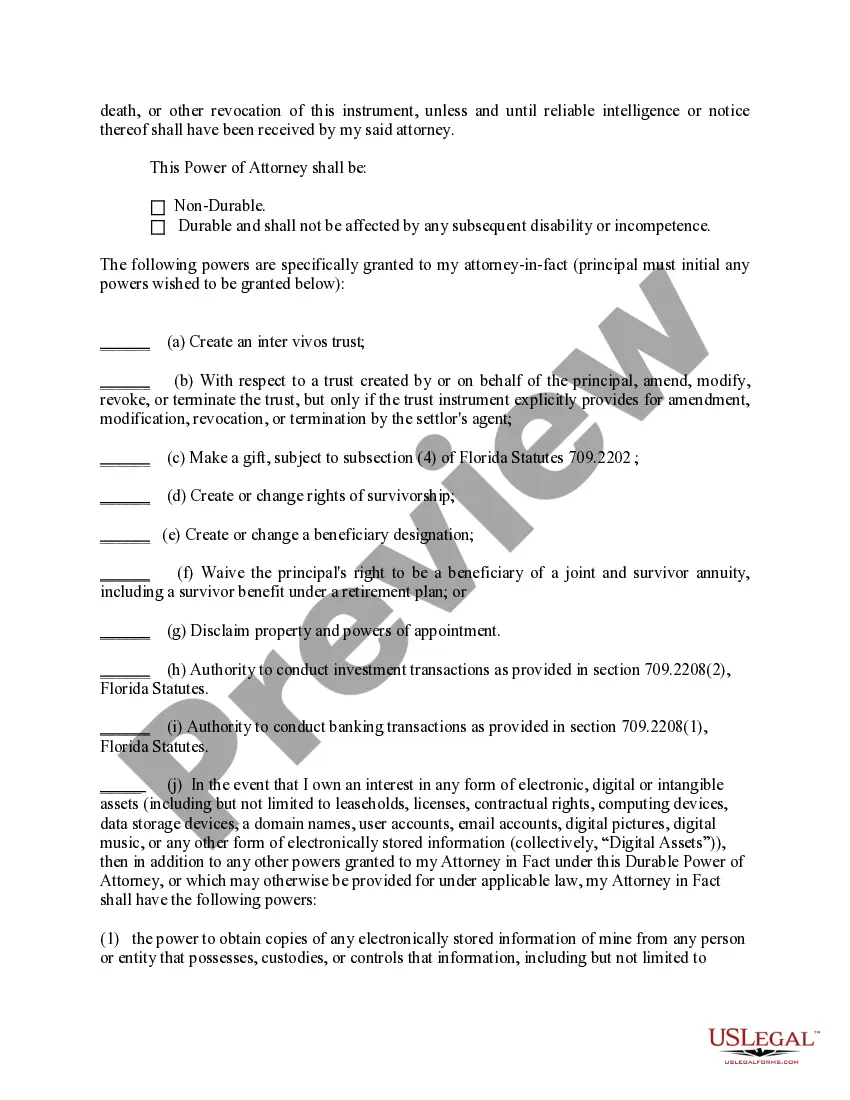

How to fill out Florida Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Creating legal documentation from the beginning can frequently be intimidating.

Certain situations could require extensive research and significant financial investment.

If you're seeking a simpler and more budget-friendly method of preparing Attorney Powers Power Forward or any other documents without the hassle of unnecessary complications, US Legal Forms is always available.

Our online library of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal concerns.

However, before proceeding to download Attorney Powers Power Forward, consider the following advice: Review the form preview and descriptions to ensure you are selecting the correct form. Ensure the template you select meets the criteria of your state and county. Choose the appropriate subscription plan to acquire the Attorney Powers Power Forward. Download the form, then complete, sign, and print it out. US Legal Forms is recognized for its good reputation and has over 25 years of experience. Join us today and make form execution a straightforward and efficient process!

- With just a few clicks, you can effortlessly access state- and county-compliant templates carefully assembled for you by our legal experts.

- Utilize our platform whenever you need reliable and trustworthy services to conveniently find and download the Attorney Powers Power Forward.

- If you’re already familiar with our services and have set up an account, simply Log In to your account, choose the template, and download it or re-download it anytime in the My documents section.

- Haven't registered yet? No problem. It only takes a few minutes to create an account and explore the library.

Form popularity

FAQ

In Virginia, a power of attorney becomes valid when it meets certain requirements. Firstly, the document must be signed by the principal and witnessed by at least one other person or notarized. Additionally, the powers granted need to be clearly defined within the document. To ensure your power of attorney stands strong, turning to US Legal Forms can help you craft a valid POA tailored to your needs, enabling you to attorney powers power forward.

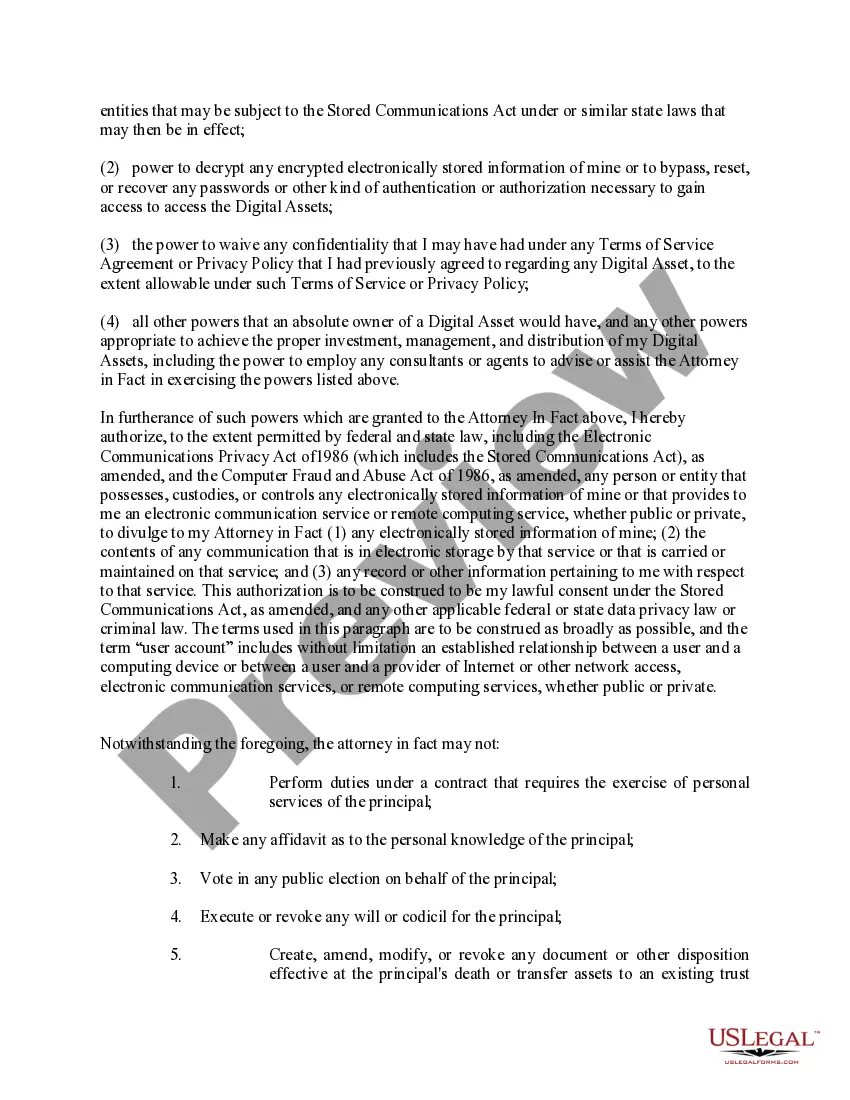

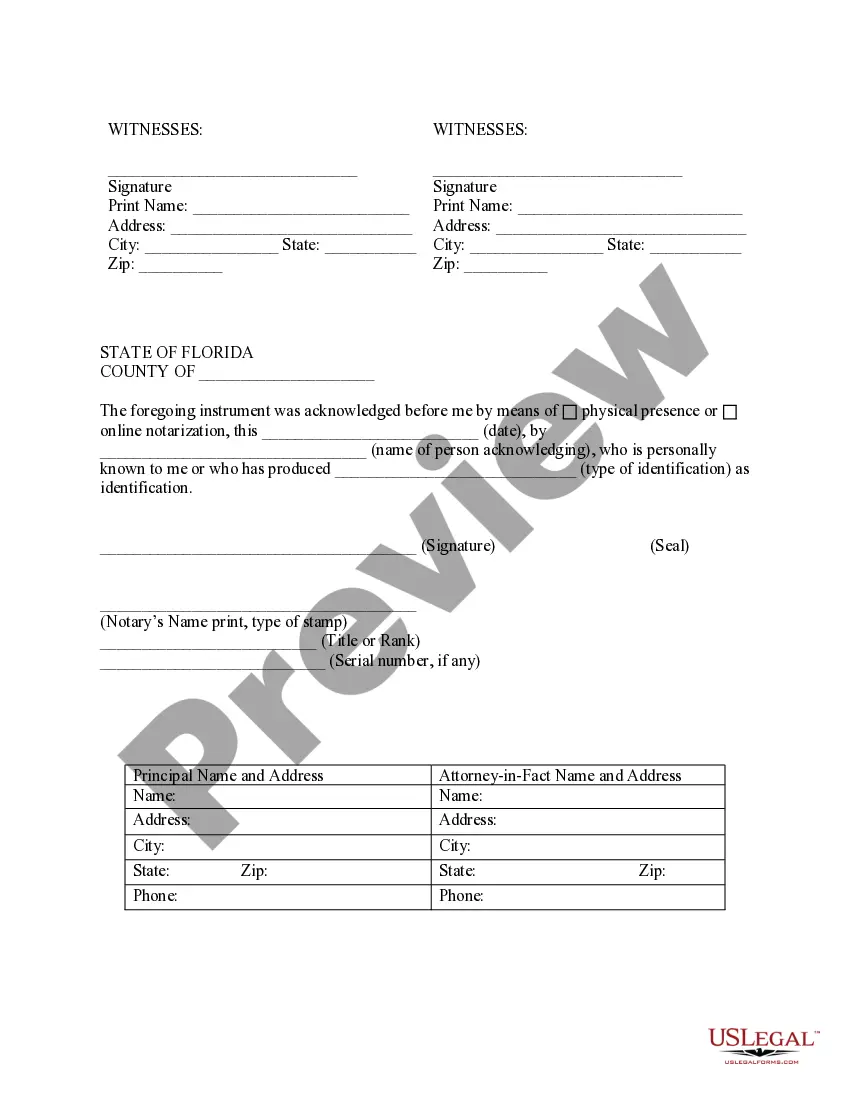

Filling out a power of attorney form involves several important steps. First, clearly identify yourself as the principal, then designate an agent who will have the authority to act for you. Next, specify which powers you are granting to that agent and ensure you signed and dated the form. To make this process easier, consider using US Legal Forms, providing straightforward templates to help you attorney powers power forward.

In Arizona, a power of attorney does need to be notarized to ensure its validity. This step adds an essential layer of authentication, confirming that you willingly granted someone else the authority to act on your behalf. When you choose to set up your power of attorney, ensure you have it signed and notarized to protect your interests. Using a reliable resource, such as US Legal Forms, can guide you through the process smoothly.

In general, a power of attorney holds more authority than next of kin in making decisions for an individual. When you designate someone as your attorney-in-fact, they gain the legal ability to act on your behalf, often overriding the preferences of next of kin. This arrangement allows your attorney powers to power forward, ensuring your wishes are respected. For precise legal documents to establish your power of attorney, consider the options available at US Legal Forms.

The most powerful type of power of attorney is called a durable power of attorney. This document remains effective even if the principal becomes incapacitated, allowing your attorney to make essential decisions on your behalf. By using this legal tool, you ensure that your affairs continue to be managed, paving the way for a smoother process when obstacles arise. US Legal Forms offers resources to help you create a durable power of attorney, enabling your attorney powers to power forward.

To submit a POA to the IRS, you must fill out Form 2848 and send it to the designated address. Ensuring that you follow the proper submission procedures helps in maintaining compliance and facilitating the process. USLegalForms can guide you through creating and submitting your POA, helping attorney powers power forward with clarity.

When submitting documents to the IRS, it is advisable to avoid stapling and to use paper clips instead. This ensures that your documents remain secure but easy to separate for processing. When you use USLegalForms to prepare your submissions, you can easily follow these best practices to ensure that attorney powers power forward seamlessly.

Certified mail is often considered better than priority mail when dealing with tax submissions. It provides proof of mailing and delivery, crucial for keeping your tax records clear and verifiable. Utilizing USLegalForms can help you prepare your necessary documents to accompany your certified mail, ensuring the attorney powers power forward as intended.

In Minnesota, a Power of Attorney typically requires notarization to be valid. Notarization helps to authenticate the document and ensure its acceptance by institutions. Use USLegalForms to generate a compliant POA that includes the necessary notarization details, so the attorney powers power forward seamlessly.

The best way to submit a POA to the IRS is to send it via certified mail. This method offers tracking and ensures delivery confirmation, which can be crucial for your records. Using USLegalForms can help you in preparing the POA correctly, so that the attorney powers power forward without any issues.