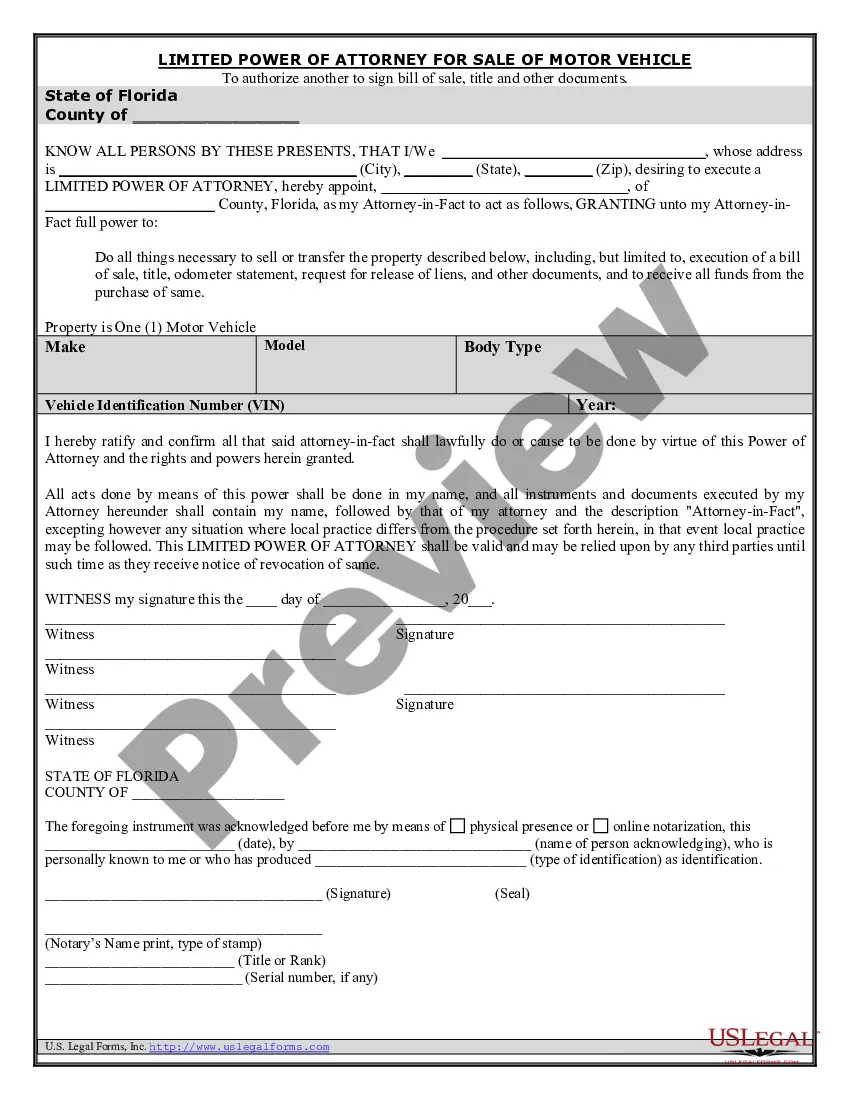

Poder Venta Withholding

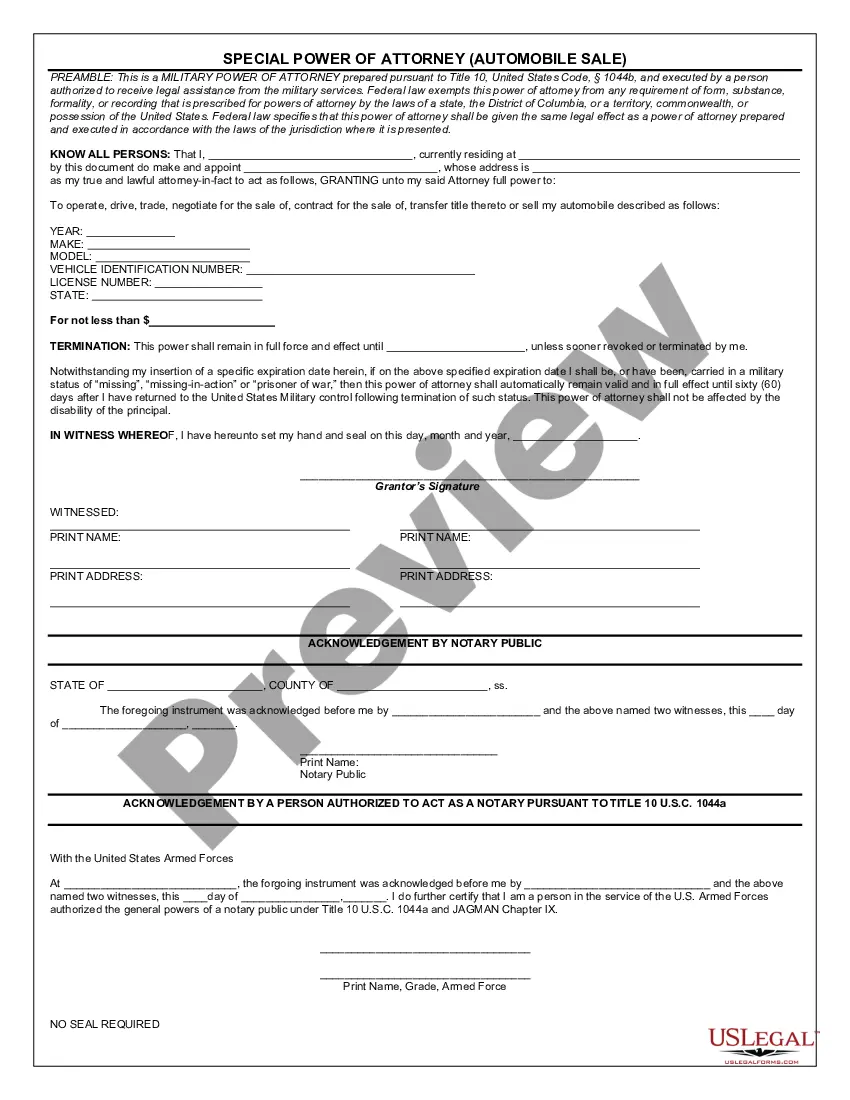

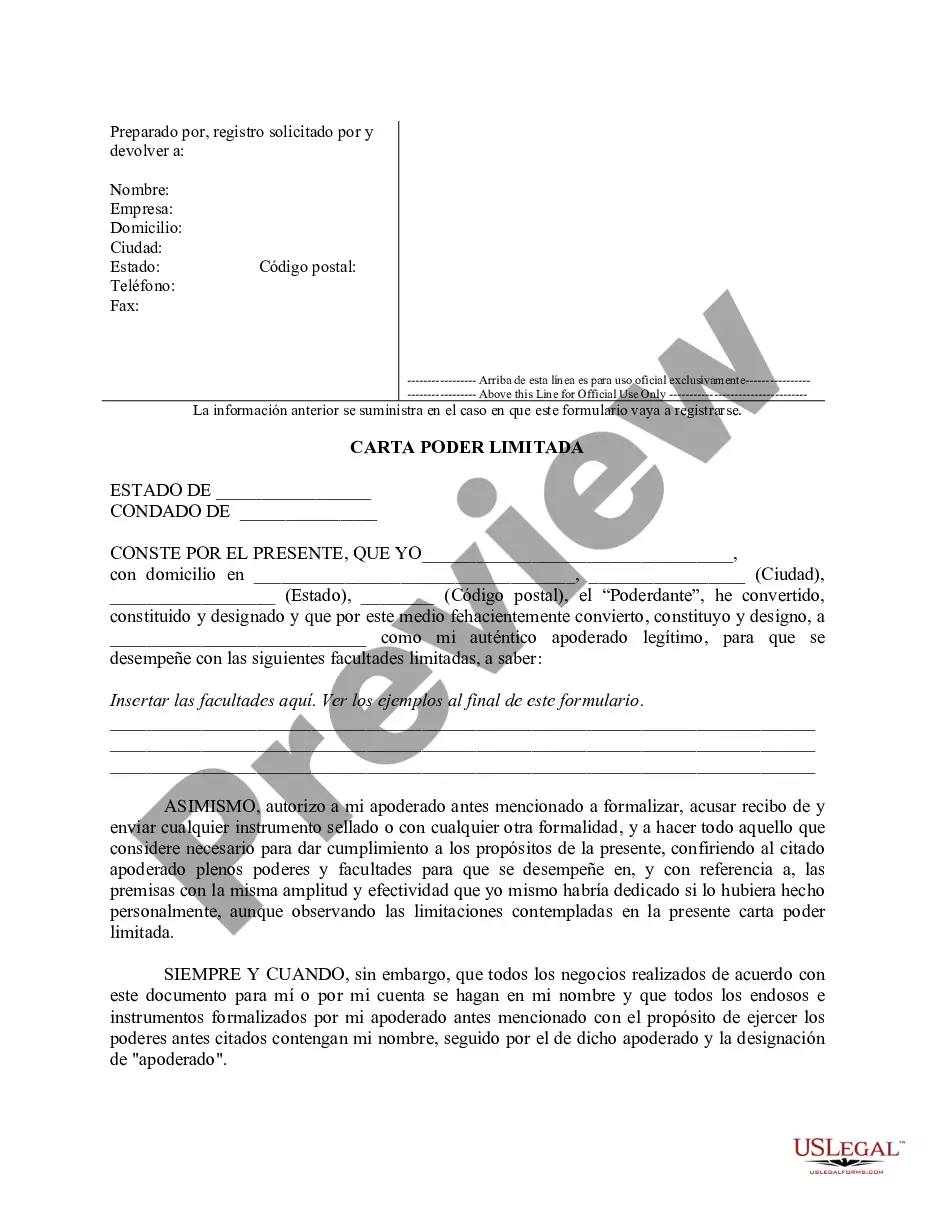

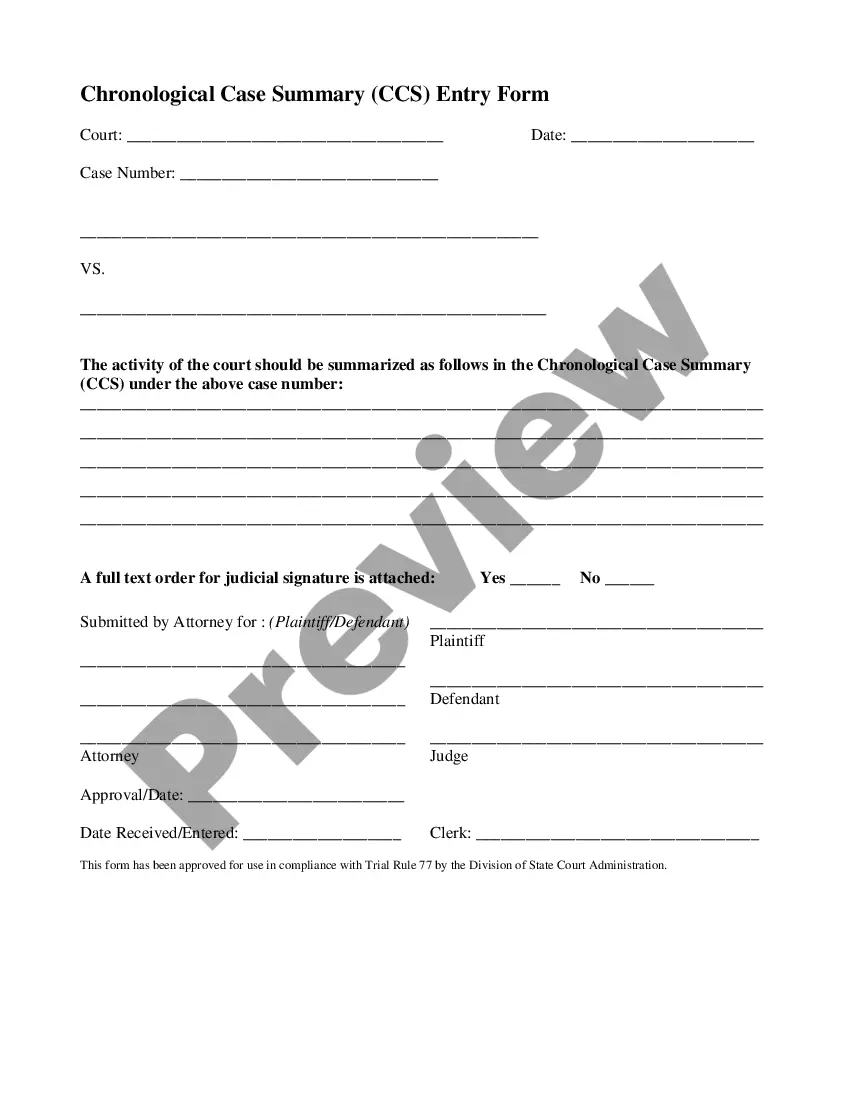

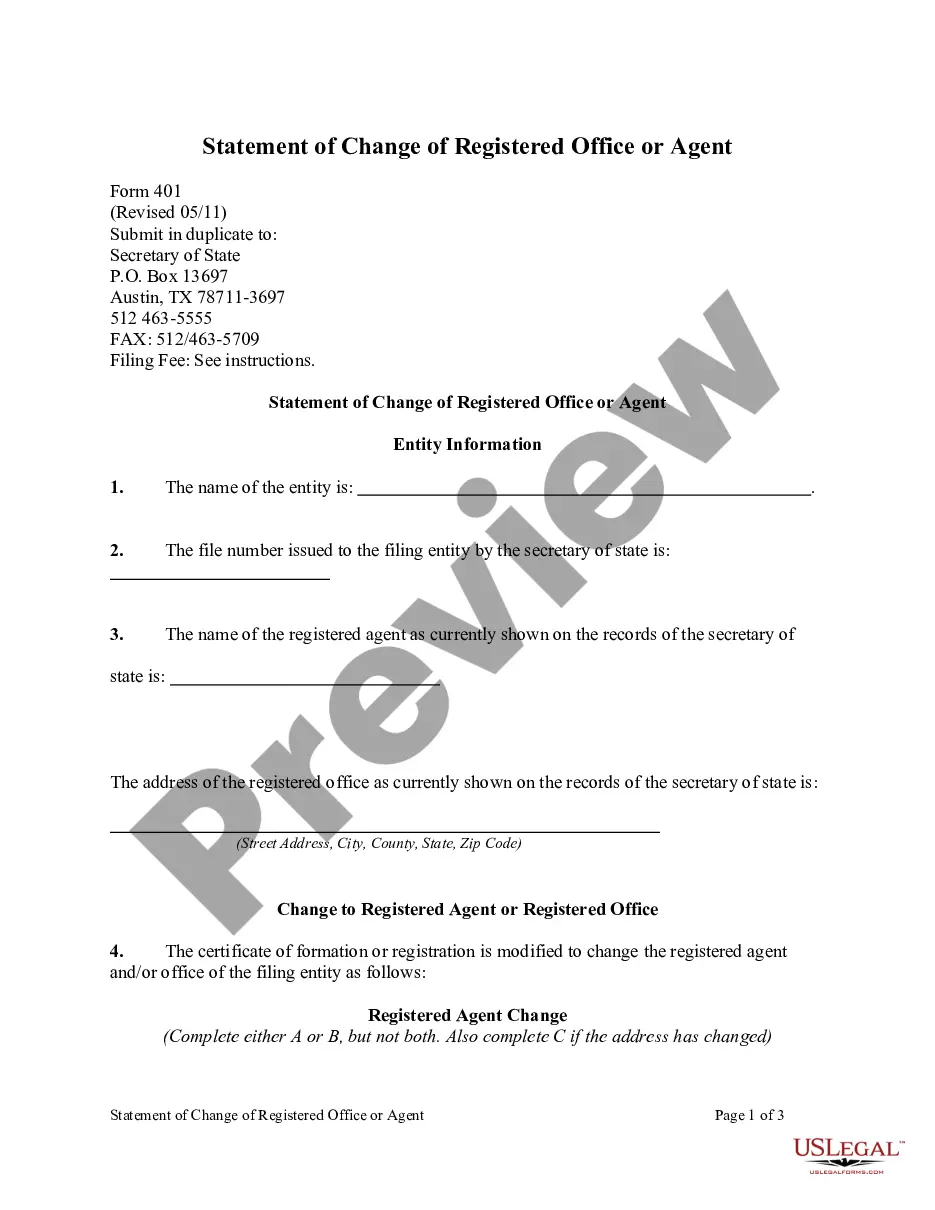

Description

How to fill out Florida Power Of Attorney For Sale Of Motor Vehicle?

Locating a reliable source to obtain the latest and most applicable legal templates is a significant part of navigating bureaucracy.

Securing the appropriate legal documents demands accuracy and meticulousness, which is why it is essential to source Poder Venta Withholding samples exclusively from trusted providers, such as US Legal Forms. An inadequate template can squander your time and postpone your circumstances.

Eliminate the complications that come with your legal documentation. Explore the vast US Legal Forms library to discover legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the catalog browsing or search option to locate your template.

- Examine the information of the form to ascertain if it aligns with the specifications of your state and locality.

- Preview the form, if available, to confirm that it is indeed the document you seek.

- If the Poder Venta Withholding does not suit your requirements, continue searching for the correct document.

- If you are confident in the form’s appropriateness, proceed to download it.

- For registered clients, click Log in to verify and access your selected forms in My documents.

- If you do not possess an account yet, click Buy now to obtain the form.

- Select a pricing plan that meets your needs.

- Complete registration to finalize your transaction.

- Finish your purchase by choosing a payment method (credit card or PayPal).

- Select the file format for downloading Poder Venta Withholding.

- After acquiring the form on your device, you can edit it with the editor or print it for manual completion.

Form popularity

FAQ

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

Beginning in 2023, Arizona is doing away with a progressive tax system and instead applying a flat tax rate of 2.5% on taxable income. This tax rate will apply to income earned throughout 2023 that is reported on returns filed in 2024.

The amount withheld depends on: The amount of income earned and. Three types of information an employee gives to their employer on Form W?4, Employee's Withholding Allowance Certificate: Filing status: Either the single rate or the lower married rate.

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W?4.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).