Power Of Attorney Without Will

Description

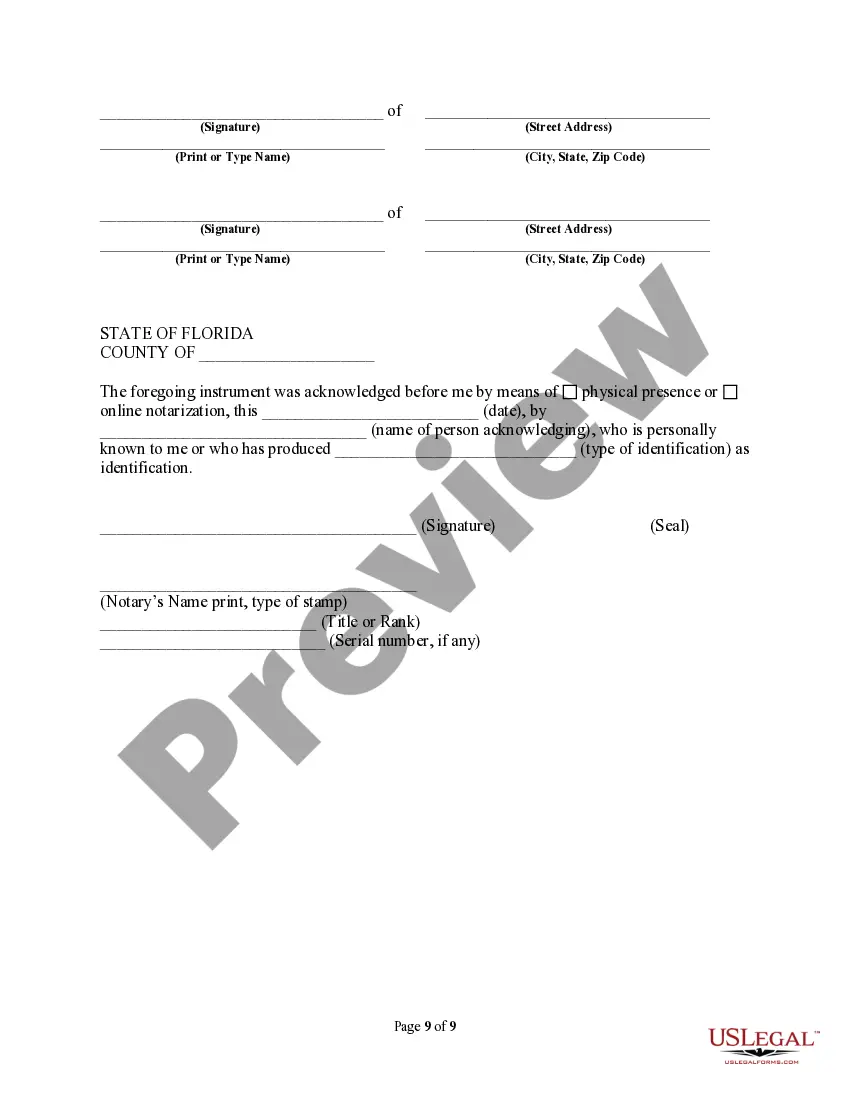

How to fill out Florida Durable Power Of Attorney For Property, Finances And Health Care?

Getting a go-to place to access the most recent and appropriate legal templates is half the struggle of handling bureaucracy. Choosing the right legal files needs precision and attention to detail, which explains why it is important to take samples of Power Of Attorney Without Will only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and see all the information regarding the document’s use and relevance for your situation and in your state or county.

Consider the listed steps to finish your Power Of Attorney Without Will:

- Make use of the library navigation or search field to find your template.

- View the form’s description to check if it matches the requirements of your state and county.

- View the form preview, if available, to make sure the template is the one you are interested in.

- Get back to the search and find the correct document if the Power Of Attorney Without Will does not fit your needs.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing plan that suits your preferences.

- Go on to the registration to complete your purchase.

- Finalize your purchase by selecting a transaction method (bank card or PayPal).

- Select the document format for downloading Power Of Attorney Without Will.

- When you have the form on your device, you may change it with the editor or print it and complete it manually.

Get rid of the inconvenience that comes with your legal documentation. Explore the extensive US Legal Forms library where you can find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

For most people, the best option is to have a general durable power of attorney because it gives your agent broad powers that will remain in effect if you lose the ability to handle your own finances. An attorney can customize a general POA to limit powers even more?or add powers, Berkley says.

After someone dies, someone (called the deceased person's 'executor' or 'administrator') must deal with their money and property (the deceased person's 'estate'). They need to pay the deceased person's taxes and debts, and distribute his or her money and property to the people entitled to it.

In general, the executor of the estate handles any assets the deceased owned, including money in bank accounts. If there is no will to name an executor, the state appoints one based on local law.

The order of priority is any surviving spouse or domestic partner, then a child, then a grandchild, then a parent, and then a sibling. A judge will need to decide which person has priority.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.