Mortgage Deed Form Without

Description

How to fill out Florida Mortgage Deed From Individual?

Whether for business purposes or for personal matters, everyone has to handle legal situations at some point in their life. Filling out legal paperwork needs careful attention, beginning from selecting the appropriate form template. For example, if you pick a wrong edition of the Mortgage Deed Form Without, it will be rejected once you submit it. It is therefore important to have a dependable source of legal files like US Legal Forms.

If you have to get a Mortgage Deed Form Without template, follow these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Check out the form’s information to ensure it suits your case, state, and region.

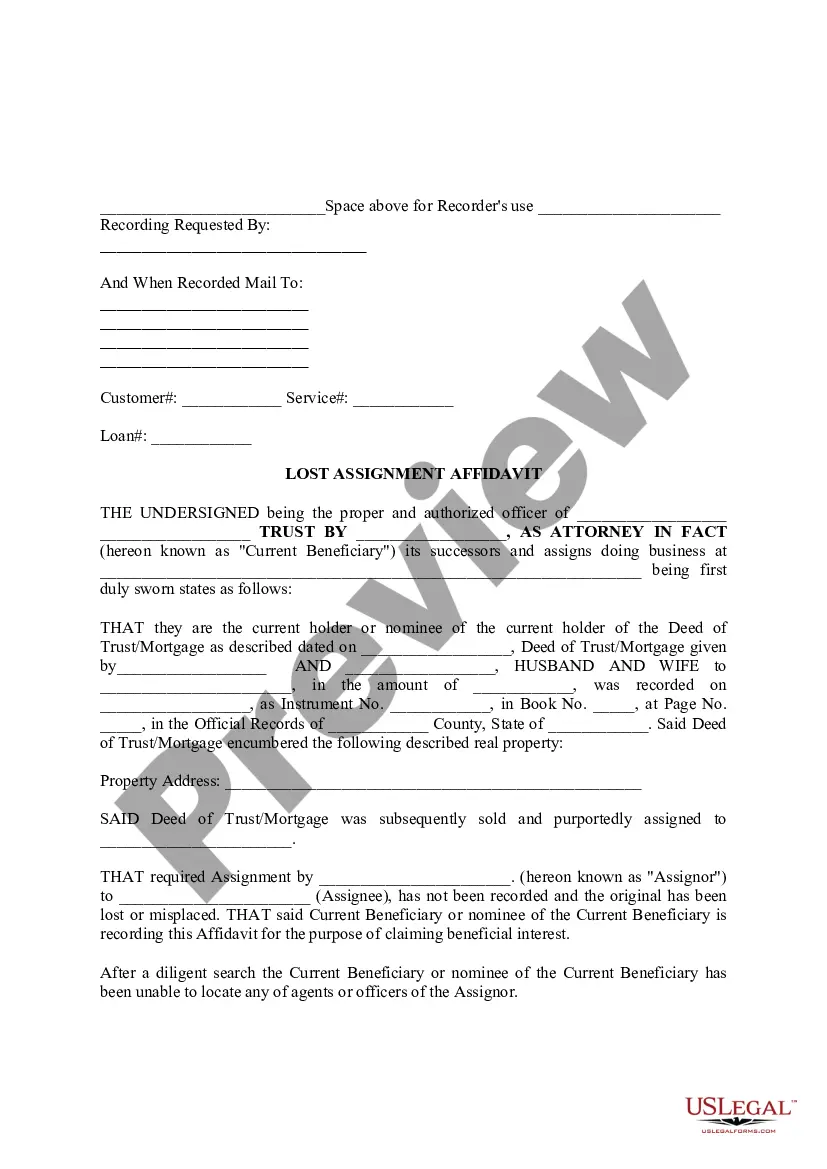

- Click on the form’s preview to see it.

- If it is the incorrect document, get back to the search function to locate the Mortgage Deed Form Without sample you need.

- Download the template when it matches your requirements.

- If you already have a US Legal Forms profile, just click Log in to access previously saved files in My Forms.

- In the event you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Pick your payment method: use a credit card or PayPal account.

- Choose the file format you want and download the Mortgage Deed Form Without.

- After it is saved, you can complete the form by using editing software or print it and complete it manually.

With a large US Legal Forms catalog at hand, you never have to spend time searching for the appropriate template across the web. Utilize the library’s straightforward navigation to find the right template for any situation.

Form popularity

FAQ

Remortgaging is the standard way to add someone to a mortgage. If you approach your existing lender, they will undertake the new application and assist with any questions you have along the way. It isn't advisable to just accept a remortgage offer from your existing lender.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

No. A mortgage only involves two parties: the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

Adding a co-borrower requires refinancing. You can't add a co-borrower without refinancing your mortgage. It allows you to change the terms of your home loan and add or remove names from mortgages.

There are 2 ways of adding someone to a mortgage. You can either ask your existing lender if they can add a name to your mortgage. Or you can swap your current mortgage for a new, joint one with a different lender ? known as remortgaging. Do you own your own home?