Mortgage Deed Form Withdrawal

Description

How to fill out Florida Mortgage Deed From Individual?

Finding a go-to place to take the most recent and relevant legal samples is half the struggle of handling bureaucracy. Discovering the right legal files calls for accuracy and attention to detail, which is why it is vital to take samples of Mortgage Deed Form Withdrawal only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the information regarding the document’s use and relevance for the circumstances and in your state or region.

Consider the listed steps to complete your Mortgage Deed Form Withdrawal:

- Make use of the catalog navigation or search field to locate your sample.

- Open the form’s description to ascertain if it fits the requirements of your state and region.

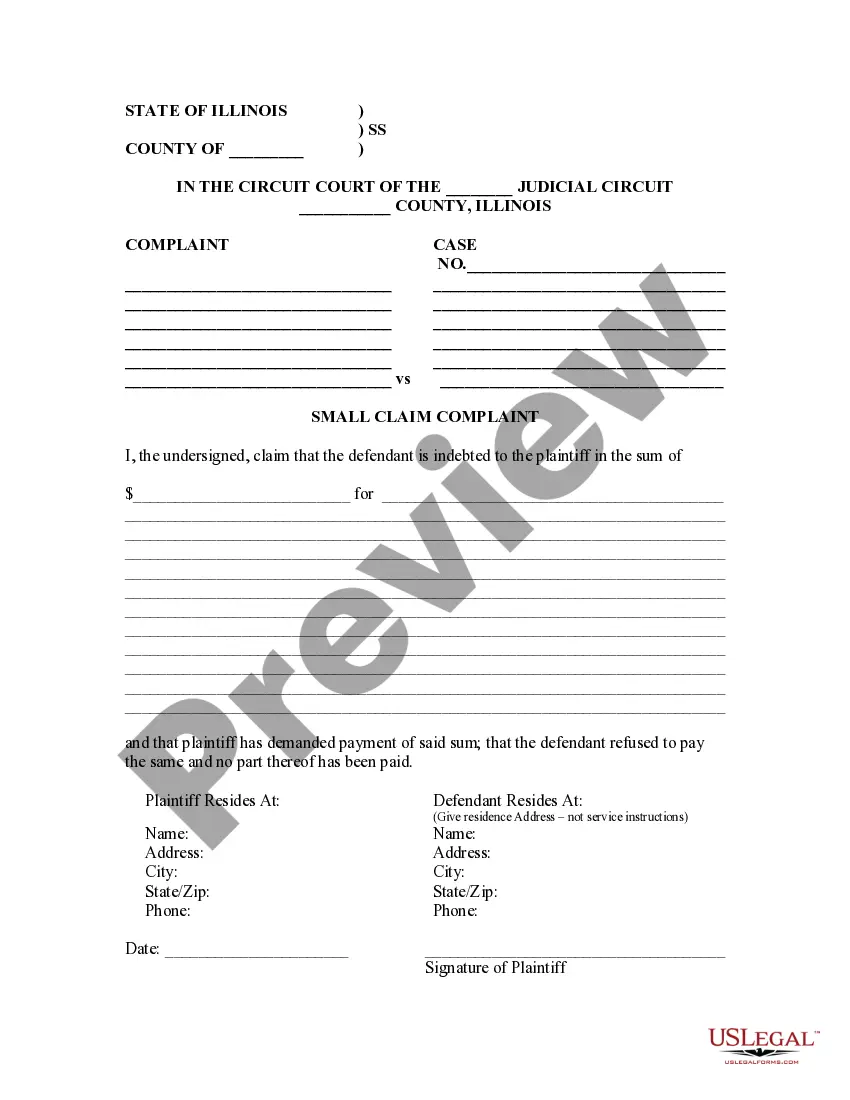

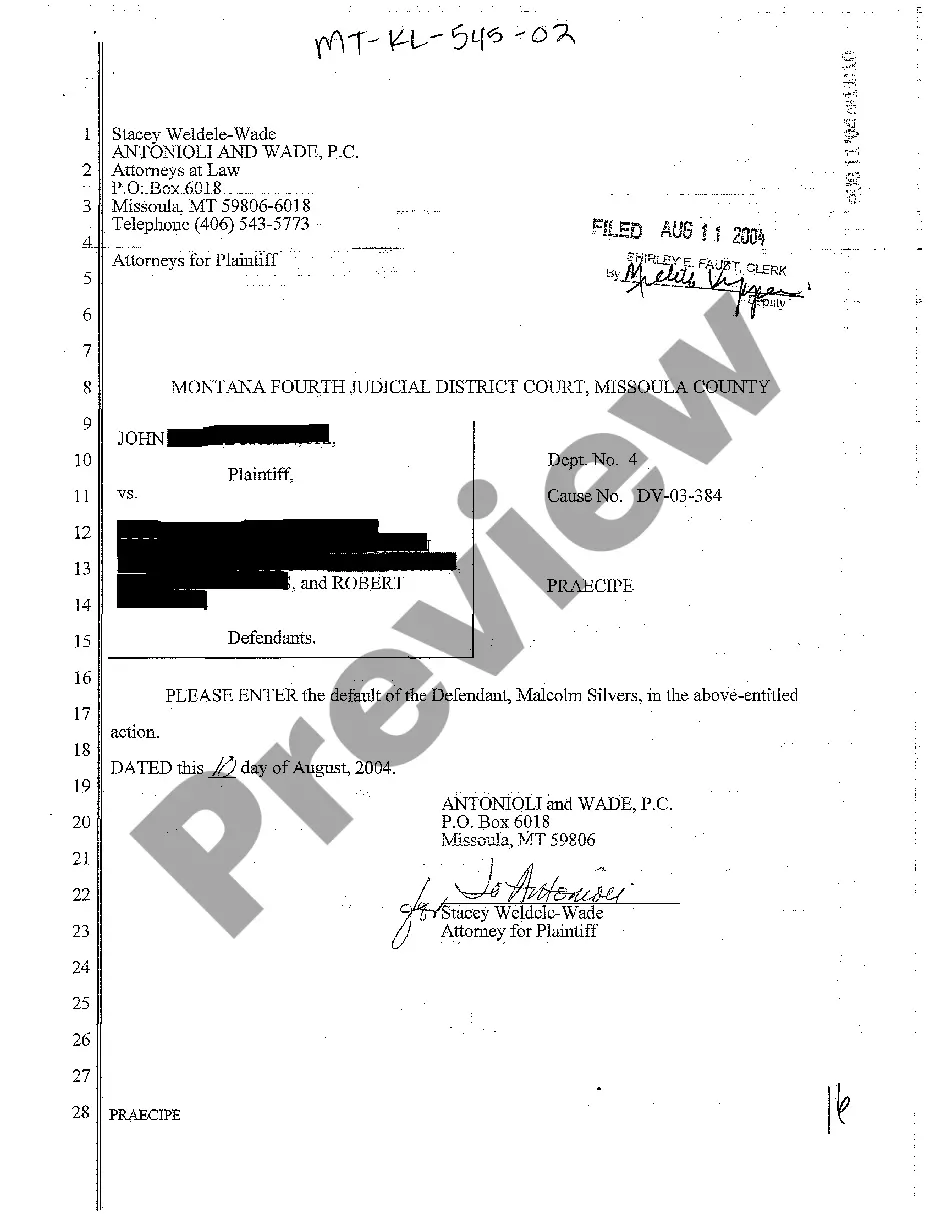

- Open the form preview, if available, to make sure the template is the one you are looking for.

- Get back to the search and locate the proper document if the Mortgage Deed Form Withdrawal does not suit your requirements.

- If you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the template.

- Choose the pricing plan that fits your needs.

- Proceed to the registration to complete your purchase.

- Complete your purchase by picking a payment method (credit card or PayPal).

- Choose the file format for downloading Mortgage Deed Form Withdrawal.

- When you have the form on your device, you can change it using the editor or print it and finish it manually.

Remove the inconvenience that comes with your legal paperwork. Explore the extensive US Legal Forms collection where you can find legal samples, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

The promissory note portion includes: The dollar amount of the mortgage loan. The interest rate that borrowers will pay. ... The down payment amount. Whether monthly or bimonthly payments are required. Whether a prepayment penalty is imposed. The penalties for late payments.1.

Refinancing is generally the best way to take a person's name off a mortgage. Depending on your lender, it may be the only way. If you have sufficient home equity, credit, and income ? and your ex-partner agrees to give you the house ? you should be able to refinance your current mortgage in your name only.

There are two ways to remove an ex-spouse from a loan: Release and refinance. A lender may release the ex-spouse from the loan. If presented with a divorce decree and a quitclaim deed, many lenders will remove the ex-spouse and leave the loan in the name of one spouse only.

Removing a name from your mortgage: Can it be done without refinancing? Yes, it is possible to take sole responsibility for a home that you're currently sharing without refinancing, even if your ex-spouse or another co-borrower or cosigner is currently on the mortgage.