Trustee For A Will

Description

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

- If you're an existing user, log in to your account on the US Legal Forms website to access your previously purchased documents. Check if your subscription is active; if it’s not, renew it based on your selected payment plan.

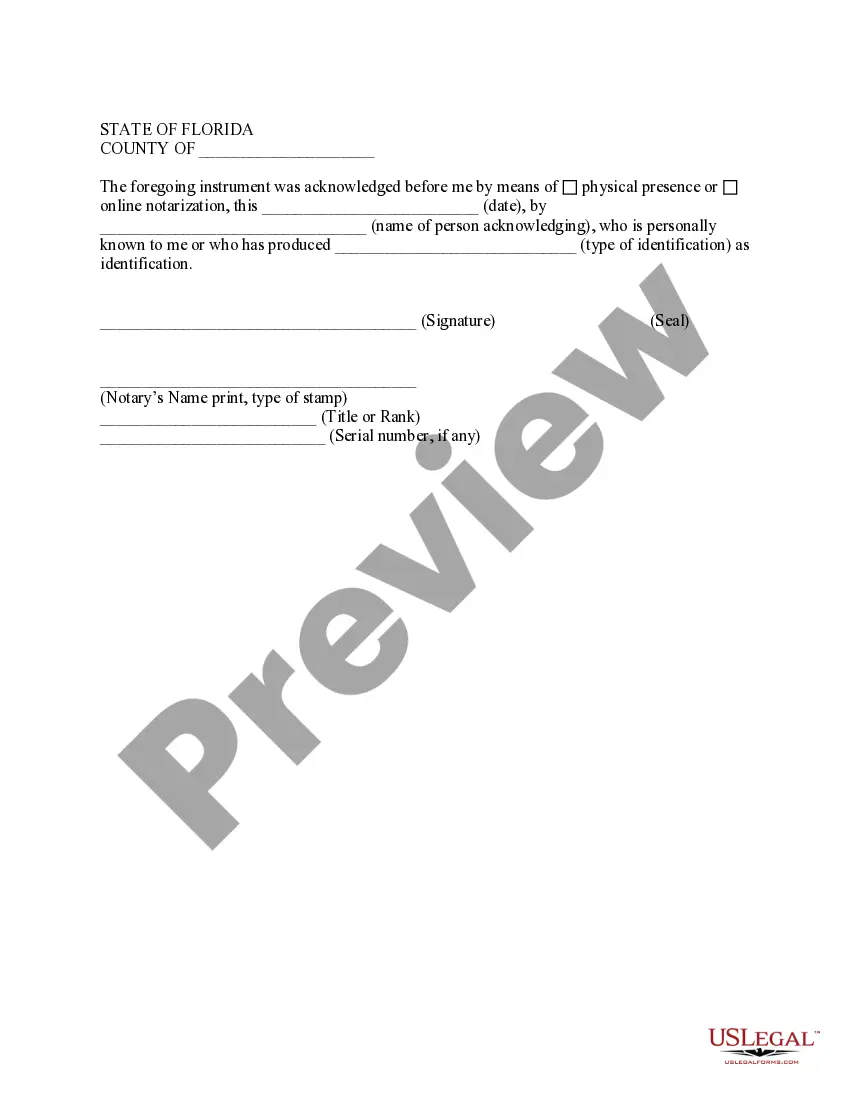

- For first-time users, start by browsing the extensive library of over 85,000 legal forms. Use the Preview mode to find the specific trustee for a will template that fits your requirements.

- Should you need a different template, utilize the Search feature to locate the appropriate document that meets your regional jurisdiction.

- Once you've found the correct form, click on the Buy Now button to select your desired subscription plan and create an account to gain access.

- Complete the payment process by entering your credit card information or through your PayPal account to finalize your purchase.

- After the transaction is confirmed, download the template directly to your device for completion. You can also find it later in the My Forms section of your account.

In conclusion, using US Legal Forms empowers you to create legally sound documents efficiently. Their extensive and user-friendly resources ensure you choose the right forms and complete them accurately.

Start your journey towards efficient legal documentation today—visit US Legal Forms and navigate with confidence!

Form popularity

FAQ

Choosing a trustee for a will involves assessing the character, skills, and availability of potential candidates. First, evaluate who in your life can fulfill the responsibilities of a trustee, considering their integrity and decision-making abilities. Next, discuss your choices with those individuals to gauge their willingness to serve. If you prefer a more professional approach, platforms like uslegalforms can help guide you in setting up a trustee arrangement that meets your needs.

A good person to be a trustee for a will is someone who demonstrates reliability and sound judgment. This individual should also be able to communicate effectively with your beneficiaries and be prepared to navigate potential conflicts. Think about someone with experience in handling financial matters, as this skill set can greatly aid your loved ones. Trust is key, so select someone you have confidence in.

The best choice for a trustee for a will often depends on your unique circumstances. Family members or close friends may be good options, provided they have the necessary qualities like integrity and organization. However, professionals such as attorneys or financial advisors can offer added expertise, especially in complex situations. Ultimately, choose someone you trust completely to handle important decisions.

When considering a trustee for a will, it is important to select someone who is responsible and trustworthy. Ideally, this individual should have a clear understanding of your financial matters and the ability to manage assets properly. Additionally, consider someone who can remain impartial and act in the best interest of your beneficiaries. A reliable trustee for a will can help ensure your wishes are fulfilled smoothly.

One disadvantage of appointing a trustee for a will is the potential for conflicts of interest, especially if the trustee is also a beneficiary. This can complicate decisions and affect relationships among beneficiaries. Additionally, the responsibilities of a trustee can be time-consuming and stressful. Utilizing resources like uslegalforms can help streamline your estate planning process, reducing the burdens associated with these responsibilities.

Generally, an executor does not override a trustee for a will, as their roles operate independently. The executor manages the probate process, while the trustee oversees the trust assets. However, in some situations, disputes may arise that require legal intervention to address the specifics. Understanding these roles can help you mitigate potential conflicts.

An executor for a will is responsible for administering the probate process, while a trustee for a will manages the assets held in a trust. Executors focus on the distribution of assets after death, whereas trustees safeguard and oversee assets during a designated period or until specific goals are met. By knowing these differences, you can select the right individuals for your estate planning needs.

The roles of a trustee for a will and an executor are distinct and operate within different realms. While the trustee manages the trust assets, the executor handles the probate process of the will. Each has specific powers; however, their authority is not directly comparable. Understanding these roles can help you navigate estate management more effectively.

A trustee for a will manages and distributes the estate according to the deceased's wishes. This includes gathering assets, paying debts, and ensuring beneficiaries receive their inheritance. The trustee serves as a pivotal figure in honoring the decedent's intentions. For clarity and structure, using online platforms like uslegalforms can provide you with the necessary guidance.

Yes, a trustee for a will can also be a beneficiary. However, this can lead to potential conflicts of interest. It is essential to consider the implications carefully. By understanding the dynamics between these roles, you can ensure that your estate plan operates smoothly.