Trustee For A Trust

Description

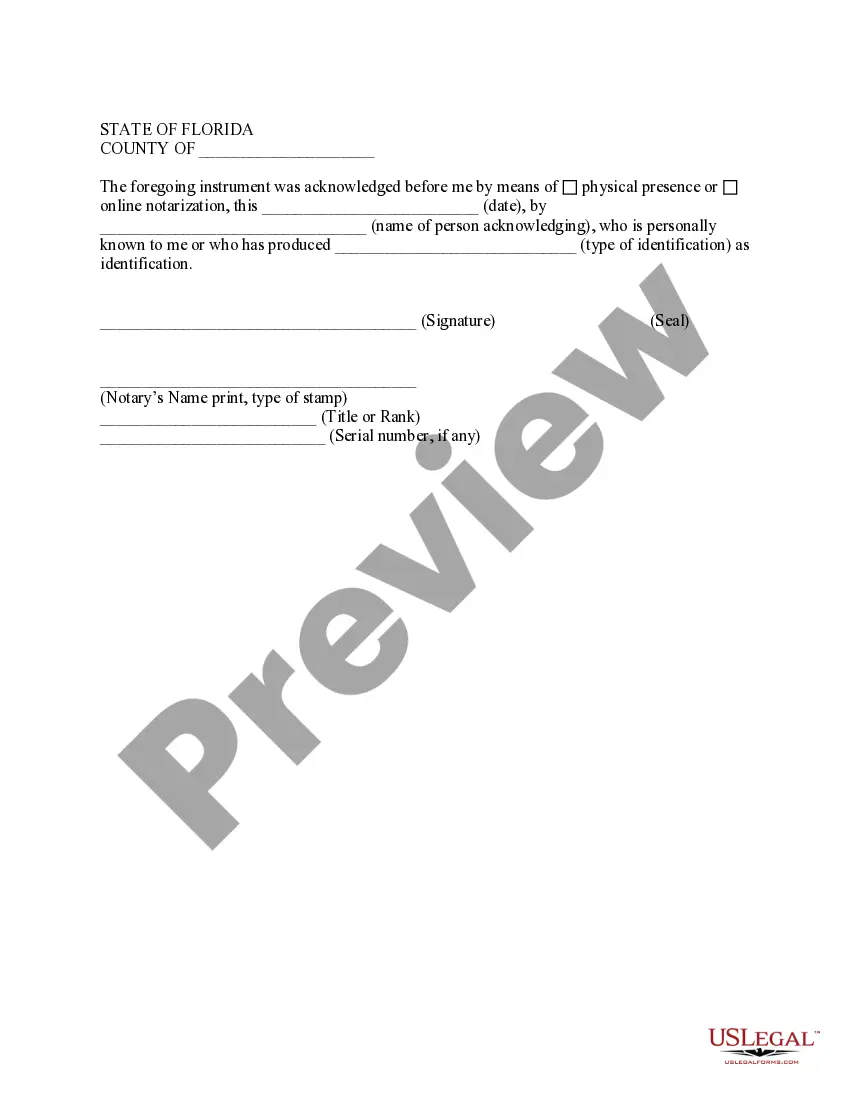

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

- Log in to your US Legal Forms account, or create one if you're a new user. Access your profile to begin the process.

- Explore the extensive library of legal forms and locate templates pertinent to trusts. Utilize the Preview mode to ensure you select the right document.

- If necessary, adjust your search using the Search tab to find alternate templates that may be better suited to your jurisdiction and requirements.

- Once you've identified the appropriate document, click the 'Buy Now' button. Choose the subscription plan that fits your needs and complete your registration.

- Finalize your purchase by entering your payment information or using your PayPal account. This will allow you to gain access to US Legal Forms' vast resources.

- Download your form and save it on your device. Access it anytime through the 'My Forms' menu in your account.

US Legal Forms empowers both individuals and attorneys by providing a comprehensive library of over 85,000 fillable and editable legal forms. This resource not only saves time but also ensures that your documentation is accurate and compliant with legal standards.

Don't wait any longer to secure your trust documents. Visit US Legal Forms today to access the tools you need to make informed legal decisions!

Form popularity

FAQ

The role of a trustee in a trust is to manage the trust's assets according to the terms set forth in the trust document. A trustee is responsible for making decisions that are in the best interest of the beneficiaries, safeguarding the assets, and ensuring proper distribution. Effective trusteeship requires diligence, fairness, and a clear understanding of legal obligations. For those looking to establish a trust, US Legal Forms offers valuable resources to facilitate this process.

Indeed, the trustee and beneficiary can be the same person. While this arrangement is legally permissible, it does require careful management to avoid potential disputes or misunderstandings. Proper documentation and communication are vital to maintain transparency in the trust's administration. Utilizing platforms like US Legal Forms can provide templates and guidance tailored to your specific needs.

Yes, a trustee can also be a beneficiary of the trust. However, this situation can lead to conflicts of interest that may complicate the trustee's responsibilities. It is essential to define the roles clearly to ensure the trust is managed effectively. For clarity and legal support, consider using US Legal Forms to help navigate these complexities.

To become a trustee for a trust, you need to possess certain qualities, such as responsibility and integrity. Additionally, you should have a basic understanding of financial management and legal obligations related to trusts. While specific requirements can vary, having a willingness to learn and seek help when needed is essential. Resources like UsLegalForms can provide valuable information and tools to help you succeed in this role.

To add a trustee to a trust, begin by reviewing the trust agreement to understand the requirements for amendments. Typically, you will need to create a formal document specifying the new trustee’s role and have it signed and witnessed as per your state's laws. If the trust document permits, you can easily make this addition. For guidance, UsLegalForms is an excellent resource for drafting the necessary documents.

Appointing trustees for a trust generally involves a clear process outlined in the trust documents. You can designate a trustee when you create the trust or make changes later through a formal amendment. It’s essential to ensure that the appointed trustee understands their responsibilities. For a seamless appointment, using a legal platform like UsLegalForms can simplify the process and ensure all legal requirements are met.

While being a trustee for a trust can be rewarding, there are potential downsides. You may face personal liability if the trust is mismanaged, which underscores the need for careful oversight. Additionally, you will need time and commitment to fulfill your responsibilities diligently. Therefore, understanding these aspects is crucial before taking on the role of a trustee for a trust.

You should appoint a trustee for a trust who aligns with your vision and possesses the necessary skills to manage the trust effectively. This could be a person you trust implicitly, a professional with expertise in trust management, or an institution experienced in handling such matters. Always ensure that your choice can communicate well with beneficiaries and adhere to your wishes regarding the trust.

If a trust has no trustee, it cannot be managed or executed properly, leading to significant issues. In such cases, beneficiaries may face delays in receiving their inheritance and potential conflicts may arise. To prevent this, it's wise to have a backup trustee listed in your trust document. If needed, you can rely on resources like uslegalforms to navigate trustee appointments seamlessly.

Suitability for the role of trustee for a trust involves having both the personal qualities and professional capabilities needed. Look for someone with financial knowledge, ethical standards, and a willingness to engage with beneficiaries. Professional trustees and fiduciaries can also be excellent choices when impartiality is crucial. Always evaluate candidates' ability to commit time and energy to the role.