Quitclaim Deed To Revocable Trust Form With Two Points

Description

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

Whether for business purposes or for personal matters, everybody has to manage legal situations at some point in their life. Filling out legal paperwork demands careful attention, beginning from choosing the appropriate form template. For example, when you choose a wrong edition of the Quitclaim Deed To Revocable Trust Form With Two Points, it will be declined when you send it. It is therefore essential to get a trustworthy source of legal papers like US Legal Forms.

If you need to get a Quitclaim Deed To Revocable Trust Form With Two Points template, stick to these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Check out the form’s information to make sure it fits your case, state, and county.

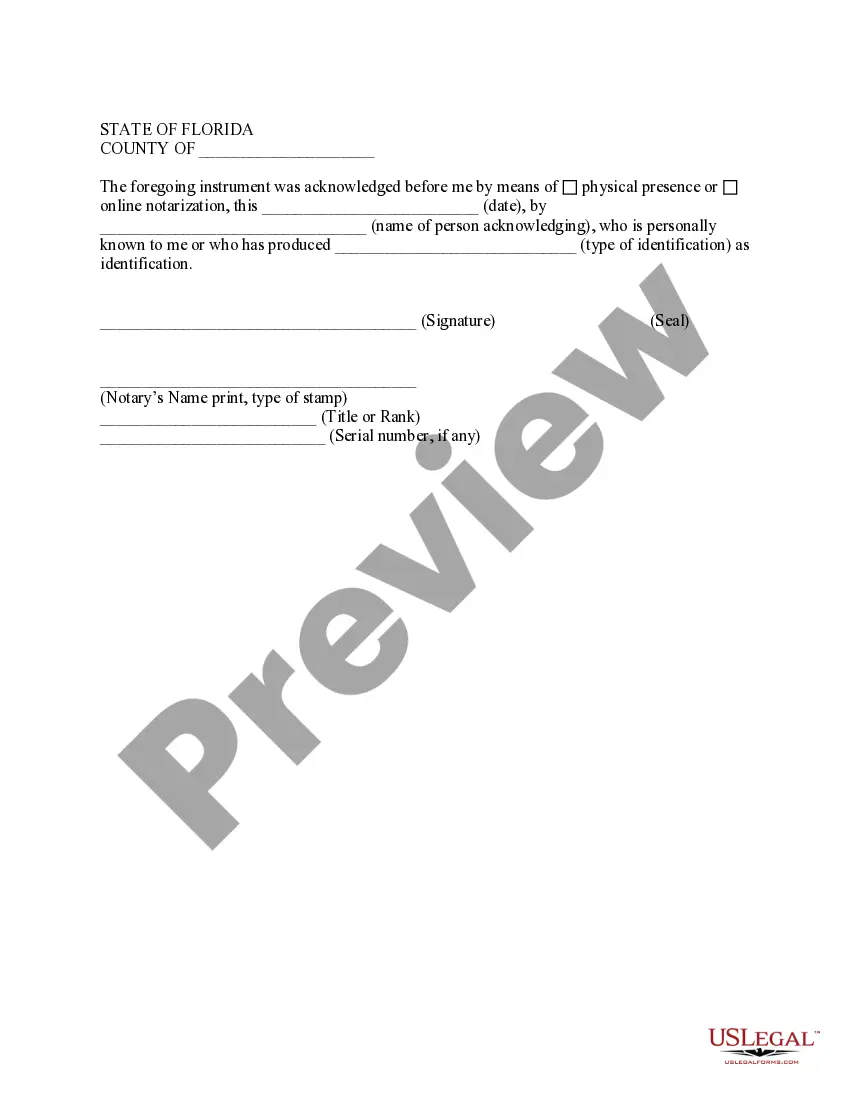

- Click on the form’s preview to see it.

- If it is the incorrect form, get back to the search function to locate the Quitclaim Deed To Revocable Trust Form With Two Points sample you require.

- Download the file if it meets your needs.

- If you already have a US Legal Forms profile, click Log in to access previously saved documents in My Forms.

- In the event you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the profile registration form.

- Choose your transaction method: use a bank card or PayPal account.

- Choose the document format you want and download the Quitclaim Deed To Revocable Trust Form With Two Points.

- Once it is downloaded, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not need to spend time looking for the right sample across the internet. Utilize the library’s straightforward navigation to find the right form for any situation.

Form popularity

FAQ

Pricing for Short Form Deed of Trust The cost to prepare and file a Short Form Deed of Trust in California is $375.00* total. The flat rate pricing includes filing fees. *Our flat rate pricing covers filing fees for up to 5 pages and do not include notary fees.

A trust deed is a legal document that sets out the rules for establishing and operating your fund. It includes such things as the fund's objectives, who can be a member and whether benefits can be paid as a lump sum or income stream.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

A quit claim deed should be filed with the clerk of court in the county where the property is located. This will involve taking the deed to the clerk's office and paying the required filing fee (typically about $10 for a one-page quit claim deed).

Real estate can be transferred into a trust by a deed that transfers title from the grantor to the name of the trust. Under California law, a Preliminary Change of Ownership Report must be filed simultaneously with the deed at the county recorder's office in the county where the real property is situated.