Quitclaim Deed To Revocable Trust Form For California

Description

Form popularity

FAQ

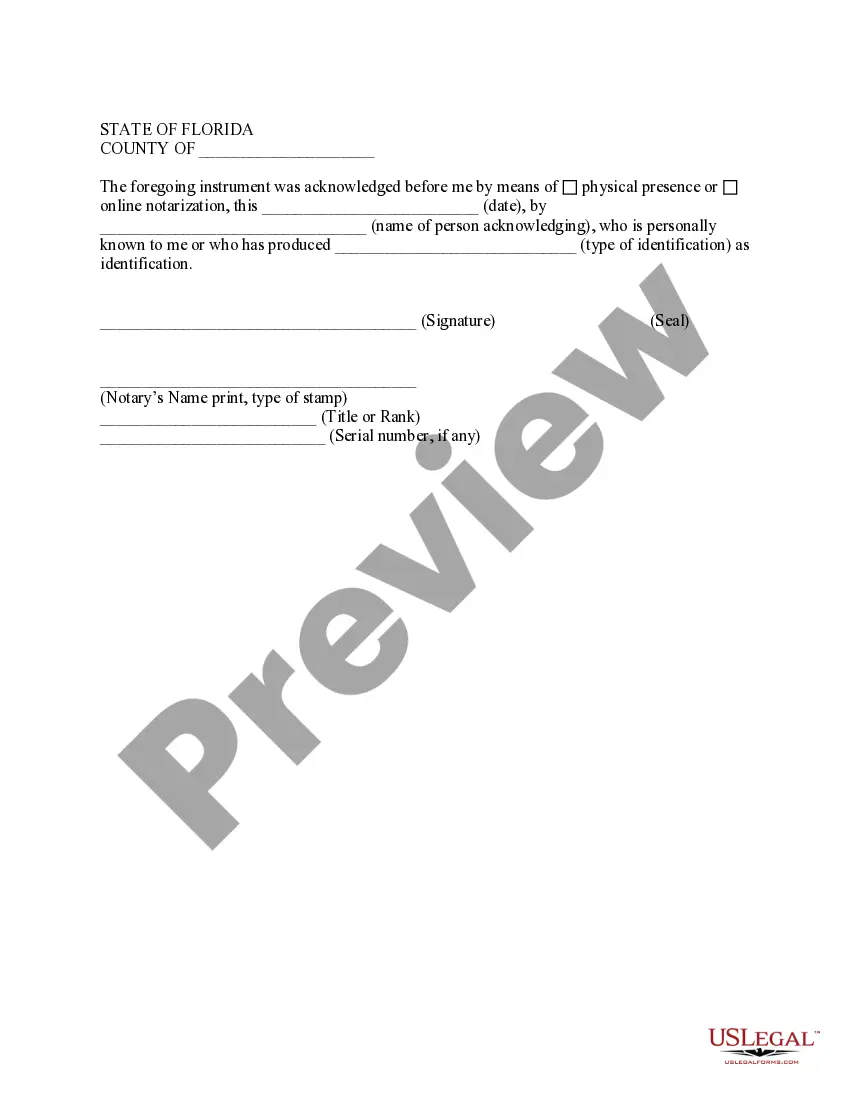

First, you need to make sure you fill out the quitclaim deed properly and get it notarized. Next, take the quitclaim deed to the County Recorder's Office. Make sure to file a Preliminary Change of Ownership Report and a Documentary of Transfer Tax or a Notice of Exempt Transaction.

Pricing for Short Form Deed of Trust The cost to prepare and file a Short Form Deed of Trust in California is $375.00* total. The flat rate pricing includes filing fees. *Our flat rate pricing covers filing fees for up to 5 pages and do not include notary fees.

How to create a living trust in California Take stock of your assets. ... Choose a trustee. ... Choose your beneficiaries. ... Draw up your Declaration of Trust. ... Consider signing your trust document in front of a notary public. ... Transfer your property to the trust.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.