Estate Trustee With A Will

Description

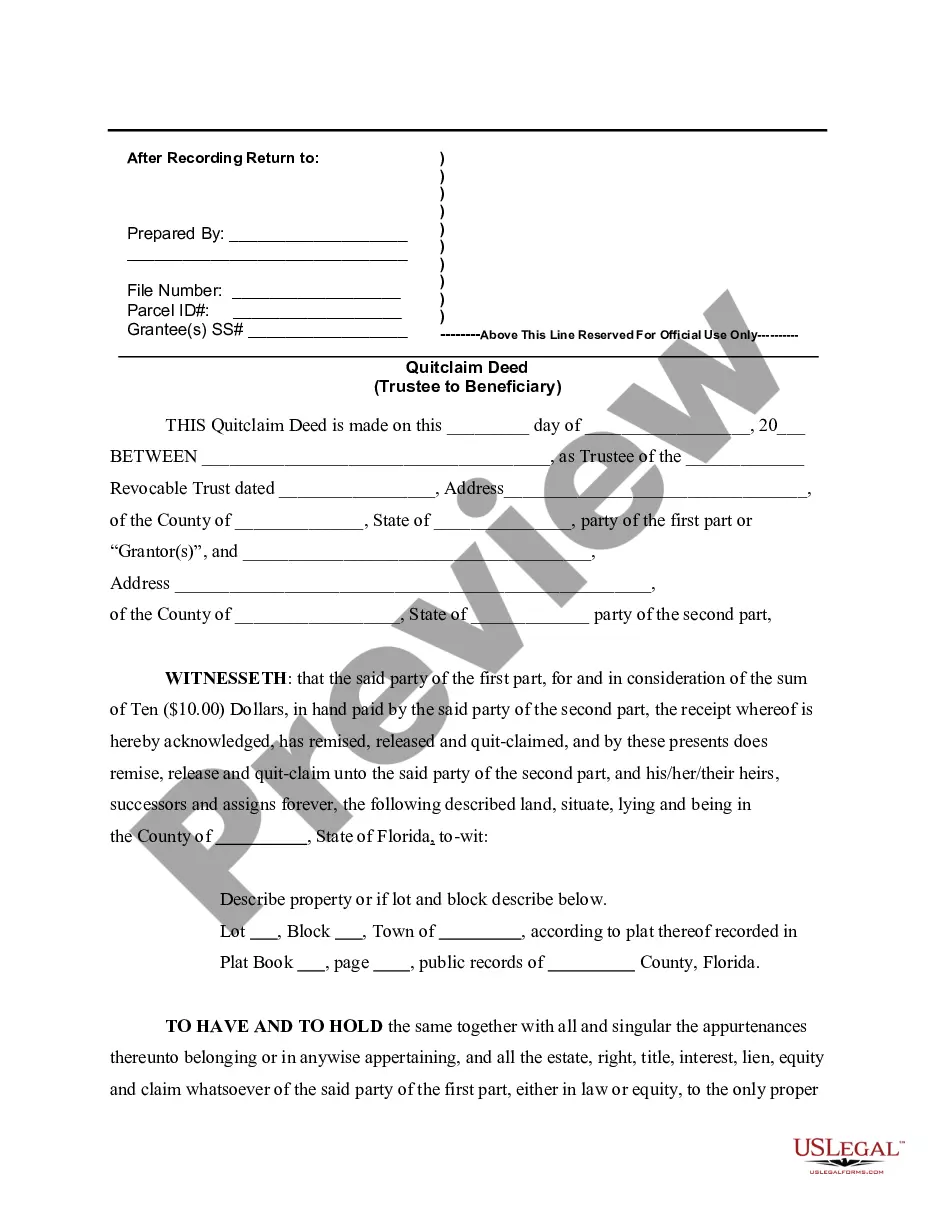

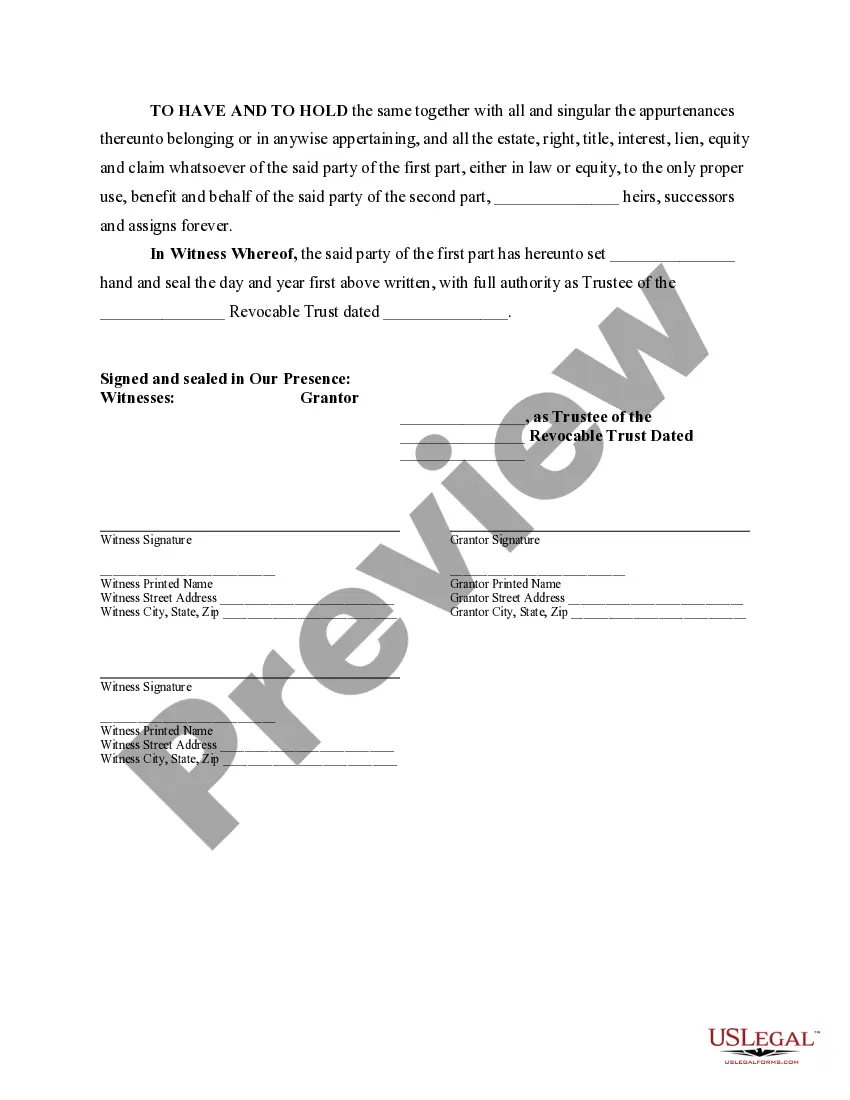

How to fill out Florida Quitclaim Deed For Trustee To Beneficiary?

- If you're a returning user, start by logging into your US Legal Forms account and check your subscription status. Click the Download button for your desired template.

- If you're new, begin by browsing the extensive library. Ensure the form’s preview matches your requirements and local jurisdiction.

- Use the search function if you need a different template, ensuring it aligns with your needs.

- Purchase the selected document by clicking 'Buy Now' and choosing a subscription plan. If you don’t have an account, create one.

- Complete the payment process using a credit card or PayPal and then download your form.

- Access your downloaded template anytime from the 'My Forms' section in your account.

In conclusion, US Legal Forms provides a robust resource for acquiring essential legal documents efficiently. With their extensive library and user-friendly service, becoming an informed estate trustee has never been easier. Start your journey today and experience the convenience of their services.

Visit US Legal Forms now to find the perfect form for your needs!

Form popularity

FAQ

Being an estate trustee with a will comes with certain challenges. You may experience emotional stress as you fulfill this vital role, especially if family dynamics are complicated. Additionally, the responsibilities can be time-consuming and may require you to make difficult decisions. However, you can find support through platforms like USLegalForms that provide resources to help navigate these challenges.

The first duty of an estate trustee with a will is to ensure that the will is validated in probate court. This process confirms the legitimacy of the will and allows you to act according to the deceased's wishes. Successfully completing this step is crucial for moving forward with other responsibilities involved in managing the estate.

As an estate trustee with a will, your initial steps involve gathering the deceased's important documents, including financial records and death certificates. Additionally, you may need to open an estate account to manage the estate's funds. Organizing these documents sets a solid foundation for efficiently administering the estate and reduces potential complications.

When you take on the role of an estate trustee with a will, your first step is to locate the original will and understand its provisions. You should also notify relevant parties, including beneficiaries and any financial institutions. This action helps establish communication and prepares everyone for the next steps in the estate process.

Being an estate trustee with a will comes with important challenges that you should be aware of. You are accountable for managing the estate's assets and distributing them according to the will, which can create expectations from beneficiaries. Mismanagement can lead to disputes and legal ramifications. It's wise to understand these responsibilities fully, and platforms like US Legal Forms can provide helpful guidance.

You are not required to hire a lawyer to become an executor of an estate, but it is often a smart choice. The role entails complex legal and financial responsibilities that an estate trustee with a will must handle carefully. Having a lawyer can help you navigate these challenges and ensure the estate is settled correctly. If you prefer guidance, consider utilizing resources like US Legal Forms for clarity.

In a trust, the estate trustee with a will holds significant responsibility. The trustee manages the assets and ensures they are distributed according to the terms set out in the will. While beneficiaries benefit from the trust, they do not have the same control over the assets as the trustee does. This balance of power is essential for effective estate management.

You would need an estate trustee with a will to ensure that your estate is managed effectively and in accordance with your wishes. The trustee provides a neutral party who can make impartial decisions regarding asset distribution and estate management. This helps to reduce family conflicts and ensures that legal requirements are met. By using a reputable platform like US Legal Forms, you can create a will that specifies your choice of trustee and clearly outlines their responsibilities.

The power dynamics between a trustee and an executor depend on the context of their responsibilities. An estate trustee with a will can wield significant authority over trust assets, while an executor has specific duties tied to the will. Each role has its own set of powers and responsibilities, and it is more about the context rather than one being inherently more powerful than the other.

While the terms 'trustee' and 'executor' are often used interchangeably, there are notable distinctions. An estate trustee with a will supervises the distribution of assets as specified in the trust, whereas an executor of a will is responsible for executing the terms of a will. Essentially, an executor manages the estate until assets are transferred, while a trustee manages those assets thereafter, making these roles sequential rather than identical.