Living Trusts

Description

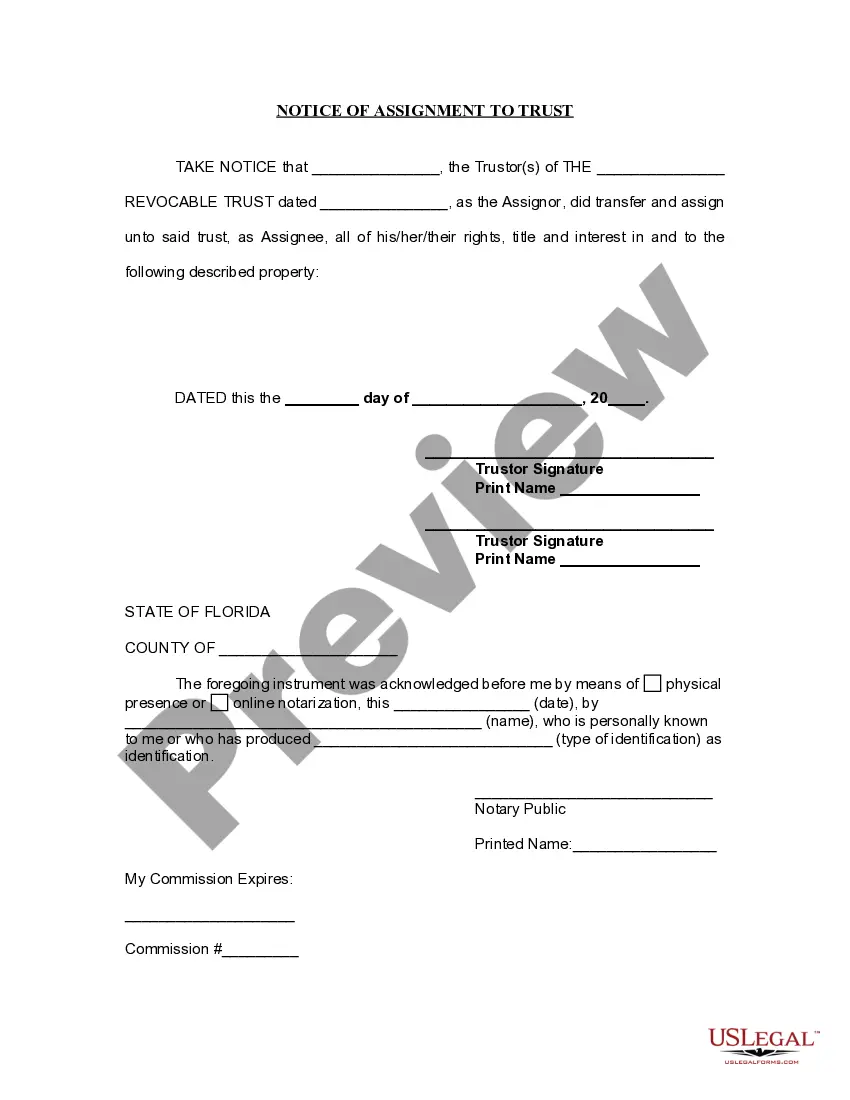

How to fill out Florida Notice Of Assignment To Living Trust?

- If you're already a US Legal Forms user, log into your account to download the living trust template. Ensure your subscription is active; renew it if necessary.

- For first-time users, start by browsing the form options available. Preview the documents and read the descriptions carefully to find one that meets your specific needs.

- If you need a different template, utilize the Search feature to locate additional forms compatible with your jurisdiction requirements.

- Once you find the suitable living trust template, proceed to purchase it by clicking the Buy Now button and select a subscription plan.

- Complete the checkout process by entering your payment details or using PayPal to pay for your subscription.

- After purchase, download the living trust form to your device, where it can be accessed again anytime from the My Forms section.

By utilizing US Legal Forms, you gain access to over 85,000 editable legal templates, including living trusts, ensuring that your documents meet both legal standards and your personal requirements.

Start your estate planning journey today by visiting US Legal Forms and empower yourself with the right legal tools.

Form popularity

FAQ

In her discussions about living trusts, Suze Orman emphasizes their role in protecting your family's financial future. She points out that living trusts allow for more privacy compared to wills, as they do not become public record after your death. This means your financial matters remain confidential, providing peace of mind to you and your loved ones.

Suze Orman often highlights the importance of living trusts for effective estate planning. She believes that living trusts provide clarity and control in managing your assets. According to her, they help avoid probate, ensuring that your beneficiaries receive their inheritance without unnecessary delays and costs. This way, a living trust can preserve your legacy without the hassle.

The primary purpose of a living trust is to manage your assets during your lifetime and ensure a smooth transfer of those assets upon your death. Living trusts can help you avoid probate, a lengthy and costly process. Furthermore, they allow you to maintain control over your assets and dictate how they are distributed after your passing, making it easier for your loved ones.

While placing your house in a living trust can offer benefits, there are certain disadvantages to consider. For instance, transferring your home to a trust may complicate your taxes, as you could lose certain exemptions. Moreover, if the trust is not structured properly, it can create challenges during the estate settlement process. It’s wise to consult experts who can guide you on how living trusts can meet your needs without potential pitfalls.

One significant mistake parents often make when setting up living trusts is failing to specify how the funds will be used. Without clear instructions, the trust may not serve its intended purpose, leading to confusion among beneficiaries. Additionally, some parents overlook updating the trust as family dynamics change, such as births or deaths. It’s essential to regularly review and adjust your living trusts to ensure they align with your current wishes.

Filling out a living trust involves several key steps. First, gather necessary information about your assets and beneficiaries. Next, use our USLegalForms platform to access customizable living trust templates, which guide you through the process with ease. Finally, ensure that you sign and notarize the document as required, making your living trust legally binding.