Living Trust 101

Description

How to fill out Florida Notice Of Assignment To Living Trust?

- Log in to your US Legal Forms account if you are a returning user. Ensure your subscription is active; if it has lapsed, renew it as per your payment plan.

- Preview the available templates and read the descriptions carefully. Confirm that the selected form meets your specific needs and adheres to your local laws.

- If necessary, search for alternative templates by using the search function. Make sure the one you select is accurate for your situation.

- Select the desired document by clicking the 'Buy Now' button and pick a suitable subscription plan. New users must create an account for access to the document library.

- Complete your purchase by providing your payment information through credit card or PayPal to finalize your subscription.

- Download the completed form and save it on your device. You can revisit your documents anytime from the 'My Forms' section of your account.

In conclusion, US Legal Forms provides a robust platform that facilitates easy access to an extensive range of legal documents. Whether you are a returning user or a first-time visitor, following these steps will help you create your living trust effortlessly.

Start today and simplify your estate planning with US Legal Forms!

Form popularity

FAQ

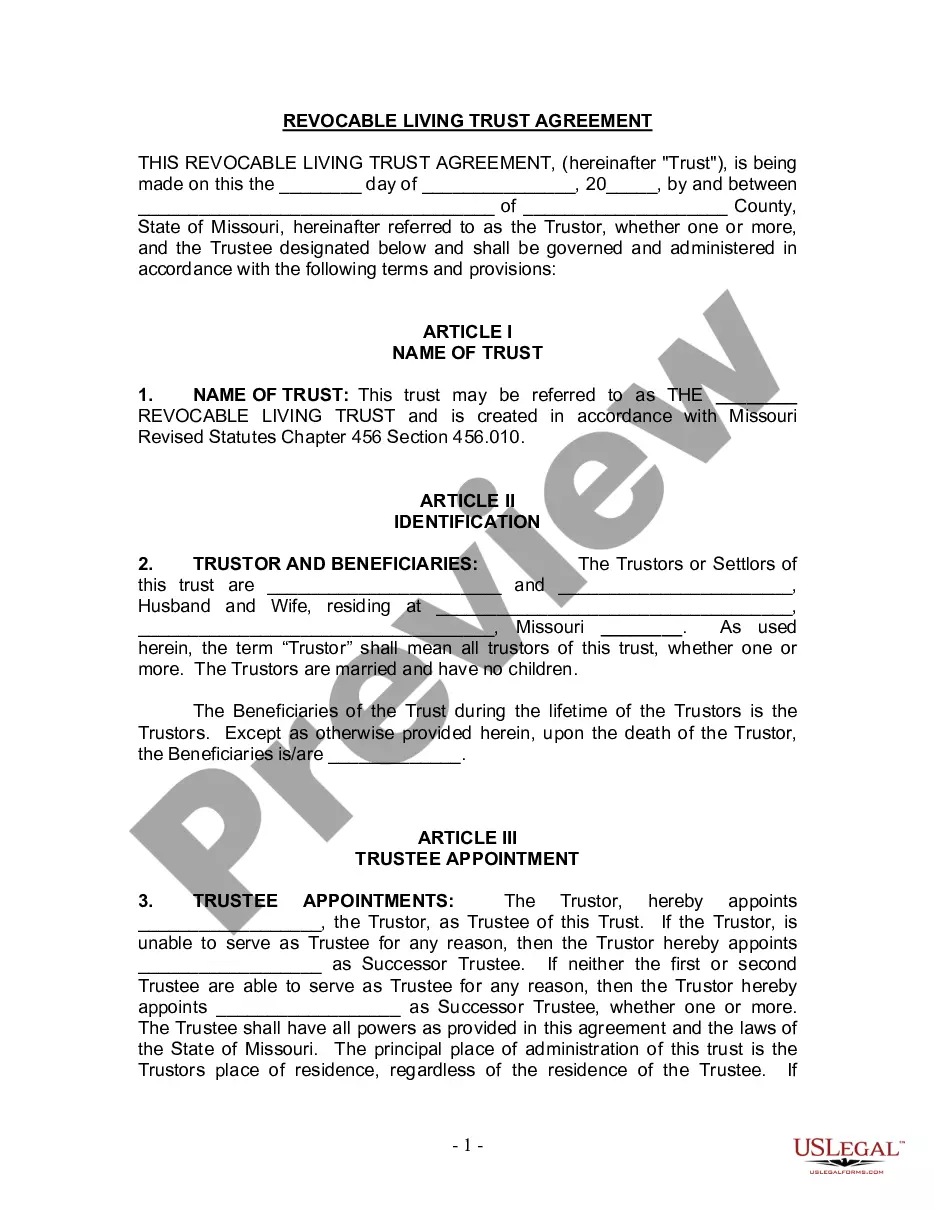

The 5 by 5 rule in trust refers to a provision that allows a beneficiary to withdraw up to $5,000 or 5% of the trust principal, whichever is greater, each year without penalty. This rule is important in the context of a living trust because it provides flexibility for beneficiaries while protecting the integrity of the trust's assets. Understanding this concept is crucial for anyone exploring Living Trust 101, as it highlights how trust distributions can be managed effectively. If you're seeking further guidance on such rules, uslegalforms can help you navigate your living trust options.

Having a trust can come with its own set of challenges, such as costs associated with trust administration and potential tax implications. While a living trust 101 offers benefits like avoiding probate, improper management can lead to complications or disputes among beneficiaries. Understanding these issues ensures you can address them proactively. Consulting with experts, such as US Legal Forms, can be invaluable in overcoming these hurdles.

Encouraging your parents to consider a trust for their assets can be beneficial, especially regarding estate planning. A living trust 101 may simplify the distribution of their estate and minimize probate costs. However, it’s crucial to discuss their unique situation and financial goals as a family. Tools like US Legal Forms can help you navigate this process more easily.

When you place assets in a trust, you may face limitations on control and access to those assets. This can be particularly challenging if you need liquidity for unexpected expenses. Moreover, a living trust 101 requires ongoing administration, which can be complex and time-consuming. It's essential to weigh these factors carefully before making decisions about asset placement.

While a living trust can be beneficial, it also comes with downsides that deserve consideration. One significant issue is the potential lack of asset protection from creditors, as the assets in a living trust are not shielded in the same way as other structures. Furthermore, a living trust does not eliminate estate taxes, so it's vital to evaluate your overall estate plan carefully. In understanding these points, you enhance your knowledge of Living trust 101.

To set up a living trust effectively, start by defining your goals and identifying the assets you want to include. Then, work with a qualified attorney or utilize trusted online platforms like US Legal Forms to draft the trust document. After creating the trust, be sure to transfer your assets into it, as they need to be retitled in the name of the trust. This comprehensive approach provides a solid foundation for your Living trust 101 knowledge.

When you put your house in a living trust, you may face disadvantages that could impact your financial decisions. First, there are potential costs associated with creating and maintaining the trust, including legal fees and trustee expenses. Additionally, if you need to finance your home, banks may find it more complicated to issue loans for properties in trust. Therefore, while a living trust can offer benefits, it’s important to consider these challenges as part of your Living trust 101 journey.

Filling out a living trust requires careful attention to detail. Start by gathering all relevant financial information, including assets and liabilities. Then, when you look into living trust 101 guides, you will see the importance of precisely naming beneficiaries and outlining their share. Platforms such as US Legal Forms provide templates and resources to help you accurately fill out and finalize your living trust, ensuring peace of mind for you and your loved ones.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define their goals and intentions. Without a well-thought-out plan, the trust may not effectively serve its purpose. Living trust 101 emphasizes the importance of detailing how assets should be managed and distributed. By using platforms like US Legal Forms, you can create customized trust documents tailored to your family’s specific needs.