Living Trust Form Sample For Single

Description

How to fill out Florida Assignment To Living Trust?

- If you're a returning user, simply log in to your account and locate the desired form template. Ensure your subscription is active, or renew it if necessary.

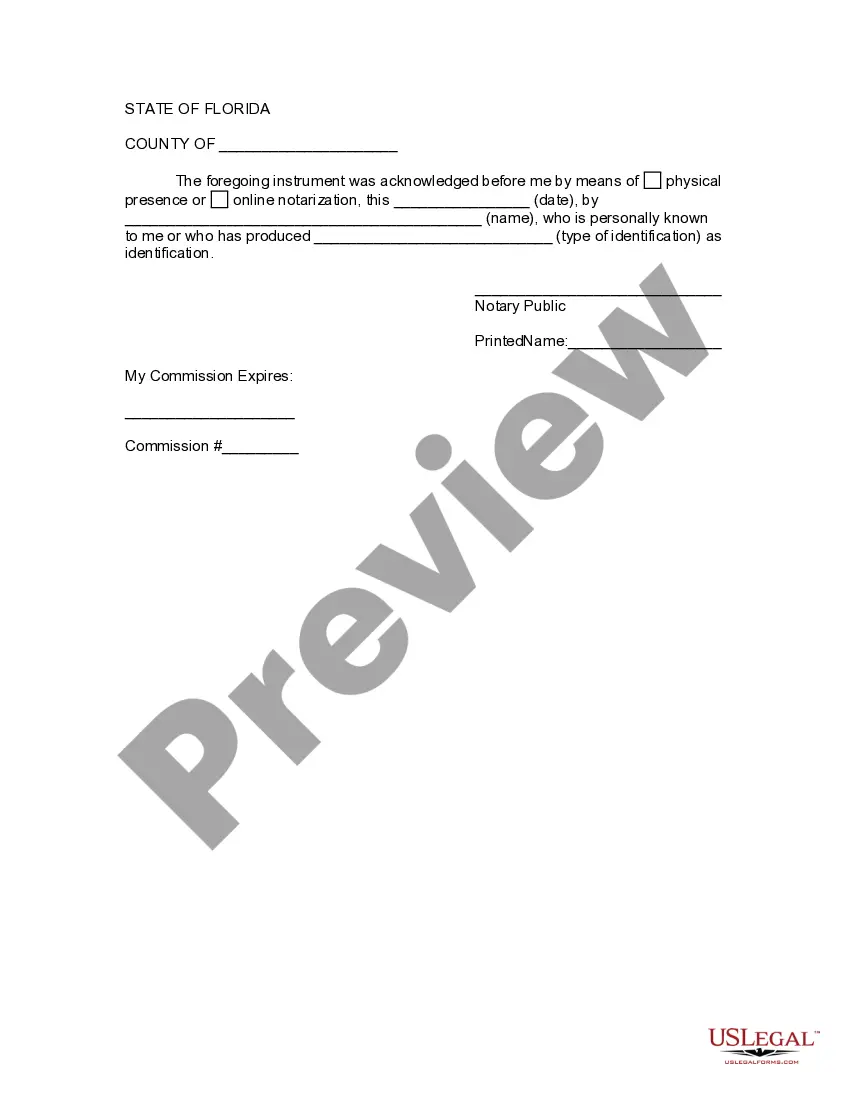

- For first-time users, start by checking the Preview mode and reading the form description to guarantee it fits your requirements and complies with your local laws.

- If the initial form isn’t suitable, use the Search feature to find another template that meets your needs.

- Proceed to purchase the document by clicking the Buy Now button; choose your preferred subscription plan and create an account to access the extensive library.

- Complete your purchase using your credit card or PayPal. After payment, download the living trust form to your device.

- Access your downloaded form anytime through the My Forms section of your profile.

With US Legal Forms, users gain access to a robust library exceeding 85,000 editable forms, empowering both individuals and attorneys to prepare legal documents swiftly and accurately.

Start your journey towards stress-free estate planning today by utilizing our living trust templates. For more information, visit US Legal Forms now!

Form popularity

FAQ

To create a living trust by yourself, start with a reliable living trust form sample for single that includes all necessary details like your assets and beneficiaries. Fill out the form carefully, ensuring compliance with your state's laws. It's also crucial to transfer your assets into the trust properly. Platforms like US Legal Forms provide the tools you need to make this process more manageable and efficient.

The simplest form of trust is a revocable living trust, which you can modify or cancel while you are alive. A living trust form sample for single reflects this ease of management and flexibility. It allows you to maintain control of your assets during your lifetime while seamlessly transferring them upon your death. This trust type is a popular choice for its straightforward nature.

A single living trust is a legal entity you create to manage your assets during your lifetime, primarily intended for one individual. The living trust form sample for single serves as the template for this personal management. It provides benefits such as avoiding probate and maintaining privacy regarding your estate. This trust can later become irrevocable upon your passing, ensuring your wishes are fulfilled.

Yes, you can establish a trust fund by yourself using a living trust form sample for single. This process allows you to manage your assets according to your wishes without needing a lawyer. However, it’s wise to research your state laws to ensure compliance and proper management of the trust. Utilizing platforms like US Legal Forms can guide you through this process.

One downside of a living trust is that it does not provide protection from creditors. Additionally, setting up a living trust form sample for single can involve initial costs, such as attorney fees, if you seek legal assistance. It's important to ensure that transferring your assets into the trust is part of your estate planning. Otherwise, your assets may not have the desired protections.

Yes, you can create your own certificate of trust using a living trust form sample for single. This document outlines the existence of your living trust and specifies your assets and beneficiaries. However, it's essential to follow your state's legal requirements to ensure your certificate is valid. You might also consider using resources like US Legal Forms to simplify the process.

A straightforward example of a trust is a revocable living trust, where the trustor retains control over their assets during their life. For instance, consider a single individual who places their home and bank accounts into a living trust. By using a living trust form sample for single individuals, they can designate beneficiaries to receive these assets upon their passing, streamlining the process and avoiding probate.

Filling out a living trust involves several clear steps. Start by collecting all necessary information about your assets and beneficiaries. Then, you can utilize a living trust form sample for single individuals to guide you through the process. Completing this form correctly ensures that your assets are managed according to your wishes during your lifetime and beyond.

One common mistake parents make when setting up a trust fund is failing to communicate their intentions clearly. This can create confusion among family members about the purpose and distribution of assets. By using a living trust form sample for single individuals, you can outline your goals and make your wishes known. This clarity avoids potential disputes and ensures your legacy is carried out as intended.

Yes, you can set up a trust fund for yourself using a living trust form sample for single individuals. This type of trust allows you to manage your assets while providing instructions for their distribution after your passing. With a living trust, you maintain control over your assets during your lifetime, and your beneficiaries can avoid the lengthy probate process. Using a reliable platform like USLegalForms can help you create the necessary documentation easily and efficiently.