Living Trust Form Sample For Parents

Description

How to fill out Florida Assignment To Living Trust?

- If you are an existing member, log into your account and download the required form template directly. Ensure that your subscription remains valid, or renew it as per your payment plan.

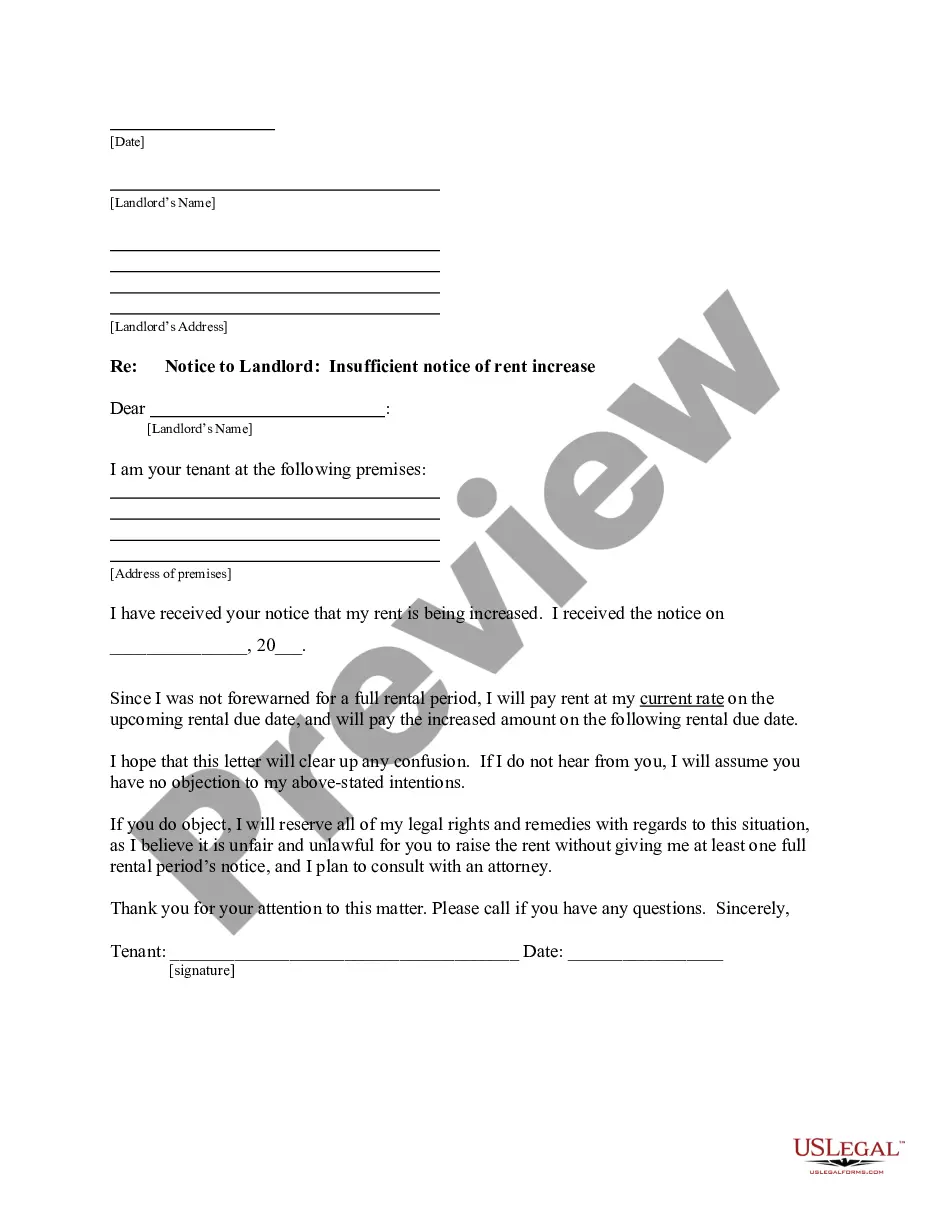

- Review the form description and preview mode to verify that you have selected the correct template aligned with your legal requirements.

- Should you find inconsistencies, utilize the Search tab at the top to locate an alternative form that fits your needs.

- Once you've found the right document, click on the Buy Now button and choose your preferred subscription plan. You'll need to create an account to access the resources.

- Complete your purchase by entering your credit card information or utilizing your PayPal account for the subscription fee.

- Finally, download the completed form to your device. You can always access it again through the My Forms section in your profile.

Utilizing US Legal Forms not only provides you with a robust collection of legal documents but also ensures you have access to a wealth of resources, including over 85,000 customizable forms.

Take control of your family's future today. Start your journey towards legal peace of mind by obtaining your living trust form now!

Form popularity

FAQ

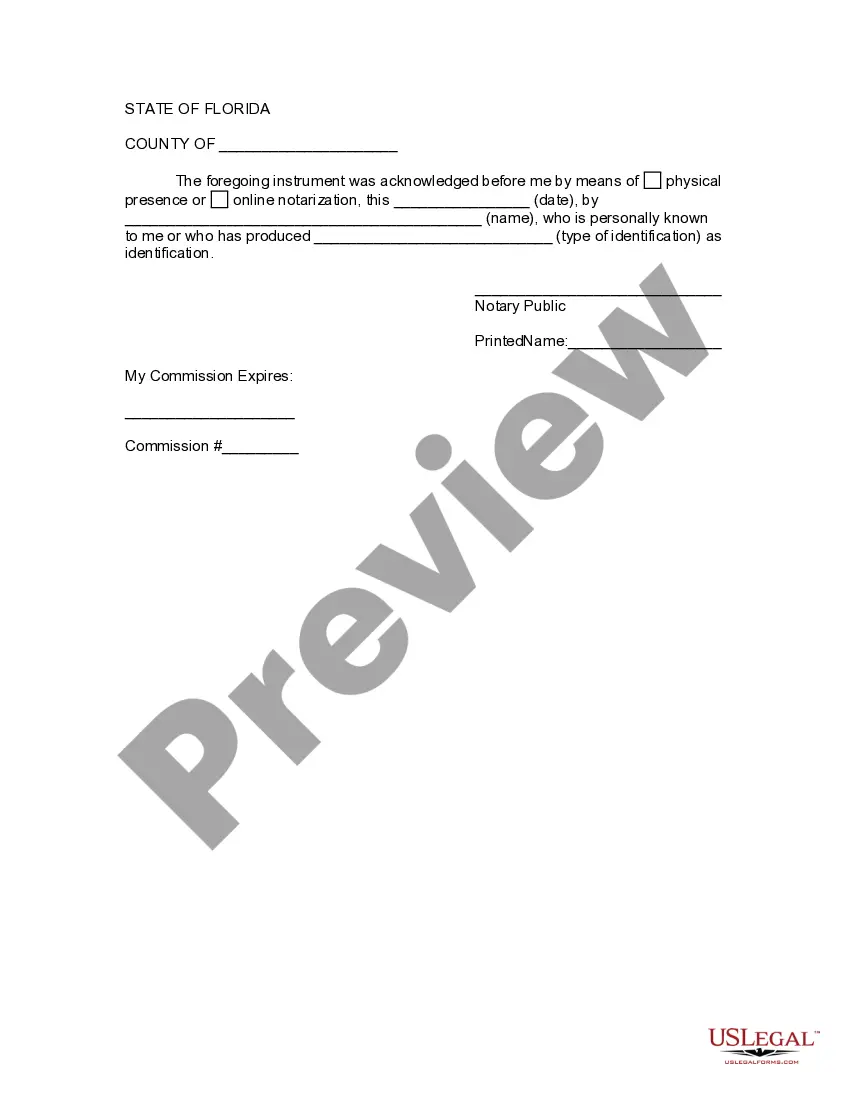

To create a living trust by yourself, start by gathering essential documents such as property deeds and bank account information. Next, look for a living trust form sample for parents that reflects your needs and read through the instructions carefully. Complete the form, sign it in front of a notary, and then fund the trust by transferring your assets into it. With resources available on platforms like US Legal Forms, you can navigate this process confidently.

Yes, you can set up a trust fund by yourself using a living trust form sample for parents that you can find online. By doing it on your own, you save on attorney fees and become familiar with the details of your trust. However, be aware of the legal requirements in your state and ensure your trust is properly funded. Utilizing online platforms like US Legal Forms can make this process more straightforward and efficient.

While living trusts offer many benefits, there are some downsides to consider. They can require time and expenses for setup, especially when you tailor a living trust form sample for parents to fit your specific needs. Additionally, a living trust does not cover all aspects of estate planning, such as certain types of life insurance or assets that may not be included. As a result, it is essential to evaluate your overall estate plan, and platforms like US Legal Forms can provide resources to help you create a comprehensive plan.

Whether your parents should put their assets in a trust depends on their financial goals and family dynamics. A living trust can provide peace of mind by ensuring a smoother transition of wealth and avoiding probate. It’s wise to discuss this option with them, using a living trust form sample for parents to better understand the benefits and implications.

Filling out a living trust requires clear identification of your assets, beneficiaries, and any specific wishes regarding management. You can use a living trust form sample for parents to guide the necessary sections and make the process smoother. It’s advisable to consult a professional if you are unsure about how to specify your terms effectively.

The biggest mistake parents often make is not updating the trust to reflect changes in family circumstances or asset ownership. Failing to review and adjust the living trust can result in unintended consequences. Using a living trust form sample for parents helps ensure that provisions align with current family needs and wishes.

One significant downfall of having a trust is the potential for misunderstanding or poor communication among beneficiaries. If heirs are not aware of the trust conditions or assets, it can lead to confusion and conflict. A clear living trust form sample for parents can help mitigate these issues by providing straightforward guidelines.

A family trust might limit flexibility in asset management, which can be a disadvantage for some families. If the wrong terms are set, it can also lead to disputes among family members. When using a living trust form sample for parents, it's crucial to clarify your intentions to avoid misunderstandings that can arise later.

Typically, assets that require direct control or that have beneficiary designations should not be put into a trust. For instance, a primary residence might complicate tax liability if placed in the trust. When using a living trust form sample for parents, it’s essential to consider which assets remain outside for easier management and accessibility.