Living Trust Form Sample For Indiana

Description

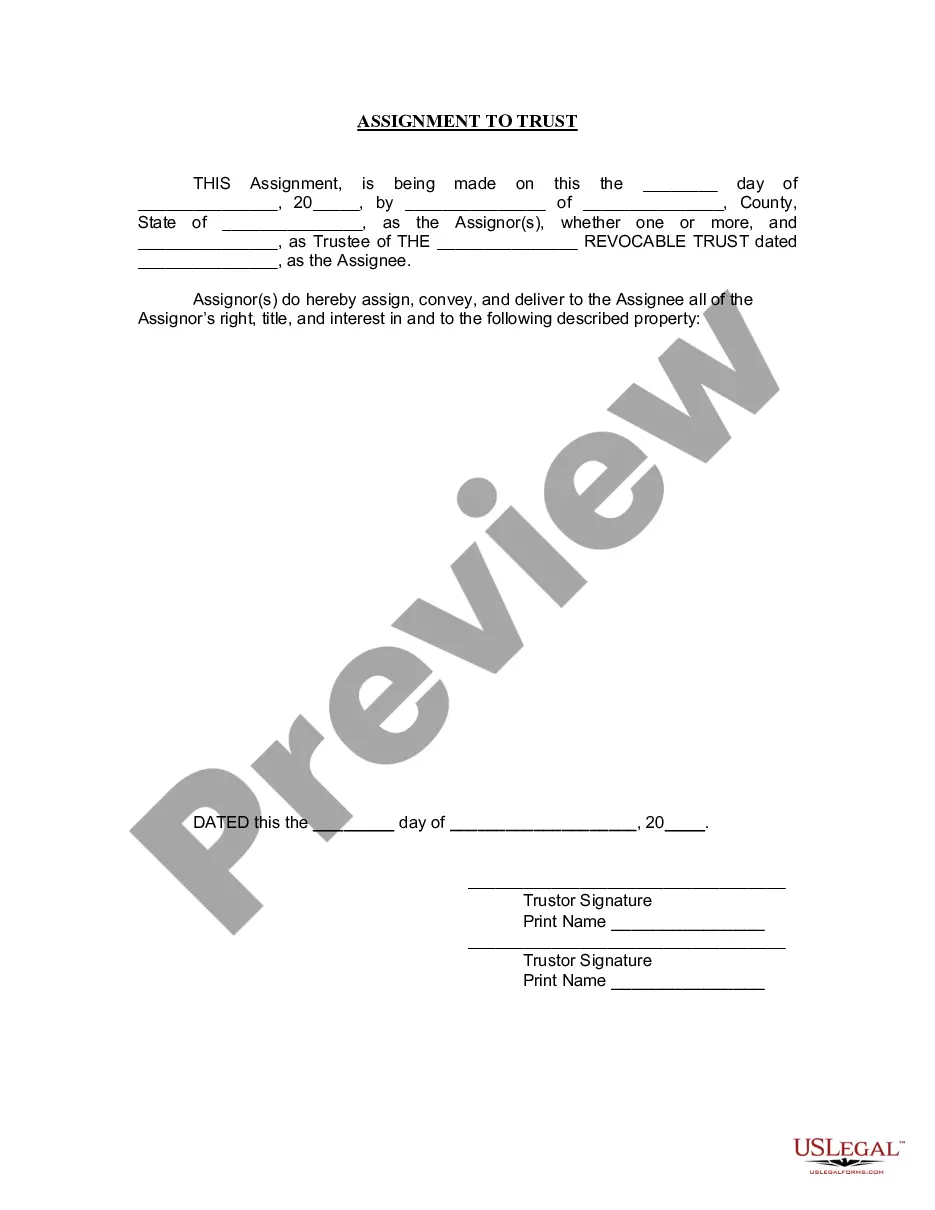

How to fill out Florida Assignment To Living Trust?

- Log in to your US Legal Forms account if you're a returning user to access your saved document templates.

- For new users, review the available forms in preview mode. Ensure you select the correct living trust form that aligns with Indiana's legal requirements.

- If you can’t find the right form, utilize the search feature to refine your options based on your specific needs.

- Purchase the selected document by clicking the 'Buy Now' button. Choose the subscription plan that suits you best, remembering to create an account for full access.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Once you've made your payment, download your living trust form and store it on your device. You can find it later in the 'My Forms' section of your account.

In conclusion, US Legal Forms offers a user-friendly platform that empowers individuals and attorneys to navigate the legal document creation process efficiently. With an extensive library and expert assistance available, you can be confident that your living trust will meet all legal standards.

Start your journey today by visiting US Legal Forms and streamline your estate planning process!

Form popularity

FAQ

Filing a trust in Indiana involves several steps. First, complete a living trust form sample for Indiana. Then, you need to transfer any assets into the trust by retitling them in the name of the trust. While a trust typically does not require court approval, you should keep documentation organized in case of future questions or audits.

To fill a living trust, you will need a living trust form sample for Indiana. Start by gathering essential information about your assets, beneficiaries, and any specific instructions for the trust. Fill in the details accurately on the form. Once completed, make sure to sign it in front of a notary to ensure its validity.

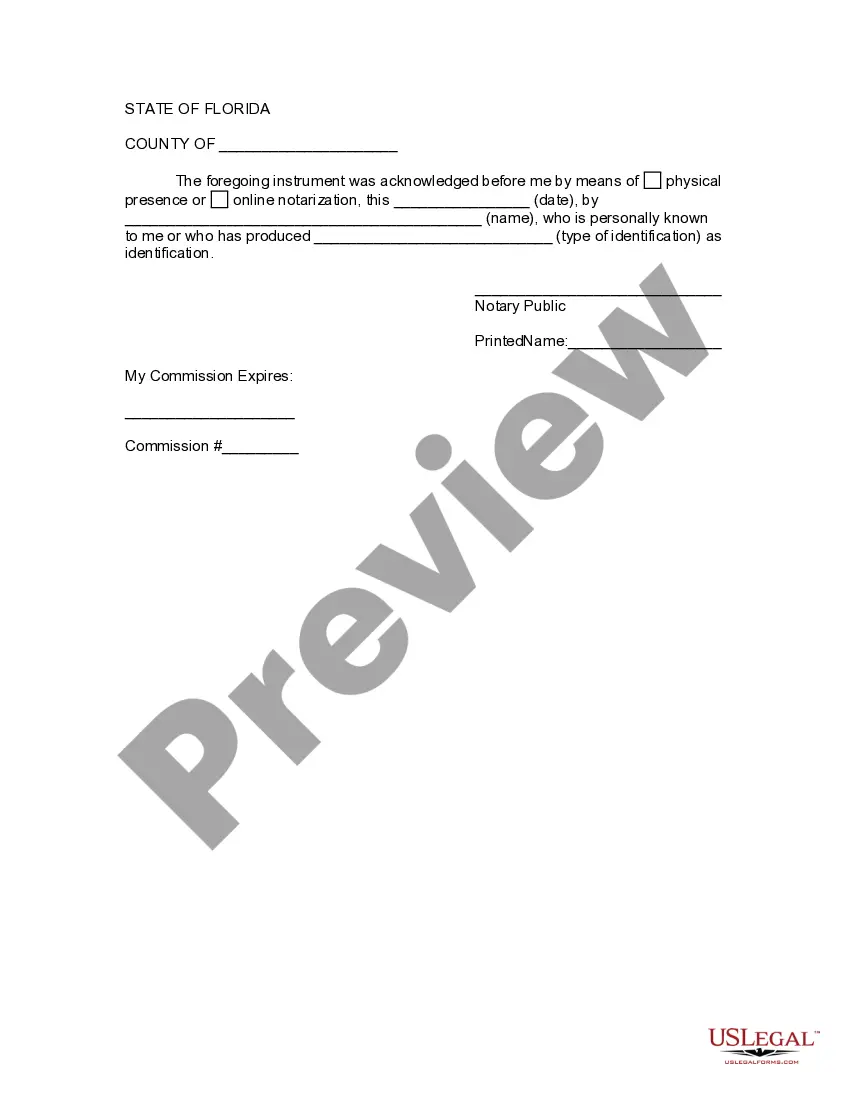

No, a trust document does not have to be notarized to be valid in Indiana. However, notarization can enhance credibility and clarity, potentially preventing future disputes. Using a living trust form sample for Indiana can guide you in drafting a solid trust document, whether or not you choose to notarize it.

Trust documents generally do not need to be notarized in Indiana. Even though notarization isn’t strictly required, it is a good practice because it may help support the authenticity of the document during legal proceedings. Utilizing a living trust form sample for Indiana can assist you in preparing robust documents that suit your needs.

To create a living trust template, start by gathering information about your assets and beneficiaries. You can use a living trust form sample for Indiana as a foundation, which you can then customize to fit your specific situation. Platforms like uslegalforms offer various templates and guidance, making the process straightforward and efficient.

One of the biggest mistakes parents make is not clearly defining the terms and beneficiaries of the trust. Failing to specify how assets will be distributed can lead to confusion and conflict among heirs. To avoid this, using a well-structured living trust form sample for Indiana can help ensure clarity and prevent disputes in the future.

In Indiana, a trust document does not specifically need to be notarized to be valid. That said, having a notary can provide additional legal assurance and may help in certain situations, such as when transferring property into the trust. Using a living trust form sample for Indiana can help you understand these nuances and simplify the process.

Yes, you can write your own trust in Indiana. However, while it's possible to create a living trust using a living trust form sample for Indiana, it's important to ensure that it complies with Indiana law. Properly drafting your trust can help avoid legal complications in the future. Consider using templates from trusted sources, such as uslegalforms, to guide you through the process.

Yes, you can place a trust in your own name. Typically, your living trust form sample for Indiana will designate you as the trustee, allowing you to manage your assets while you are alive. This structure ensures that you maintain control over your property, and it simplifies the process of transferring your assets after your passing.

To create a valid trust in Indiana, you must have a clear intention to establish the trust and identify the trust assets. Additionally, it is essential to designate a trustee who will manage the trust according to your wishes. By utilizing the living trust form sample for Indiana, you can easily meet these requirements while ensuring your intentions for asset distribution are respected.