Change Name After Marriage With Hmrc

Description

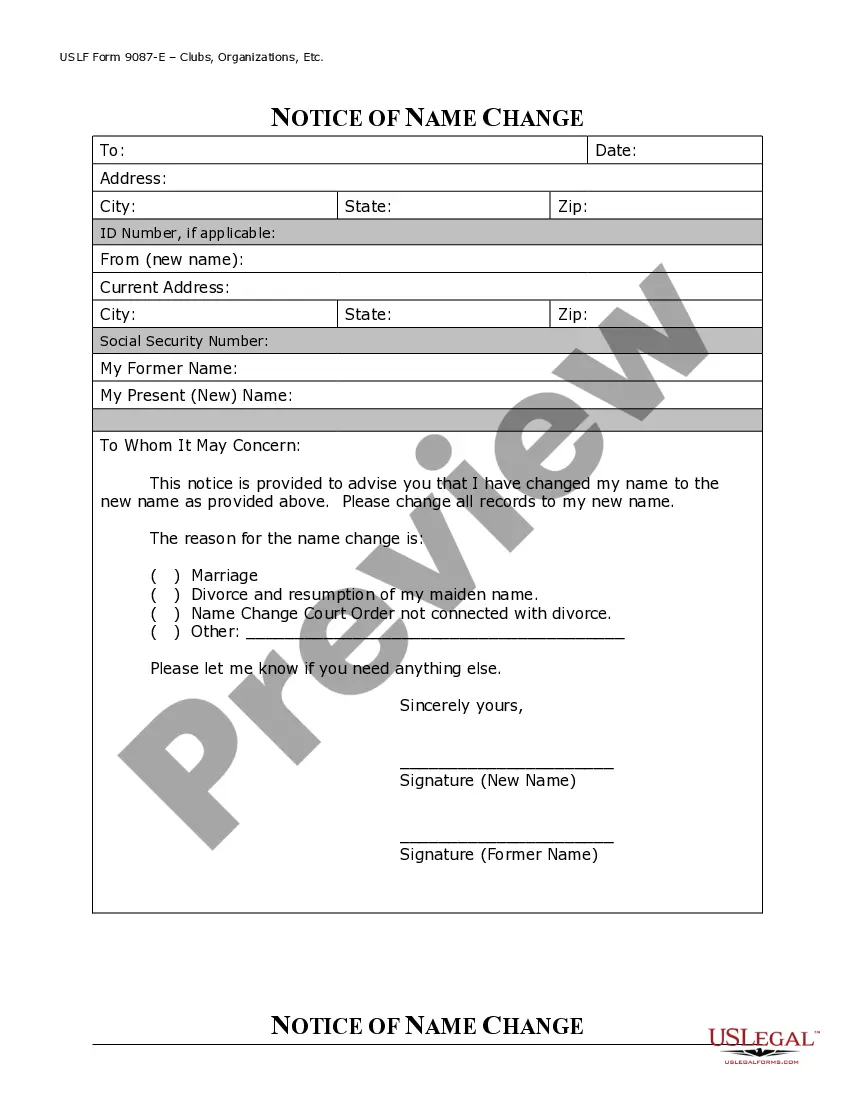

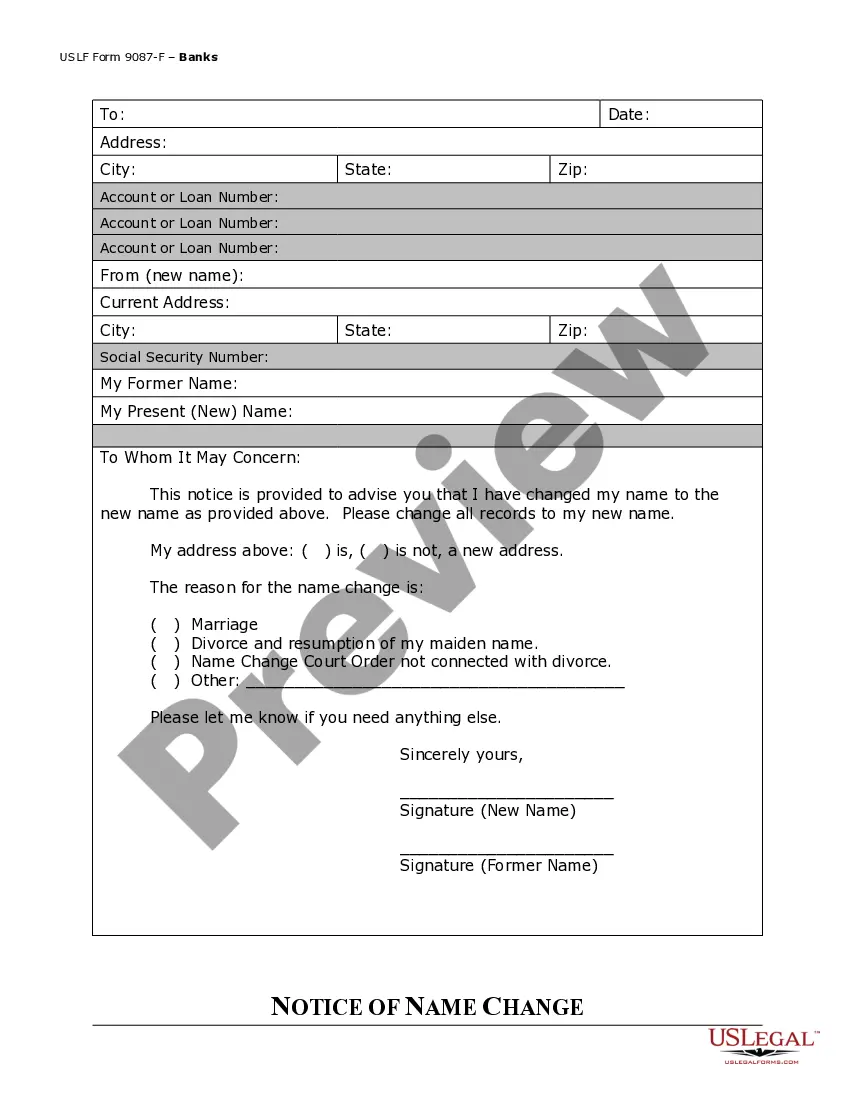

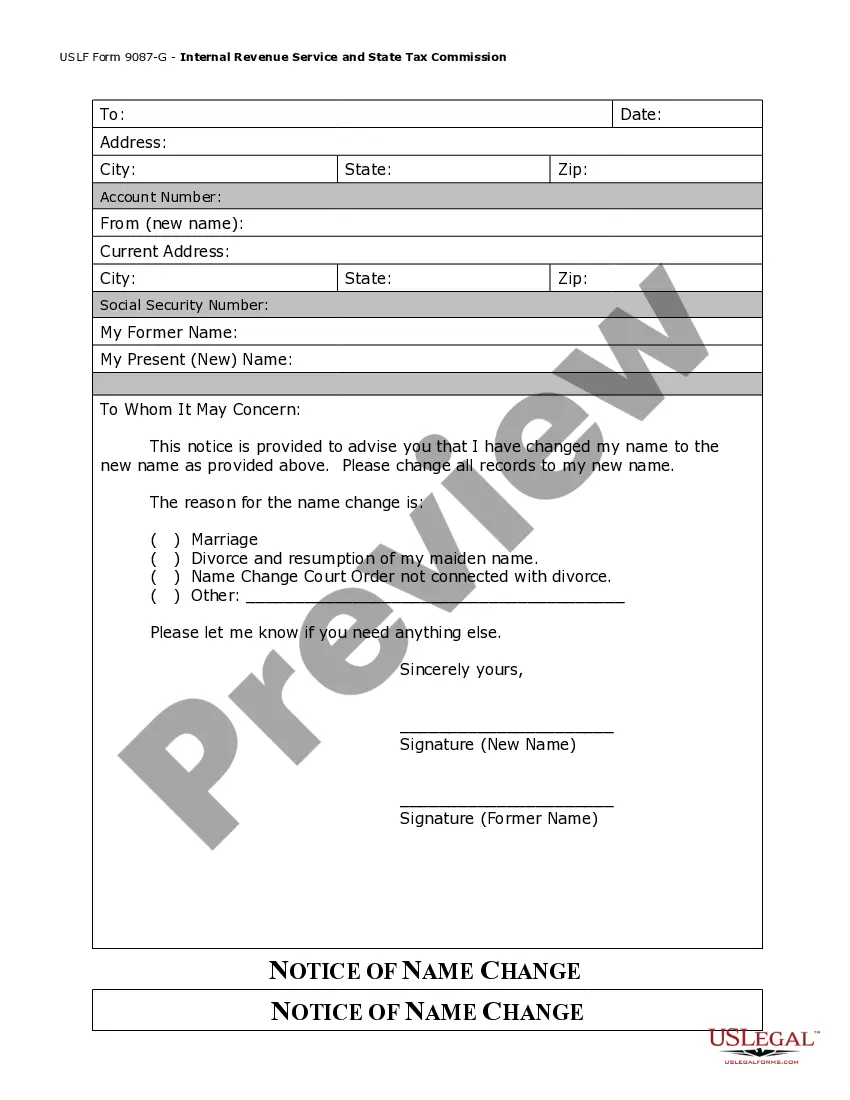

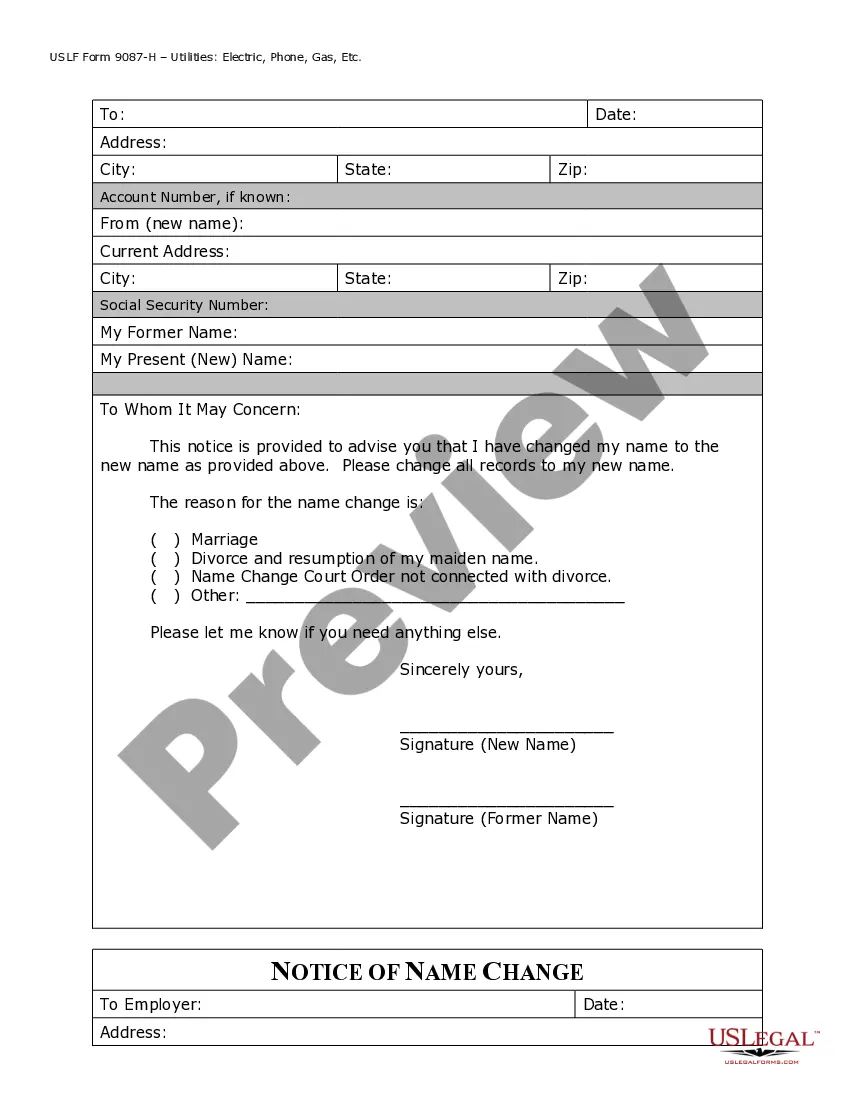

How to fill out Florida Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

- Log in to your US Legal Forms account. If you're a returning user, ensure your subscription is active to access your documents.

- Preview the form you need. Carefully check the form description to confirm it meets your requirements and adheres to local jurisdiction.

- Search for additional templates if necessary. If the form doesn’t meet your needs, utilize the search function above to find the correct document.

- Select the document. Once you find the appropriate form, proceed to purchase it by clicking the Buy Now button.

- Complete your purchase. Input your payment details with credit card or PayPal and finalize your transaction.

- Download the form. Once purchased, save the template on your device for easy access and further completion from the My Forms section in your account.

US Legal Forms empowers individuals and attorneys with a robust library of over 85,000 legal forms, making it an invaluable resource for quickly executing necessary legal documents.

Start simplifying your legal paperwork today. Visit US Legal Forms for reliable assistance in changing your name after marriage with HMRC.

Form popularity

FAQ

To support your name change after marriage with HMRC, you must provide evidence, such as your marriage certificate or a deed poll. These documents serve to verify your identity and confirm your new name legally. If you use uslegalforms, you can easily access templates to create the necessary legal documents, streamlining the process. Always keep copies of all documentation for your records.

When you decide to change your name after marriage with HMRC, you will need to update several important documents. This includes your marriage certificate, driver’s license, passport, and bank accounts. Additionally, inform HMRC and other government bodies about your name change to ensure your records remain accurate. Keeping all your documents updated will help prevent any future complications.

To legally change your name in the UK after marriage, start by securing a copy of your marriage certificate. Next, inform HMRC along with other institutions like banks and utility companies. Following these steps ensures that all your legal documentation and tax records reflect your new name accurately. Platforms like USLegalForms can assist in this process, making it smoother for you.

Upon getting married in the UK, it's important to inform various organizations. Key entities include HMRC, your bank, and your employer. This ensures that your records are updated to reflect your new marital status and name. Utilizing resources like USLegalForms can simplify this notification process.

Yes, you must change your name on your passport after marriage in the UK if you plan to use your new name for travel. To do this, fill out a passport application form and provide your marriage certificate as supporting documentation. This step is important for consistency across all your legal documents, including those with HMRC.

Yes, 0300 322 7835 is a legitimate HMRC contact number. However, it is advisable to verify this by checking the official HMRC website. When reaching out about your name change after marriage with HMRC, use this number to ensure that the information you receive is accurate and trustworthy.

Updating your name in the UK involves notifying several organizations. Key institutions include banks, utilities, and HMRC. Make sure to also update your identification documents like your passport and driver's license. Always keep copies of your marriage certificate handy as you may need to provide proof of your name change.

To officially change your name after marriage in the UK, you will need your marriage certificate as proof. Begin by notifying HMRC and other essential agencies of your new name. This ensures all records are consistent and avoids any future complications. USLegalForms offers guidance on managing these updates efficiently.

When you change your name after marriage in the UK, you need to update several important documents. This includes your passport, driver's license, bank accounts, and utility bills. Additionally, informing HMRC is crucial to ensure your tax details reflect your new name. Using a reliable service like USLegalForms can streamline this process.

To verify if a specific HMRC number is genuine, consult the official HMRC website for a complete list of contact numbers. If you are looking to change your name after marriage with HMRC, using the correct contact will help expedite and clarify the process. Always stay vigilant about ensuring the authenticity of any contact information.