Como Funciona O Leasing De Carros

Description

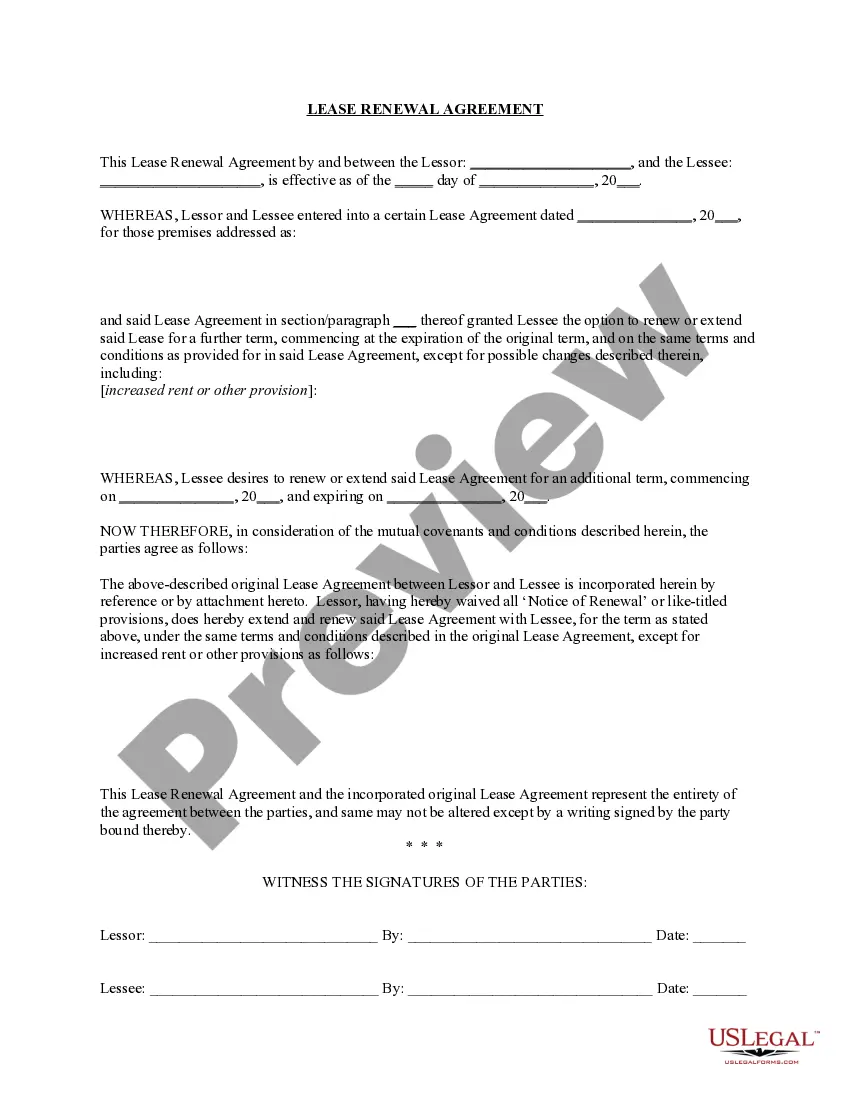

How to fill out Florida Residential Lease Renewal Agreement?

Dealing with legal documents and processes can be a lengthy addition to your day.

Como Funciona O Leasing De Carros and similar forms typically necessitate you to search for them and comprehend how to fill them out correctly.

For this reason, whether you are managing financial, legal, or personal matters, having a comprehensive and accessible online collection of forms readily available will significantly help.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific forms and various resources to help you complete your documentation effortlessly.

Is it your first time using US Legal Forms? Register and create a free account in a few minutes, and you will have access to the form library and Como Funciona O Leasing De Carros. Then, follow the steps below to complete your form: Ensure you have located the correct form using the Review option and examining the form description. Select Buy Now when ready, and choose the monthly subscription plan that suits your requirements. Click Download and then fill out, sign, and print the form. US Legal Forms has 25 years of experience assisting clients in managing their legal documents. Acquire the form you need today and streamline any process without breaking a sweat.

- Explore the collection of suitable documents available to you with just a single click.

- US Legal Forms offers you state- and county-specific forms available for download at any time.

- Protect your document management processes with a high-quality service that enables you to create any form within minutes without incurring additional or hidden fees.

- Simply Log In to your account, find Como Funciona O Leasing De Carros, and download it instantly in the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

As long as your dealer or leasing company reports to all three credit bureaus?Experian, TransUnion and Equifax?and all your payments are made on time, an auto lease can certainly help to build your credit history.

Leasing helps protect you against unanticipated depreciation. If the market value of your car unexpectedly drops, your decision to lease will prove to be a wise financial move. If the leased car holds its value well, you can typically buy it at a good price at the end of the lease and keep it or decide to resell it.

If you're on a tight budget, leasing might be a cheaper option. Limits your vehicle options: Because financing a car is more expensive than leasing upfront, it might limit the types of vehicles you can realistically afford. Cost of maintenance: Financing a car means you're responsible for all maintenance costs.

Paying cash for your car may be your best option if the interest rate you earn on your savings is lower than the after-tax cost of borrowing. However, keep in mind that while you do free up your monthly budget by eliminating a car payment, you may also have depleted your emergency savings to do so.

If you're approved for your lease, you can use it as an opportunity to boost your credit score, which could give you more leverage when it comes time to upgrade. Just make sure to stay on top of your payments. Lease payments are reported to the major credit bureaus the same way finance payments are.