Florida Double Llc For Rental Property

Description

Form popularity

FAQ

Yes, you can have multiple LLCs in Florida. This flexibility allows you to manage different aspects of your business separately. For example, if you plan to invest in various properties, forming a Florida double LLC for rental property can help you segregate risks and manage liability effectively. Each LLC has its own legal identity, which can be beneficial for tax and financial management.

Yes, an LLC can have two or more owners, often referred to as members, in Florida. This flexibility allows you to form a Florida double LLC for rental property with partners or co-investors, enhancing your investment opportunities. Just ensure that your operating agreement outlines the roles and responsibilities of each member to avoid potential conflicts.

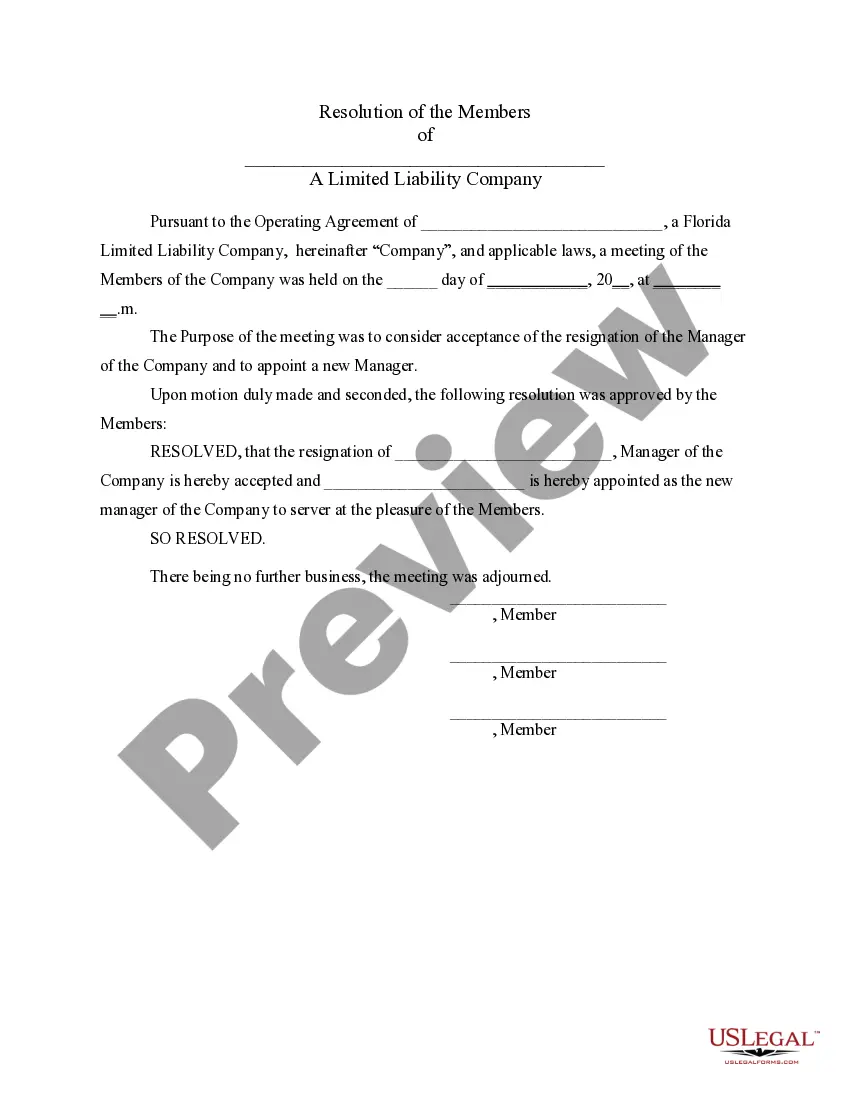

To put your rental property into your Florida double LLC for rental property, start by transferring the title of the property. You will need to draft a deed that indicates the transfer from your name to the LLC's name. Since this process can involve legal intricacies, consider using platforms like US Legal Forms to simplify the documentation and ensure compliance with local regulations.

A double LLC in Florida refers to a two-tiered structure where one LLC owns the other, often used for asset protection purposes. This arrangement is particularly beneficial for rental property owners, as it helps shield personal assets from potential liabilities. By forming a Florida double LLC for rental property, you can also enjoy favorable tax treatment. Using platforms like US Legal Forms can assist you in navigating this complex setup effectively.

Creating an LLC for rental property in Florida involves several straightforward steps, including filing your articles of organization with the state. Consider establishing a Florida double LLC for rental property to enhance your asset protection. You'll also need to obtain any necessary permits and licenses, along with an EIN from the IRS. US Legal Forms can guide you through the entire process, making it easier to set up your rental business.

To put multiple businesses under one LLC in Florida, you can utilize the Florida double LLC for rental property structure. This allows you to manage different business entities as separate divisions within the same LLC. Remember to maintain clear records for each business to comply with legal regulations. Utilizing a service like US Legal Forms can simplify the filing process and help you establish the appropriate documentation.

The best LLC structure for rental properties often involves creating what is known as a Florida double LLC for rental property. This structure allows you to separate your assets and liabilities effectively. By using a double LLC, you can safeguard your personal assets while optimizing tax benefits. It also offers flexibility in managing multiple rental properties under a single structure.

Yes, having separate LLCs for each rental property can offer important legal and financial protections. A Florida double LLC for rental property allows you to limit liability, as each property remains isolated from potential risks associated with the others. This structure also helps with asset protection and can simplify management during disputes. Consider using US Legal Forms to easily set up your LLCs according to Florida regulations.

The ideal business structure for rental properties often depends on your individual goals and risk tolerance. Many investors find that a Florida double LLC for rental property works effectively, combining asset protection with operational benefits. This structure allows you to manage multiple properties while safeguarding your personal assets from potential legal claims. Consulting with a legal expert can help you select the best option tailored to your needs.

Grouping all your properties into a single LLC may offer simplicity in management and lower administrative costs. However, this approach exposes all your assets to potential liabilities from any one property. If you opt for the Florida double LLC for rental property structure, you can balance the need for protection with the efficiency of management. It is a smart move to analyze your portfolio when deciding on this option.