Lease Property Form For A Trust

Description

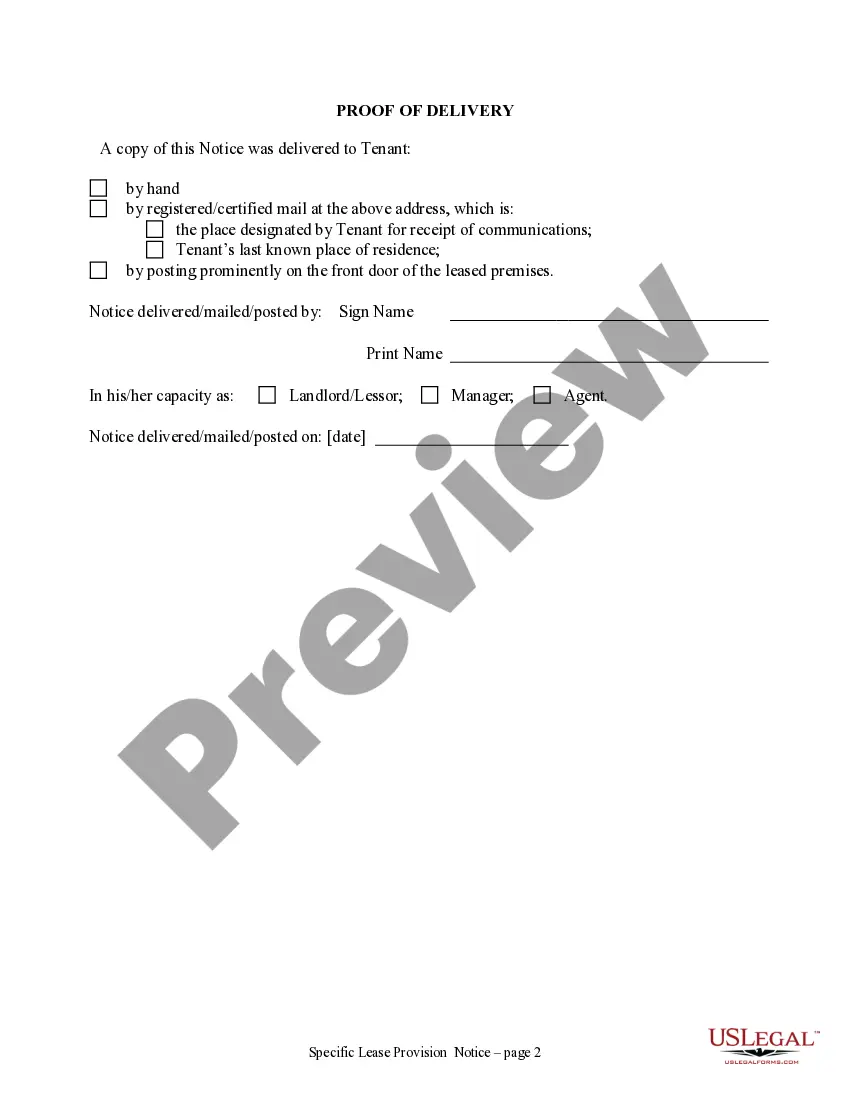

How to fill out Florida Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With No Right To Cure For Residential Property From Landlord To Tenant?

- Log in to your US Legal Forms account if you are an existing user. Ensure your subscription is active to access the form.

- Preview the lease property form for a trust carefully. Confirm that it meets your local jurisdiction requirements and fully caters to your needs.

- If necessary, use the Search tab at the top of the page to find any additional template that may better suit your situation.

- Select the desired document by clicking on the Buy Now button. Choose a subscription plan that fits your needs and register for an account to unlock full access.

- Complete your purchase by entering your payment details through credit card or PayPal.

- After the transaction, download the lease property form for a trust to your device and save it for easy access via the My Forms section of your profile.

With US Legal Forms, you gain access to an extensive library containing over 85,000 legal templates, ensuring you find exactly what you need. The platform also connects you with premium experts who can assist in crafting precise and legally sound documents.

Don't hesitate to take control of your legal needs today! Start your journey with US Legal Forms and get your lease property form for a trust now.

Form popularity

FAQ

The IL 1041 must be filed by trusts that generate income in Illinois. Irrevocable trusts or those that retain earnings often trigger this requirement. If your trust holds leased property, using a lease property form for a trust can clarify income streams and assist in correctly filing the IL 1041.

Yes, you can place a lease in a trust. Including a lease property form for a trust helps formalize the lease agreement and ensure consistent management. This can protect both the trust and the beneficiaries by clearly outlining responsibilities and rights regarding the leased property.

If your trust earns income during the tax year, you generally need to file a 1041. This form reports the income received by the trust to the IRS. If your trust includes properties governed by a lease property form for a trust, this income typically needs to be reported as part of the trust's obligations.

One common mistake is not properly funding the trust, which can lead to confusion about asset management. Parents often overlook the importance of including relevant documents, like a lease property form for a trust, that clearly outline the management of rental properties. It’s crucial to ensure all assets are properly titled in the name of the trust.

Typically, the primary form required is the IRS Form 1041 for income tax returns. Depending on the trust’s structure, additional forms like the 8453 may also be needed. If you are managing leased property within a trust, a lease property form for a trust can assist in properly documenting financial activity.

Not all trusts need to file a tax return. Only certain types, like irrevocable trusts or those that generate income, are required to file. If your trust owns rental property, utilizing a lease property form for a trust can help clarify income obligations and may affect tax filing needs.

The 8453 form for a trust is the Declaration for an IRS e-filed return. It helps the trust electronically submit its tax returns while confirming various details. If you're managing a trust that involves rental properties, using a lease property form for a trust can streamline the process of handling those assets.

Generally, a trust does not need to file a Tax Return if there is no income. However, it's important to check specific state laws and conditions. Even without income, having a Lease property form for a trust helps maintain organized records, which can be beneficial for future income assessments or legal requirements.

The responsibility for K-1 forms primarily lies with the trustee of the trust. It is their duty to ensure all relevant information is accurately reported and distributed to beneficiaries. Implementing a Lease property form for a trust can assist in organizing rental income data, making it easier to fulfill this responsibility.

The preparation of a K-1 form for a trust falls to the trustee or accounting professional familiar with the trust's financial activities. Their role involves reporting accurate distributions and taxable income to beneficiaries. By utilizing a standardized Lease property form for a trust, trustees can track income more effectively, which eases the K-1 preparation process.