Florida Termination Withdrawal

Description

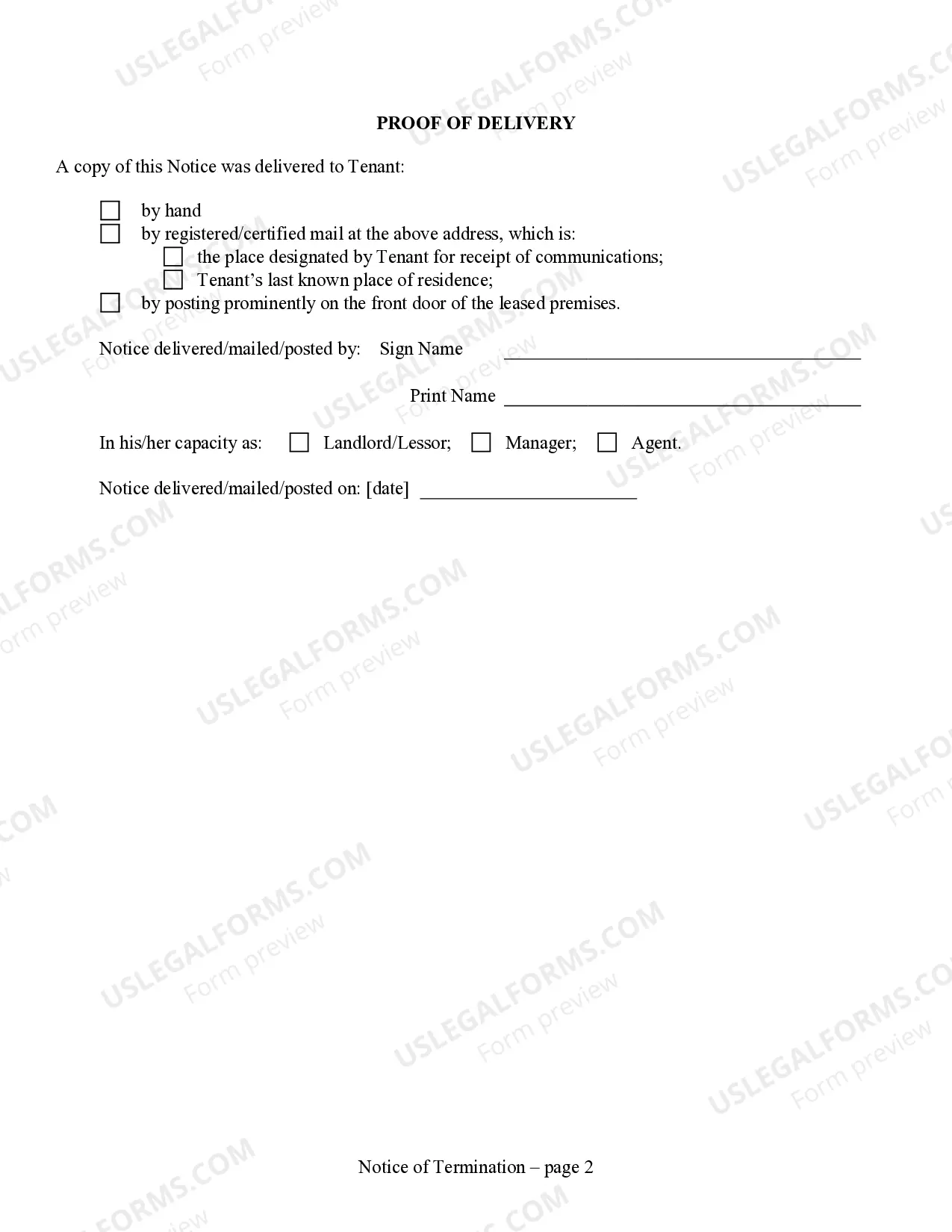

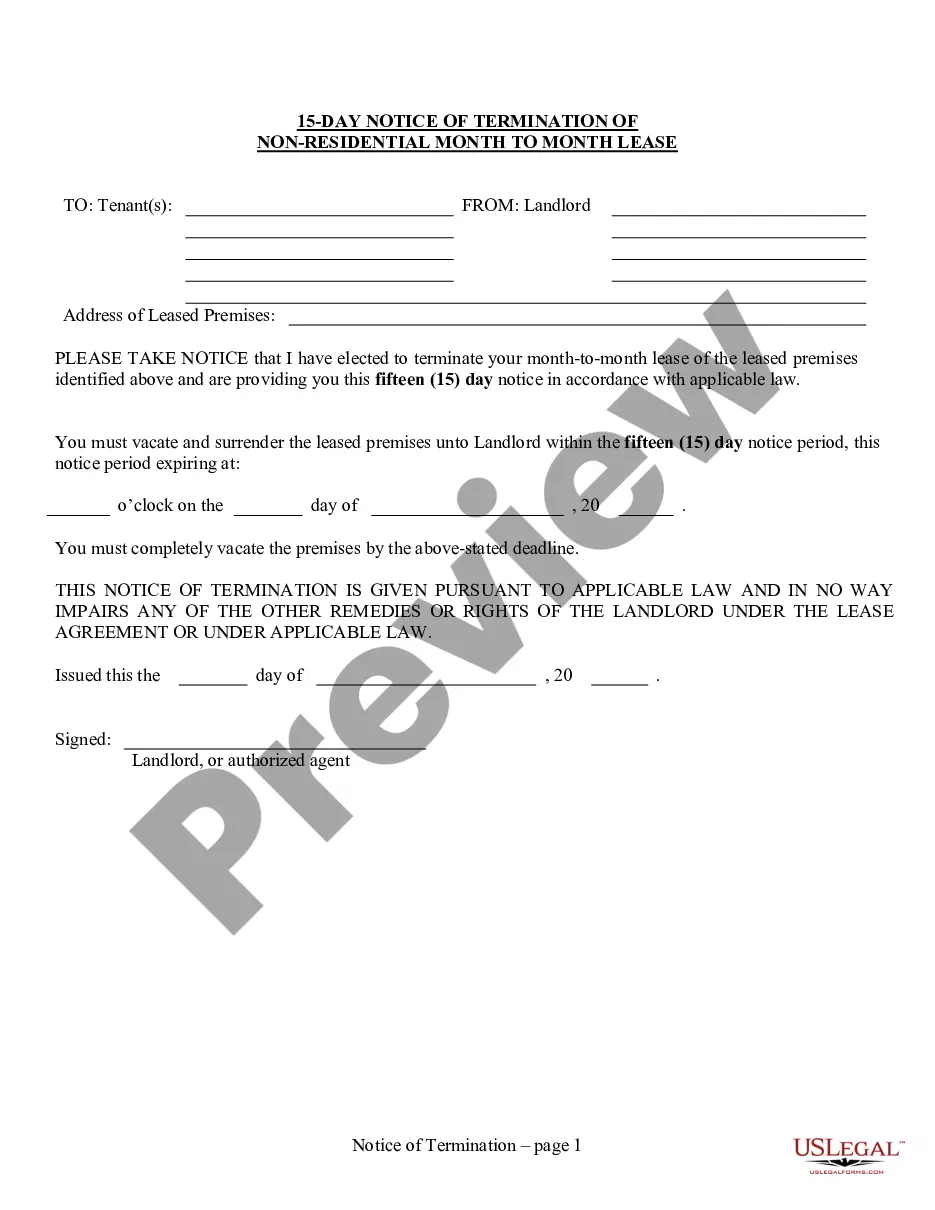

How to fill out Florida 15 Day Notice Of Termination Of Lease - Nonresidential?

It’s widely recognized that you cannot instantly become a legal expert, nor can you swiftly master how to prepare the Florida Termination Withdrawal without possessing a specific skill set.

Drafting legal documents is a lengthy procedure that demands particular education and expertise. So why not entrust the creation of the Florida Termination Withdrawal to the specialists.

With US Legal Forms, one of the most extensive libraries of legal templates, you can access everything from court documents to templates for internal corporate communication.

You can regain access to your documents from the My documents tab any time. If you’re a current customer, you can simply Log In and find and download the template from the same tab.

Regardless of the purpose of your documents—whether financial, legal, or personal—our website has you covered. Give US Legal Forms a try now!

- Locate the document you require using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to decide if the Florida Termination Withdrawal meets your needs.

- Begin your search again if you need another template.

- Sign up for a free account and choose a subscription option to purchase the template.

- Select Buy now. After the transaction is complete, you can obtain the Florida Termination Withdrawal, fill it out, print it, and deliver it or mail it to the appropriate individuals or entities.

Form popularity

FAQ

How much interest will my DROP account earn? Beginning July 1, 2023, your DROP accumulation earns interest at an effective annual rate of 4.00%, compounded monthly on the prior month's accumulated balance. If you participated in DROP before this date, your interest accrual rate for prior DROP months was different.

Employees may enter DROP any time after becoming fully vested and reaching their normal retirement date. The annual interest rate has tripled from 1.3% to 4%, compounded monthly, for the accrued monthly DROP benefit.

FRS Investment Plan If you leave before reaching normal retirement and elect to begin receiving your vested benefit, it will be subject to an early retirement reduction. Your benefit will be reduced 5% for each year your age at retirement is under your normal retirement age.

DROP Rollover to the Investment Plan FAQs. FRS Pension Plan members are permitted to roll over some or all of their DROP accumulation to the FRS Investment Plan. This option allows DROP participants to keep their money in the FRS and take advantage of the low-cost investment products offered in the Investment Plan.

DROP plans were initially promoted as cost-neutral programs that would keep experienced employees around longer. That optimistic outlook, however, is shifting. The Los Angeles Times recently reported that Los Angeles' DROP plan is distributing exorbitant payments to both retired and unretired public employees.