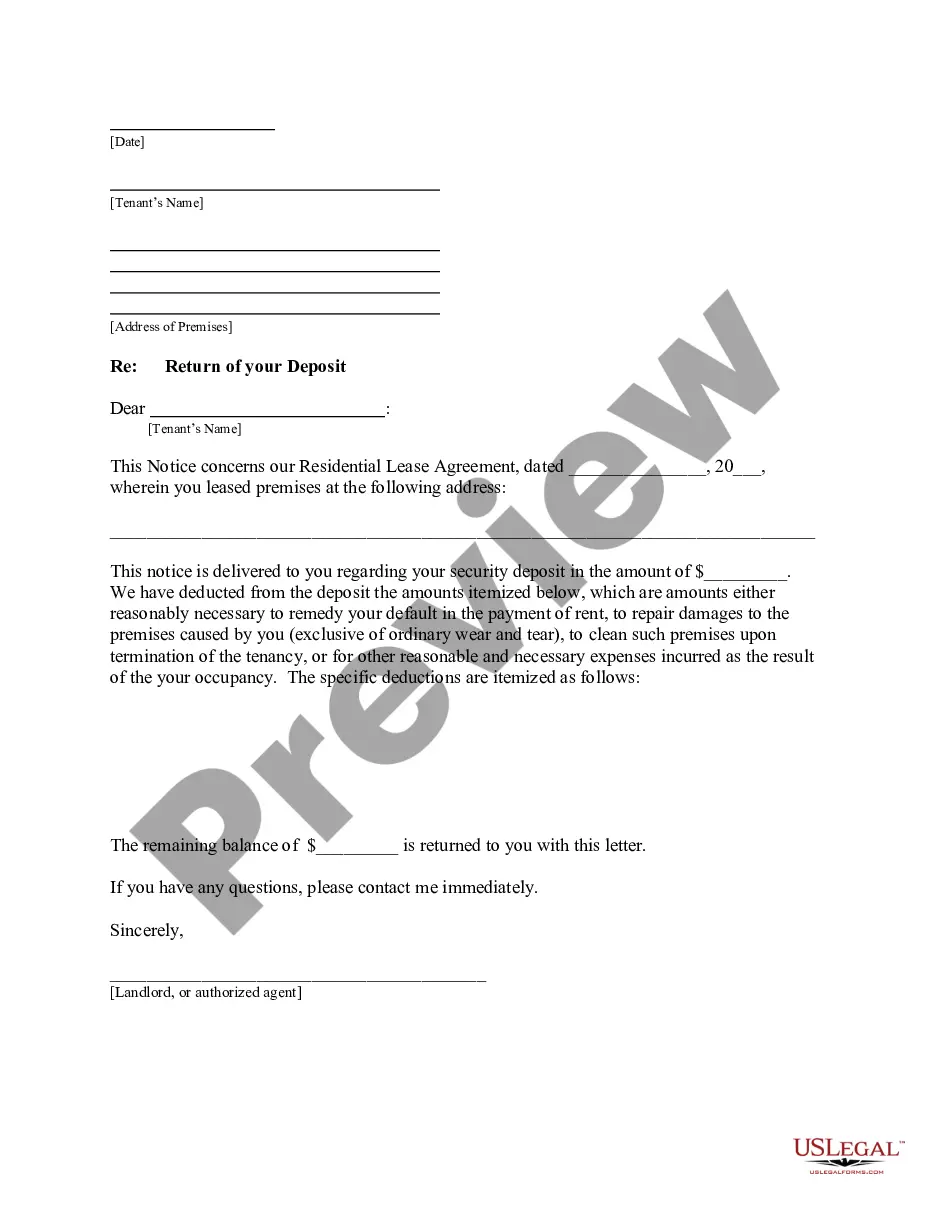

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Return item from a previous deposit refers to a situation where a deposit made by an individual or a business is not accepted by the bank and is sent back to the depositor. This can happen due to various reasons such as insufficient funds in the account, a discrepancy in the account information, or a technical issue during the deposit process. When this occurs, the depositor receives a return item indicating the failure of the deposit. Return items from previous deposits can take different forms based on the circumstances of the rejected deposit. Some common types of return items from previous deposits include: 1. Insufficient Funds: This type of return item occurs when the depositor does not have enough money in their account to cover the deposited amount. It typically results in a returned check or an unsuccessful electronic deposit. 2. Closed Account: If an account has been closed either by the account holder or by the bank, any deposit made into that account will be returned as a return item from a previous deposit. 3. Invalid Account Information: When the account details provided by the depositor are incorrect or incomplete, the bank cannot process the deposit and returns it as a return item. Examples of invalid account information include an incorrect account number or an expired account. 4. Endorsement Issue: When a deposited item, such as a check, does not have a proper endorsement or the endorsement is unclear or mismatched, the bank may return it as a return item from a previous deposit. 5. Time Limit Exceeded: Some deposits may have a time limit within which they must be processed. If this time limit is exceeded, the deposit may be returned as a return item. 6. Suspected Fraud: In cases where a deposit appears to be fraudulent or suspicious, such as a forged check or counterfeit currency, the bank may return the item as a return item from the previous deposit. It is important for individuals and businesses to carefully review their deposit transactions to ensure accuracy and avoid common issues that may lead to return items from previous deposits. Maintaining sufficient funds, providing accurate account information, endorsing checks correctly, and promptly addressing any discrepancies can help minimize the occurrence of return items and ensure smooth banking transactions.