Enhanced Estate Five Withdrawal

Description

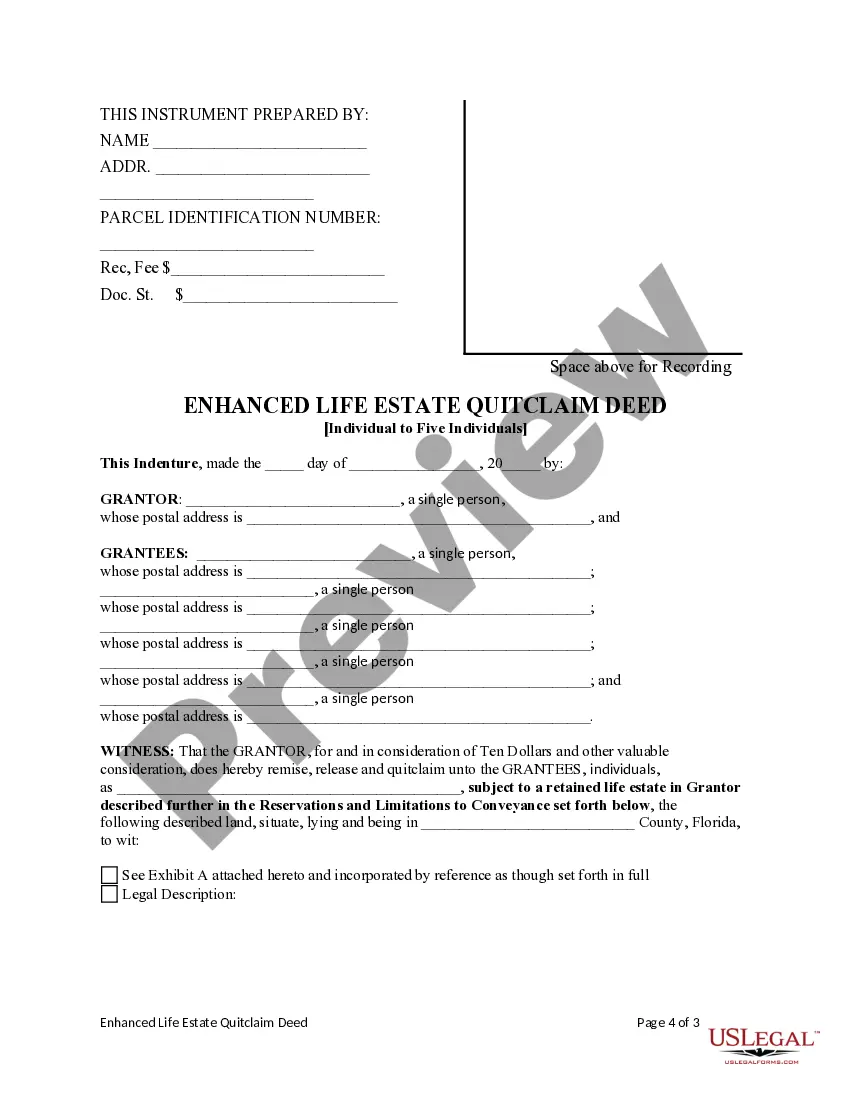

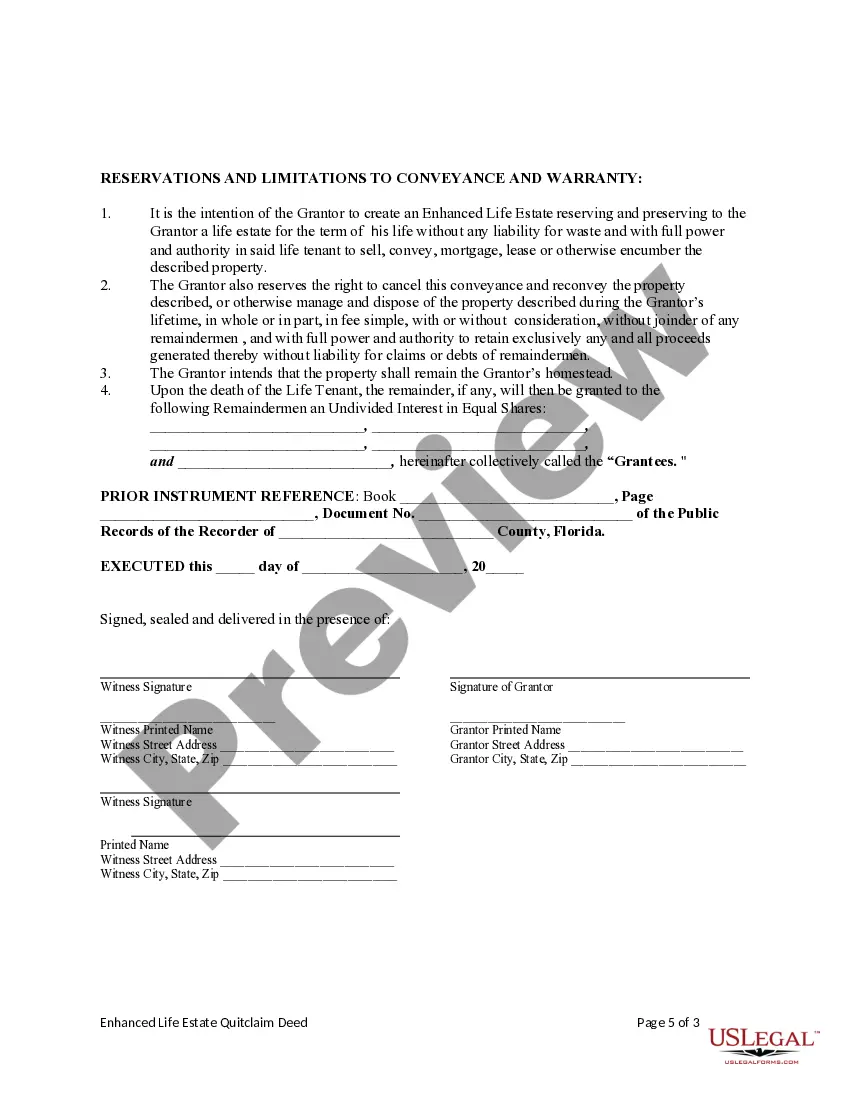

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Quitclaim - Individual To Five Individuals?

Whether for business purposes or for personal matters, everybody has to handle legal situations at some point in their life. Completing legal papers requires careful attention, starting with choosing the appropriate form sample. For instance, when you pick a wrong edition of the Enhanced Estate Five Withdrawal, it will be declined once you submit it. It is therefore crucial to get a dependable source of legal papers like US Legal Forms.

If you need to get a Enhanced Estate Five Withdrawal sample, stick to these easy steps:

- Find the template you need using the search field or catalog navigation.

- Examine the form’s information to ensure it fits your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search function to find the Enhanced Estate Five Withdrawal sample you require.

- Download the file if it matches your requirements.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved documents in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Pick the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: use a bank card or PayPal account.

- Pick the document format you want and download the Enhanced Estate Five Withdrawal.

- Once it is saved, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time searching for the right template across the internet. Utilize the library’s straightforward navigation to get the correct template for any situation.

Form popularity

FAQ

The 5 and 5 power clause exists to either effectively minimize capital gains taxes on the contents of a trust or distribute a large sum of money piece-by-piece over a period of multiple years. It is defined by the annual distribution of the greater of either: $5,000, or. 5 percent of the trust's total fair market value.

What Is 5 by 5 Power? A 5 by 5 power clause in a trust document gives the beneficiary the right to withdraw either $5,000 or 5% of the fair market value of the trust account per year, whichever is greater. This is in addition to the regular income payout benefit of the trust.

A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.

The idea behind the 5-by-5 rule is pretty straightforward. If something won't matter five years down the line, don't bother wasting more than five minutes obsessing over it.