Personal Representative For Deceased

Description

How to fill out Florida Personal Representative's Deed Of Distribution?

Whether for corporate endeavors or personal matters, everyone must navigate legal circumstances at some time in their lives.

Completing legal paperwork requires meticulous care, starting from selecting the appropriate form template.

After it is downloaded, you can fill out the form using editing software or print it and complete it by hand. With an extensive catalog from US Legal Forms available, you need not waste time searching for the right sample online. Make use of the library's easy navigation to find the appropriate template for any circumstance.

- For instance, if you select an incorrect version of a Personal Representative For Deceased, it will be rejected once you submit it.

- Therefore, it is vital to have a reliable source of legal documents like US Legal Forms.

- If you wish to obtain a Personal Representative For Deceased template, follow these simple instructions.

- Locate the sample you need using the search bar or catalog browsing.

- Review the form's details to confirm it fits your situation, state, and county.

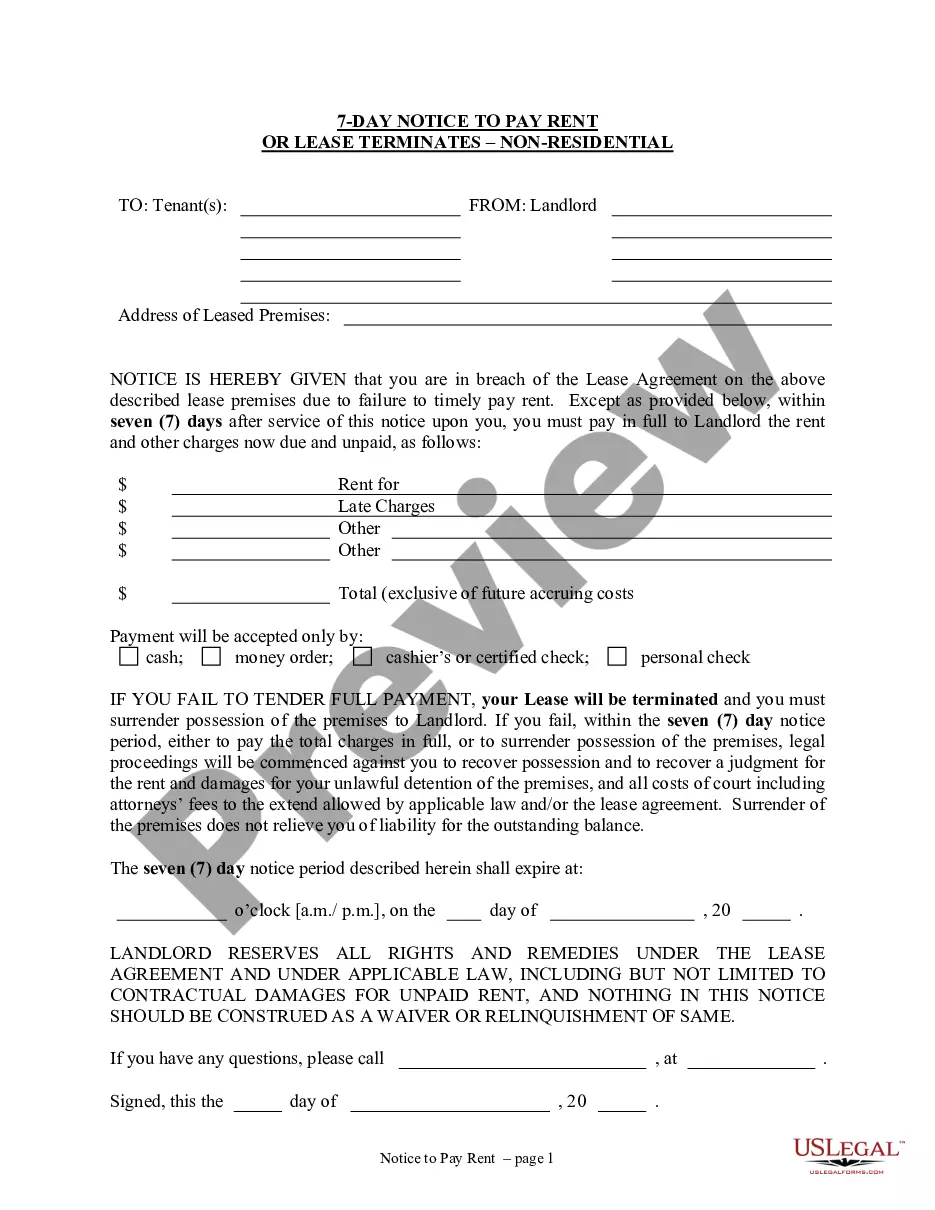

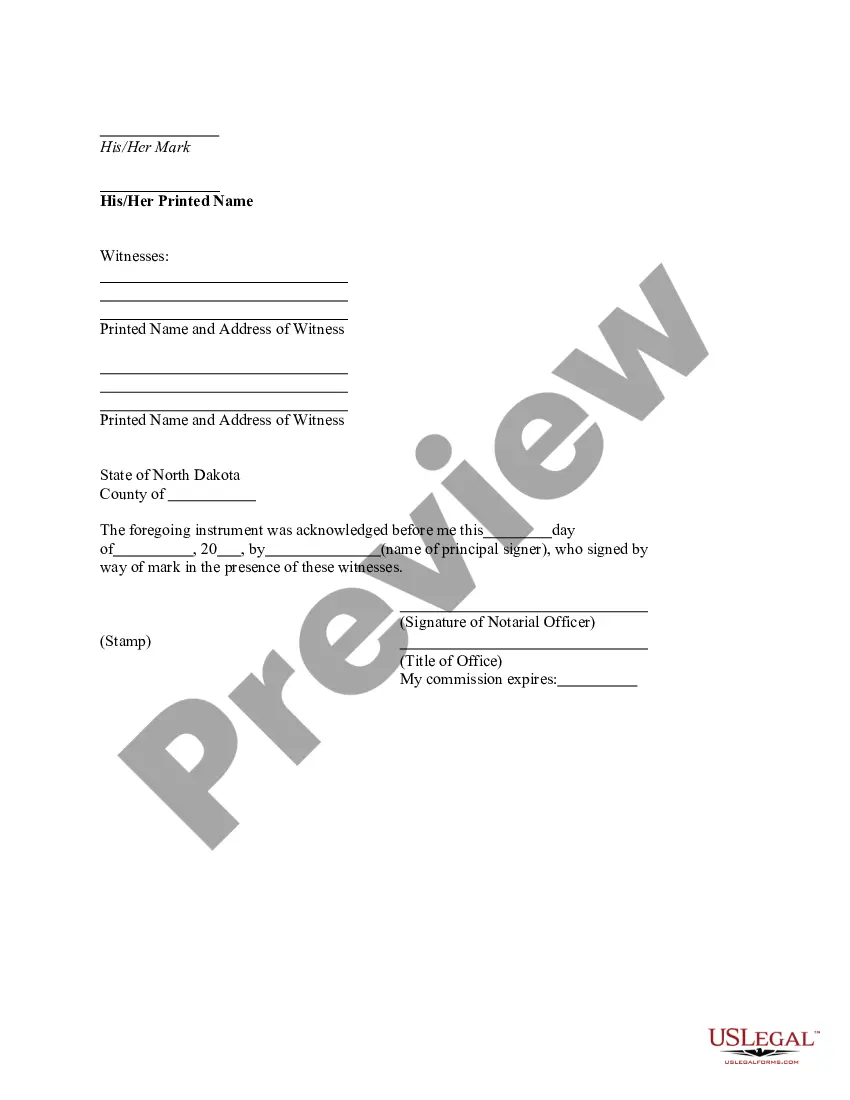

- Click on the form's preview to examine it.

- If it is not the correct document, return to the search feature to find the necessary Personal Representative For Deceased template.

- Download the document when it meets your requirements.

- If you already possess a US Legal Forms account, just click Log in to access previously saved documents in My documents.

- If you have not created an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing plan.

- Complete the registration form for your profile.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the file format you prefer and download the Personal Representative For Deceased.

Form popularity

FAQ

The final return can be filed electronically or on paper. For more information on these filing methods, see "How to file your return" in the Federal Income Tax and Benefit Guide. On the final return, report all of the deceased's income from January 1 of the year of death, up to and including the date of death.

A personal representative is the person, or it may be more than one person, who is legally entitled to administer the estate of the person who has died (referred to as 'the deceased'). The term 'personal representatives', sometimes abbreviated to PR, is used because it includes both executors and administrators.

A Final Return must be filed for every person who dies. In addition, you may be able to reduce or eliminate tax by reporting income from specific sources earned during specific time periods in optional T1 returns.

As the legal representative, you should provide the CRA with the deceased's date of death as soon as possible. You can advise the CRA by calling 1-800-959-8281, by sending a letter, or a completed Request for the Canada Revenue Agency to Update Records form.

You need to: make sure the CRA has been notified of the death. notify the CRA that you are the legal representative. provide the CRA with any requested documentation. cancel or transfer payments, such as the: ... find out if the person who died had any uncashed cheques from the CRA.