Florida Personal Representative With Examples

Description

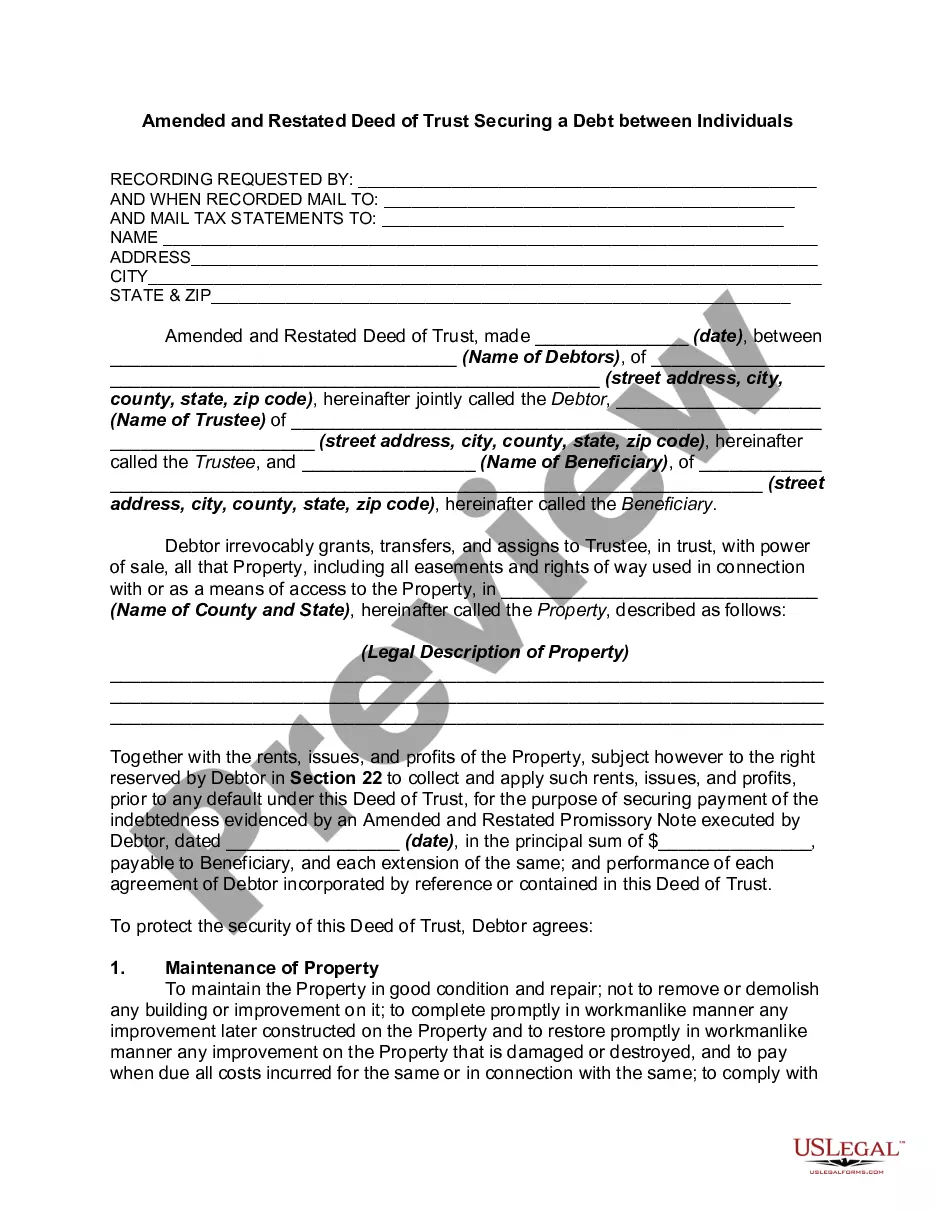

How to fill out Florida Personal Representative's Deed Of Distribution?

Locating a preferred location to obtain the most up-to-date and suitable legal templates is part of the challenge of navigating red tape.

Selecting the correct legal documents requires precision and careful consideration, which is why it is crucial to obtain samples of Florida Personal Representative With Examples exclusively from trustworthy sources, such as US Legal Forms. An incorrect template will squander your time and prolong your situation.

Eliminate the stress associated with your legal documents. Explore the extensive US Legal Forms catalog where you can discover legal samples, verify their suitability for your situation, and download them instantly.

- Utilize the library navigation or search bar to locate your template.

- Access the form’s description to verify if it meets the criteria of your state and area.

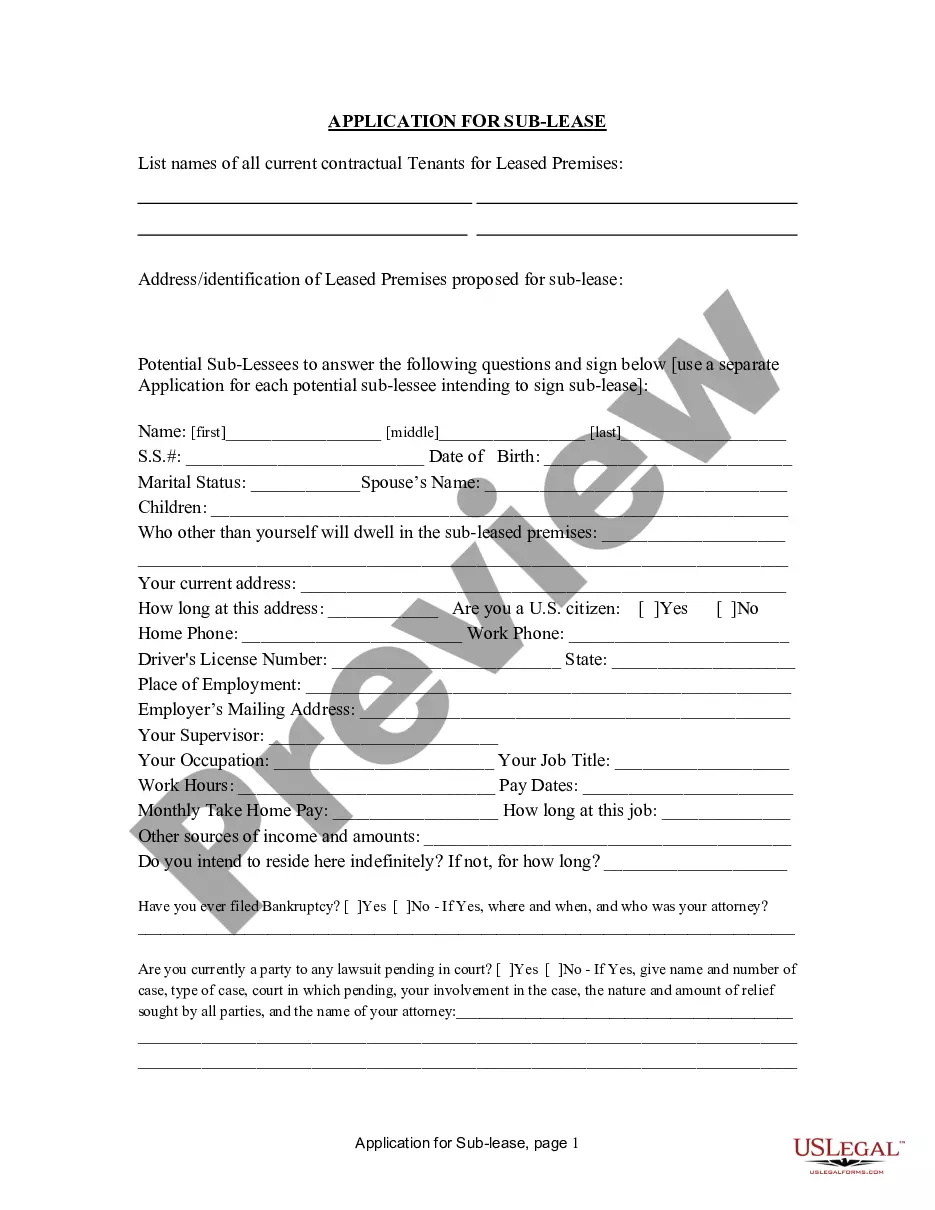

- View the form preview, if available, to confirm that the template is indeed the one you seek.

- Return to the search and seek out the appropriate document if the Florida Personal Representative With Examples does not meet your needs.

- If you are confident about the form’s applicability, download it.

- As a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to purchase the form.

- Select the pricing plan that aligns with your preferences.

- Continue with the registration to complete your purchase.

- Complete your transaction by selecting a payment option (credit card or PayPal).

- Choose the file format for downloading Florida Personal Representative With Examples.

- Once you have the form on your device, you can edit it using the editor or print it out and complete it by hand.

Form popularity

FAQ

In Florida, the terms 'executor' and 'personal representative' often refer to the same role, but there are distinctions. A personal representative is the official title used in Florida law, while an executor is a term commonly used in other states. Both are responsible for managing the deceased's estate, but in Florida, the personal representative must be appointed by the court. Understanding these terms can clarify your responsibilities, and USLegalForms can assist you in finding the right resources and forms for this process.

To get a Florida personal representative, start by determining who would be suitable for the role, such as a family member or a trusted friend. Next, file a petition for administration in the probate court in the county where the deceased lived. The court will then appoint the personal representative, provided they meet the necessary qualifications. For a smoother process, consider using a platform like USLegalForms, which offers templates and guidance for navigating probate effectively.

In Florida, a personal representative is typically an individual or institution appointed to administer a deceased person's estate. To qualify, the person must be at least 18 years old, a resident of Florida, or a close relative of the deceased. Examples of eligible candidates include a spouse, child, or sibling of the deceased. Using a reliable platform like US Legal Forms can help you navigate the process of appointing a Florida personal representative with examples tailored to your specific situation.

A personal representative in Florida is an individual designated to settle the estate of a deceased person. This can include executing the will, managing assets, and addressing debts. Typically, the courts recognize anyone named in the will or appointed by the court as a personal representative. It's essential to choose someone with the necessary skills and integrity to fulfill this important role.

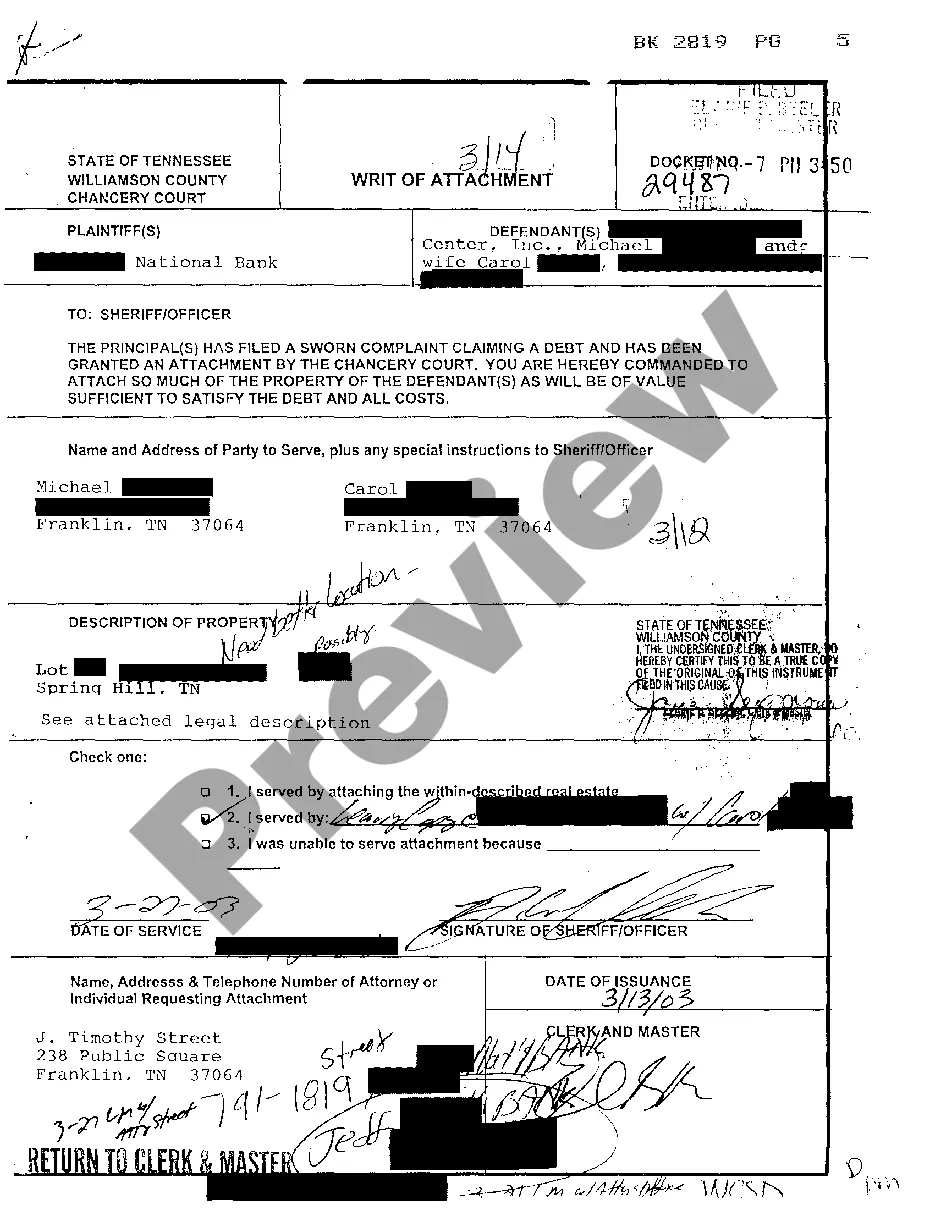

Completing a personal representative deed involves several steps. First, gather necessary documents, such as the will and letters of administration from the probate court. Next, use a reliable platform like USLegalForms to access templates that guide you through the process. This ensures that your deed complies with Florida laws and accurately reflects the intentions of the deceased.

To serve as a Florida personal representative, one must be at least 18 years old, a resident of Florida, or a close relative of the deceased. Additionally, individuals who have been convicted of a felony may face restrictions. Understanding these requirements can help ensure that the appointed personal representative can effectively manage the estate.

A Florida personal representative is an individual who manages the estate of a deceased person. For example, if a mother passes away and names her eldest son as her personal representative in her will, he has the authority to handle her assets, debts, and distribute her belongings according to her wishes. This role is crucial in ensuring that the estate is settled fairly and legally.

Yes, you can prepare a deed yourself, but it requires attention to detail and understanding of legal terminology. A Florida personal representative with examples can provide insights into the specific requirements for your situation. If you choose to take this route, ensure that you comply with state laws to avoid issues later. USLegalForms offers user-friendly tools and templates that can help you draft a deed correctly.

You may not necessarily need a lawyer to do a deed transfer, but having one can simplify the process. A Florida personal representative with examples can guide you through the legal requirements and ensure all paperwork is correctly completed. Working with a legal expert can also help you avoid potential mistakes that could lead to complications down the line. Consider using USLegalForms to access templates and resources that can assist you in this process.