Llc Non Us Resident

Description

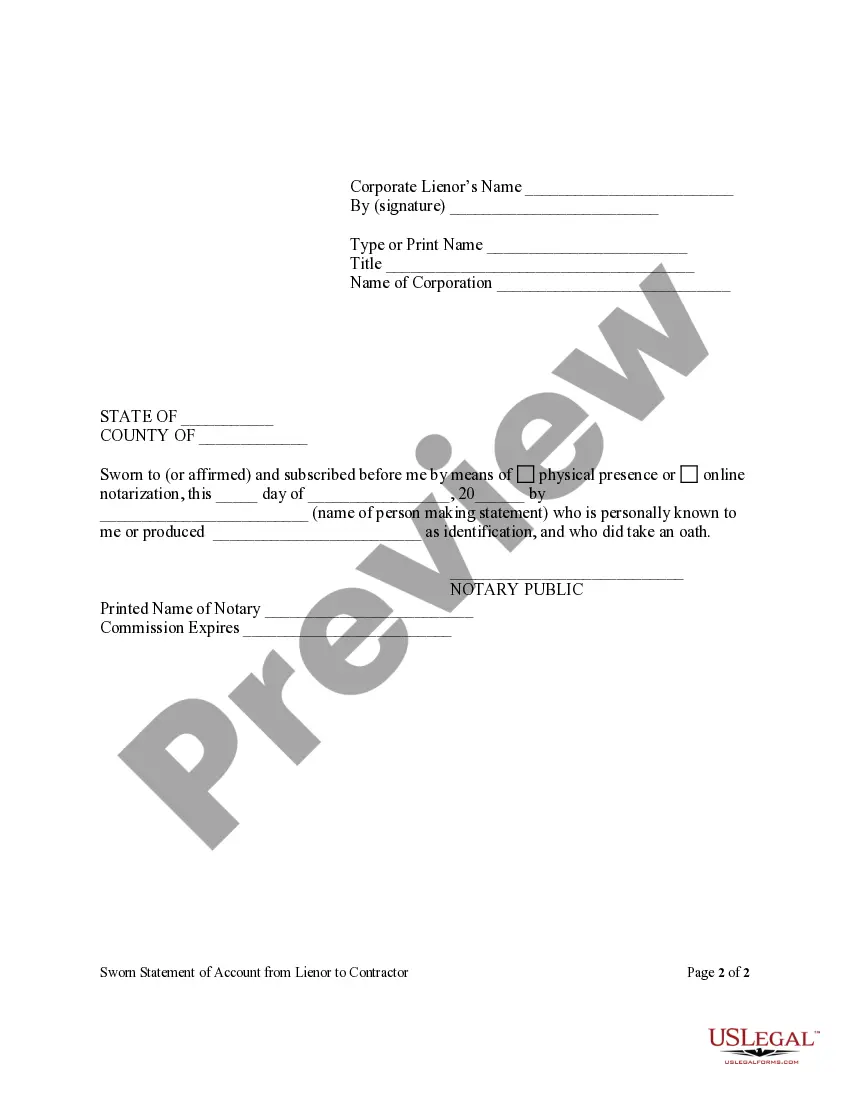

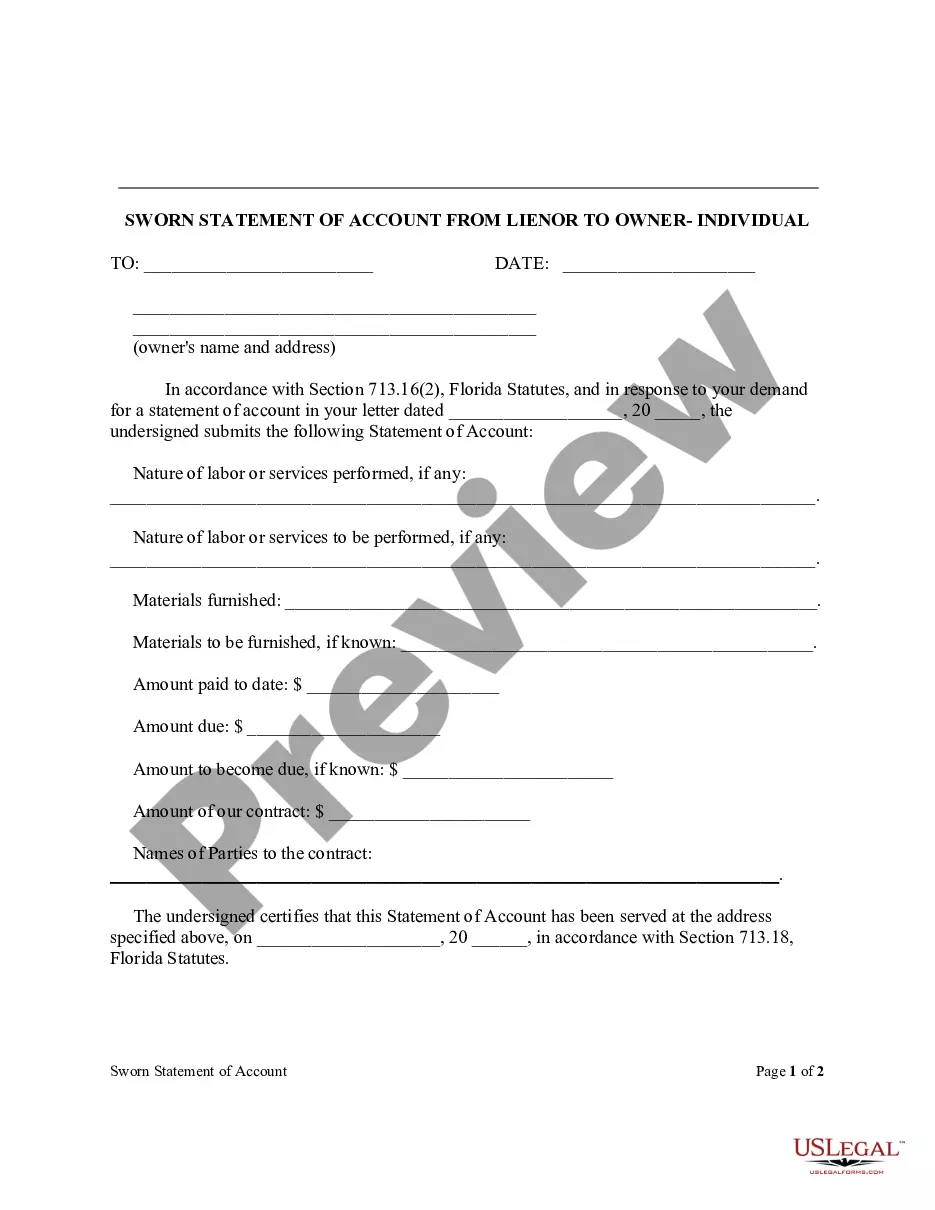

How to fill out Florida Sworn Statement Of Account From Lienor To Contractor - Corporation?

- If you already use US Legal Forms, log in to your account. Check that your subscription is active, and download your desired form template.

- For first-time users, begin by browsing the Preview mode and form descriptions. Confirm you have selected the document that meets your requirements and complies with your local jurisdiction.

- If the desired template isn't found, utilize the Search feature to explore additional options. Ensure it aligns with your needs before proceeding.

- Purchase the document by clicking on the Buy Now button and selecting your preferred subscription plan. You will need to create an account to access the forms.

- Complete your transaction by entering your payment information, either via credit card or PayPal.

- Download the form to your device. You can also find it later in the My Forms section of your profile.

US Legal Forms empowers individuals and attorneys alike, providing an extensive collection of documents—over 85,000 fillable legal forms. With premium support from legal experts, you can ensure that your documents are both accurate and compliant.

Take the stress out of legal document preparation and explore US Legal Forms today. Start your journey towards effortless legal compliance!

Form popularity

FAQ

Creating an LLC as a non-US citizen involves several straightforward steps. Begin by choosing a state where you intend to form the LLC, then file your articles of organization with that state's authority. Additionally, obtaining an EIN will be necessary for tax operations. Utilizing UsLegalForms can help you manage these tasks efficiently, making the process smoother.

Yes, you can open an LLC if you are not a US citizen. Many non-residents successfully establish companies in the USA each year. It is crucial to understand the rules and regulations governing business ownership to ensure compliance. Using resources from UsLegalForms can streamline your setup process.

To register an LLC for non-US residents, start by selecting a state and submitting the necessary formation documents to that state’s business authority. You will also need an Employer Identification Number (EIN) from the IRS for tax purposes. A platform like UsLegalForms simplifies this process, ensuring you complete each step correctly.

Yes, a non-US citizen can open an LLC in the USA with relative ease. There are no citizenship requirements, allowing individuals from abroad to establish a business presence. However, it’s essential to comply with state regulations and tax obligations. UsLegalForms provides guidance to help navigate these requirements smoothly.

Many non-US residents find that Wyoming, Delaware, and Nevada are some of the best states to form an LLC. These states offer benefits such as low fees, privacy protections, and favorable business regulations. Choosing the right state can impact your taxes and business operations, so consider your goals carefully. Consulting resources like UsLegalForms can clarify these nuances.

No, you do not have to be a US citizen to own an LLC. The laws in most states allow non-residents to own and operate companies in the United States. This flexibility makes it easier for foreign nationals to expand their businesses and tap into the US market. Therefore, forming an LLC as a non-US resident is a viable option.

Setting up a US company as a non-resident involves several steps. First, you need to choose a business structure, often an LLC, which provides liability protection. Next, select a state that meets your business needs and file the necessary formation documents. Platforms like UsLegalForms can assist you in navigating these steps efficiently.

The best state to register a foreign LLC often depends on your business's specific needs. Delaware is frequently chosen for its corporate laws, while other states like Wyoming offer low fees and privacy. Make sure to evaluate what aspects are most important to you as an LLC non US resident.

Absolutely, you can open an LLC even if you don't live in the US. Many non-residents successfully establish their LLCs in American states. It's crucial to work with professionals or platforms like uslegalforms that can guide you through the necessary steps and legal requirements.

Yes, the state where you set up your LLC can significantly impact your business operations. Different states have various laws, fees, and tax implications that can affect your bottom line. Thus, it's essential to evaluate these factors carefully to ensure effective business management as an LLC non US resident.