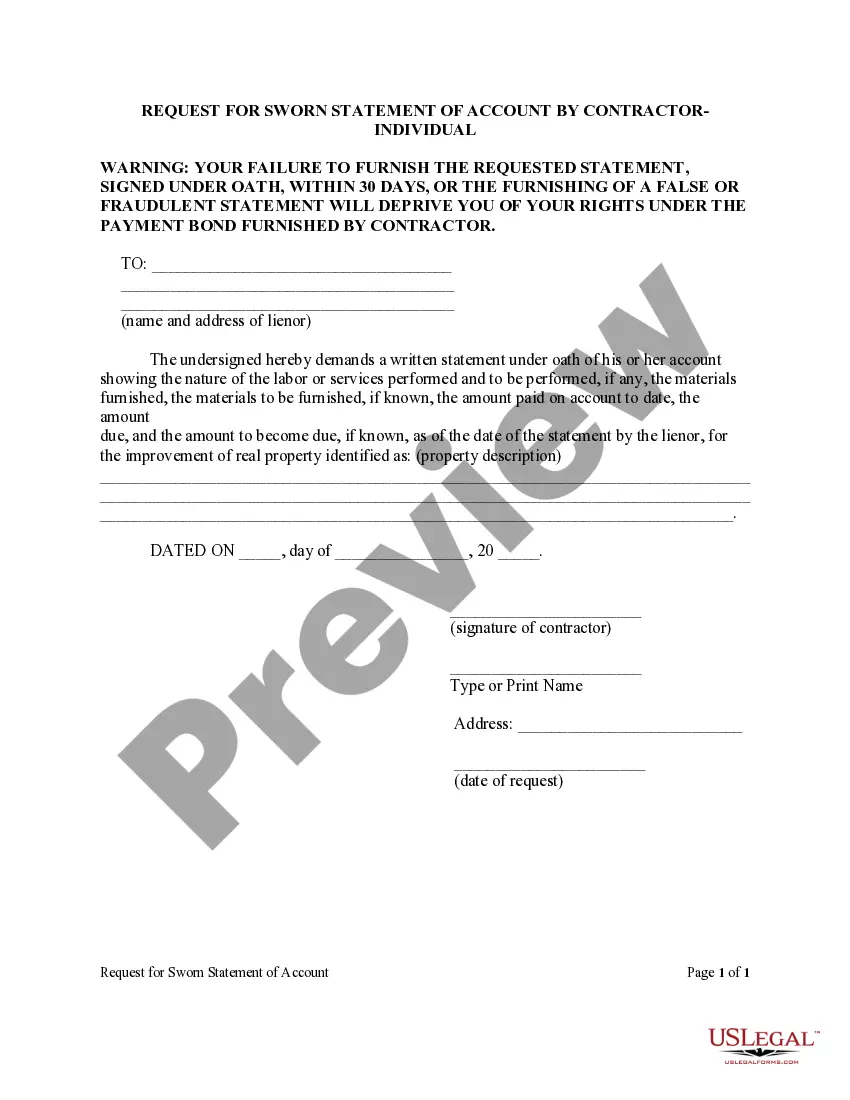

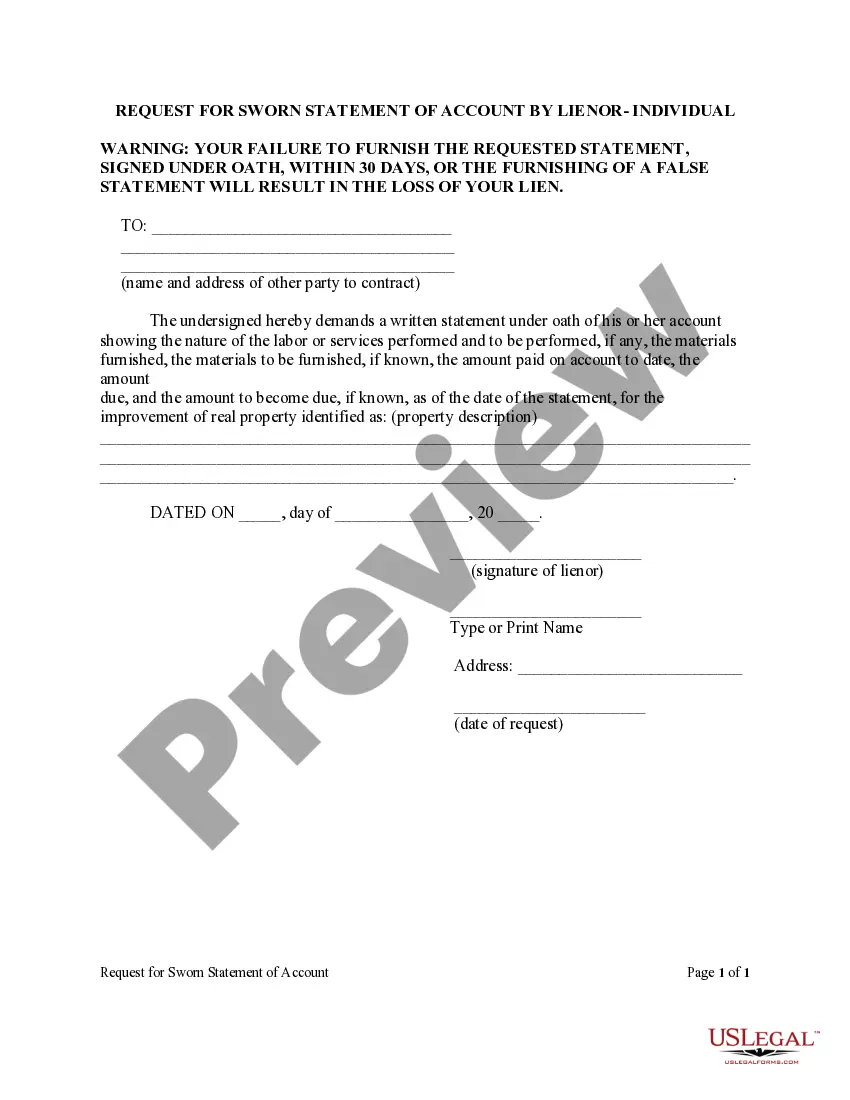

Florida Request For Sworn Statement Of Account

Description

How to fill out Florida Request For Sworn Statement Of Account By Lienor - Individual?

Handling legal documents and processes can be a lengthy addition to your day.

Florida Request For Sworn Statement Of Account and similar forms frequently necessitate searching for them and determining the most effective way to fill them out proficiently.

Consequently, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and accessible online repository of forms readily available will be extremely beneficial.

US Legal Forms is the premier online service for legal templates, featuring over 85,000 state-specific documents and a range of tools to help you fill out your paperwork effortlessly.

Is it your first experience with US Legal Forms? Sign up and establish your account in a few moments to gain access to the form repository and Florida Request For Sworn Statement Of Account. Next, follow the steps outlined below to fill out your form.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms provides state- and county-specific forms at your convenience for download.

- Protect your document handling processes with a high-quality service that enables you to prepare any form in minutes without incurring additional or unexpected charges.

- Simply Log In to your account, locate the Florida Request For Sworn Statement Of Account, and download it instantly from the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

Even without a signature from a notary public, it can still be a valid promissory note. Getting your loan agreement notarized can strengthen it in sensitive cases: Notarizing your note could make it legally stronger. ? This means it's more likely to stand up in court thanks to the extra witness of a notary public.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline for repayment. Once the document is signed by both parties, it becomes a legally binding contract.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note cannot be valid unless it contains details about the nature of credit, the means to repay it along with the duration given for the repayment, the signatures of all parties, the conditions agreed in the sanction of the loan, the rate of interest and all related terms.