Subcontractors Without Workers Compensation

Description

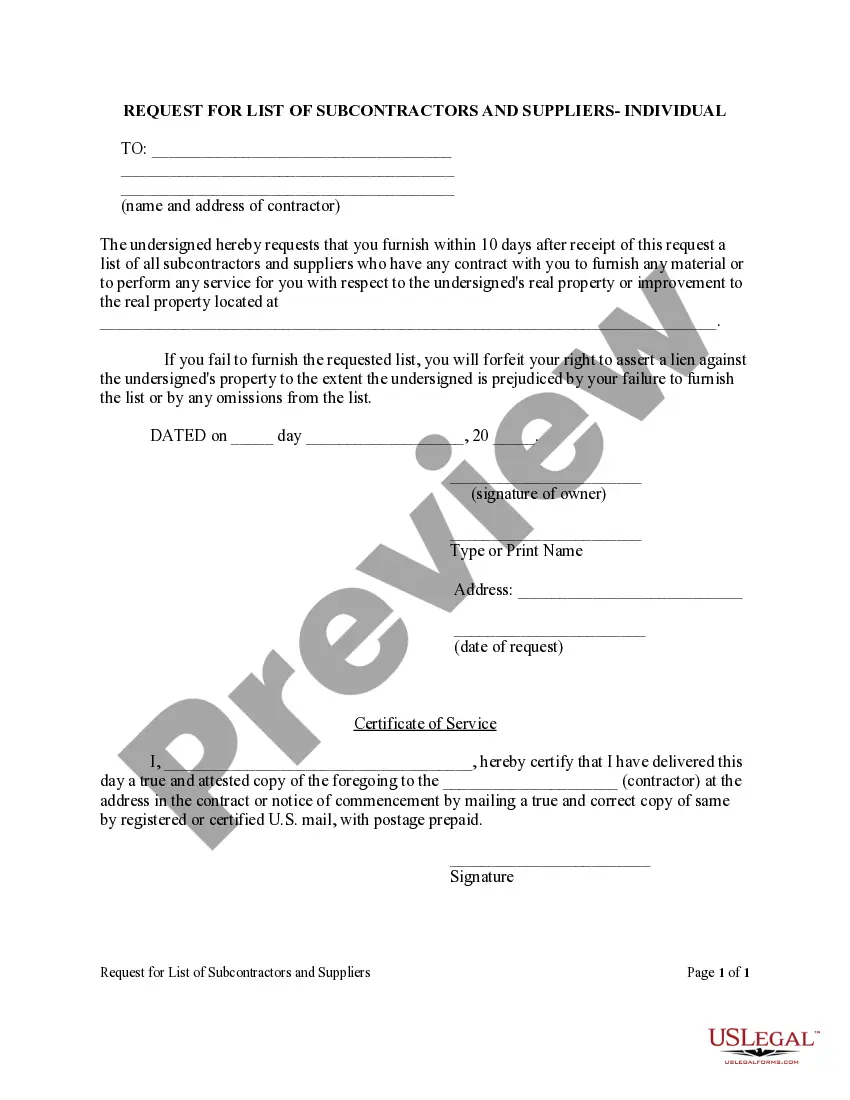

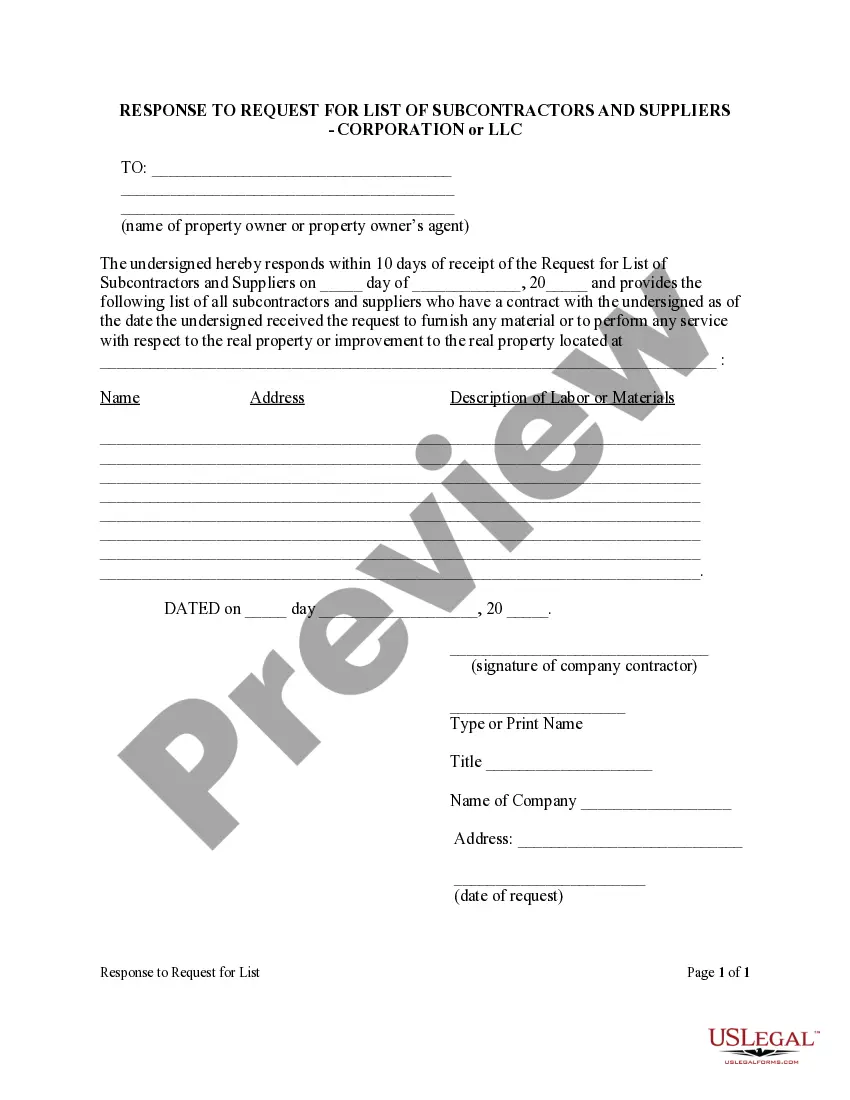

How to fill out Florida Response To Request For List Of Subcontractors And Suppliers - Individual?

There's no longer a reason to spend hours searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one location and made them easily accessible.

Our platform provides over 85,000 templates for any business and personal legal situations organized by state and area of use.

Utilize the Search field above to find another sample if the current one doesn't fit your needs.

- All forms are expertly drafted and validated for authenticity, so you can be assured of receiving an up-to-date Subcontractors Without Workers Compensation.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also access all stored paperwork whenever necessary by navigating to the My documents tab in your profile.

- If this is your first time using our platform, the process will require a few more steps to finalize.

- Here’s how new users can discover the Subcontractors Without Workers Compensation in our catalog.

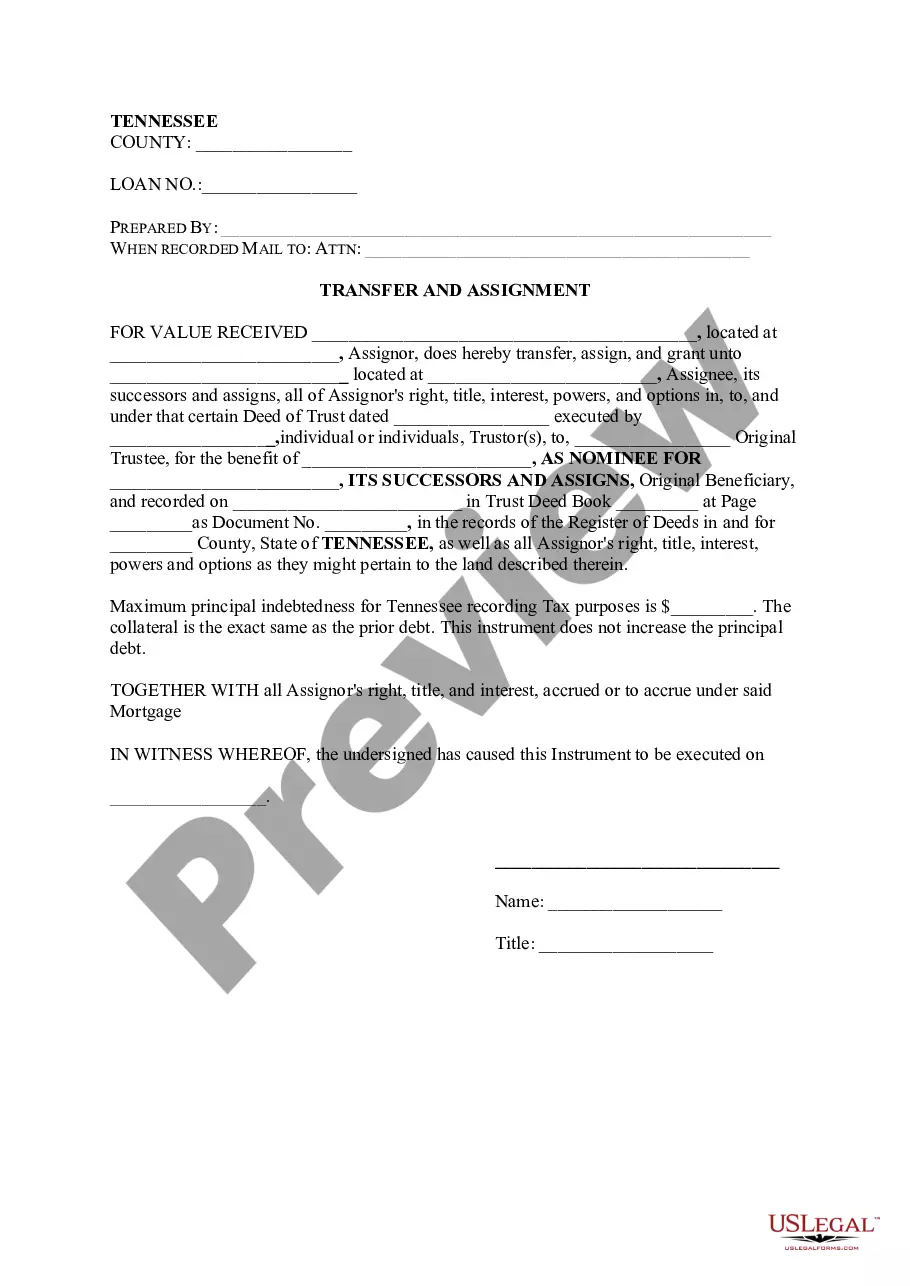

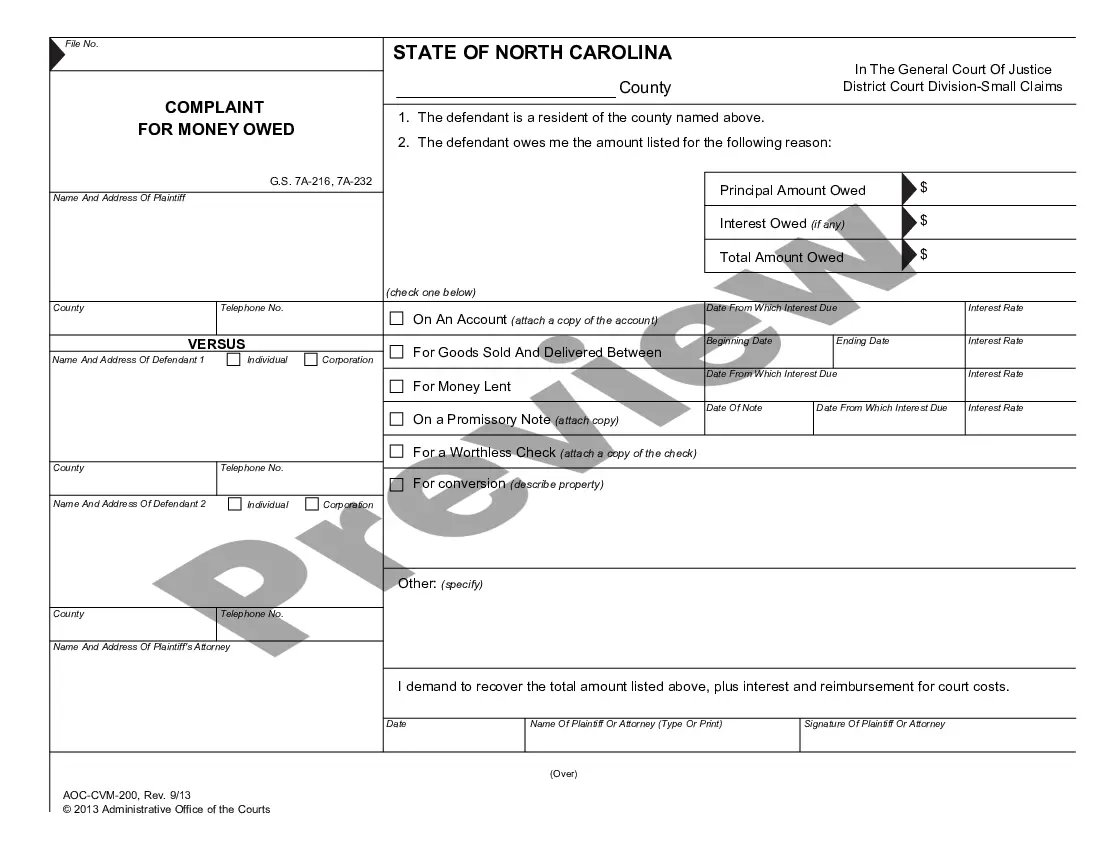

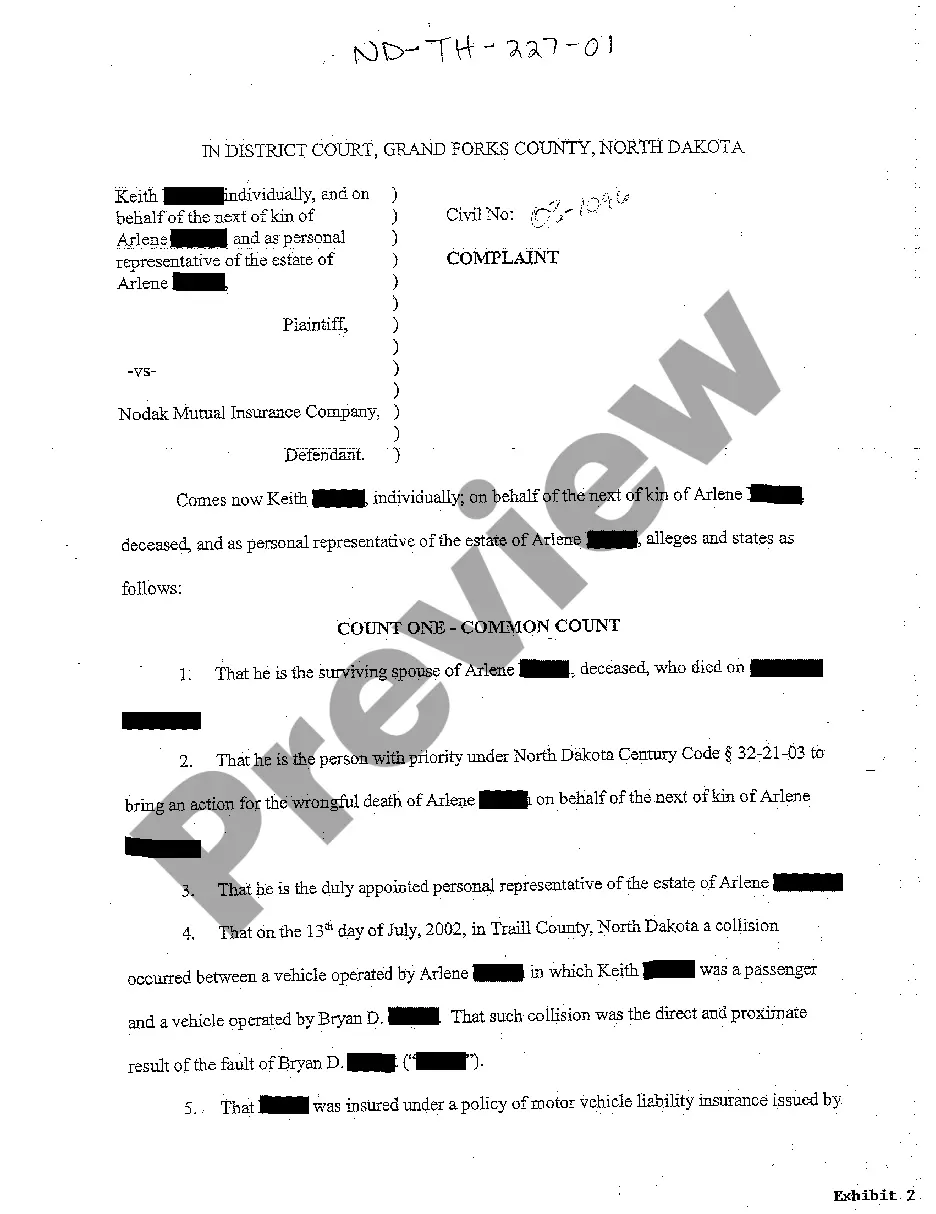

- Read the page content thoroughly to ensure it contains the sample you need.

- To do this, make use of the form description and preview options if available.

Form popularity

FAQ

Exemptions include: people covered under other workers' compensation acts, such as railroad workers, longshoremen and federal employees; domestic servants (coverage is optional); agricultural workers who work fewer than 30 days or earn less than $1,200 in a calendar year from one employer; and employees who have

Effective July 1, 2018, a sole shareholder who is an officer or director of a private corporation or a private cooperative corporation, or who is an owner of a private professional corporation, is excluded from the definition of employee, unless the officer, director, owner, private corporation, private cooperative

Some states, including Texas, don't require employers to have workers' comp insurance at all. If you're a freelancer, an IC, or a sole proprietor, you're legally self-employed and not automatically covered by workers' comp. Workers not classified as employees receive a 1099 form at the end of the tax year.

No, in most cases, independent contractors working for your business do not require workers' compensation insurance.

A subcontractor receives a portion of what the contractor earns for an overall job. Contractors receive payment per job or by the hour. As a contractor, you a receive 1099 form, and the IRS determines if a worker is a contractor or an employee.