Florida Objection To Request For Production

Description

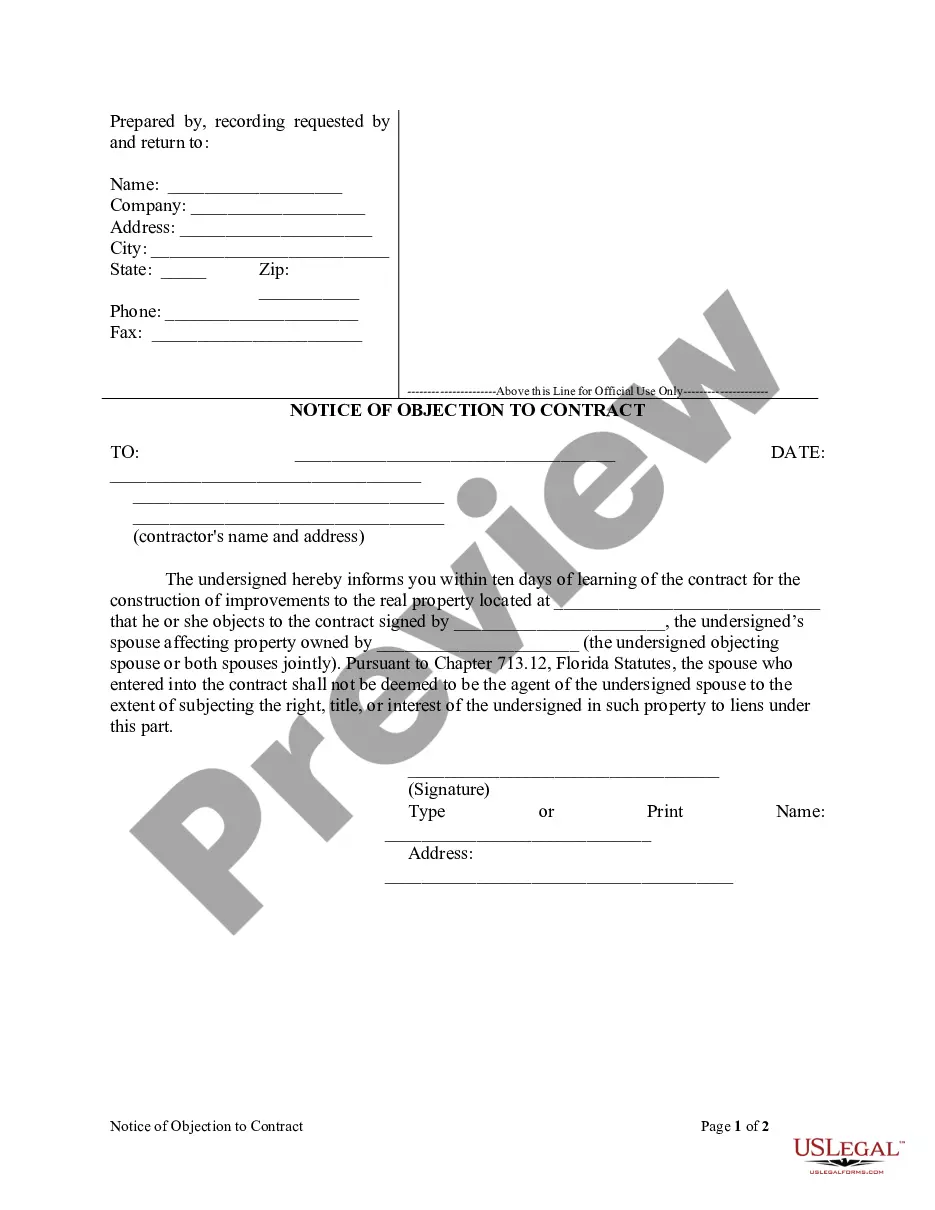

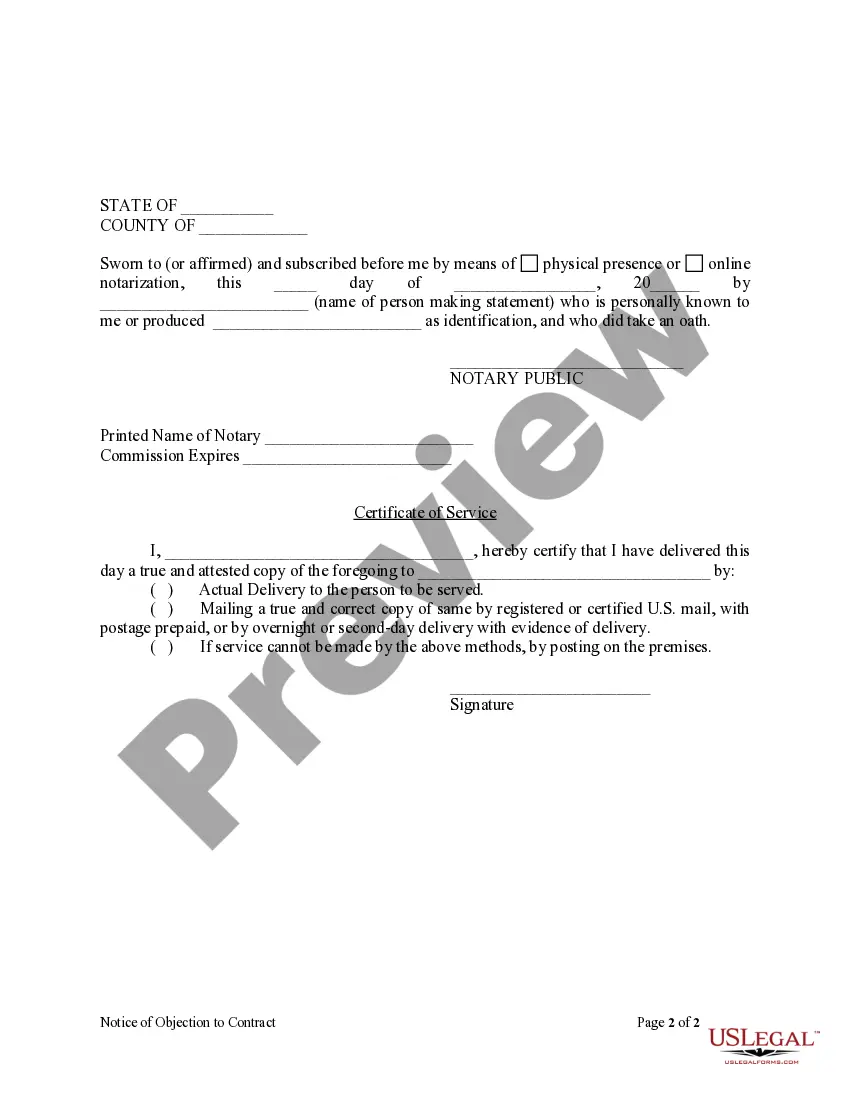

How to fill out Florida Notice Of Objection To Contract?

Managing legal paperwork can be daunting, even for seasoned professionals.

When you're looking for a Florida Objection To Request For Production and lack the time to search for the appropriate and current version, the process can be stressful.

US Legal Forms fulfills all your requirements, from personal to business documents, all in one place.

Utilize advanced tools to fill out and manage your Florida Objection To Request For Production.

Here are the steps to follow after downloading the form you seek: Verify this is the appropriate form by previewing it and examining its description.

- Explore a valuable resource library of articles, guides, and materials related to your situation and requirements.

- Save time and energy searching for the necessary documents by using US Legal Forms’ sophisticated search and Review tool to locate Florida Objection To Request For Production and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, look for the form, and download it.

- Check your My documents tab to review the documents you have previously downloaded and organize your folders as you prefer.

- If it’s your first experience with US Legal Forms, create a complimentary account for unlimited access to all features of the library.

- Utilize a comprehensive online form repository that could transform the way you handle these matters.

- US Legal Forms is a leading provider in the online legal form industry, offering over 85,000 state-specific legal forms accessible to you at any time.

- Access state- or county-specific legal and business documents.

Form popularity

FAQ

You must send the Owner notice of your right to claim a lien within twenty (20) days of first work performed and/or materials supplied. You must file this notice of your right to claim a lien with the county recorder where the property is located within five (5) days of sending the notice to the Owner.

You must file your lien within ninety (90) days of your last work and/or materials supplied. You must send the Owner a copy of the lien that you file. You must file suit to enforce your lien within two (2) years of the date that it was filed.

About Montana Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

New Filings UCC1 Lien$7.00UCC1 Transmitting Utility Lien$7.00EFS Lien$7.00Federal Tax Lien$7.00DPHHS Notice Of Child Support Lien$7.008 more rows

Ing to the mechanics lien law, after your notices are served timely the lien must be filed in the county recorder's office in the county where the property is located. The lien may either be served by certified mail, return receipt requested, or personally served on each of the parties.

After you file Mechanics liens in Montana are valid for 2 years after filing. After you file, you generally have 2 options. If you go unpaid, you can enforce your lien to spur payment, and if you get paid after you file, you can release your lien claim to free up the property.