Florida Lien Foreclosure Process

Description

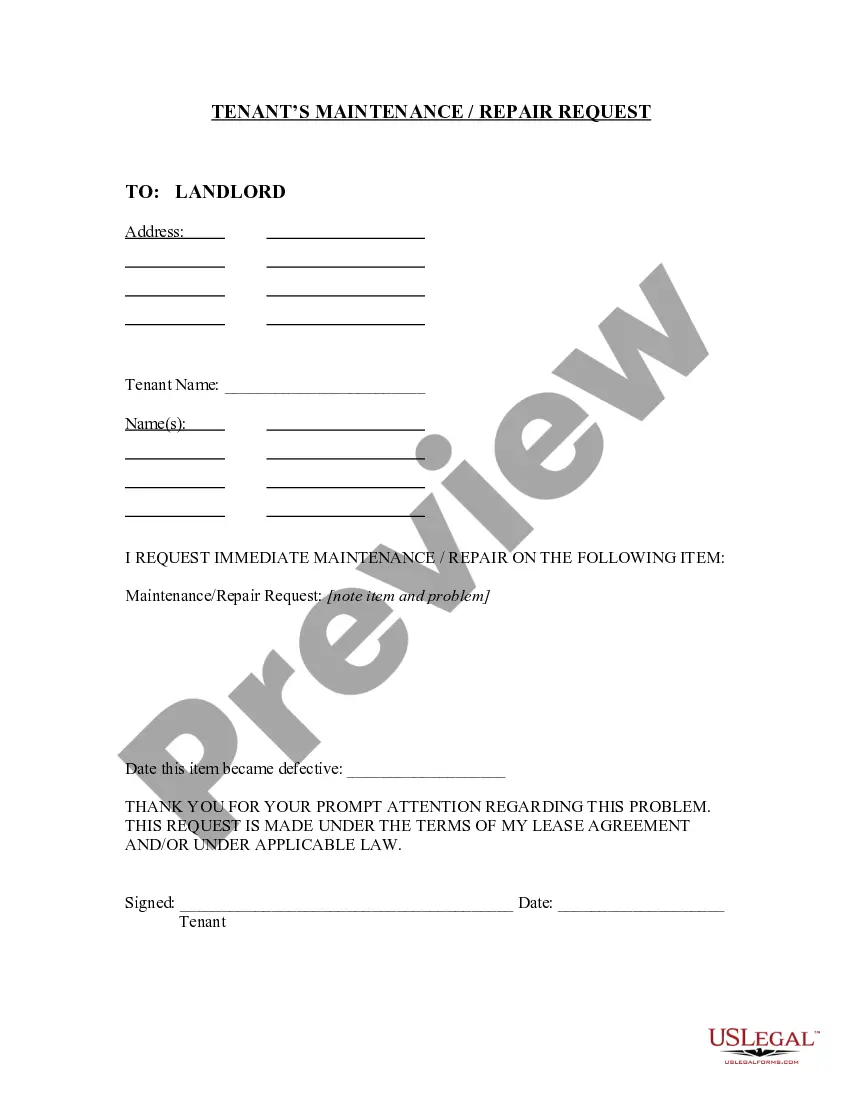

How to fill out Florida Notice To Contractor Form - Construction - Mechanic Liens - Individual?

It’s clear that you cannot become a legal expert instantly, nor can you swiftly master how to draft the Florida Lien Foreclosure Process without having a specialized education.

Crafting legal documents is a lengthy process that demands specific training and abilities. So why not allow the experts to handle the development of the Florida Lien Foreclosure Process.

With US Legal Forms, one of the most extensive legal template collections, you can discover everything from court documents to templates for internal communication.

You can access your documents again from the My documents tab at any time.

If you’re an existing user, you can simply Log In and find and download the template from the same section.

- Find the form you require by utilizing the search bar at the top of the webpage.

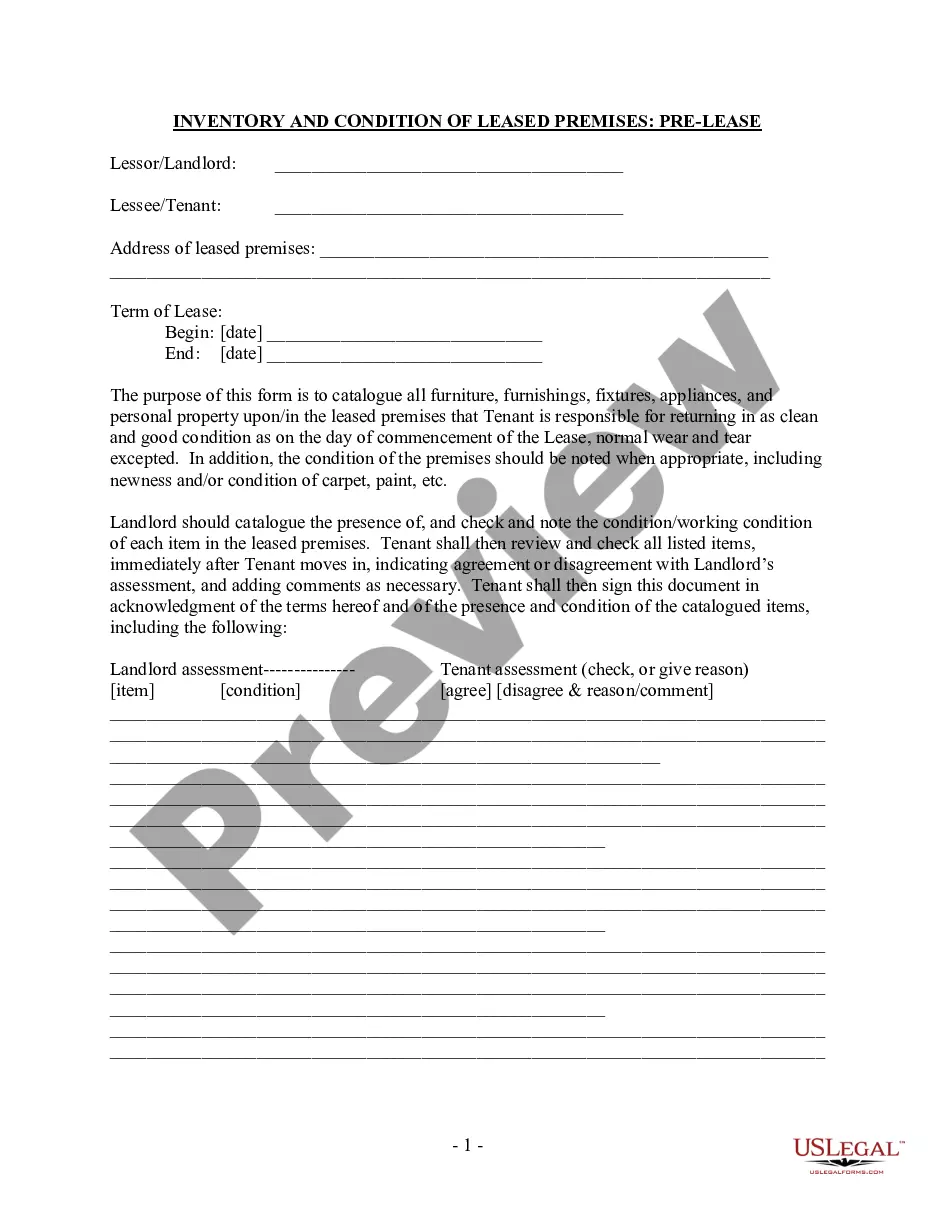

- Preview it (if this choice is available) and read the accompanying description to ascertain whether the Florida Lien Foreclosure Process is what you need.

- Restart your search if you require any additional template.

- Create a free account and choose a subscription plan to buy the form.

- Select Buy now. Once the payment is processed, you can download the Florida Lien Foreclosure Process, complete it, print it, and send or mail it to the specified individuals or organizations.

Form popularity

FAQ

The Florida lien foreclosure process begins when a lender files a lawsuit against the borrower for defaulting on the mortgage. The court then issues a judgment, allowing the lender to proceed with the foreclosure. Afterward, a public auction takes place, where the property is sold to the highest bidder. To navigate this complex process smoothly, consider using US Legal Forms, which provides essential documents and guidance tailored to the Florida lien foreclosure process.

Certain liens can survive foreclosure in Florida, including tax liens and some homeowners association liens. These liens often remain attached to the property even after the foreclosure is completed. Understanding which liens can persist is essential when entering the Florida lien foreclosure process. Consulting resources like USLegalForms can provide clarity on these complex matters.

In Florida, you generally have five years to foreclose on a lien. This period starts from the date the lien becomes due. It’s crucial to act within this timeframe, as failing to do so may result in losing the right to foreclose. Keeping track of these timelines can help ensure your interests are protected.

To foreclose on a lien in Florida, start by filing a foreclosure complaint in the appropriate court. You will need to provide documentation of the lien and the amount owed. Once filed, the court will schedule a hearing, and if successful, you will receive a judgment allowing the sale of the property. Utilizing platforms like USLegalForms can simplify this process, providing necessary legal documents and guidance.

Yes, you can foreclose on a lien in Florida. The Florida lien foreclosure process allows a lienholder to recover the amount owed by selling the property tied to the lien. This process typically involves filing a lawsuit and obtaining a court order. By understanding the steps involved, you can effectively navigate the foreclosure process.

Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a few exceptions. (12 C.F.R. § 1024.41). This 120-day period provides most homeowners with ample opportunity to submit a loss mitigation application to the servicer.

Florida's foreclosure law requires the HOA to send the homeowner notice of their intent to foreclose on the lien. This notice must be sent at least 45 days before filing for a homeowner's association foreclosure. The notice of intent to foreclose the lien should be sent after the HOA files their lien for fees.

The Length of the Florida Foreclosure Process Timeline can vary. Generally, it lasts between 8 to 14 months. On the other hand, if you hire a Foreclosure Defense Attorney, it can take longer.

What Are the Steps in the Florida Foreclosure Process? Receive Notice of Default. Every homebuyer signs two very important documents when they purchase a house. ... Accept and Read the Summons and Complaint. ... File Your Answer. ... Attend Hearings. ... Foreclosure Sale and Deficiency Judgments. ... Consult With a Florida Foreclosure Attorney.