Limited Lliability

Description

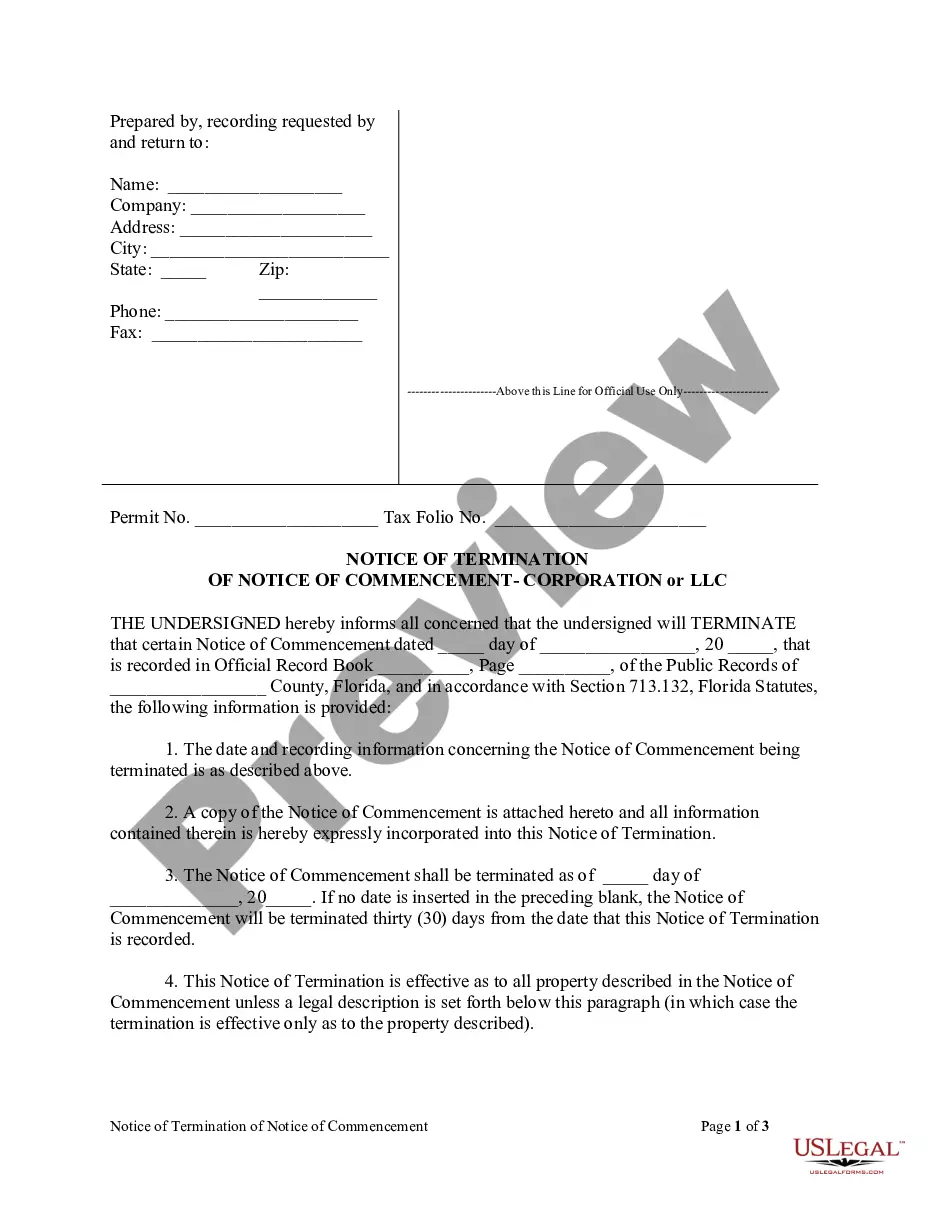

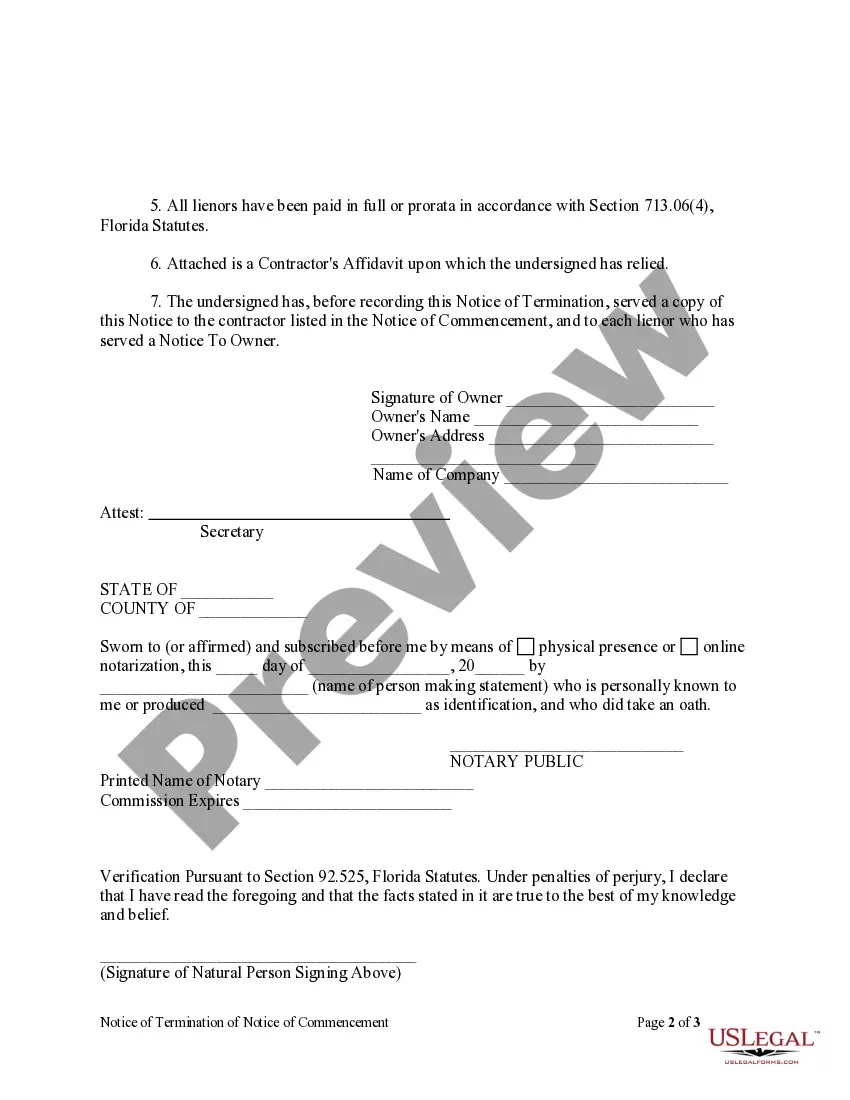

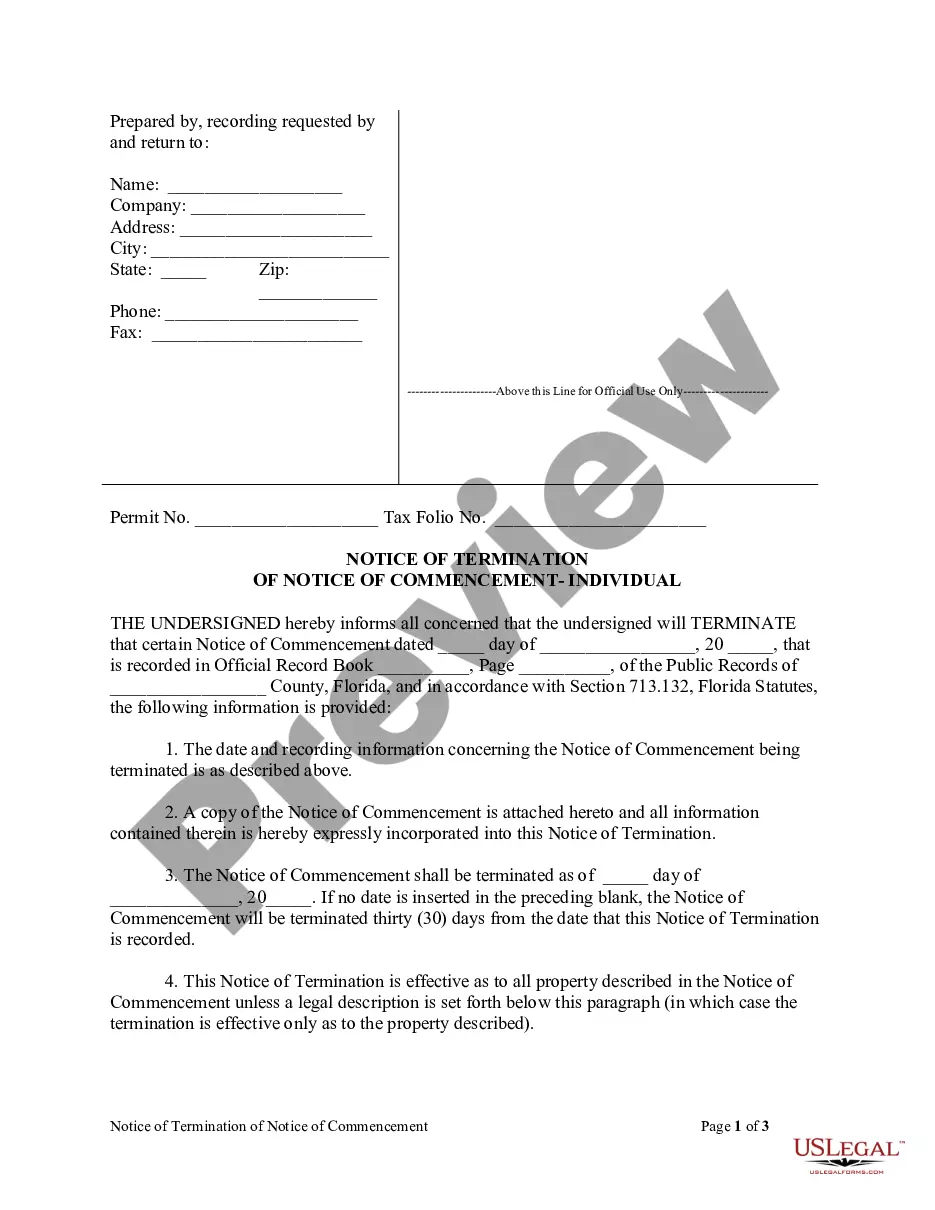

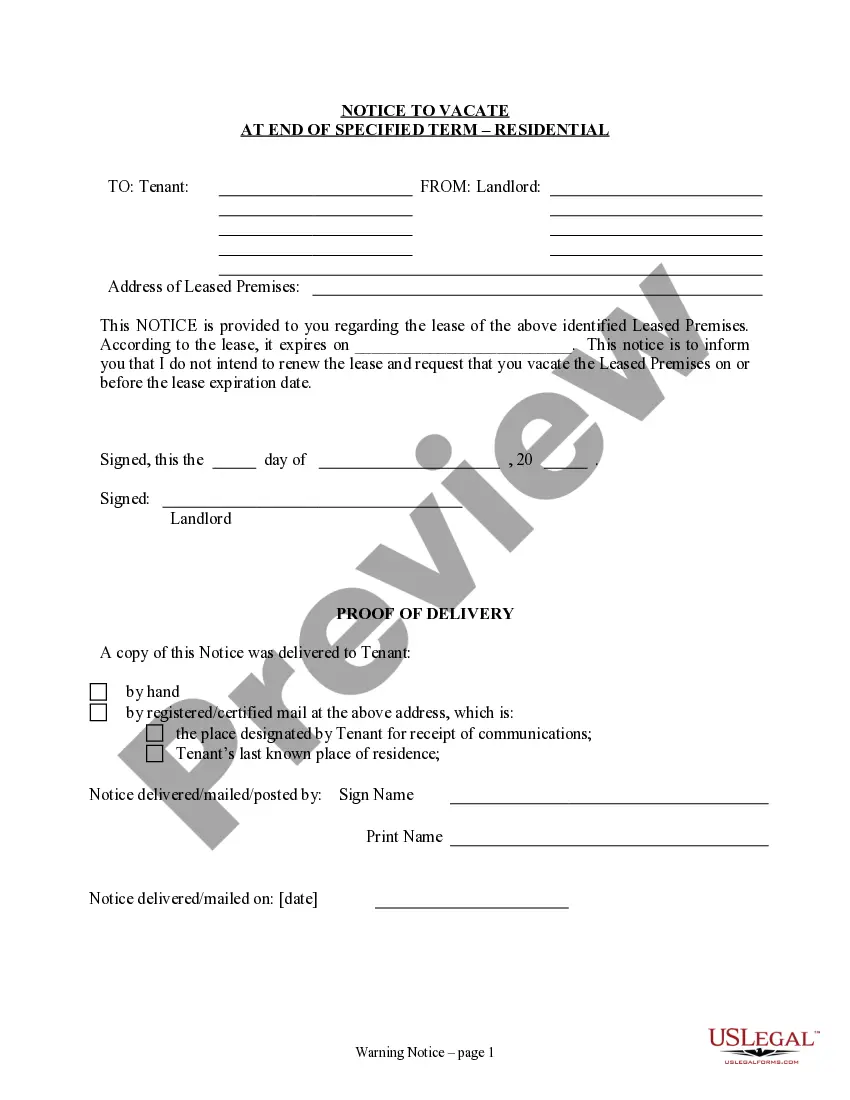

How to fill out Florida Notice Of Termination Of Notice Of Commencement Form - Construction - Mechanic Liens - Corporation Or LLC?

- Start by checking the Preview mode and reading the form description. Ensure the selected form aligns with your specific requirements and complies with local jurisdiction.

- If the form doesn't meet your needs, utilize the Search tab to find a more suitable template. Once you find the right match, proceed to the next step.

- Purchase your document by clicking on the Buy Now button and selecting a subscription plan that best fits your needs. Registration is necessary to access the library.

- Complete your purchase by entering your credit card information or using your PayPal account for the subscription payment.

- Finally, download your form and save it to your device. You can access it anytime in the My Forms menu within your profile.

US Legal Forms empowers users with a broader selection of forms compared to competitors, offering over 85,000 easily editable legal documents. The platform also connects users with premium experts for additional assistance.

Ready to streamline your legal document needs? Visit US Legal Forms today and start creating your limited liability documents with ease!

Form popularity

FAQ

Yes, you can start an LLC without an active business, but it may not be the most practical option. Forming an LLC without a business plan means you might incur costs without generating revenue. However, if you are planning to launch a business in the future, establishing the LLC now can provide immediate limited liability protections and prepare you for smoother operations later. Always consider your goals and consult professionals for guidance.

Establishing an LLC before launching your business can be beneficial in protecting your assets from liabilities. It allows you to operate legally and demonstrates professionalism to potential clients and partners. Additionally, forming an LLC can help streamline your finances, separating personal and business expenses. Overall, the limited liability provided by an LLC is a solid safeguard as you embark on your entrepreneurial journey.

Creating an LLC for your side hustle can be a wise choice if you want to protect your personal assets. The limited liability structure shields you from debts and legal issues that could arise from your business activities. Furthermore, this decision might help you establish business credit and professionalism. Essentially, forming an LLC can provide security as your side hustle grows.

While an LLC offers limited liability protection, it does come with some downsides. These includes formation costs, operational costs, and certain compliance requirements that might not appeal to everyone. Additionally, some states impose higher taxes on LLCs, which can affect profitability. It's essential to weigh these factors against the benefits before deciding to form an LLC.

If you start a Limited Liability Company (LLC) but take no further action, it can lead to complications. An LLC requires ongoing compliance with state regulations, such as filing annual reports and paying fees. If you neglect these responsibilities, your LLC could lose its legal status and the protection it offers. It's important to stay proactive to maintain your limited liability protections.

The decision to be taxed as an individual or an LLC largely hinges on your business activities and personal financial situation. Having an LLC generally provides limited liability protection and may afford tax benefits that individual taxation might not cover. Evaluating how each option aligns with your income and business operations will help you make the most informed choice.

A Limited Liability Company (LLC) typically files Form 1065 if it has multiple members, or the income can be reported through Schedule C on Form 1040 for single-member LLCs. Each form serves to ensure that the respective company type complies with tax regulations, keeping limited liability intact while addressing individual tax obligations. Understanding your LLC's structure will guide you to the right form.

Filing your personal and business taxes together can be beneficial, particularly for single-member LLCs. By including your LLC income on your personal tax return, you leverage limited liability while streamlining your filings. However, analyzing your specific tax situation and consulting a tax professional can provide a clearer pathway tailored to your needs.

Filing separately when you have an LLC depends on individual circumstances. If you are a single-member LLC, you can report your LLC income on your personal return and enjoy limited liability benefits. However, exploring the option of separate business tax filings may be worthwhile, especially if your LLC has multiple members or requires different tax considerations.

member LLC typically files taxes as a disregarded entity. This means you report your LLC income directly on your personal tax return, using Schedule C. By doing this, you maintain the benefits of limited liability while simplifying your tax filing process.