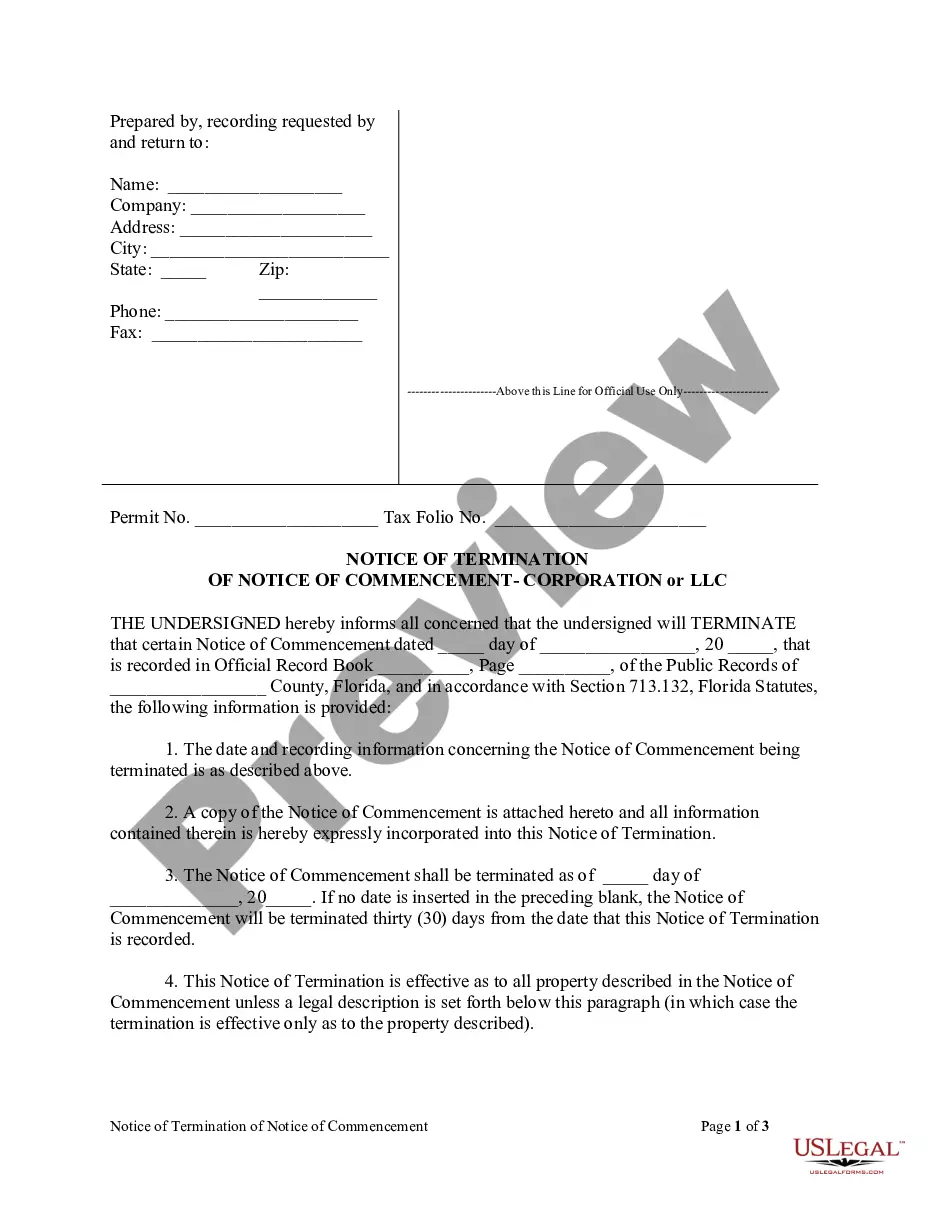

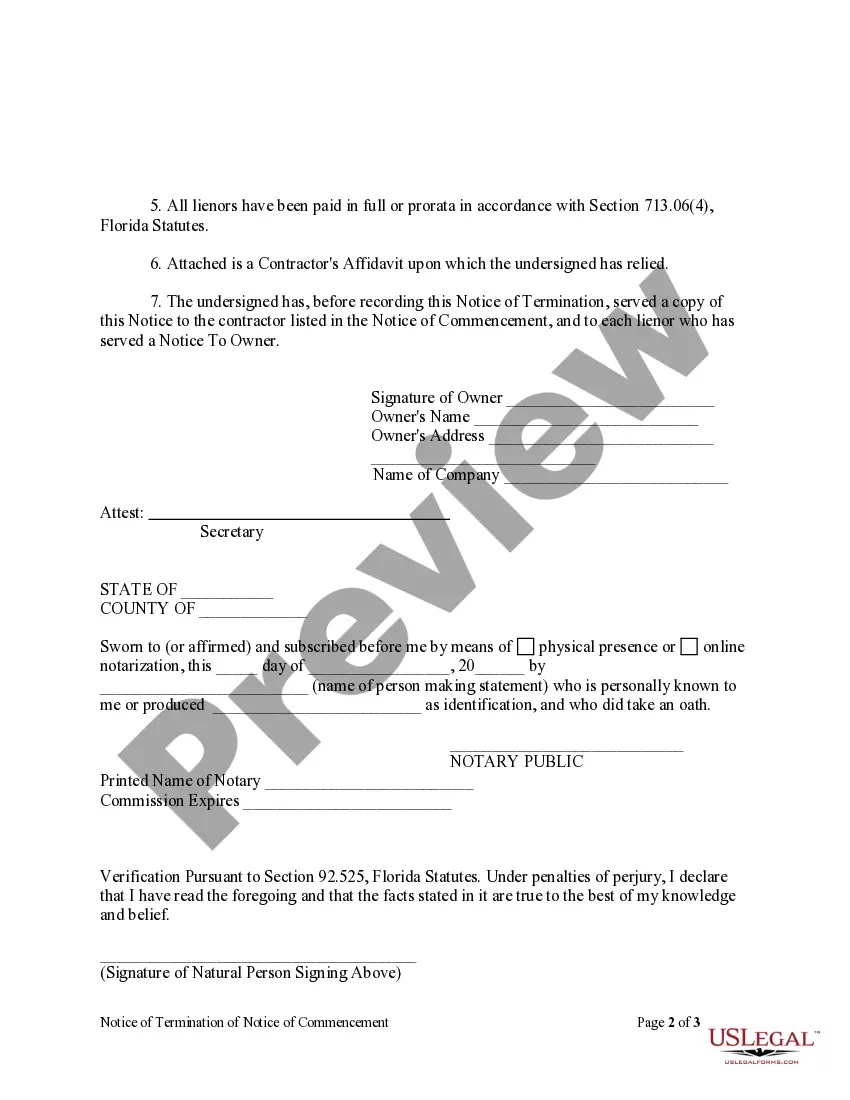

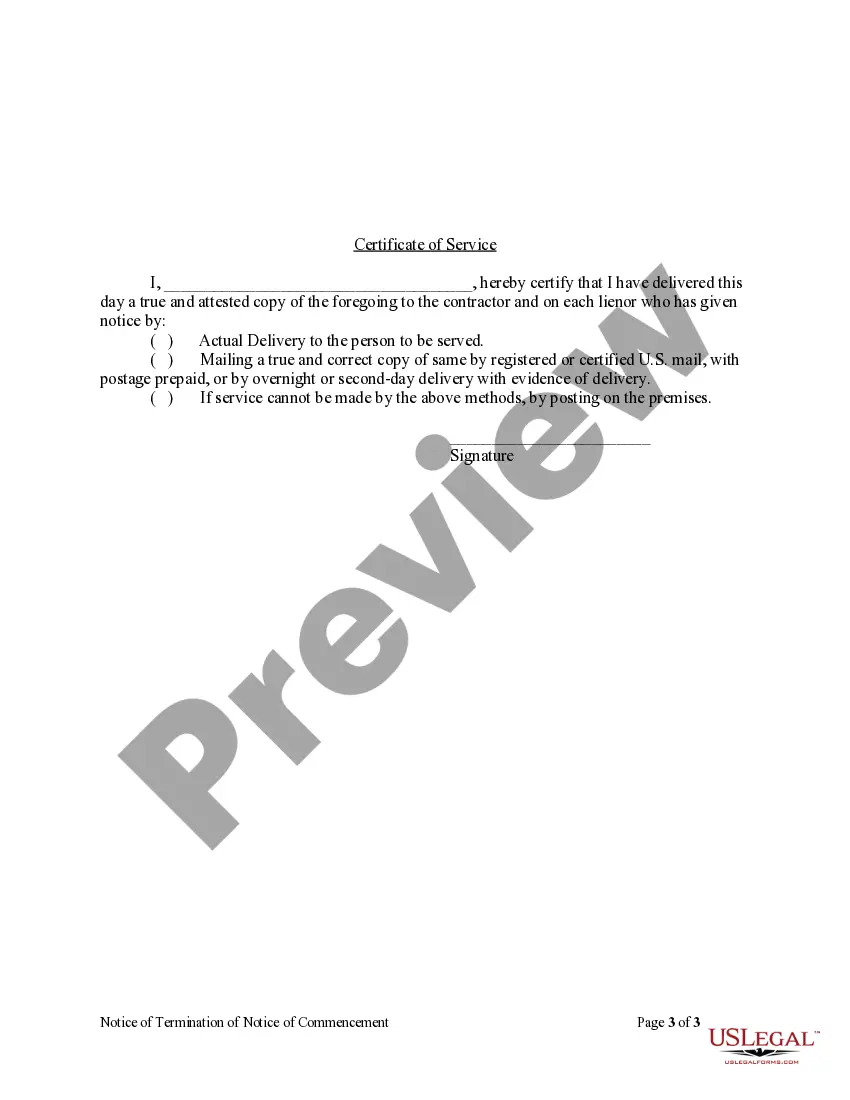

A corporate owner may terminate the period of effectiveness of a notice of commencement by executing, swearing to, and recording a notice of termination.

Form Mechanic Liability Company For Insurance

Description

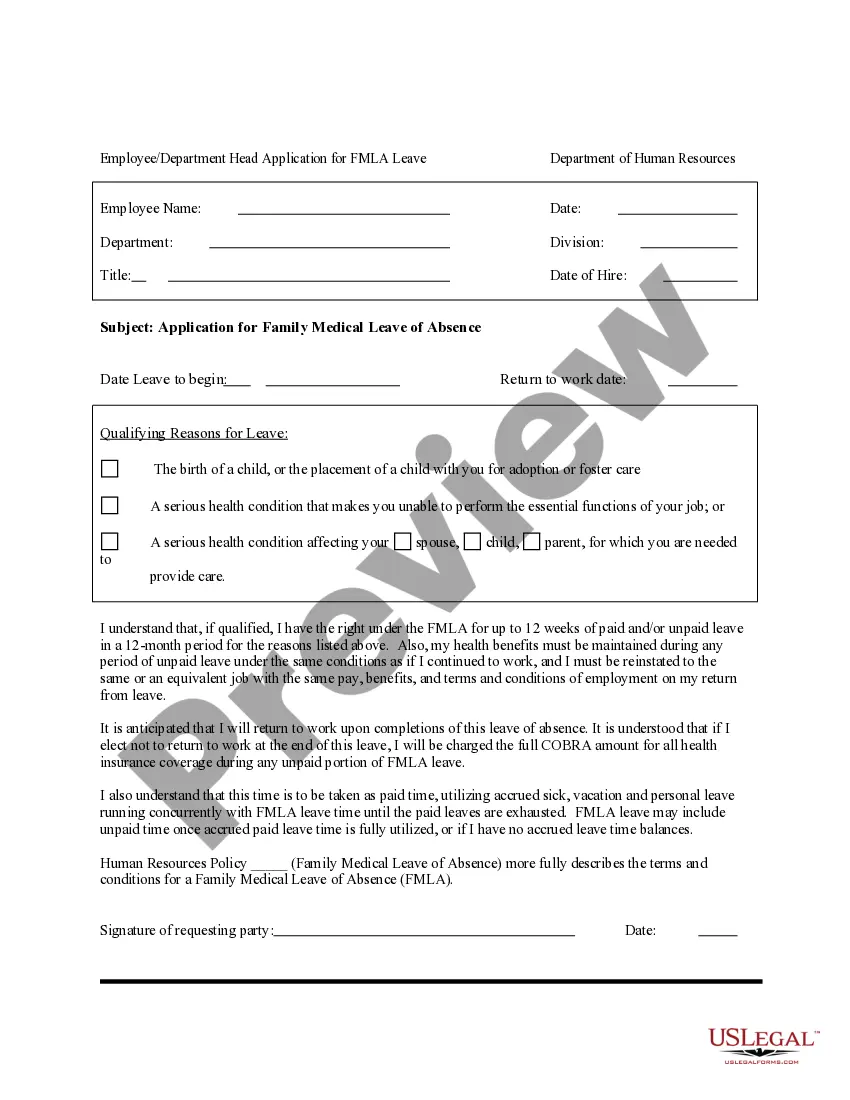

How to fill out Florida Notice Of Termination Of Notice Of Commencement Form - Construction - Mechanic Liens - Corporation Or LLC?

- Log in to your US Legal Forms account. If you’re a new user, create an account first.

- Preview the forms available to find the mechanic liability insurance template that suits your requirements. Ensure it complies with your local jurisdiction.

- If necessary, utilize the search feature to locate alternative templates that better meet your needs.

- Select the form you wish to purchase by clicking the 'Buy Now' button and choose a subscription plan that fits your budget.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download the form to your device and easily access it later in the 'My Forms' section of your profile.

In conclusion, using US Legal Forms to manage your mechanic liability insurance forms streamlines the entire process. With an extensive library of over 85,000 documents and the ability to consult premium experts, you are equipped to create legally sound files with ease.

Take advantage of US Legal Forms today and empower yourself with the tools to handle your legal needs efficiently!

Form popularity

FAQ

A form of liability insurance protects businesses from financial loss associated with claims of negligence or harm. It covers expenses such as legal fees and settlements, making it essential for a form mechanic liability company for insurance. This type of insurance allows businesses to operate with peace of mind, knowing they are safeguarded against unexpected incidents. Consider uslegalforms to explore various options for liability insurance tailored to your specific business needs.

GL class code 10073 specifically relates to businesses involved in mechanical contracting. This code is crucial for a form mechanic liability company for insurance, as it helps insurers classify the risk and determine the appropriate premiums. Understanding this code ensures that your business is adequately protected in case of claims related to property damage or bodily injury. You can use this information to seek proper coverage through platforms like uslegalforms, which can help you navigate your insurance needs.

In Ohio, there is typically no official grace period for auto insurance once your policy expires. However, some insurers may offer a short window where you can renew your policy without facing penalties. Always consult a form mechanic liability company for insurance to clarify your options and ensure that you remain compliant with state requirements.

The primary purpose of garagekeepers insurance is to provide financial protection for businesses that handle vehicles belonging to others. This type of insurance helps cover repairs, replacements, and liability costs that arise from incidents affecting these vehicles. Engaging a form mechanic liability company for insurance can help streamline your coverage options and offer tailored solutions based on your specific needs.

A garage insurance policy typically covers both property and liability risks associated with your garage or auto repair business. This includes coverage for your own equipment, the building itself, and any third-party injury claims. By leveraging services from a form mechanic liability company for insurance, you can ensure that your garage is fully protected against unexpected events.

Garagekeepers coverage insures against various risks, primarily focusing on physical damage to a customer's vehicle while it is under your care. This includes incidents like accidental collisions, fire, and even natural disasters. Utilizing a form mechanic liability company for insurance gives you the necessary support and resources to effectively handle potential claims.

Garage keepers insurance primarily covers the vehicles you store or park for customers. This insurance protects against damages that may occur while the vehicles are in your care, such as theft, vandalism, or weather-related incidents. As a form mechanic liability company for insurance, it helps you safeguard your business assets and offers peace of mind to your clients.

Mechanics professional liability refers to coverage designed to protect auto repair professionals from claims related to errors or negligence in their services. This insurance specifically addresses risks associated with providing mechanical services and helps cover legal fees and settlements. By forming a mechanic liability company for insurance, you can ensure comprehensive protection against unexpected claims, which is essential for successful business operation.

Forming an LLC for your mechanic shop provides various protections and benefits. An LLC offers limited liability, meaning personal assets remain separate from business obligations, which is vital in the event of a lawsuit. Additionally, it gives your business a formal structure that can enhance credibility with clients and insurance providers. It's advisable to consider forming a mechanic liability company for insurance to further protect your interests.

Professionals in the automotive industry, including mechanics, should consider obtaining professional liability insurance. This insurance protects against claims of negligence, errors, or omissions in the services you provide. If you form a mechanic liability company for insurance, you can safeguard your assets while ensuring compliance with industry standards and client expectations. This coverage is crucial for maintaining credibility and trust with your customers.