Limited Liability Company With The Ability To Establish Series

Description

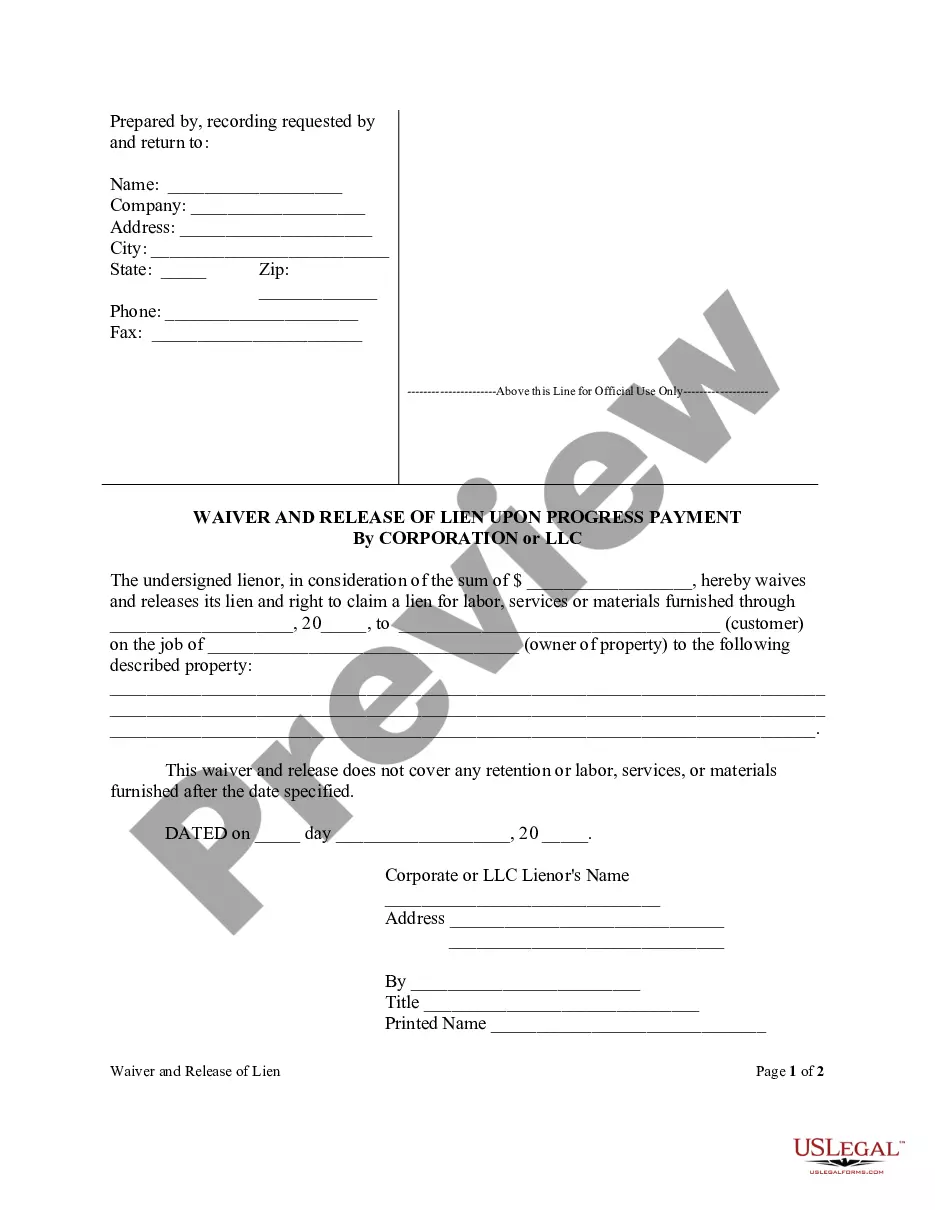

How to fill out Florida Waiver And Release Of Lien Upon Final Payment Form - Construction - Mechanic Liens - Corporation Or LLC?

- Log into your US Legal Forms account. If you're a first-time user, create your account to access our extensive library.

- Browse the form library and check the preview mode to ensure you select the right document that aligns with your business needs and local jurisdiction.

- If the form doesn’t meet your criteria, utilize the search feature at the top to find the appropriate template quickly.

- After selecting the right document, click the 'Buy Now' button and pick your subscription plan, registering if necessary.

- Complete the purchase by entering your payment details, using either a credit card or your PayPal account.

- Once your transaction is confirmed, download the form and save it to your device. You can also access it later via the 'My Forms' section in your profile.

US Legal Forms empowers individuals and attorneys to swiftly create legal documents with a vast collection of easily accessible forms. The service offers more forms than competitors at similar costs, enhancing your document acquisition experience.

Streamline your legal document process today by visiting US Legal Forms and explore the extensive resources available. Don't miss out on the opportunity to secure your LLC with confidence!

Form popularity

FAQ

Filing taxes for a limited liability company with the ability to establish series can be complex due to each series's unique financial situation. Generally, each series can file independently, but you may also choose to file a consolidated return. It is advisable to work with a tax professional familiar with Series LLCs to ensure compliance and optimize your tax strategy.

While a Series LLC offers several benefits, it may come with drawbacks such as increased legal complexity and limited recognition in some states. Not every jurisdiction acknowledges Series LLCs, which could complicate interstate business operations. It's essential to consult legal professionals to weigh these factors against your business needs.

To convert your LLC into a Series LLC, you must first ensure that your state allows this structure. Next, you will need to amend your existing operating agreement to include provisions for the series. After that, file the required documents with your state’s business filing agency, which is often outlined on platforms like uslegalforms.

You can convert an existing limited liability company into a Series LLC, but this process typically requires compliance with state regulations. You will need to amend your LLC's operating agreement and possibly file additional documentation with your state. Consider using platforms like uslegalforms to simplify this transition.

The primary purpose of a Series LLC is to allow you to segregate assets and liabilities for different business ventures under one LLC. This means that the risks associated with one series do not affect the others, providing a layer of financial protection. Additionally, this structure can reduce administrative costs and streamline the management process.

Yes, a limited liability company with the ability to establish series can create multiple series under one umbrella. Each series can have its own assets and liabilities, effectively allowing you to manage distinct ventures without forming separate LLCs. This structure simplifies administration and enhances organizational flexibility.

To convert your LLC to a series LLC, you typically need to amend your existing operating agreement and file the appropriate paperwork with your state. This process can vary by state, as not all recognize series LLCs. Utilizing resources from US Legal Forms can simplify this transition, ensuring you meet all necessary legal requirements for establishing a limited liability company with the ability to establish series.

Establishing a series LLC means creating separate divisions within a single limited liability company that operate independently. This allows each series to hold its own assets, conduct its own business, and be responsible for its liabilities. This structure brings both simplicity in administration and effective liability protection for business owners, making it a powerful tool for managing diversified interests.

A series LLC can be an excellent idea for businesses looking to separate different operations or assets while maintaining a streamlined structure. This model provides asset protection, reduces administrative costs, and simplifies management. If you plan to manage multiple distinct ventures, a limited liability company with the ability to establish series may offer significant advantages and efficiencies.

In general, each series within a series LLC does not require a separate Employer Identification Number (EIN) if it does not have employees or operate independently. However, if a series engages in business activities or hires employees, it may need its own EIN. Consulting with a legal expert or using a platform like US Legal Forms can help clarify these requirements based on your specific situation.